개요

다단계 균형화 거래 전략은 여러 기술 지표와 가격 수준을 결합한 복잡한 거래 시스템이다. 이 전략은 MACD, RSI, EMA, 브린 벨트와 같은 지표를 사용하여 피보나치 회수 수준을 결합하여 여러 가격 범위에 다른 거래 전략을 사용하여 다단계 균형 거래를 달성한다. 전략의 핵심 아이디어는 여러 가지 확인을 통해 거래의 정확성을 높이고, 단계적 인 포지션으로 자금 관리를 최적화하는 것이다.

전략 원칙

이 전략의 핵심 원칙은 다음과 같습니다.

- MACD, RSI 및 EMA 지표를 사용하여 시장의 추세와 동력을 결정하십시오.

- 브린 벨트와 피보나치 회귀 레벨을 사용하여 중요한 지원 및 저항 지점을 식별하십시오.

- 다양한 가격 수준에서 여러 거래 입시점을 설정하여 점진적으로 입장을 구축하십시오.

- 다른 스톱과 스톱로스 레벨을 설정하여 위험을 관리합니다.

- 하이켄 아치 도표는 추가적인 시장 구조 정보를 제공합니다.

전략은 이러한 요소들을 종합적으로 분석하여 다양한 시장 조건에서 상응하는 거래 행동을 취하여 안정적인 수익을 달성합니다.

전략적 이점

- 다중 확인: 여러 기술 지표를 결합하여 거래 신호의 신뢰도를 높입니다.

- 융통성 있는 자금 관리: 단계적 인 포장 방식을 채택하여 위험을 더 잘 통제하고 자금을 최적화 할 수 있습니다.

- 적응력: 전략은 다른 시장 조건에 따라 거래 행동을 조정할 수 있다.

- 포괄적 인 위험 관리: 여러 계층의 중지 및 차단 장치가 설치되어 위험을 효과적으로 제어합니다.

- 높은 수준의 자동화: 전략은 인간의 개입을 줄여 완전히 자동화 할 수 있습니다.

전략적 위험

- 과도한 거래: 전략이 여러 거래 레벨을 설정하기 때문에 거래가 빈번하게 발생하여 거래 비용이 증가할 수 있습니다.

- 변수 민감성: 전략은 여러 지표와 변수를 사용하며, 다른 시장 환경에 적응하기 위해 신중하게 조정해야합니다.

- 회수 위험: 급격한 변동이 있는 시장에서 회수 위험이 커질 수 있다.

- 기술 의존성: 전략은 기술 지표에 크게 의존하며, 특정 시장 조건에서 실패할 수 있다.

- 자금 관리 위험: 점진적 인 포지션 방식은 경우에 따라 과도한 노출로 이어질 수 있습니다.

전략 최적화 방향

- 동적 변수 조정: 시장 상황에 따라 전략 변수를 자동으로 조정하는 기계 학습 알고리즘을 도입한다.

- 시장 정서 분석: 시장 정서 지표, 예를 들어 VIX 지수를 통합하여 전략의 적응성을 향상시킵니다.

- 다중 시간 프레임 분석: 거래 신호의 신뢰성을 높이기 위해 다중 시간 프레임 분석을 도입한다.

- 변동률 조정: 시장 변동률에 따라 거래량과 중지 손실 수준을 조정한다.

- 거래 비용 최적화: 거래 비용 모델을 도입하여 거래 빈도 및 규모를 최적화합니다.

요약하다

다단계 균형 거래 전략은 통합적이고 적응력이 좋은 거래 시스템입니다. 여러 기술 지표와 가격 수준을 결합하여 다양한 시장 환경에서 안정성을 유지할 수 있습니다. 위험이 있지만 지속적인 최적화와 조정으로 이러한 위험을 효과적으로 제어 할 수 있습니다. 머신 러닝 및 감정 분석과 같은 더 고급 기술을 도입하여 더 나은 성과를 낼 수 있습니다.

