전략 개요

이 전략은 가격 평형점에 기반한 트렌드 추적 및 반전 거래 시스템이다. 그것은 지난 X 루트 K 선의 최고점과 최저점의 중간값을 계산하여 평형 가격을 결정하고, 평형 가격에 대한 종식 가격의 위치에 따라 트렌드 방향을 판단한다. 가격이 평형 가격의 한쪽에 연속적으로 유지되어 설정된 K 선의 수에 도달하면 시스템이 트렌드를 인정한다.

전략 원칙

- 평형 가격 계산: 과거 X 근 K 선의 최고 가격과 최저 가격의 중간 지점을 평형 가격으로 사용한다. 이것은 1차 평형 도표의 기준 선 계산 방법과 동일하다.

- 트렌드 판단: 가격이 평형 가격의 같은 편에서 연속적으로 X 루트 K 라인을 유지하면 트렌드가 성립한다.

- 입시 신호: 트렌드가 확립된 후 첫 번째 회전 (가격이 균형 가격을 뚫는 경우) 에서 입시 신호를 유발한다.

- 손해정지: ATR의 60% 점수를 사용하여 손해정지 거리를 동적으로 조정하여 위험 관리의 유연성을 제공합니다.

- 큰 변동성 보호: 가격의 평형점 오차가 설정된 ATR 배수를 초과할 때, 시스템은 급격한 철수를 방지하기 위해 자동으로 포지션을 청산한다.

전략적 이점

- 적응력: 시장 특성에 따라 유연하게 트렌드를 추적하고 거래 모드를 역전할 수 있다.

- 위험 제어: 동적 ATR 상실을 적용하고, 큰 변동 보호 장치가 있다.

- 명확한 운영: 거래 신호가 명확하고 복잡한 기술 지표 조합에 의존하지 않습니다.

- 시각화 효과는 좋습니다: 컬러 K선과 배경을 사용하여 시장 상태를 직관적으로 보여줍니다.

- 자동화 친화적: MT5와 같은 거래 플랫폼을 편리하게 연결하여 자동화 거래를 수행할 수 있습니다.

전략적 위험

- 위축 시장 위험: 위축 시장에서 빈번한 잘못된 신호가 발생할 수 있습니다.

- 슬라이드 효과: 급격한 변동이 있을 때 더 큰 슬라이드 문제가 발생할 수 있다.

- 변수 민감성: 균형 기간, 트렌드 판단 주기 등 핵심 변수들은 시장에 따라 신중하게 최적화되어야 한다.

- 시장 전환 위험: 시장이 추세에서 흔들림으로 전환하는 시기는 큰 회전을 초래할 수 있다.

전략 최적화 방향

- 시장 환경 인식: 시장 환경 판단 모듈을 추가하여 다양한 시장 조건에 따라 전략 매개 변수를 동적으로 조정합니다.

- 신호 필터링: 트래픽, 변동률과 같은 보조 지표를 추가하는 것을 고려하여 가짜 신호를 필터링하십시오.

- 포지션 관리: 더 복잡한 포지션 관리 메커니즘을 도입, 예를 들어 변동률에 기반한 동적 조정.

- 다중 시간 주기: 거래의 정확성을 높이기 위해 여러 시간 주기의 신호를 통합한다.

- 거래 비용 최적화: 다양한 거래 품종에 대한 비용 특성을 최적화하기 위한 시점.

요약하다

이것은 합리적으로 설계된 트렌드 거래 시스템이며, 균형 가격이라는 핵심 개념을 통해 명확한 거래 논리를 제공합니다. 이 전략의 가장 큰 특징은 유연성이 강하며, 트렌드 추적과 역전 거래 모두 사용할 수 있으며, 완벽한 위험 제어 장치를 갖추고 있습니다. 일부 시장 조건에서 도전을 받을 수 있지만, 지속적인 최적화와 유연한 조정으로, 이 전략은 다양한 시장 환경에서 안정적인 성능을 유지할 것으로 예상됩니다.

