개요

이 전략은 주로 SSL 통로 지표와 파동 트렌드 지표에 기반하며, 다른 보조 지표와 결합하여 보다 완전한 양적 거래 전략을 구현한다. 이 전략 이름은 핵심 지표 SSL 통로와 파동 트렌드, 그리고 양적 거래의 키워드를 포함하고 있으며, 요구 사항에 부합한다.

전략 원칙

이 전략은 6개의 조건에 따라 거래가 이루어집니다. 그 중 첫 번째 두 가지는 핵심 조건입니다.

- SSL 혼성 지표의 기준은 파란색 ((상승) 또는 빨간색 ((하락) 이다.

- SSL 통로 지표 상부 포크 (상향) 또는 하부 포크 (하향)

- 파동 트렌드 지표 상부 포크 (상향) 또는 하부 포크 (하향)

- 입구 K선 높이는 임계값을 넘지 않는다.

- 입구 K 라인은 부린 통로 내부에 있다.

- 정지점은 평행선과 접촉하지 않는다.

이 6가지 조건이 동시에 충족될 때, 전략은 상장하거나 상장하지 않는다. 스톱로스 거리는 ATR 지표의 수치를 기준으로 계산되며, 스톱로스 거리는 스톱로스의 리스크 리워드 비율의 두 배이다.

이 전략은 또한 stop loss 설정, 포지션 규모 제어, 최대 철회 제어 등이 포함된 완벽한 위험 관리 메커니즘을 갖추고 있습니다. 또한, 이 전략은 차트에 보조 라인을 그리고 있으며, 각 스톱 및 스톱 포지션을 직관적으로 볼 수 있으며, 구체적인 손실 상황을 볼 수 있습니다. 이것은 분석 및 최적화 전략에 매우 도움이됩니다.

우위 분석

이 전략의 가장 큰 장점은 SSL 통로 지표를 사용하여 트렌드 방향을 판단하는 정확도가 매우 높으며, 파동 트렌드와 같은 지표와 함께 확인하면 가짜 신호를 크게 줄일 수 있다는 것입니다. 또한, 엄격한 입시 조건은 불필요한 거래를 피할 수 있으며, 따라서 거래 횟수를 줄이고 거래 비용을 줄일 수 있습니다.

또한, 이 전략의 완벽한 위험과 자금 관리 메커니즘도 큰 장점이다. 미리 설정된 좋은 중지 손실 및 중지 전략은 단일 거래의 최대 손실을 효과적으로 제어할 수 있다. 포지션 규모의 제어와 함께, 계좌의 최대 인출을 감당할 수 있는 범위 내에서 제어할 수 있다.

위험 분석

이 전략의 가장 큰 위험은, 엄격한 입시 조건으로 거래 기회를 놓치게 되고, 이로 인해 수익성에 영향을 미치게 된다. 시장이 흔들리는 상태일 때 이 전략의 수익성은 또한 할인된다.

또한, 파동 트렌드 같은 지표가 시장 트렌드를 판단하는 효과에 영향을 미치기도 한다. 이때는 파라미터를 조정하거나, 다른 지표를 추가하여 확인해야 한다.

전반적으로, 이 전략의 위험은 통제할 수 있다. 매개 변수를 조정하고 최적화함으로써 전략이 다른 시장 환경에 더 잘 적응할 수 있다.

최적화 방향

이 전략은 다음과 같은 몇 가지 측면에서 최적화될 수 있습니다.

트렌드 전환점을 더 정확하게 판단할 수 있도록 파동 트렌드의 매개 변수를 최적화합니다.

KDJ, MACD 등과 같은 다른 지표를 추가하여 확인하여 가짜 돌파의 영향을 피하십시오.

다양한 품종, 다양한 주기에 따라 매개 변수를 조정하여 최적화하여 전략의 안정성을 높일 수 있습니다.

기계 학습 알고리즘을 추가하고, 역사 데이터 훈련을 사용하여 실시간 최적화 전략 매개 변수

높은 주파수 인수와 같은 알고리즘을 활용하여 전략의 거래 빈도 및 수익성을 높이는 전략

이러한 최적화 조치의 실행은 이 전략의 수익성과 안정성을 더 높은 수준으로 끌어올릴 것으로 기대된다.

