개요

이 전략은 이동평균선(MA), 상대강도지수(RSI), 이동평균수렴발산지수(MACD), 볼린저 밴드(BB)를 포함한 여러 가지 고전적 기술 지표를 결합한 포괄적인 거래 시스템입니다. 이 시스템은 이러한 지표의 조정된 협력을 활용하여 시장에서 더 정확한 매수 및 매도 신호를 찾아 거래 성공률을 향상시킵니다.

전략 원칙

본 전략은 다층 신호 검증 메커니즘을 채택하는데, 이는 주로 다음과 같은 측면을 포함합니다.

- 단기(9일) 및 장기(21일) 이동평균선의 교차점을 사용하여 기본 추세 방향을 결정합니다.

- RSI(14일)를 사용하여 매수 과다 및 매도 과다 영역을 식별하고 70과 30을 주요 수준으로 설정합니다.

- MACD(12, 26, 9)를 사용하여 추세 강도와 가능한 전환점을 확인하세요.

- Bollinger Bands(20일, 2표준편차)를 사용하여 가격 변동 범위와 잠재적 반전 지점을 파악합니다.

시스템은 다음 조건에서 거래 신호를 생성합니다.

- 주요 매수 신호: 단기 MA가 장기 MA를 넘어 교차

- 주요 매도 신호: 단기 MA가 장기 MA를 밑돌아

- 보조 매수 신호: RSI가 30 미만이고 MACD 히스토그램이 양수이며 가격이 하단 Bollinger Band에 닿습니다.

- 보조 매도 신호: RSI가 70 이상이며 MACD 히스토그램이 음수이고 가격이 상단 Bollinger Band에 닿습니다.

전략적 이점

- 다차원 분석: 여러 기술 지표를 통합하여 보다 포괄적인 시장 분석 관점을 제공합니다.

- 신호 확인 메커니즘: 주신호와 보조신호의 조합으로 오신호의 영향을 줄일 수 있습니다.

- 완벽한 위험 관리: Bollinger Bands와 RSI의 조합을 사용하여 진입 지점의 위험을 관리합니다.

- 추세추적능력 : MA와 MACD의 협력을 통해 주요 추세를 파악할 수 있을 뿐만 아니라 추세의 전환점도 파악할 수 있습니다.

- 강력한 시각화 효과: 시스템은 배경색 프롬프트와 모양 마커를 포함한 명확한 그래픽 인터페이스를 제공합니다.

전략적 위험

- 신호 히스테리시스: 이동 평균 자체에는 히스테리시스가 있어 최적이 아닌 진입 지점으로 이어질 수 있습니다.

- 변동성 있는 시장의 위험: 횡보 및 변동성 있는 시장에서는 빈번하게 잘못된 신호가 발생할 수 있습니다.

- 충돌하는 지표: 여러 지표가 특정 시간에 충돌하는 신호를 생성할 수 있습니다.

- 매개변수 민감도: 전략의 효과는 매개변수 설정에 민감하며 충분한 매개변수 최적화가 필요합니다.

전략 최적화 방향

- 동적 매개변수 조정: 각 지표의 매개변수는 시장 변동성에 따라 자동으로 조정될 수 있습니다.

- 시장 환경 분류: 다양한 시장 환경에 대한 인식 메커니즘을 추가하고 다양한 시장 조건에서 다양한 신호 조합을 사용합니다.

- 개선된 손절매 메커니즘: 트레일링 손절매 또는 ATR 기반 손절매와 같은 보다 유연한 손절매 방식을 추가합니다.

- 포지션 관리 최적화: 신호 강도와 시장 변동성에 따라 포지션 크기를 동적으로 조정합니다.

- 시간 프레임 조정: 신호 안정성을 개선하기 위해 여러 시간 프레임 분석을 추가하는 것을 고려하세요.

요약하다

이는 여러 기술 지표의 시너지 효과를 통해 거래 신호를 제공하는 잘 설계된 다차원 거래 전략 시스템입니다. 이 전략의 주요 장점은 포괄적인 분석 프레임워크와 엄격한 신호 확인 메커니즘에 있지만, 매개변수 최적화 및 시장 환경에 대한 적응성과 같은 문제에도 주의를 기울여야 합니다. 추천된 최적화 방향을 통해 볼 때, 이 전략은 아직도 개선의 여지가 많이 있습니다.