전략 소스 코드

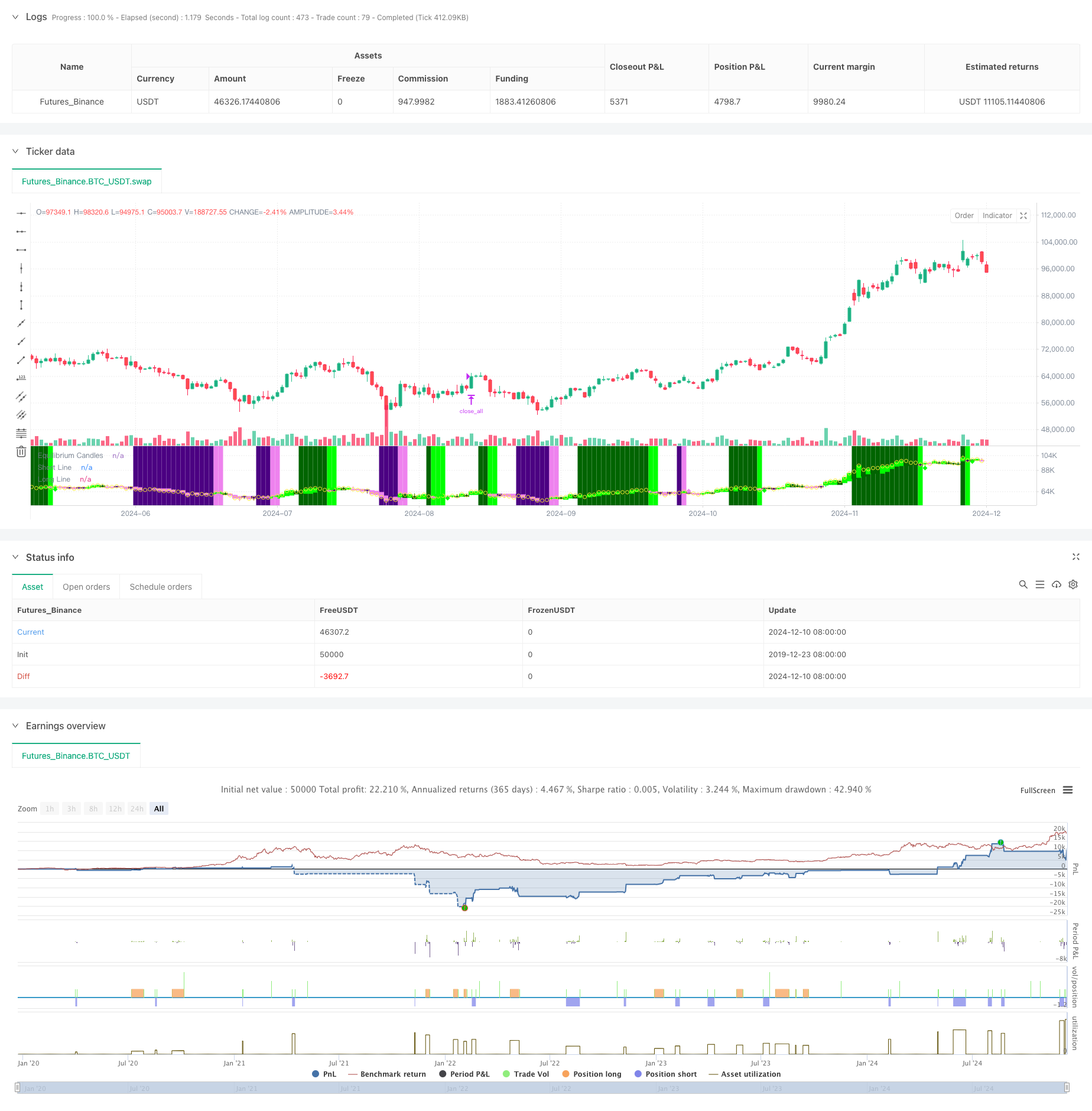

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-11 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Honestcowboy

//@version=5

strategy("Equilibrium Candles + Pattern [Honestcowboy]", overlay=false)

// ================================== //

// ---------> User Input <----------- //

// ================================== //

candleSmoothing = input.int(9, title="Equilibrium Length", tooltip="The lookback for finding equilibrium.\nIt is same calculation as the Baseline in Ichimoku Cloud and is the mid point between highest and lowest value over this length.", group="Base Settings")

candlesForTrend = input.int(7, title="Candles needed for Trend", tooltip="The amount of candles in one direction (colored) before it's considered a trend.\nOrders get created on the first candle in opposite direction.", group="Base Settings")

maxPullbackCandles = input.int(2, title="Max Pullback (candles)", tooltip="The amount of candles can go in opposite direction until a pending trade order is cancelled.", group="Base Settings")

candle_bull_c1 = input.color(color.rgb(0,255,0), title="", inline="1", group="Candle Coloring")

candle_bull_c2 = input.color(color.rgb(0,100,0), title="", inline="1", group="Candle Coloring")

candle_bear_c1 = input.color(color.rgb(238,130,238), title="", inline="2", group="Candle Coloring")

candle_bear_c2 = input.color(color.rgb(75,0,130), title="", inline="2", group="Candle Coloring")

highlightClosePrices = input.bool(defval=true, title="Highlight close prices", group="Candle Coloring", tooltip="Will put small yellow dots where closing price would be.")