전략 소스 코드

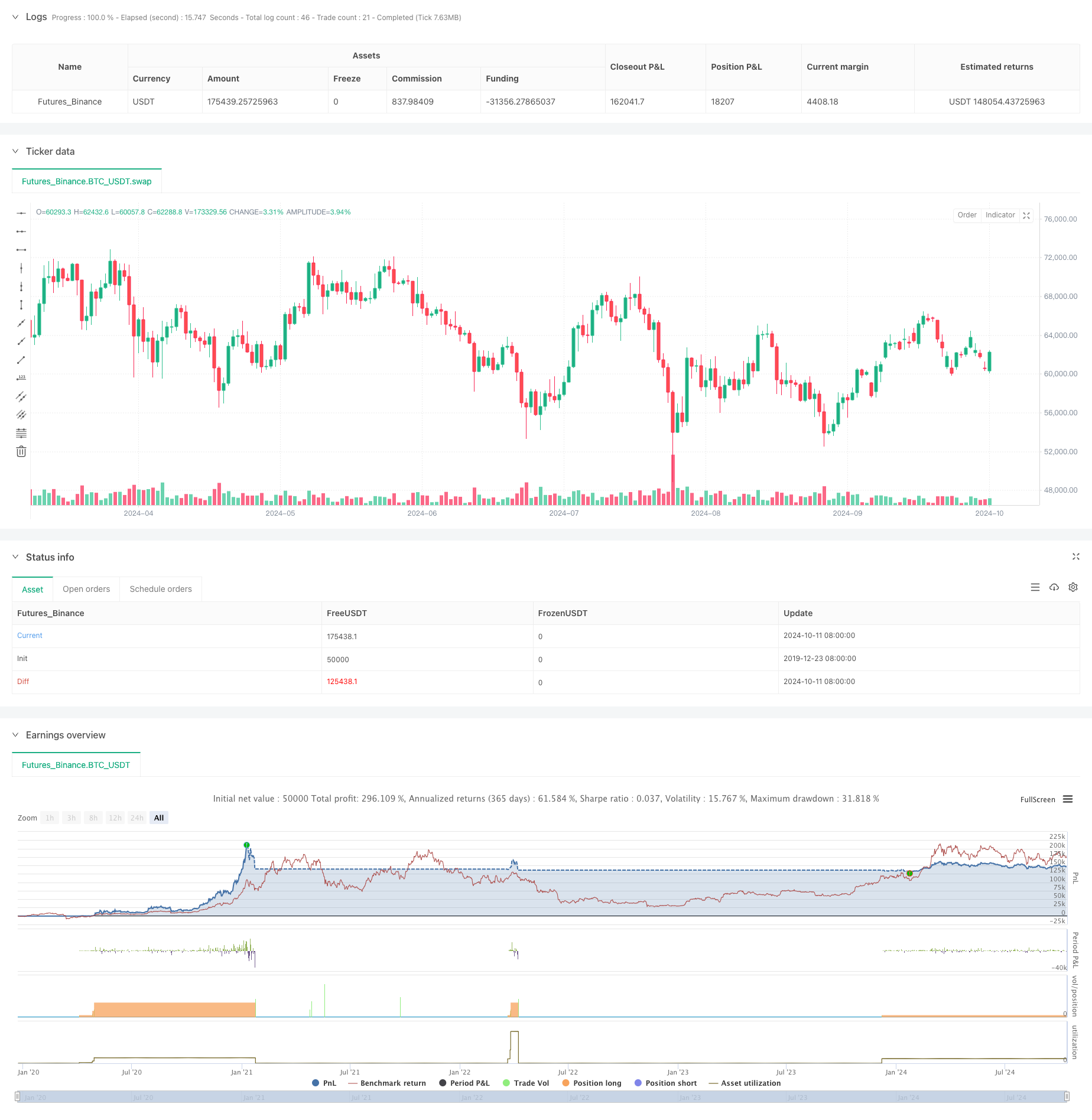

/*backtest

start: 2019-12-23 08:00:00

end: 2024-10-12 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Incremental Order size +', shorttitle='TradingPost', overlay=true, default_qty_value=1, pyramiding=10)

//Heiken Ashi

isHA = input(false, 'HA Candles')

//MACD

fastLength = 12

slowlength = 26

MACDLength = 9

MACD = ta.ema(close, fastLength) - ta.ema(close, slowlength)

aMACD = ta.ema(MACD, MACDLength)

delta = MACD - aMACD

//Bollinger Bands Exponential

src = open

len = 18

e = ta.ema(src, len)

evar = (src - e) * (src - e)

evar2 = math.sum(evar, len) / len

std = math.sqrt(evar2)

Multiplier = input.float(3, minval=0.01, title='# of STDEV\'s')

upband = e + Multiplier * std

dnband = e - Multiplier * std

//EMA

ema3 = ta.ema(close, 3)