요약하다

전체적으로, 이 전략은 다양한 지표와 엄격한 입시 메커니즘을 통합하고, 높은 승률을 보장하면서도, 또한 좋은 위험 통제 효과를 달성한다. 미래 최적화 방향과 결합하면, 이 전략은 큰 발전 잠재력을 가지고 있으며, 권장되는 양적 거래 전략이다.

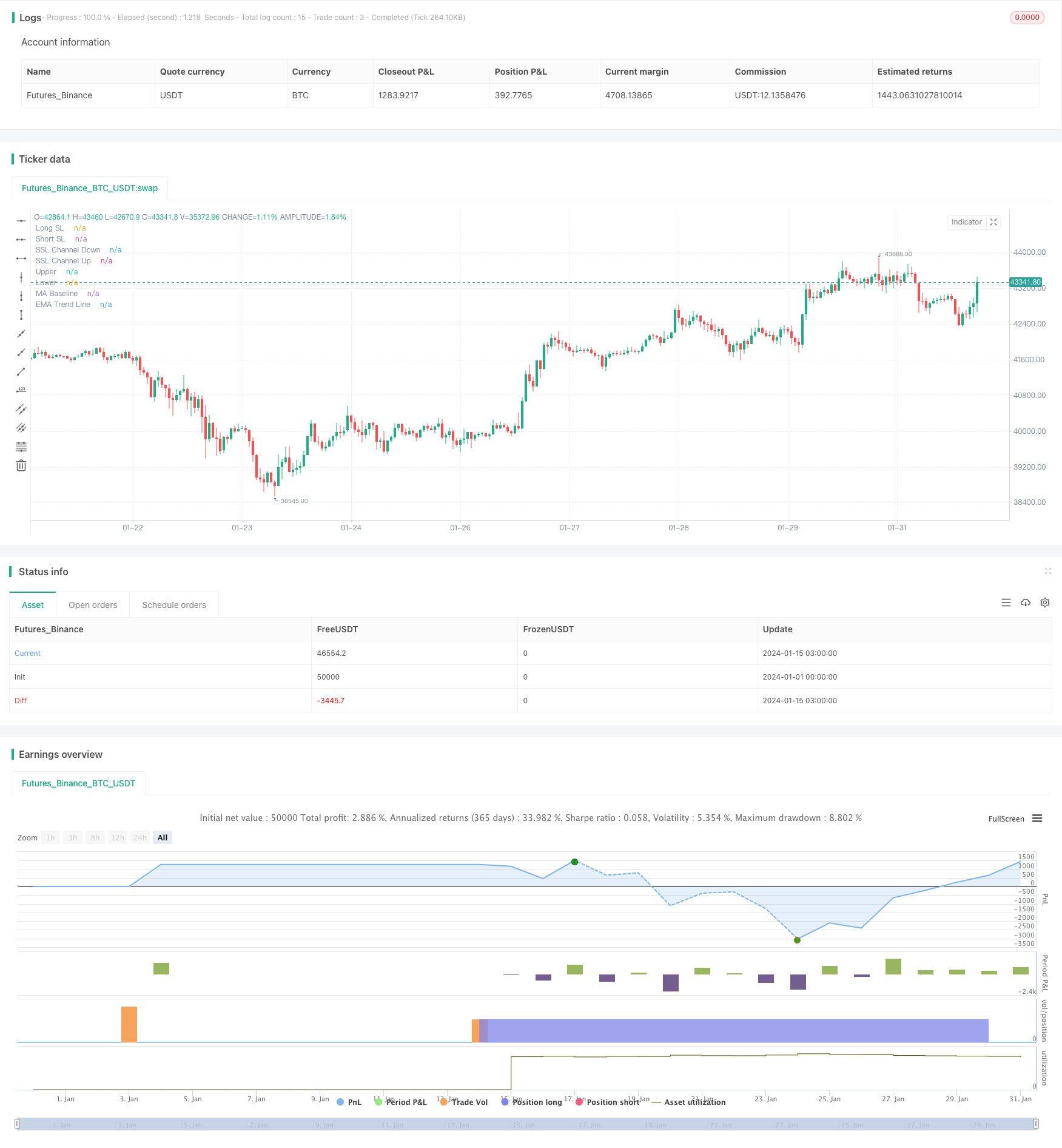

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @credits

// - Wave Trend: Indicator: WaveTrend Oscillator [WT] by @LazyBear

// - SSL Channel: SSL channel by @ErwinBeckers

// - SSL Hybrid: SSL Hybrid by @Mihkel00

// - Keltner Channels: Keltner Channels Bands by @ceyhun

// - Candle Height: Candle Height in Percentage - Columns by @FreeReveller

// - NNFX ATR: NNFX ATR by @sueun123

//

// Strategy: Based on the YouTube video "This Unique Strategy Made 47% Profit in 2.5 Months [SSL + Wave Trend Strategy Tested 100 Times]" by TradeSmart.