전략 소스 코드

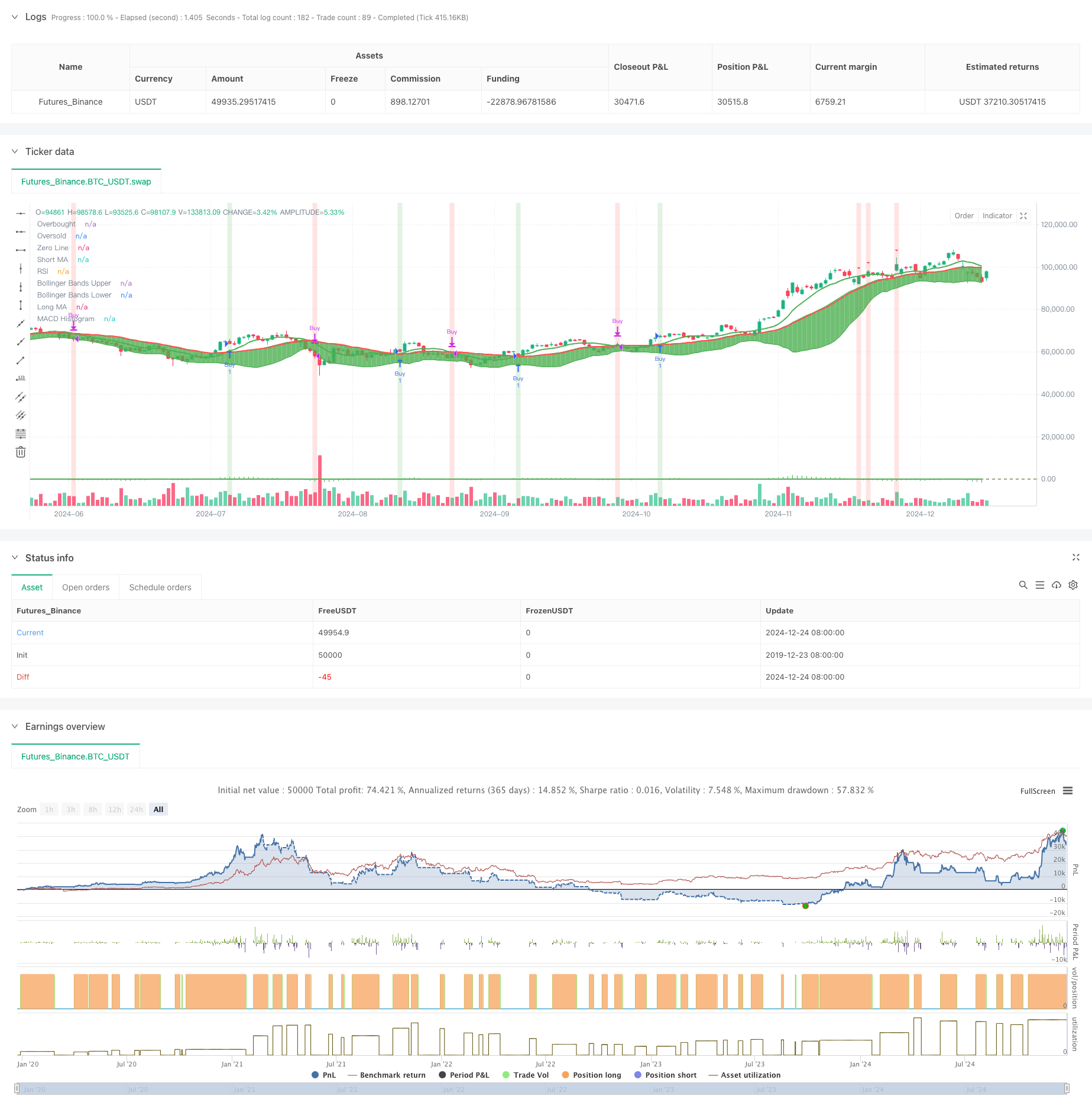

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ultimate Buy/Sell Indicator", overlay=true)