//RSIplot

length = 45

overSold = 90

overBought = 10

price = close

vrsi = ta.rsi(price, length)

notna = not na(vrsi)

macdlong = ta.crossover(delta, 0)

macdshort = ta.crossunder(delta, 0)

rsilong = notna and ta.crossover(vrsi, overSold)

rsishort = notna and ta.crossunder(vrsi, overBought)

lentt = input(14, 'Pivot Length')

//The length defines how many periods a high or low must hold to be a "relevant pivot"

h = ta.highest(lentt)

//The highest high over the length

h1 = ta.dev(h, lentt) ? na : h

//h1 is a pivot of h if it holds for the full length

hpivot = fixnan(h1)

//creates a series which is equal to the last pivot

l = ta.lowest(lentt)

l1 = ta.dev(l, lentt) ? na : l

lpivot = fixnan(l1)

//repeated for lows

last_hpivot = 0.0

last_lpivot = 0.0

last_hpivot := h1 ? time : nz(last_hpivot[1])

last_lpivot := l1 ? time : nz(last_lpivot[1])

long_time = last_hpivot > last_lpivot ? 0 : 1

//FIBS

z = input(100, 'Z-Index')

p_offset = 2

transp = 60

a = (ta.lowest(z) + ta.highest(z)) / 2

b = ta.lowest(z)

c = ta.highest(z)

fibonacci = input(0, 'Fibonacci') / 100

//Fib Calls

fib0 = (hpivot - lpivot) * fibonacci + lpivot

fib1 = (hpivot - lpivot) * .21 + lpivot

fib2 = (hpivot - lpivot) * .3 + lpivot

fib3 = (hpivot - lpivot) * .5 + lpivot

fib4 = (hpivot - lpivot) * .62 + lpivot

fib5 = (hpivot - lpivot) * .7 + lpivot

fib6 = (hpivot - lpivot) * 1.00 + lpivot

fib7 = (hpivot - lpivot) * 1.27 + lpivot

fib8 = (hpivot - lpivot) * 2 + lpivot

fib9 = (hpivot - lpivot) * -.27 + lpivot

fib10 = (hpivot - lpivot) * -1 + lpivot

//Heiken Ashi Candles

heikenashi_1 = ticker.heikinashi(syminfo.tickerid)

data2 = isHA ? heikenashi_1 : syminfo.tickerid

res5 = input.timeframe('5', 'Resolution')

//HT Fibs

hfib0 = request.security(data2, res5, fib0[1])

hfib1 = request.security(data2, res5, fib1[1])

hfib2 = request.security(data2, res5, fib2[1])

hfib3 = request.security(data2, res5, fib3[1])

hfib4 = request.security(data2, res5, fib4[1])

hfib5 = request.security(data2, res5, fib5[1])

hfib6 = request.security(data2, res5, fib6[1])

hfib7 = request.security(data2, res5, fib7[1])

hfib8 = request.security(data2, res5, fib8[1])

hfib9 = request.security(data2, res5, fib9[1])

hfib10 = request.security(data2, res5, fib10[1])

vrsiup = vrsi > vrsi[1] and vrsi[1] > vrsi[2]

vrsidown = vrsi < vrsi[1] and vrsi[1] < vrsi[2]

long = ta.cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

short = ta.cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long2 = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short2 = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

// long = cross(close, fib0) and delta > 0 and vrsi < overSold and vrsiup

// short = cross(close, fib6) and delta < 0 and vrsi > overBought and vrsidown

reverseOpens = input(false, 'Reverse Orders')

if reverseOpens

tmplong = long

long := short

short := tmplong

short

//Strategy

ts = input(99999, 'TS')

tp = input(30, 'TP')

sl = input(15, 'SL')

last_long = 0.0

last_short = 0.0

last_long := long ? time : nz(last_long)

last_short := short ? time : nz(last_short)

in_long = last_long > last_short

in_short = last_short > last_long

long_signal = ta.crossover(last_long, last_short)

short_signal = ta.crossover(last_short, last_long)

last_open_long = 0.0

last_open_short = 0.0

last_open_long := long ? open : nz(last_open_long[1])

last_open_short := short ? open : nz(last_open_short[1])

last_open_long_signal = 0.0

last_open_short_signal = 0.0

last_open_long_signal := long_signal ? open : nz(last_open_long_signal[1])

last_open_short_signal := short_signal ? open : nz(last_open_short_signal[1])