useBgColoring = input.bool(defval=true, title="color main chart Bg based on trend and entry point", tooltip="colors main chart background based on trend and entry points", group="Chart Background")

trend_bull_c = input.color(color.rgb(0,100,0,50), title="Trend Bull Color", group="Chart Background")

trend_bear_c = input.color(color.rgb(75,0,130, 50), title="Trend Bear Color", group="Chart Background")

long_zone_c = input.color(color.rgb(0,255,0,60), title="Long Entry Zone Color", group="Chart Background")

short_zone_c = input.color(color.rgb(238,130,238,60), title="Short Entry Zone Color", group="Chart Background")

atrLenghtScob = input.int(14, title="ATR Length", group = "Volatility Settings")

atrAverageLength = input.int(200, title="ATR percentile averages lookback", group = "Volatility Settings")

atrPercentile = input.int(60, minval=0, maxval=99, title="ATR > bottom X percentile", group = "Volatility Settings", tooltip="For the Final ATR value in which percentile of last X bars does it need to be a number. At 60 it's the lowest ATR in top 40% of ATR over X bars")

useReverse = input.bool(true, title="Use Reverse", group="Strategy Inputs", tooltip="The Strategy will open short orders where normal strategy would open long orders. It will use the SL as TP and the TP as SL. So would create the exact opposite in returns as the normal strategy.")

stopMultiplier = input.float(2, title="stop+tp atr multiplier", group="Strategy Inputs")

useTPSL = input.bool(defval=true, title="use stop and TP", group="Strategy Inputs")

useBigCandleExit = input.bool(defval=true, title="Big Candle Exit", group="Strategy Inputs", inline="1", tooltip="Closes all open trades whenever price closes too far from the equilibrium")

bigCandleMultiplier = input.float(defval=1, title="Exit Multiplier", group="Strategy Inputs", inline="1", tooltip="The amount of times in ATR mean candle needs to close outside of equilibrium for it to be a big candle exit.")

tvToQPerc = input.float(defval=1, title="Trade size in Account risk %", group="Tradingview.to Connection (MT5)", tooltip="Quantity as a percentage with stop loss in the commands; the lot size is calculated based on the percentage to lose in case sl is hit. If SL is not specified, the Lot size will be calculated based on account balance.")

tvToOverrideSymbol = input.bool(defval=false, title="Override Symbol?", group="Tradingview.to Connection (MT5)")

tvToSymbol = input.string(defval="EURUSD", title="", group="Tradingview.to Connection (MT5)")

// ================================== //

// -----> Immutable Constants <------ //

// ================================== //

var bool isBullTrend = false

var bool isBearTrend = false

var bool isLongCondition = false

var bool isShortCondition = false

var int bullCandleCount = 0

var int bearCandleCount = 0

var float longLine = na

var float shortLine = na

// ================================== //

// ---> Functional Declarations <---- //

// ================================== //

baseLine(len) =>

math.avg(ta.lowest(len), ta.highest(len))

// ================================== //

// ----> Variable Calculations <----- //

// ================================== //

longSignal = false

shortSignal = false

equilibrium = baseLine(candleSmoothing)

atrEquilibrium = ta.atr(atrLenghtScob)

atrAveraged = ta.percentile_nearest_rank(atrEquilibrium, atrAverageLength, atrPercentile)

equilibriumTop = equilibrium + atrAveraged*bigCandleMultiplier

equilibriumBottom = equilibrium - atrAveraged*bigCandleMultiplier

// ================================== //

// -----> Conditional Variables <---- //

// ================================== //

if not isBullTrend and close>equilibrium

bullCandleCount := bullCandleCount + 1

bearCandleCount := 0

isBearTrend := false

if not isBearTrend and close<equilibrium

bearCandleCount := bearCandleCount + 1

bullCandleCount := 0

isBullTrend := false

if bullCandleCount >= candlesForTrend

isBullTrend := true

isBearTrend := false

bullCandleCount := 0

bearCandleCount := 0

if bearCandleCount >= candlesForTrend

isBearTrend := true

isBullTrend := false

bullCandleCount := 0

bearCandleCount := 0

// ================================== //

// ------> Strategy Execution <------ //

// ================================== //

if isBullTrend[1] and close<equilibrium

if useReverse and (not na(atrAveraged))

strategy.entry("short", strategy.short, limit=high)

alert("Sell " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(high) + " TP=" + str.tostring(high-stopMultiplier*atrAveraged)+ " SL=" + str.tostring(high+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

if (not useReverse) and (not na(atrAveraged))

strategy.entry("long", strategy.long, stop=high)

alert("Buy " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(high) + " TP=" + str.tostring(high+stopMultiplier*atrAveraged) + " SL=" + str.tostring(high+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

