이는 다중 이동평균 교차 지표와 거래량 가격 지표를 기반으로 한 포괄적인 모멘텀 트레이딩 전략입니다. 이 전략은 빠르고 느린 지수 이동 평균(EMA) 크로스오버, 거래량 가중 평균 가격(VWAP) 및 SuperTrend의 조합을 기반으로 거래 신호를 생성하는 동시에 일일 거래 시간 창과 가격 변화 범위와 같은 조건을 결합하여 진입을 제어합니다. 그리고 종료합니다.

전략 원칙

이 전략은 5일 및 13일 EMA를 주요 추세 판단 지표로 사용합니다. 빠른 EMA가 느린 EMA를 위로 교차하고 종가가 VWAP 위에 있을 때 롱 신호가 트리거되고 빠른 EMA가 느린 EMA를 아래로 교차할 때 그리고 종가가 VWAP보다 낮으면 롱 신호가 트리거됩니다. 떨어지면 숏 신호가 트리거됩니다. 동시에 이 전략은 추세 확인 및 손절매의 기준으로 SuperTrend 지표를 도입합니다. 이 전략은 이전 거래일의 종가 대비 가격 변화 범위, 당일 최고가와 최저가의 변동 범위 등을 포함하여, 거래일별로 다른 진입 조건을 설정합니다.

전략적 이점

- 다양한 기술 지표를 조화롭게 활용하면 거래 신호의 신뢰성이 향상됩니다.

- 시장 특성에 더 잘 적응하기 위해 다양한 거래일에 대해 차별화된 진입 조건을 설정합니다.

- 동적 손절매 및 손절매 메커니즘을 채택하면 위험을 효과적으로 통제할 수 있습니다.

- 일일 거래 시간 제한과 결합하여 변동성이 높은 기간의 위험을 피할 수 있습니다.

- 이전 최고가와 최저가, 그리고 가격 변동 범위를 제한함으로써 최고가를 쫓아가 최저가에 판매하는 위험이 줄어듭니다.

전략적 위험

- 빠르게 움직이는 시장 상황에서는 거짓 신호가 나타날 수 있습니다.

- 추세 반전 초기 단계에는 지연이 있을 수 있습니다.

- 매개변수 최적화에는 과적합의 위험이 있을 수 있습니다.

- 거래 비용은 전략 수익에 영향을 미칠 수 있습니다.

- 시장은 변동성이 높은 기간 동안 큰 하락을 겪을 수 있습니다.

전략 최적화 방향

- 추세 강도를 더욱 확인하기 위해 볼륨 분석 지표 도입을 고려하세요.

- 다양한 거래일에 대한 매개변수 설정을 최적화하여 전략 적응성을 개선합니다.

- 예측 정확도를 높이기 위해 더 많은 시장 감정 지표를 추가하세요

- 자본활용 효율성 제고를 위한 손절매 및 손절매 메커니즘 개선

- 포지션 관리를 최적화하기 위해 변동성 지표를 추가하는 것을 고려하세요

요약하다

이 전략은 여러 기술 지표를 포괄적으로 활용하여 추세 추적과 모멘텀 거래를 결합합니다. 전략 설계는 시장의 다양성을 충분히 고려하고 각 거래일마다 차별화된 거래 규칙을 채택합니다. 엄격한 위험 관리와 유연한 손절매 및 손절매 메커니즘을 통해 이 전략은 우수한 실용적 적용 가치를 입증합니다. 앞으로는 더 많은 기술 지표를 도입하고 매개변수 설정을 최적화함으로써 전략의 안정성과 수익성을 더욱 개선할 수 있습니다.

