개요

세 개의 촛불 역전 경향 전략 (Three Candle Reversal Trend Strategy) 은 단선 거래 전략으로, 세 개의 연속적인 양선 또는 음선을 식별하고, 그 다음에는 삼키기 K 선을 따라 단선 경향의 반전을 판단하여, 여러 가지 기술 지표와 결합하여 침입 시기를 필터링합니다. 이 전략은 1:3의 중지 손실 비율로 거래되어 초과 수익을 얻습니다.

전략 원칙

이 전략의 핵심 논리는 세 개의 연속적인 양선 또는 음선으로 이루어진 K 선 형태를 식별하는 것이며, 이 형태는 일반적으로 단기 트렌드 반전의 예시이다. 세 개의 음선이 검출된 후, 다음의 삼진형 양선이 나타날 때까지, 더 많은 일을 한다. 반대로, 세 개의 양선이 검출된 후, 다음의 삼진형 음선이 나타날 때까지, 공백을 한다.

또한, 전략은 진입 시기를 필터링하기 위해 여러 가지 기술 지표를 도입한다. 두 가지 다른 파라미터 설정을 사용하는 SMA 평균선은 빠른 선에서 느린 선을 통과했을 때만 진입을 고려하기 시작한다. 또한, 선형 회귀 지표를 통해 시장의 흔들림과 추세 상태를 판단하고, 추세 상태에서만 거래한다. 전략은 또한 K 선 형태를 결합하여 진입을 선택할 수있는 전환을 제공합니다.

스톱 스 설정에서, 전략은 1: 3 이하의 리스크 수익률을 요구한다. 가장 최근의 N 근 K 선의 변동폭의 ATR 지수를 계산하여 변동폭의 비율과 결합하여 스톱 스 설정을 수행하고, 그 후 스톱 스 레벨을 계산한다. 따라서 일정 위험을 감수하는 전제 조건에서 적절한 초과 수익을 얻을 수 있다.

전략적 이점

세 개의 K선 역전 전략은 다음과 같은 장점을 가지고 있다:

- 단기적 트렌드 전환점을 파악하고, 기회를 잡기

- 다양한 지표 필터링으로 입학 정확도를 높여줍니다.

- “피해 방지 장치가 합리적이고 위험과 수익률이 적당하다”

- 간단한 매개 변수 설정, 쉽게 이해할 수 있는 동작

전략적 위험

이 전략에는 몇 가지 위험도 있습니다.

- 단기 반전은 반드시 장기 트렌드 반전을 나타내지 않으며, 더 높은 시간 주기 트렌드에 주의를 기울여야 한다. 더 긴 주기 평균선을 필터 조건으로 설정할 수 있다.

- 단일 K선 형태 신호는 오판이 발생할 수 있으며, 다른 보조 판단 신호를 추가하는 것을 고려할 수 있다.

- 스톱포인트 설정이 너무 낙관적일 수 있으므로 스톱포인트 범위를 적절히 좁힐 수 있습니다.

- 리드 디스크의 성능에 대해서는 불확실성이 있다.

전략 최적화 방향

이 전략은 다음과 같은 방향으로 최적화될 수 있습니다.

- 평균선 및 선형 회귀 변수를 조정하여 트렌드 상태를 판단하는 효과를 최적화

- 스토치 지표와 같은 다른 보조 판단 지표를 추가하여 신호의 정확도를 최적화

- ATR과 스톱마인드 변수의 설정을 최적화하여 위험과 수익을 균형을 맞추기

- 트렌드 브레이크포인트 추적 장치를 추가하여 수익성을 향상시킵니다.

- 더 엄격한 자금 관리 전략을 구축하고 거래 위험을 통제하십시오.

요약하다

전체적으로 볼 때, 세 개의 K선 역향 전략은 간단한 가격 형태와 여러 가지 보조 지표 판단을 결합하여 적당한 위험과 이익의 균형을 기반으로 한 짧은 라인 거래 전략입니다. 그것은 낮은 복잡성으로 좋은 성적을 거두며 투자자의 관심과 테스트가 가치가 있으며 개선 할 수있는 공간이 많습니다. 매개 변수 최적화 및 규칙의 보완으로 안정적이고 효율적인 양적 거래 전략으로 성장할 가능성이 있습니다.