// @description

//

// Strategy incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Based on strategy conditions below

//

// - Trade exit: Based on strategy conditions below

//

// - Backtesting: Configurable backtesting range by date

//

// - Chart drawings: Each entry condition indicator can be turned on and off

// TP/SL boxes drawn for all trades. Can be turned on and off

// Trade exit information labels. Can be turned on and off

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Alerting: Alerts on LONG and SHORT trade entries

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: SSL Hybrid baseline is BLUE

// C2: SSL Channel crosses up (green on top)

// C3: Wave Trend crosses up (represented by pink candle body)

// C4: Entry candle height is not greater than configured threshold

// C5: Entry candle is inside Keltner Channel (wicks or body depending on configuration)

// C6: Take Profit target does not touch EMA (represents resistance)

//

// SHORT: C1: SSL Hybrid baseline is RED

// C2: SSL Channel crosses down (red on top)

// C3: Wave Trend crosses down (represented by orange candle body)

// C4: Entry candle height is not greater than configured threshold

// C5: Entry candle is inside Keltner Channel (wicks or body depending on configuration)

// C6: Take Profit target does not touch EMA (represents support)

//

// - Trade exit: Stop Loss: Size configurable with NNFX ATR multiplier

// Take Profit: Calculated from Stop Loss using R:R ratio

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("SSL + Wave Trend Strategy", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ----------------------

// Trade Entry Conditions

// ----------------------

useSslHybrid = input.bool (true, "Use SSL Hybrid Condition", group = "Strategy: Entry Conditions", inline = "SC1")

useKeltnerCh = input.bool (true, "Use Keltner Channel Condition ", group = "Strategy: Entry Conditions", inline = "SC2")

keltnerChWicks = input.bool (true, "Keltner Channel Include Wicks", group = "Strategy: Entry Conditions", inline = "SC2")

useEma = input.bool (true, "Target not touch EMA Condition", group = "Strategy: Entry Conditions", inline = "SC3")

useCandleHeight = input.bool (true, "Use Candle Height Condition", group = "Strategy: Entry Conditions", inline = "SC4")

candleHeight = input.float (1.0, "Candle Height Threshold ", group = "Strategy: Entry Conditions", inline = "SC5", minval = 0, step = 0.1, tooltip = "Percentage difference between high and low of a candle. Expressed as a decimal. Lowering this value will filter out trades on volatile candles.")

// ---------------------

// Trade Exit Conditions

// ---------------------

slAtrMultiplier = input.float (1.7, "Stop Loss ATR Multiplier ", group = "Strategy: Exit Conditions", inline = "EC1", minval = 0, step = 0.1, tooltip = "Size of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

// ---------------

// Risk Management

// ---------------

riskReward = input.float (2.5, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Used to determine Take Profit level. Take Profit will be Stop Loss multiplied by this value.")

accountRiskPercent = input.float (1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM2", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// ----------

// Date Range

// ----------

startYear = input.int (2022, "Start Date ", group = "Strategy: Date Range", inline = "DR1", minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR1", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = "Strategy: Date Range", inline = "DR2", minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = "Strategy: Date Range", inline = "DR2", options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Display Settings

// ----------------

showTpSlBoxes = input.bool (true, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool (false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// ------------------

// Indicator Settings

// ------------------

// Indicator display options

showSslHybrid = input.bool (true, "Show SSL Hybrid", group = "Indicators: Drawings", inline = "ID1")

showSslChannel = input.bool (true, "Show SSL Channel", group = "Indicators: Drawings", inline = "ID2")

showEma = input.bool (true, "Show EMA", group = "Indicators: Drawings", inline = "ID3")

showKeltner = input.bool (true, "Show Keltner Channel", group = "Indicators: Drawings", inline = "ID4")

showWaveTrend = input.bool (true, "Show Wave Trend Flip Candles", group = "Indicators: Drawings", inline = "ID5")

showAtrSl = input.bool (true, "Show ATR Stop Loss Bands", group = "Indicators: Drawings", inline = "ID6")