last_high = 0.0

last_low = 0.0

last_high := not in_long ? na : in_long and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_short ? na : in_short and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = not na(last_high) and high <= last_high - ts and high >= last_open_long_signal

short_ts = not na(last_low) and low >= last_low + ts and low <= last_open_short_signal

long_tp = high >= last_open_long + tp and long[1] == 0

short_tp = low <= last_open_short - tp and short[1] == 0

long_sl = low <= last_open_long - sl and long[1] == 0

short_sl = high >= last_open_short + sl and short[1] == 0

last_hfib_long = 0.0

last_hfib_short = 0.0

last_hfib_long := long_signal ? fib1 : nz(last_hfib_long[1])

last_hfib_short := short_signal ? fib5 : nz(last_hfib_short[1])

last_fib7 = 0.0

last_fib10 = 0.0

last_fib7 := long ? fib7 : nz(last_fib7[1])

last_fib10 := long ? fib10 : nz(last_fib10[1])

last_fib8 = 0.0

last_fib9 = 0.0

last_fib8 := short ? fib8 : nz(last_fib8[1])

last_fib9 := short ? fib9 : nz(last_fib9[1])

last_long_signal = 0.0

last_short_signal = 0.0

last_long_signal := long_signal ? time : nz(last_long_signal[1])

last_short_signal := short_signal ? time : nz(last_short_signal[1])

last_long_tp = 0.0

last_short_tp = 0.0

last_long_tp := long_tp ? time : nz(last_long_tp[1])

last_short_tp := short_tp ? time : nz(last_short_tp[1])

last_long_ts = 0.0

last_short_ts = 0.0

last_long_ts := long_ts ? time : nz(last_long_ts[1])

last_short_ts := short_ts ? time : nz(last_short_ts[1])

long_ts_signal = ta.crossover(last_long_ts, last_long_signal)

short_ts_signal = ta.crossover(last_short_ts, last_short_signal)

last_long_sl = 0.0

last_short_sl = 0.0

last_long_sl := long_sl ? time : nz(last_long_sl[1])

last_short_sl := short_sl ? time : nz(last_short_sl[1])

long_tp_signal = ta.crossover(last_long_tp, last_long)

short_tp_signal = ta.crossover(last_short_tp, last_short)

long_sl_signal = ta.crossover(last_long_sl, last_long)

short_sl_signal = ta.crossover(last_short_sl, last_short)

last_long_tp_signal = 0.0

last_short_tp_signal = 0.0

last_long_tp_signal := long_tp_signal ? time : nz(last_long_tp_signal[1])

last_short_tp_signal := short_tp_signal ? time : nz(last_short_tp_signal[1])

last_long_sl_signal = 0.0

last_short_sl_signal = 0.0

last_long_sl_signal := long_sl_signal ? time : nz(last_long_sl_signal[1])

last_short_sl_signal := short_sl_signal ? time : nz(last_short_sl_signal[1])

last_long_ts_signal = 0.0

last_short_ts_signal = 0.0

last_long_ts_signal := long_ts_signal ? time : nz(last_long_ts_signal[1])

last_short_ts_signal := short_ts_signal ? time : nz(last_short_ts_signal[1])

true_long_signal = long_signal and last_long_sl_signal > last_long_signal[1] or long_signal and last_long_tp_signal > last_long_signal[1] or long_signal and last_long_ts_signal > last_long_signal[1]

true_short_signal = short_signal and last_short_sl_signal > last_short_signal[1] or short_signal and last_short_tp_signal > last_short_signal[1] or short_signal and last_short_ts_signal > last_short_signal[1]

// strategy.entry("BLUE", strategy.long, when=long)

// strategy.entry("RED", strategy.short, when=short)

g = delta > 0 and vrsi < overSold and vrsiup

r = delta < 0 and vrsi > overBought and vrsidown

long1 = ta.cross(close, fib1) and g and last_long_signal[1] > last_short_signal // and last_long_signal > long

short1 = ta.cross(close, fib5) and r and last_short_signal[1] > last_long_signal // and last_short_signal > short

last_long1 = 0.0

last_short1 = 0.0

last_long1 := long1 ? time : nz(last_long1[1])

last_short1 := short1 ? time : nz(last_short1[1])

last_open_long1 = 0.0

last_open_short1 = 0.0

last_open_long1 := long1 ? open : nz(last_open_long1[1])