전략 소스 코드

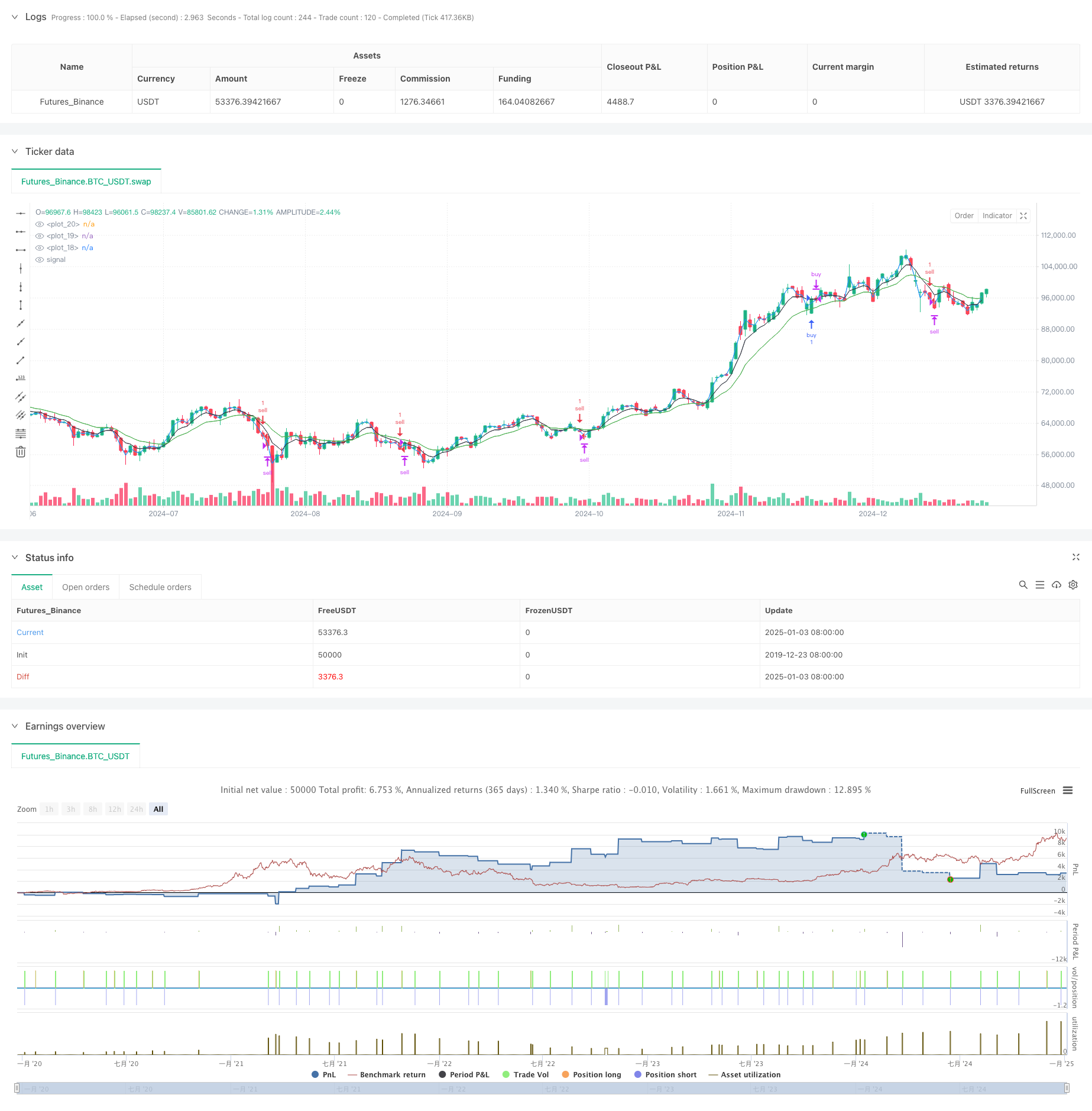

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=6

strategy("S1", overlay=true)

fastEMA = ta.ema(close, 5)

slowEMA = ta.ema(close,13)

ema9 = ta.ema(close, 9)

ema100 = ta.ema(close, 100)

ema5 = ta.ema(close, 5)

ema200 = ta.ema(close, 200)

ma = ta.sma(close, 50)

mult = input.float(defval=3)

len = input.int(defval=11)