// Wave Trend Settings

n1 = input.int (10, "Channel Length ", group = "Indicators: Wave Trend", inline = "WT1")

n2 = input.int (21, "Average Length ", group = "Indicators: Wave Trend", inline = "WT2")

obLevel1 = input.int (60, "Over Bought Level 1 ", group = "Indicators: Wave Trend", inline = "WT3")

obLevel2 = input.int (53, "Over Bought Level 2 ", group = "Indicators: Wave Trend", inline = "WT4")

osLevel1 = input.int (-60, "Over Sold Level 1 ", group = "Indicators: Wave Trend", inline = "WT5")

osLevel2 = input.int (-53, "Over Sold Level 2 ", group = "Indicators: Wave Trend", inline = "WT6")

// SSL Channel Settings

sslChLen = input.int (10, "Period ", group = "Indicators: SSL Channel", inline = "SC1")

// SSL Hybrid Settings

// Show/hide Inputs

show_color_bar = input.bool (false, "Show Color Bars", group = "Indicators: SSL Hybrid", inline = "SH2")

// Baseline Inputs

maType = input.string ("HMA", "Baseline Type ", group = "Indicators: SSL Hybrid", inline = "SH3", options=["SMA", "EMA", "DEMA", "TEMA", "LSMA", "WMA", "MF", "VAMA", "TMA", "HMA", "JMA", "Kijun v2", "EDSMA", "McGinley"])

len = input.int (60, "Baseline Length ", group = "Indicators: SSL Hybrid", inline = "SH4")

src = input.source (close, "Source ", group = "Indicators: SSL Hybrid", inline = "SH5")

kidiv = input.int (1, "Kijun MOD Divider ", group = "Indicators: SSL Hybrid", inline = "SH6", maxval=4)

jurik_phase = input.int (3, "* Jurik (JMA) Only - Phase ", group = "Indicators: SSL Hybrid", inline = "SH7")

jurik_power = input.int (1, "* Jurik (JMA) Only - Power ", group = "Indicators: SSL Hybrid", inline = "SH8")

volatility_lookback = input.int (10, "* Volatility Adjusted (VAMA) Only - Volatility lookback length", group = "Indicators: SSL Hybrid", inline = "SH9")

//Modular Filter Inputs

beta = input.float (0.8, "Modular Filter, General Filter Only - Beta ", group = "Indicators: SSL Hybrid", inline = "SH10", minval=0, maxval=1, step=0.1)

feedback = input.bool (false, "Modular Filter Only - Feedback", group = "Indicators: SSL Hybrid", inline = "SH11")

z = input.float (0.5, "Modular Filter Only - Feedback Weighting ", group = "Indicators: SSL Hybrid", inline = "SH12", step=0.1, minval=0, maxval=1)

//EDSMA Inputs

ssfLength = input.int (20, "EDSMA - Super Smoother Filter Length ", group = "Indicators: SSL Hybrid", inline = "SH13", minval=1)

ssfPoles = input.int (2, "EDSMA - Super Smoother Filter Poles ", group = "Indicators: SSL Hybrid", inline = "SH14", options=[2, 3])

///Keltner Baseline Channel Inputs

useTrueRange = input.bool (true, "Use True Range?", group = "Indicators: SSL Hybrid", inline = "SH15")

multy = input.float (0.2, "Base Channel Multiplier ", group = "Indicators: SSL Hybrid", inline = "SH16", step=0.05)

// EMA Settings

emaLength = input.int (200, "EMA Length ", group = "Indicators: EMA", inline = "E1", minval = 1)

// Keltner Channel Settings

kcLength = input.int (20, "Length ", group = "Indicators: Keltner Channel", inline = "KC1", minval=1)

kcMult = input.float (1.5, "Multiplier ", group = "Indicators: Keltner Channel", inline = "KC2")

kcSrc = input.source (close, "Source ", group = "Indicators: Keltner Channel", inline = "KC3")

alen = input.int (10, "ATR Length ", group = "Indicators: Keltner Channel", inline = "KC4", minval=1)

// Candle Height in Percentage Settings

chPeriod = input.int (20, "Period ", group = "Indicators: Candle Height", inline = "CH1")