last_open_short1 := short1 ? open : nz(last_open_short1[1])

long1_signal = ta.crossover(last_long1, last_long_signal)

short1_signal = ta.crossover(last_short1, last_short_signal)

last_long1_signal = 0.0

last_short1_signal = 0.0

last_long1_signal := long1_signal ? time : nz(last_long1_signal[1])

last_short1_signal := short1_signal ? time : nz(last_short1_signal[1])

long2 = ta.cross(close, fib2) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short2 = ta.cross(close, fib4) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long2 = 0.0

last_short2 = 0.0

last_long2 := long2 ? time : nz(last_long2[1])

last_short2 := short2 ? time : nz(last_short2[1])

last_open_short2 = 0.0

last_open_short2 := short2 ? open : nz(last_open_short2[1])

long2_signal = ta.crossover(last_long2, last_long1_signal) and long1_signal == 0

short2_signal = ta.crossover(last_short2, last_short1_signal) and short1_signal == 0

last_long2_signal = 0.0

last_short2_signal = 0.0

last_long2_signal := long2_signal ? time : nz(last_long2_signal[1])

last_short2_signal := short2_signal ? time : nz(last_short2_signal[1])

//Trade 4

long3 = ta.cross(close, fib3) and g and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short3 = ta.cross(close, fib3) and r and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long3 = 0.0

last_short3 = 0.0

last_long3 := long3 ? time : nz(last_long3[1])

last_short3 := short3 ? time : nz(last_short3[1])

last_open_short3 = 0.0

last_open_short3 := short3 ? open : nz(last_open_short3[1])

long3_signal = ta.crossover(last_long3, last_long2_signal) and long2_signal == 0

short3_signal = ta.crossover(last_short3, last_short2_signal) and short2_signal == 0

last_long3_signal = 0.0

last_short3_signal = 0.0

last_long3_signal := long3_signal ? time : nz(last_long3_signal[1])

last_short3_signal := short3_signal ? time : nz(last_short3_signal[1])

//Trade 5

long4 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short4 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long4 = 0.0

last_short4 = 0.0

last_long4 := long4 ? time : nz(last_long4[1])

last_short4 := short4 ? time : nz(last_short4[1])

long4_signal = ta.crossover(last_long4, last_long3_signal) and long2_signal == 0 and long3_signal == 0

short4_signal = ta.crossover(last_short4, last_short3_signal) and short2_signal == 0 and short3_signal == 0

last_long4_signal = 0.0

last_short4_signal = 0.0

last_long4_signal := long4_signal ? time : nz(last_long4_signal[1])

last_short4_signal := short4_signal ? time : nz(last_short4_signal[1])

//Trade 6

long5 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short5 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long5 = 0.0

last_short5 = 0.0

last_long5 := long5 ? time : nz(last_long5[1])

last_short5 := short5 ? time : nz(last_short5[1])

long5_signal = ta.crossover(last_long5, last_long4_signal) and long3_signal == 0 and long4_signal == 0

short5_signal = ta.crossover(last_short5, last_short4_signal) and short3_signal == 0 and short4_signal == 0

last_long5_signal = 0.0

last_short5_signal = 0.0

last_long5_signal := long5_signal ? time : nz(last_long5_signal[1])

last_short5_signal := short5_signal ? time : nz(last_short5_signal[1])

//Trade 7

long6 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short6 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long6 = 0.0

last_short6 = 0.0

last_long6 := long6 ? time : nz(last_long6[1])

last_short6 := short6 ? time : nz(last_short6[1])

long6_signal = ta.crossover(last_long6, last_long5_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0

short6_signal = ta.crossover(last_short6, last_short5_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0

last_long6_signal = 0.0

last_short6_signal = 0.0

last_long6_signal := long6_signal ? time : nz(last_long6_signal[1])

last_short6_signal := short6_signal ? time : nz(last_short6_signal[1])

//Trade 8

long7 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short7 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long7 = 0.0

last_short7 = 0.0

last_long7 := long7 ? time : nz(last_long7[1])

last_short7 := short7 ? time : nz(last_short7[1])

long7_signal = ta.crossover(last_long7, last_long6_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0

short7_signal = ta.crossover(last_short7, last_short6_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0

last_long7_signal = 0.0

last_short7_signal = 0.0

last_long7_signal := long7_signal ? time : nz(last_long7_signal[1])

last_short7_signal := short7_signal ? time : nz(last_short7_signal[1])