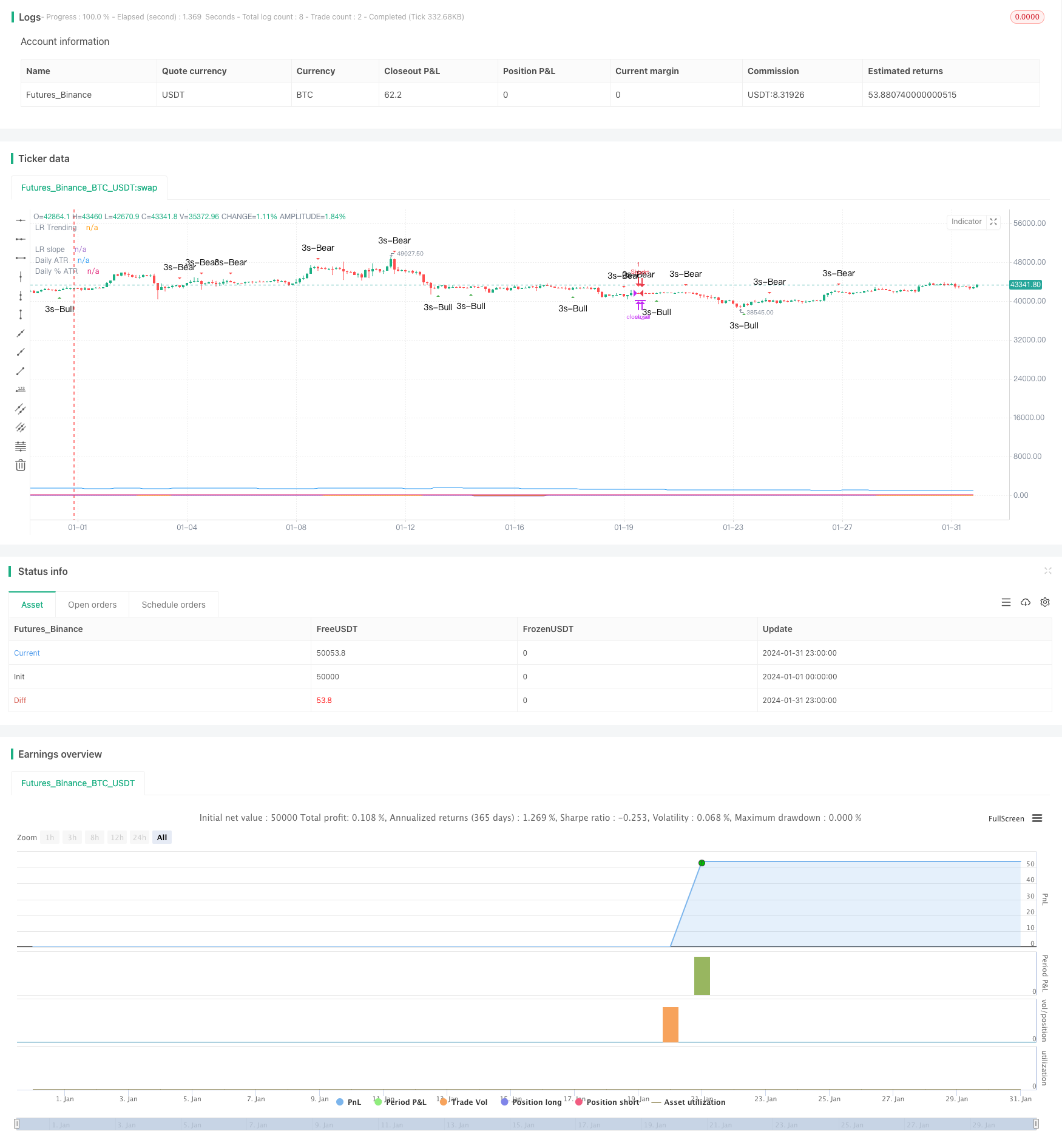

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © platsn

//

// Mainly developed for SPY trading on 1 min chart. But feel free to try on other tickers.