// NNFX ATR Settings

nnfxAtrLength = input.int (14, "Length ", group = "Indicators: NNFX ATR (Stop Loss Settings)", inline = "ATR1", minval = 1)

nnfxSmoothing = input.string ("RMA", "Smoothing ", group = "Indicators: NNFX ATR (Stop Loss Settings)", inline = "ATR3", options = ["RMA", "SMA", "EMA", "WMA"])

// =============================================================================

// INDICATORS

// =============================================================================

// ----------

// Wave Trend

// ----------

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Show Wave Trend crosses on chart as colour changes (pink bullish, orange bearish)

wtBreakUp = ta.crossover (wt1, wt2)

wtBreakDown = ta.crossunder (wt1, wt2)

barColour = showWaveTrend ? wtBreakUp ? color.fuchsia : wtBreakDown ? color.orange : na : na

barcolor(color = barColour)

// -----------

// SSL Channel

// -----------

smaHigh = ta.sma(high, sslChLen)

smaLow = ta.sma(low, sslChLen)

var int sslChHlv = na

sslChHlv := close > smaHigh ? 1 : close < smaLow ? -1 : sslChHlv[1]

sslChDown = sslChHlv < 0 ? smaHigh : smaLow

sslChUp = sslChHlv < 0 ? smaLow : smaHigh

plot(showSslChannel ? sslChDown : na, "SSL Channel Down", linewidth=1, color=color.new(color.red, 30))

plot(showSslChannel ? sslChUp : na, "SSL Channel Up", linewidth=1, color=color.new(color.lime, 30))

// ----------

// SSL Hybrid

// ----------

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = math.sqrt(2) * PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(arg)

c2 = b1

c3 = -math.pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf:= c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

ssf

get3PoleSSF(src, length) =>

PI = 2 * math.asin(1)

arg = PI / length

a1 = math.exp(-arg)

b1 = 2 * a1 * math.cos(1.738 * arg)

c1 = math.pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = math.pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ssf

ma(type, src, len) =>

float result = 0

if type == "TMA"

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == "MF"

ts = 0.

b = 0.

c = 0.

os = 0.

//----

alpha = 2 / (len + 1)

a = feedback ? z * src + (1 - z) * nz(ts[1], src) : src

//----

b := a > alpha * a + (1 - alpha) * nz(b[1], a) ? a : alpha * a + (1 - alpha) * nz(b[1], a)

c := a < alpha * a + (1 - alpha) * nz(c[1], a) ? a : alpha * a + (1 - alpha) * nz(c[1], a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta * b + (1 - beta) * c

lower = beta * c + (1 - beta) * b

ts := os * upper + (1 - os) * lower

result := ts

result

if type == "LSMA"

result := ta.linreg(src, len, 0)

result

if type == "SMA" // Simple

result := ta.sma(src, len)

result

if type == "EMA" // Exponential

result := ta.ema(src, len)

result

if type == "DEMA" // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == "TEMA" // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == "WMA" // Weighted

result := ta.wma(src, len)

result

if type == "VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, volatility_lookback)

vol_down= ta.lowest(dev, volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == "HMA" // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == "JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = math.pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * math.pow(1 - alpha, 2) + math.pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

result

if type == "Kijun v2"

kijun = math.avg(ta.lowest(len), ta.highest(len)) //, (open + close)/2)

conversionLine = math.avg(ta.lowest(len / kidiv), ta.highest(len / kidiv))

delta = (kijun + conversionLine) / 2

result := delta

result

if type == "McGinley"

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

if type == "EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2 ? get2PoleSSF(avgZeros, ssfLength) : get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = ta.stdev(ssf, len)

scaledFilter= stdev != 0 ? ssf / stdev : 0

alpha = 5 * math.abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

result

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

Keltma = ma(maType, src, len)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, len)

upperk = Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//COLORS

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

//PLOTS

p1 = plot(showSslHybrid ? BBMC : na, color=color.new(color_bar, 0), linewidth=4, title="MA Baseline")

barcolor(show_color_bar ? color_bar : na)

// ---

// EMA

// ---

ema = ta.ema(close, emaLength)

plot(showEma ? ema : na, "EMA Trend Line", color.white)

// ----------------

// Keltner Channels

// ----------------

kcMa = ta.ema(kcSrc, kcLength)