isLongCondition := true

isBullTrend := false

longLine := high

if isBearTrend[1] and close>equilibrium

if useReverse and (not na(atrAveraged))

strategy.entry("long", strategy.long, limit=low)

alert("Buy " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(low) + " TP=" + str.tostring(low+stopMultiplier*atrAveraged) + " SL=" + str.tostring(low-stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

if (not useReverse) and (not na(atrAveraged))

strategy.entry("short", strategy.short, stop=low)

alert("Sell " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " Q=" + str.tostring(tvToQPerc) + "% P=" + str.tostring(low) + " TP=" + str.tostring(low-stopMultiplier*atrAveraged) + " SL=" + str.tostring(low+stopMultiplier*atrAveraged), freq=alert.freq_once_per_bar)

isShortCondition := true

isBearTrend := false

shortLine := low

if isLongCondition and (bearCandleCount >= maxPullbackCandles)[1]

if useReverse

strategy.cancel("short")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=sell")

if not useReverse

strategy.cancel("long")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=buy")

isLongCondition := false

bullCandleCount := 0

longLine := na

if isShortCondition and (bullCandleCount >= maxPullbackCandles)[1]

if useReverse

strategy.cancel("long")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=buy")

if not useReverse

strategy.cancel("short")

alert("Cancel " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)) + " t=sell")

isShortCondition := false

bearCandleCount := 0

shortLine := na

// ---- Save for graphical display that there is a longcondition + reset other variables

if high>longLine

longSignal := true

longLine := na

isLongCondition := false

if low<shortLine

shortSignal := true

shortLine := na

isShortCondition := false

// ---- Get Stop loss and Take Profit in there

if useReverse

if useTPSL

if strategy.position_size < 0 and strategy.position_size[1] >= 0

strategy.exit("short exit", "short", limit=longLine[1]-stopMultiplier*atrAveraged, stop=longLine[1]+stopMultiplier*atrAveraged)

if strategy.position_size > 0 and strategy.position_size[1] <= 0

strategy.exit("long exit", "long", limit=shortLine[1]+stopMultiplier*atrAveraged, stop=shortLine[1]-stopMultiplier*atrAveraged)

if not useReverse

if useTPSL

if strategy.position_size > 0 and strategy.position_size[1] <= 0

strategy.exit("long exit", "long", limit=longLine[1]+stopMultiplier*atrAveraged, stop=longLine[1]-stopMultiplier*atrAveraged)

if strategy.position_size < 0 and strategy.position_size[1] >=0

strategy.exit("short exit", "short", limit=shortLine[1]-stopMultiplier*atrAveraged, stop=shortLine[1]+stopMultiplier*atrAveraged)

// ----- Logic for closing positions on a big candle in either direction

if (strategy.position_size[1]>0 or strategy.position_size[1]<0) and useBigCandleExit

if close>equilibriumTop or close<equilibriumBottom

strategy.close_all("Big Candle Stop")

alert("close " + str.tostring((tvToOverrideSymbol ? tvToSymbol : syminfo.ticker)))

// ================================== //

// ------> Graphical Display <------- //

// ================================== //

// Deviation from equilibrium using smoothed ATR and percentile nearest rank to rank the coloring of the candles

candle_c2 = close>equilibrium ? close>open ? candle_bull_c1 : candle_bull_c2 : close<open ? candle_bear_c1 : candle_bear_c2

//

plotcandle(equilibrium, high, low, close, title="Equilibrium Candles", color=candle_c2, wickcolor=candle_c2, bordercolor=candle_c2)

plotshape(highlightClosePrices ? close : na, title="Closing Bubble", style=shape.circle, location=location.absolute, color=color.yellow)

bgcolor(useBgColoring ? (isBullTrend ? trend_bull_c : isBearTrend ? trend_bear_c : isLongCondition ? long_zone_c : isShortCondition ? short_zone_c : na) : na, force_overlay=true)

plot(longLine, color=candle_bull_c1, title="Long Line", style=plot.style_linebr, linewidth=4)

plot(shortLine, color=candle_bear_c1, title="Short Line", style=plot.style_linebr, linewidth=4)

plotshape(longSignal ? math.min(equilibrium, low)+(-0.5*atrAveraged) : na, title="Long Signal", color=candle_bull_c1, style=shape.diamond, size=size.tiny, location=location.absolute)

plotshape(shortSignal ? math.max(equilibrium, high)+(0.5*atrAveraged) : na, title="Short Signal", color=candle_bear_c1, style=shape.diamond, size=size.tiny, location=location.absolute)

// =================================== //

// ------> Simple Form Alerts <------- //

// =================================== //

alertcondition(longSignal, "Simple Long Signal")

alertcondition(shortSignal, "Simple Short Signal")