// Basic idea of this strategy is to look for 3 candle reversal pattern within trending market structure. The 3 candle reversal pattern consist of 3 consecutive bullish or bearish candles,

// followed by an engulfing candle in the opposite direction. This pattern usually signals a reversal of short term trend. This strategy also uses multiple moving averages to filter long or short

// entries. ie. if the 21 smoothed moving average is above the 50, only look for long (bullish) entries, and vise versa. There is option change these moving average periods to suit your needs.

// I also choose to use Linear Regression to determine whether the market is ranging or trending. It seems the 3 candle pattern is more successful under trending market. Hence I use it as a filter.

// There is also an option to combine this strategy with moving average crossovers. The idea is to look for 3 canddle pattern right after a fast moving average crosses over a slow moving average.

// By default , 21 and 50 smoothed moving averages are used. This gives additional entry opportunites and also provides better results.

// This strategy aims for 1:3 risk to reward ratio. Stop losses are calculated using the closest low or high values for long or short entries, respectively, with an offset using a percentage of

// the daily ATR value. This allows some price flucuation without being stopped out prematurely. Price target is calculated by multiplying the difference between the entry price and the stop loss

// by a factor of 3. When price target is reach, this strategy will set stop loss at the price target and wait for exit considion to maximize potential profit.

// This strategy will exit an order if an opposing 3 candle pattern is detected, this could happend before stop loss or price target is reached, and may also happen after price target is reached.

// *Note that this strategy is designed for same day SPY option scalping. I haven't determined an easy way to calculate the # of contracts to represent the equivalent option values. Plus the option

// prices varies greatly depending on which strike and expiry that may suits your trading style. Therefore, please be mindful of the net profit shown. By default, each entry is approxiately equal

// to buying 10 of same day or 1 day expiry call or puts at strike $1 - $2 OTM. This strategy will close all open trades at 3:45pm EST on Mon, Wed, and Fri.

// **Note that this strategy also takes into account of extended market data.

// ***Note pyramiding is set to 2 by default, so it allows for multiple entries on the way towards price target.

// Remember that market conditions are always changing. This strategy was only able to be backtested using 1 month of data. This strategy may not work the next month. Please keep that in mind.

// *****************************************************************************************************************************************************************************************************

//@version=5

strategy("3 Candle Strike Stretegy", overlay=true, pyramiding=2, initial_capital=5000, commission_type=strategy.commission.cash_per_contract, commission_value = 0.01)

// ******************** Period **************************************

startY = input(title='Start Year', defval=2011, group = "Trading window")

startM = input.int(title='Start Month', defval=1, minval=1, maxval=12, group = "Trading window")

startD = input.int(title='Start Day', defval=1, minval=1, maxval=31, group = "Trading window")

finishY = input(title='Finish Year', defval=2050, group = "Trading window")

finishM = input.int(title='Finish Month', defval=12, minval=1, maxval=12, group = "Trading window")

finishD = input.int(title='Finish Day', defval=31, minval=1, maxval=31, group = "Trading window")

timestart = timestamp(startY, startM, startD, 00, 00)

timefinish = timestamp(finishY, finishM, finishD, 23, 59)

t1 = time(timeframe.period, "0930-1545:23456")

window = true

// *****************************************************

isSPY = input.bool(defval=true,title="SPY trading only", group = "Trading Options")

SPY_option = input.int(defval=10,title="# of SPY options per trade", group = "Trading Options")

reinvest = input.bool(defval=false,title="reinvest profit?", group = "Trading Options")

src = close

// ***************************************************************************************************** Daily ATR *****************************************************

// Inputs

atrlen = input.int(14, minval=1, title="ATR period", group = "Daily ATR")

iPercent = input.float(5, minval=1, maxval=100, step=0.1, title="% ATR to use for SL / PT", group = "Daily ATR")

// PTPercent = input.int(100, minval=1, title="% ATR for PT")

// Logic

percentage = iPercent * 0.01

datr = request.security(syminfo.tickerid, "1D", ta.rma(ta.tr, atrlen))

datrp = datr * percentage

// datrPT = datr * PTPercent * 0.01

plot(datr,"Daily ATR")

plot(datrp, "Daily % ATR")