//Trade 9

long8 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short8 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long8 = 0.0

last_short8 = 0.0

last_long8 := long8 ? time : nz(last_long8[1])

last_short8 := short8 ? time : nz(last_short8[1])

long8_signal = ta.crossover(last_long8, last_long7_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0

short8_signal = ta.crossover(last_short8, last_short7_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0

last_long8_signal = 0.0

last_short8_signal = 0.0

last_long8_signal := long8_signal ? time : nz(last_long8_signal[1])

last_short8_signal := short8_signal ? time : nz(last_short8_signal[1])

//Trade 10

long9 = long and last_long1_signal > last_long_signal[1] and long1_signal == 0 and last_long_signal[1] > last_short_signal

short9 = short and last_short1_signal > last_short_signal[1] and short1_signal == 0 and last_short_signal[1] > last_long_signal

last_long9 = 0.0

last_short9 = 0.0

last_long9 := long9 ? time : nz(last_long9[1])

last_short9 := short9 ? time : nz(last_short9[1])

long9_signal = ta.crossover(last_long9, last_long8_signal) and long2_signal == 0 and long4_signal == 0 and long5_signal == 0 and long6_signal == 0 and long7_signal == 0 and long8_signal == 0

short9_signal = ta.crossover(last_short9, last_short8_signal) and short2_signal == 0 and short4_signal == 0 and short5_signal == 0 and short6_signal == 0 and short7_signal == 0 and short8_signal == 0

last_long9_signal = 0.0

last_short9_signal = 0.0

last_long9_signal := long9_signal ? time : nz(last_long9_signal[1])

last_short9_signal := short9_signal ? time : nz(last_short9_signal[1])

strategy.entry('Long', strategy.long, qty=1, when=long_signal)

strategy.entry('Short', strategy.short, qty=1, when=short_signal)

strategy.entry('Long', strategy.long, qty=2, when=long1_signal)

strategy.entry('Short1', strategy.short, qty=2, when=short1_signal)

strategy.entry('Long', strategy.long, qty=4, when=long2_signal)

strategy.entry('Short2', strategy.short, qty=4, when=short2_signal)

strategy.entry('Long', strategy.long, qty=8, when=long3_signal)

strategy.entry('Short3', strategy.short, qty=8, when=short3_signal)

strategy.entry('Long', strategy.long, qty=5, when=long4_signal)

strategy.entry('Short', strategy.short, qty=5, when=short4_signal)

strategy.entry('Long', strategy.long, qty=6, when=long5_signal)

strategy.entry('Short', strategy.short, qty=6, when=short5_signal)

strategy.entry('Long', strategy.long, qty=7, when=long6_signal)

strategy.entry('Short', strategy.short, qty=7, when=short6_signal)

strategy.entry('Long', strategy.long, qty=8, when=long7_signal)

strategy.entry('Short', strategy.short, qty=8, when=short7_signal)

strategy.entry('Long', strategy.long, qty=9, when=long8_signal)

strategy.entry('Short', strategy.short, qty=9, when=short8_signal)

strategy.entry('Long', strategy.long, qty=10, when=long9_signal)

strategy.entry('Short', strategy.short, qty=10, when=short9_signal)

short1_tp = low <= last_open_short1 - tp and short1[1] == 0

short2_tp = low <= last_open_short2 - tp and short2[1] == 0

short3_tp = low <= last_open_short3 - tp and short3[1] == 0

short1_sl = high >= last_open_short1 + sl and short1[1] == 0

short2_sl = high >= last_open_short2 + sl and short2[1] == 0

short3_sl = high >= last_open_short3 + sl and short3[1] == 0

close_long = ta.cross(close, fib6)

close_short = ta.cross(close, fib0)

// strategy.close("Long", when=close_long)

// strategy.close("Long", when=long_tp)

// strategy.close("Long", when=long_sl)

// strategy.close("Short", when=long_signal)

// strategy.close("Short1", when=long_signal)

// strategy.close("Short2", when=long_signal)

// strategy.close("Short3", when=long_signal)

strategy.close('Short', when=short_tp)

strategy.close('Short1', when=short1_tp)

strategy.close('Short2', when=short2_tp)

strategy.close('Short3', when=short3_tp)

strategy.close('Short', when=short_sl)

strategy.close('Short1', when=short1_sl)

strategy.close('Short2', when=short2_sl)

strategy.close('Short3', when=short3_sl)