[superTrend, dir] = ta.supertrend(mult, len)

vwap1= ta.vwap(hlc3)

plot(slowEMA,color = color.green)

plot(fastEMA,color = color.black)

plot(vwap1, color = color.blue)

var dailyTaskDone = false

var gapdown = false

var gapup = false

var runup = 0.0

var biggapdown = false

var biggapup = false

var prevDayClose = 0.0

var todayLow = 0.0

var todayHigh = 0.0

var noBuyNow = false

var noSellNow = false

var buyPrice = 0.0

var sellPrice = 0.0

var todayBuyDone = false

var todaySellDone = false

var dragonflyDoji = false

var candleCount = 0

var candleCount1 = 0

var lastTrade = 9

var lastFiveCandles = false

var lastSevenCandlesS = false

var fiveEMACC = 0

candleCount := candleCount + 1

candleCount1 := candleCount1 + 1

if fiveEMACC > 0

fiveEMACC := fiveEMACC + 1

if fiveEMACC == 6

fiveEMACC := 0

if strategy.openprofit == 0

candleCount := 0

if hour == 9 and minute ==15

prevDayClose := close[1]

todayLow := low

todayHigh := high

lastTrade := 9

if hour == 9 and minute ==15 and (open - close[1]) > close*0.01

gapup := true

if hour == 9 and minute ==15 and (open - close[1]) < close*0.005*-1

gapdown := true

if hour == 9 and minute ==15 and (close - close[1]) > 200

biggapup := true

if hour == 9 and minute ==15 and (close - close[1]) < 200

biggapdown := true

if low < todayLow

todayLow := low

candleCount1 := 0

if high > todayHigh

todayHigh := high

if close > todayLow + 200

noBuyNow := true

if close < todayHigh - 200//0.01*close

noSellNow := false

lastFiveCandles := (close[4]<open[4] or close[3]<open[3] or close[2] < open[2] or close[1]<open[1])

lastSevenCandlesS := (close[6]>open[6] or close[5]>open[5] or close[4]>open[4] or close[3]>open[3] or close[2] > open[2] or close[1]>open[1])

if hour == 15

dailyTaskDone := false

gapdown := false

gapup := false

biggapup := false

biggapdown := false

noBuyNow := false

noSellNow := false

todayLow := 0.0

todayHigh := 0.0

buyPrice := 0.0

sellPrice := 0.0

todayBuyDone := false

todaySellDone := false

dragonflyDoji := false

lastTrade := 9

// if fastEMA < slowEMA and lastTrade == 1 and strategy.openprofit==0

// lastTrade := 9

if fastEMA > slowEMA and lastTrade == 0 and strategy.openprofit==0

lastTrade := 9

buy = (dayofweek==dayofweek.thursday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.monday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.011) or

(dayofweek==dayofweek.tuesday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1] and lastFiveCandles and close-prevDayClose < close*0.015 and close-todayLow < close*0.012) or

(dayofweek==dayofweek.wednesday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close-prevDayClose < close*0.015 and (hour!=9 or minute>=35) and close-todayLow < close*0.012) or

(dayofweek==dayofweek.friday and ((fastEMA - slowEMA > close*0.001))and close > vwap1 and close[1] > vwap1[1] and (hour!=9 or minute>=35))

sell= (dayofweek==dayofweek.thursday and (hour!=9 or minute>=35) and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and lastSevenCandlesS and close[1] < vwap1[1]) or

(dayofweek==dayofweek.monday and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.008 and todayHigh-close[1] < close * 0.01 ) or

(dayofweek==dayofweek.tuesday and (hour!=9 or minute>=35) and (open - low < 2*(high-close)) and (close-open<10) and not dragonflyDoji and (slowEMA - fastEMA > close*0.00089) and close < vwap1 and close[1] < vwap1[1] and prevDayClose-close<close*0.012 and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

(dayofweek==dayofweek.wednesday and (hour!=9 or minute>=40) and close<open and (slowEMA - fastEMA > close*0.00089) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (close-todayLow>30 or candleCount1<1) ) or

(dayofweek==dayofweek.friday and ((slowEMA - fastEMA > close*0.00089)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (hour!=9 or minute>=55) )

// buy = (dayofweek==dayofweek.thursday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1]) or

// (dayofweek==dayofweek.monday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.011) or

// (dayofweek==dayofweek.tuesday and (fastEMA > slowEMA) and close > vwap1 and close[1] > vwap1[1] and lastFiveCandles and close-prevDayClose < close*0.015 and close-todayLow < close*0.012) or

// (dayofweek==dayofweek.wednesday and (fastEMA > slowEMA) and close > vwap1 and close-prevDayClose < close*0.015 and (hour!=9 or minute>=35) and close-todayLow < close*0.012) or

// (dayofweek==dayofweek.friday and ((fastEMA > slowEMA))and close > vwap1 and close[1] > vwap1[1] and (hour!=9 or minute>=35))