// ***************************************************************************************************************** Moving Averages ************************

len0 = input.int(8, minval=1, title='Fast EMA', group= "Moving Averages")

ema1 = ta.ema(src, len0)

len1 = input.int(21, minval=1, title='Fast SMMA', group= "Moving Averages")

smma1 = 0.0

sma_1 = ta.sma(src, len1)

smma1 := na(smma1[1]) ? sma_1 : (smma1[1] * (len1 - 1) + src) / len1

len2 = input.int(50, minval=1, title='Slow SMMA', group= "Moving Averages")

smma2 = 0.0

sma_2 = ta.sma(src, len2)

smma2 := na(smma2[1]) ? sma_2 : (smma2[1] * (len2 - 1) + src) / len2

len3 = input.int(200, minval=1, title='Slow SMMA', group= "Moving Averages")

smma3 = 0.0

sma_3 = ta.sma(src, len3)

smma3 := na(smma3[1]) ? sma_3 : (smma3[1] * (len3 - 1) + src) / len3

ma_bull = smma1 > smma2 and smma1 > smma1[1]

ma_bear = smma1 < smma2 and smma1 < smma1[1]

ma_bull_macro = smma1 > smma3 and smma2 > smma3

ma_bear_macro = smma1 < smma3 and smma2 < smma3

// plot(ma_bull? 1 : 0, "MA bull")

// plot(ma_bear? 1 : 0 , "MA bear")

// **************************************************************************************************************** Linear Regression *************************

//Input

clen = input.int(defval = 50, minval = 1, title = "Linear Regression Period", group = "Linear Regression")

slen = input.int(defval=50, minval=1, title="LR Slope Period" , group = "Linear Regression")

glen = input.int(defval=14, minval=1, title="LR Signal Period", group = "Linear Regression")

LR_thres = input.float(0.03, minval=0, step=0.001, title="LR Threshold for Ranging vs Trending" , group = "Linear Regression")

//Linear Regression Curve

lrc = ta.linreg(src, clen, 0)

//Linear Regression Slope

lrs = (lrc-lrc[1])/1

//Smooth Linear Regression Slope

slrs = ta.ema(lrs, slen)

//Signal Linear Regression Slope

alrs = ta.sma(slrs, glen)

up_accel = lrs > alrs and lrs > 0

down_accel = lrs < alrs and lrs < 0

LR_ranging = math.abs(slrs) <= LR_thres

LR_trending = math.abs(slrs) > LR_thres

plot(slrs, "LR slope")

plot(LR_trending?1:0, "LR Trending")

// *********************************************************************************************************************************** Candle conditions **************************

bull_3s = close[3] <= open[3] and close[2] <= open[2] and close[1] <= open[1] and close > open[1]

bear_3s = close[3] >= open[3] and close[2] >= open[2] and close[1] >= open[1] and close < open[1]

plotshape(bull_3s, style=shape.triangleup, color=color.new(color.green, 0), location=location.belowbar, size=size.small, text='3s-Bull', title='3 Line Strike Up')

plotshape(bear_3s, style=shape.triangledown, color=color.new(color.red, 0), location=location.abovebar, size=size.small, text='3s-Bear', title='3 Line Strike Down')

// ***************************************************************************************************************************************** SL & PT ***********************************

RR = input.float(3.0, minval = 1, step = 0.1, title="Reward to Risk Ratio", group = "Trading Options")

barsSinceLastEntry()=>

strategy.opentrades > 0 ? (bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades-1)) : na

last_high = math.max(high, high[1], high[2], high[3])

last_low = math.min(low, low[1], low[2], low[3])

long_SL = last_low - datrp

short_SL = last_high + datrp

long_PT = last_high

short_PT = last_low

last_entry = strategy.opentrades.entry_price(strategy.opentrades-1)

risk = last_entry - long_SL

if strategy.opentrades > 0

long_SL := math.min(long_SL[barsSinceLastEntry()], last_low)

short_SL := math.max(short_SL[barsSinceLastEntry()], last_high)

risk := last_entry - long_SL

long_PT := last_entry + (last_entry - long_SL) * RR

short_PT := last_entry - (short_SL - last_entry) * RR

else

long_PT := open + (open - long_SL) * RR

short_PT := open - (short_SL - open) * RR

// plot(short_SL,title = "Short SL", color=color.new(color.purple,30))