// Inputs for Moving Averages

shortMaLength = input.int(9, title="Short MA Length", minval=1)

longMaLength = input.int(21, title="Long MA Length", minval=1)

// Inputs for RSI

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=1, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=1, maxval=100)

// Inputs for MACD

macdShortLength = input.int(12, title="MACD Short EMA Length", minval=1)

macdLongLength = input.int(26, title="MACD Long EMA Length", minval=1)

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing", minval=1)

// Inputs for Bollinger Bands

bbLength = input.int(20, title="Bollinger Bands Length", minval=1)

bbMultiplier = input.float(2.0, title="Bollinger Bands Multiplier", minval=0.1)

// Calculate Moving Averages

shortMa = ta.sma(close, shortMaLength)

longMa = ta.sma(close, longMaLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShortLength, macdLongLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// Calculate Bollinger Bands

[bbUpper, bbBasis, bbLower] = ta.bb(close, bbLength, bbMultiplier)

// Define colors

colorPrimary = color.new(color.green, 0)

colorSecondary = color.new(color.red, 0)

colorBackgroundBuy = color.new(color.green, 80)

colorBackgroundSell = color.new(color.red, 80)

colorTextBuy = color.new(color.green, 0)

colorTextSell = color.new(color.red, 0)

// Plot Moving Averages

plot(shortMa, color=colorPrimary, linewidth=2, title="Short MA")

plot(longMa, color=colorSecondary, linewidth=2, title="Long MA")

// Plot Bollinger Bands

bbUpperLine = plot(bbUpper, color=colorPrimary, linewidth=1, title="Bollinger Bands Upper")

bbLowerLine = plot(bbLower, color=colorPrimary, linewidth=1, title="Bollinger Bands Lower")

fill(bbUpperLine, bbLowerLine, color=color.new(colorPrimary, 90))

// Buy/Sell Conditions based on MA cross

buySignal = ta.crossover(shortMa, longMa)

sellSignal = ta.crossunder(shortMa, longMa)

// Execute Buy/Sell Orders

if buySignal

strategy.entry("Buy", strategy.long, 1)

strategy.close("Sell", qty_percent=1) // Close all positions when selling

if sellSignal

strategy.close("Sell", qty_percent=1) // Close all positions when selling

strategy.close("Buy") // Close any remaining buy positions

// Plot Buy/Sell Signals for MA crossovers

plotshape(series=buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Sell Signal")

// Background Color based on Buy/Sell Signal for MA crossovers

bgcolor(buySignal ? colorBackgroundBuy : na, title="Buy Signal Background")

bgcolor(sellSignal ? colorBackgroundSell : na, title="Sell Signal Background")

// Plot RSI with Overbought/Oversold Levels

hline(rsiOverbought, "Overbought", color=colorSecondary, linestyle=hline.style_dashed, linewidth=1)

hline(rsiOversold, "Oversold", color=colorPrimary, linestyle=hline.style_dashed, linewidth=1)

plot(rsi, color=colorPrimary, linewidth=2, title="RSI")

// Plot MACD Histogram

plot(macdHist, color=colorPrimary, style=plot.style_histogram, title="MACD Histogram", linewidth=2)

hline(0, "Zero Line", color=color.new(color.gray, 80))

// Additional Buy/Sell Conditions based on RSI, MACD, and Bollinger Bands

additionalBuySignal = rsi < rsiOversold and macdHist > 0 and close < bbLower

additionalSellSignal = rsi > rsiOverbought and macdHist < 0 and close > bbUpper

// Plot Additional Buy/Sell Signals

plotshape(series=additionalBuySignal and not buySignal, location=location.belowbar, color=colorTextBuy, style=shape.triangleup, size=size.small, title="Additional Buy Signal")

plotshape(series=additionalSellSignal and not sellSignal, location=location.abovebar, color=colorTextSell, style=shape.triangledown, size=size.small, title="Additional Sell Signal")

// Background Color based on Additional Buy/Sell Signal

bgcolor(additionalBuySignal and not buySignal ? colorBackgroundBuy : na, title="Additional Buy Signal Background")

bgcolor(additionalSellSignal and not sellSignal ? colorBackgroundSell : na, title="Additional Sell Signal Background")