개요

이 전략은 RSI 지표와 이동 평균 ((MA) 을 결합하여 거래 신호를 생성한다. RSI는 시장이 과매매 또는 과매매 여부를 판단하는데, MA는 가격 동향을 판단하는데. RSI가 과매매되고 MA보다 가격이 높을 때 구매 신호를 생성한다. RSI가 과매매 또는 MA가 사다리기를 생성할 때 판매 신호를 생성한다. 또한, 전략은 무작위 RSI 지표 ((StochRSI) 를 보조 판단으로 도입하여, StochRSI가 신호를 생성할 때 도표에 팁을 표시한다.

전략 원칙

- RSI 지표값을 계산하여 시장이 과매매 (<70) 또는 과매매 (<30) 되는지 판단합니다.

- 4가지 타입의 EMA, SMA, HMA, WMA를 포함하는 사용자 정의 주기 MA를 계산하고, 파라미터 설정에 따라 그래프에 표시되는지를 결정한다.

- RSI가 오버바이하고 마가보다 클로즈가 높을 때, 구매 신호를 생성한다. RSI가 오버바이하거나 마가 사다리를 생성할 때, 판매 신호를 생성한다.

- StochRSI 지표가 보조 판단으로 도입되면, StochRSI가 과매매 (<70) 또는 과매매 (<30) 할 때 차트에 힌트를 표시하지만 실제 거래 신호는 발생하지 않습니다.

전략적 이점

- RSI와 MA는 두 가지의 고전적인 지표들을 유기적으로 결합하여 트렌드 상황을 더 잘 포착하고 오버 구매와 오버 판매 시기를 더 잘 포착합니다.

- MA 유형과 매개 변수는 자유롭게 설정할 수 있으며, 다양한 시장 특성에 따라 조정할 수 있다.

- 거래 결정에 더 많은 참고 자료를 제공하기 위해 StochRSI 지표를 보조 판단으로 도입했습니다.

- 코드 논리는 명확하고, 읽기 쉽고, 이해하기 쉽고, 재개발하기 쉽다.

전략적 위험

- RSI와 MA는 지연된 지표이며, 트렌드 반전의 초기에는 더 많은 잘못된 신호가 발생할 수 있습니다.

- 파라미터를 잘못 설정하면 신호가 너무 일찍 또는 너무 늦게 발생하여 전체 수익에 영향을 줄 수 있습니다.

- 시장이 급격히 변동할 때, 스톱 손실과 포지션 관리 부족으로 인해 더 큰 위험을 감수할 수 있습니다.

전략 최적화 방향

- 트렌드 전환을 미리 판단하기 위해 변동률과 같은 더 많은 선행 지표를 도입하십시오.

- 구매 및 판매 신호를 필터링하여 RSI와 MA가 동시에 특정 조건을 충족하도록 요구하면 신호를 생성하여 신호의 정확성을 높인다.

- 전략에 스톱로스 및 포지션 관리 모듈을 추가하여 단일 거래 위험과 전체 위험을 제어합니다.

- 전략에 대한 변수 최적화, 최적의 변수 조합을 찾는 것.

- 다른 주기 또는 여러 품종을 포함시키는 것을 고려하고, 각 품종 또는 주기 사이의 연관 관계를 최대한 활용한다.

요약하다

이 전략은 RSI와 MA를 결합하여 트렌드 상황과 오버 바이 오버 시점을 포착 할 수 있으며, 스토크RSI 지표를 보조 판단으로 도입합니다. 전체적인 아이디어는 간단하고 명확합니다. 그러나 전략에는 위험 제어 장치의 부족과 신호 정확도가 개선되어야하는 것과 같은 몇 가지 결함이 있습니다. 미래에는 더 많은 지표, 최적화 신호 규칙, 위험 제어 모듈 등을 도입하여 전략을 개선 할 수 있습니다.