// plot(long_SL,title = "Long SL", color=color.new(color.purple,30))

// plot(long_PT,title = "Long PT", color=color.new(color.white,50))

// plot(short_PT,title = "Short PT", color=color.new(color.white,50))

// plot(last_entry, title = "Last entry")

// plot(risk, title = "Risk")

// **************************************************************************************************************************************** Trade Pauses ****************************************

bool trade_pause = false

bool trade_pause2 = false

if high - low > datr*0.3

trade_pause := true

else

trade_pause := false

no_longat10 = input.bool(true, title="No long entry between 10 - 10:30 (Avoid 10 am dump)", group = "Trading Options")

// ************************************************************************************************************************************ Entry conditions **************************

trade_3s = input.bool(title='Trade 3s candle pattern', defval=true, group = "Trading Options")

L_entry1 = bull_3s and ma_bull and LR_trending

S_entry1 = bear_3s and ma_bear and LR_trending

trade_ma_reversal = input.bool(title='Trade MA Cross Reversal Signal', defval=true, group = "Trading Options")

L_entry2 = ma_bear_macro and ema1 > smma1 and bull_3s and ta.barssince(ta.cross(ema1,smma1)) < 10

S_entry2 = ma_bull_macro and ema1 < smma1 and bear_3s and ta.barssince(ta.cross(ema1,smma1)) < 10

// ************************************************************************************************************************************** Exit Conditions ********************************

// bsle_thres = input.int(0, "Bar since entry threshold")

// exit0 = barsSinceLastEntry() >= bsle_thres

exit0 = true

L_exit1 = bear_3s

S_exit1 = bull_3s

// ************************************************************************************************************************************ Entry and Exit orders *****************************

strategy.initial_capital = 50000

trade_amount = math.floor(strategy.initial_capital / close)

if isSPY

if strategy.netprofit > 0 and reinvest

trade_amount := math.floor((strategy.initial_capital + strategy.netprofit) * 0.2 / 600) * 10 * SPY_option

else

trade_amount := math.floor(strategy.initial_capital * 0.2 / 600) * 10 * SPY_option

if not(trade_pause) and not(trade_pause2) and time(timeframe.period, "0930-1540:23456")

if trade_3s

if not(time(timeframe.period, "1000-1030:23456")) and no_longat10

strategy.entry("Long", strategy.long, 1, when = L_entry1 and window, comment="Long 3s" + " SL=" + str.tostring(math.round(long_SL,2)) + " PT=" + str.tostring(math.round(long_PT,2)))

strategy.entry("Short", strategy.short, 1, when = S_entry1 and window, comment = "Short 3s" + " SL=" + str.tostring(math.round(short_SL,2)) + " PT=" + str.tostring(math.round(short_PT,2)))

if trade_ma_reversal

strategy.entry("Long", strategy.long, 1, when = L_entry2 and window, comment="Long MA cross" + " SL=" + str.tostring(math.round(long_SL,2)) + " PT=" + str.tostring(math.round(long_PT,2)))

strategy.entry("Short", strategy.short, 1, when = S_entry2 and window, comment = "Short MA corss" + " SL=" + str.tostring(math.round(short_SL,2)) + " PT=" + str.tostring(math.round(short_PT,2)))

if high > long_PT

long_SL := low[1]

strategy.exit("Exit", "Long", when = exit0 and low < long_PT, stop= long_SL, comment = "Exit Long SL/PT hit")

strategy.close("Long", when = L_exit1, comment = "Exit on Bear Signal")

if low < short_PT

short_SL := high[1]

strategy.exit("Exit", "Short", when= exit0 and high > short_PT, stop= short_SL, comment = "Exit Short SL/PT hit")

strategy.close("Short", when = S_exit1, comment = "Exit on Bull Signal")

if time(timeframe.period, "1545-1600:246")

strategy.close_all()