KTop2 = kcMa + kcMult * ta.atr(alen)

KBot2 = kcMa - kcMult * ta.atr(alen)

upperPlot = plot(showKeltner ? KTop2 : na, color=color.new(color.blue, 0), title="Upper", style = plot.style_stepline)

lowerPlot = plot(showKeltner ? KBot2 : na, color=color.new(color.blue, 0), title="Lower", style = plot.style_stepline)

// ---------------------------

// Candle Height in Percentage

// ---------------------------

percentHL = (high - low) / low * 100

percentRed = open > close ? (open - close) / close * 100 : 0

percentGreen= open < close ? (close - open) / open * 100 : 0

// --------

// NNFX ATR

// --------

function(source, length) =>

if nnfxSmoothing == "RMA"

ta.rma(source, nnfxAtrLength)

else

if nnfxSmoothing == "SMA"

ta.sma(source, nnfxAtrLength)

else

if nnfxSmoothing == "EMA"

ta.ema(source, nnfxAtrLength)

else

ta.wma(source, nnfxAtrLength)

formula(number, decimals) =>

factor = math.pow(10, decimals)

int(number * factor) / factor

nnfxAtr = formula(function(ta.tr(true), nnfxAtrLength), 5) * slAtrMultiplier

//Sell

longSlAtr = nnfxAtrLength ? close - nnfxAtr : close + nnfxAtr

shortSlAtr = nnfxAtrLength ? close + nnfxAtr : close - nnfxAtr

plot(showAtrSl ? longSlAtr : na, "Long SL", color = color.new(color.red, 35), linewidth = 1, trackprice = true, editable = true, style = plot.style_stepline)

plot(showAtrSl ? shortSlAtr : na, "Short SL", color = color.new(color.red, 35), linewidth = 1, trackprice = true, editable = true, style = plot.style_stepline)

// =============================================================================

// FUNCTIONS

// =============================================================================

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// See strategy description at top for details on trade entry/exit logis

// ----------

// CONDITIONS

// ----------

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// Exit calculations

slAmount = nnfxAtr

slPercent = math.abs((1 - (close - slAmount) / close) * 100)

tpPercent = slPercent * riskReward

tpPoints = percentAsPoints(tpPercent)

tpTarget = calcProfitTrgtPrice(tpPoints, wtBreakUp)

inDateRange = true

// Condition 1: SSL Hybrid blue for long or red for short

bullSslHybrid = useSslHybrid ? close > upperk : true

bearSslHybrid = useSslHybrid ? close < lowerk : true

// Condition 2: SSL Channel crosses up for long or down for short

bullSslChannel = ta.crossover(sslChUp, sslChDown)

bearSslChannel = ta.crossover(sslChDown, sslChUp)

// Condition 3: Wave Trend crosses up for long or down for short

bullWaveTrend = wtBreakUp

bearWaveTrend = wtBreakDown

// Condition 4: Entry candle heignt <= 0.6 on Candle Height in Percentage

candleHeightValid = useCandleHeight ? percentGreen <= candleHeight and percentRed <= candleHeight : true

// Condition 5: Entry candle is inside Keltner Channel

withinCh = keltnerChWicks ? high < KTop2 and low > KBot2 : open < KTop2 and close < KTop2 and open > KBot2 and close > KBot2

insideKeltnerCh = useKeltnerCh ? withinCh : true

// Condition 6: TP target does not touch 200 EMA

bullTpValid = useEma ? not (close < ema and tpTarget > ema) : true

bearTpValid = useEma ? not (close > ema and tpTarget < ema) : true

// Combine all entry conditions

goLong = inDateRange and bullSslHybrid and bullSslChannel and bullWaveTrend and candleHeightValid and insideKeltnerCh and bullTpValid

goShort = inDateRange and bearSslHybrid and bearSslChannel and bearWaveTrend and candleHeightValid and insideKeltnerCh and bearTpValid

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

alert(message="BUY Trade Entry Alert", freq=alert.freq_once_per_bar_close)

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

alert(message="SELL Trade Entry Alert", freq=alert.freq_once_per_bar_close)

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

// printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

// printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

// Print TP/SL box for current open trade

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// =============================================================================

// DEBUGGING

// =============================================================================

// Data window plots

plotchar(goLong, "Enter Long", "")

plotchar(goShort, "Enter Short", "")