전략 소스 코드

/*backtest

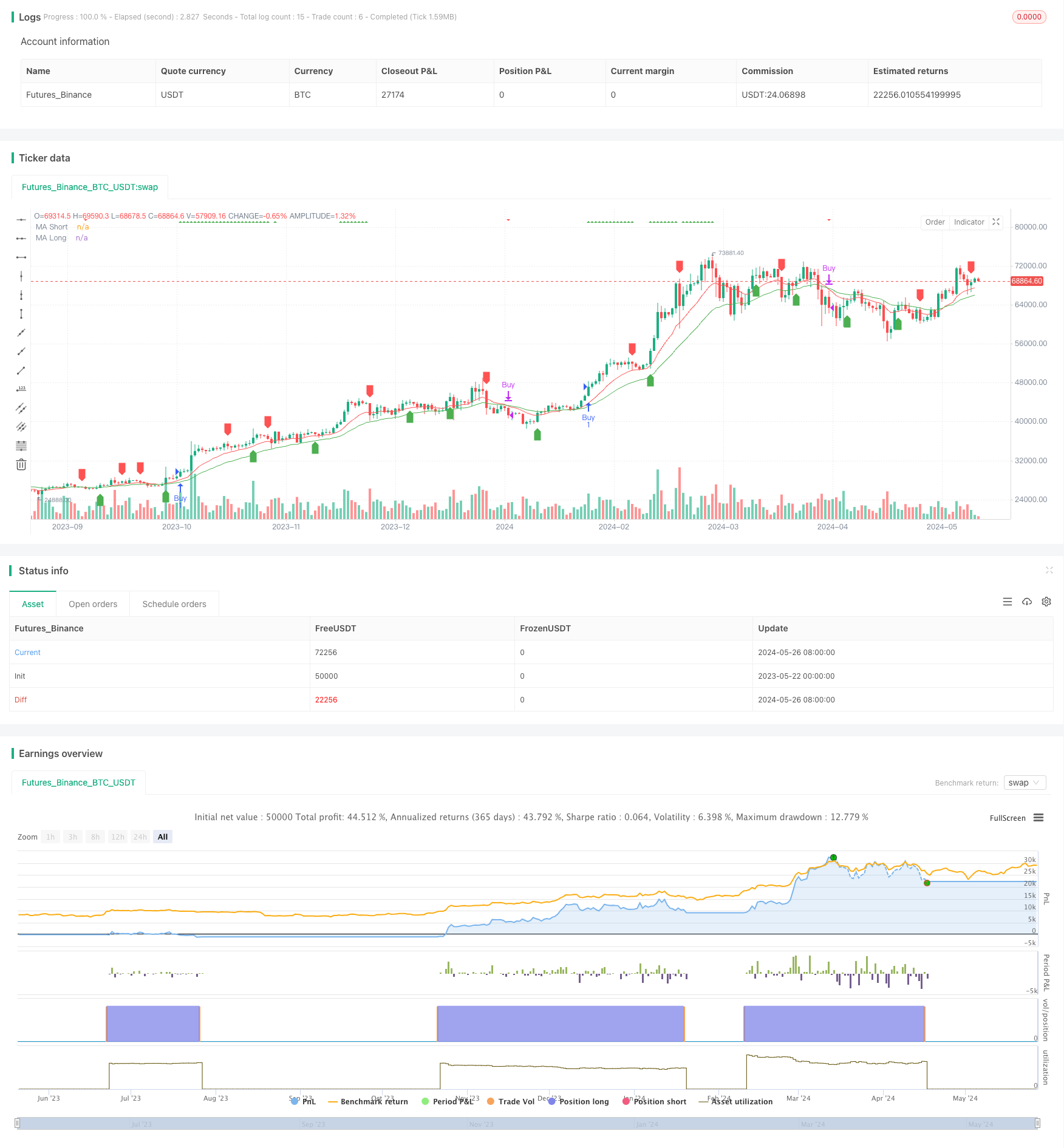

start: 2023-05-22 00:00:00

end: 2024-05-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI Strategy with Customizable MA and StochRSI Alert", overlay=true)

// กำหนดค่า RSI สำหรับการเปิดสัญญาณซื้อและขาย

rsiOverbought = input(70, title="RSI Overbought Level")

rsiOversold = input(30, title="RSI Oversold Level")

// เลือกชนิดของเส้นค่าเฉลี่ยเคลื่อนที่

maType = input.string("EMA", title="MA Type", options=["EMA", "SMA", "HMA", "WMA"])

// กำหนดค่าเส้นค่าเฉลี่ยเคลื่อนที่

maShortLength = input(12, title="MA Short Length")

maLongLength = input(26, title="MA Long Length")

// เลือกการแสดงผลของเส้นค่าเฉลี่ยเคลื่อนที่

showShortMA = input(true, title="Show Short Moving Average")

showLongMA = input(true, title="Show Long Moving Average")

// ฟังก์ชันสำหรับเลือกชนิดของเส้นค่าเฉลี่ยเคลื่อนที่

f_ma(src, length, type) =>

switch type

"SMA" => ta.sma(src, length)

"EMA" => ta.ema(src, length)

"HMA" => ta.hma(src, length)

"WMA" => ta.wma(src, length)

// คำนวณค่าเส้นค่าเฉลี่ยเคลื่อนที่

maShort = showShortMA ? f_ma(close, maShortLength, maType) : na

maLong = showLongMA ? f_ma(close, maLongLength, maType) : na

// คำนวณค่า RSI

rsiValue = ta.rsi(close, 14)

// สร้างสัญญาณซื้อและขาย

buySignal = (rsiValue > rsiOverbought and ((showShortMA and showLongMA and close > maShort and maShort > maLong) or (showShortMA and not showLongMA and close > maShort) or (showLongMA and not showShortMA and close > maLong)))

sellSignal = (showShortMA and showLongMA and ta.crossover(maLong, maShort)) or (showShortMA and not showLongMA and ta.crossover(maShort, close)) or (showLongMA and not showShortMA and ta.crossover(maLong, close))

// แสดงค่าเส้นค่าเฉลี่ยเคลื่อนที่บนกราฟ

plot(maShort, color=color.red, title="MA Short")

plot(maLong, color=color.green, title="MA Long")

// คำนวณค่า Stochastic RSI

smoothK = 3

smoothD = 3

RSIlen = 14

STOlen = 14

SRsrc = close

OSlevel = 30

OBlevel = 70

rsi1 = ta.rsi(SRsrc, RSIlen)

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, STOlen), smoothK)

d = ta.sma(k, smoothD)

stochRSIOverbought = OBlevel

stochRSIOversold = OSlevel

stochRSIBuyAlert = ta.crossover(k, stochRSIOversold)

stochRSISellAlert = ta.crossunder(k, stochRSIOverbought)

// สร้างคำสั่งซื้อและขายเมื่อมีสัญญาณจาก RSI และ MA เท่านั้น

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.close("Buy")

// แสดงสัญญาณเตือนจาก Stochastic RSI บนกราฟ

plotshape(series=stochRSIBuyAlert, location=location.belowbar, color=color.green, style=shape.labelup, title="StochRSI Buy Alert")

plotshape(series=stochRSISellAlert, location=location.abovebar, color=color.red, style=shape.labeldown, title="StochRSI Sell Alert")

// แสดงสัญญาณซื้อและขายจาก RSI และ MA บนกราฟ

plotshape(series=buySignal, location=location.top, color=color.green, style=shape.triangleup, title="RSI>70")

plotshape(series=sellSignal, location=location.top, color=color.red, style=shape.triangledown, title="MA crossoverDown")