// sell= (dayofweek==dayofweek.thursday and (hour!=9 or minute>=35) and ((slowEMA > fastEMA)) and close < vwap1 and lastSevenCandlesS and close[1] < vwap1[1]) or

// (dayofweek==dayofweek.monday and ((slowEMA > fastEMA)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.008 and todayHigh-close[1] < close * 0.01 ) or

// (dayofweek==dayofweek.tuesday and (hour!=9 or minute>=35) and (open - low < 2*(high-close)) and (close-open<10) and not dragonflyDoji and (slowEMA > fastEMA) and close < vwap1 and close[1] < vwap1[1] and prevDayClose-close<close*0.012 and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

// (dayofweek==dayofweek.wednesday and (hour!=9 or minute>=40) and close<open and (slowEMA > fastEMA) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (close-todayLow>30 or candleCount1<1) ) or

// (dayofweek==dayofweek.friday and ((slowEMA > fastEMA)) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and (hour!=9 or minute>=55) )

dragonflyDoji:= false

// (slowEMA - fastEMA > close*0.00089 or (slowEMA-fastEMA>close*0.00049 and (high[2]>vwap or high[1]>vwap)))

if sellPrice != 0 and runup < sellPrice - low

runup := sellPrice - low

if buyPrice != 0 and runup < high - buyPrice

//ourlabel = label.new(x=bar_index, y=na, text=tostring(runup), yloc=yloc.belowbar)

runup := high - buyPrice

NoBuySellTime = (hour == 15) or ((hour==14 and minute>=25)) or (hour==9 and minute<=35) or hour >= 14

//(fiveEMACC > 0 and low < fastEMA and close < vwap1)

buyexit = fastEMA<slowEMA or (close<superTrend and close < vwap1 and close[1] < vwap1[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000

sellexit = slowEMA<fastEMA or (close > vwap1 and close[1] > vwap1[1] and close>superTrend) //or strategy.openprofit > 400 or strategy.openprofit < -5000

exitPosition = (dayofweek==dayofweek.thursday and buyPrice!=0.0 and (high - buyPrice) > 50) or (dayofweek==dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > 80) or (dayofweek==dayofweek.monday and buyPrice !=0.0 and high-buyPrice > 30) or (dayofweek==dayofweek.monday and sellPrice!=0.0 and (sellPrice - low) > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and buyPrice!=0.0 and (high - buyPrice) > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and sellPrice!=0.0 and (sellPrice - low) > 30)

//code such that 2 fastema is > than 2 slowema

//exitPosition = (sellPrice!=0 and runup >21 and strategy.openprofit < -2000) or (candleCount > 18 and strategy.openprofit > 50 and strategy.openprofit < 1000) or (dayofweek==dayofweek.thursday and buyPrice!=0.0 and (high - buyPrice) > buyPrice * 0.007) or (dayofweek==dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > sellPrice * 0.007) or (dayofweek==dayofweek.monday and buyPrice !=0.0 and high-buyPrice > 30) or (dayofweek!=dayofweek.thursday and dayofweek!=dayofweek.monday and buyPrice!=0.0 and (high - buyPrice) > buyPrice * 0.002) or (dayofweek!=dayofweek.thursday and sellPrice!=0.0 and (sellPrice - low) > sellPrice * 0.002)

//(runup >21 and strategy.openprofit < -2000) or

if buy and fastEMA>vwap1 and (not todayBuyDone or lastTrade != 1) and not NoBuySellTime// and not dailyTaskDone //and (dayofweek==dayofweek.friday or (close-prevDayClose)<150)//and not biggapup

strategy.entry("buy", strategy.long)

//dailyTaskDone := true

if buyPrice == 0.0

fiveEMACC := 1

buyPrice := close

//ourlabel = label.new(x=bar_index, y=na, text=tostring(todayLow + 500), yloc=yloc.belowbar9

todayBuyDone := true

lastTrade := 1

runup := 0.0

if sell and (not todaySellDone or lastTrade != 0) and not NoBuySellTime// and not dailyTaskDone // and dayofweek!=dayofweek.friday //and (dayofweek==dayofweek.friday or (prevDayClose-close)<150)//and not biggapdown

strategy.entry("sell", strategy.short)

//dailyTaskDone := true

if sellPrice == 0.0

fiveEMACC := 1

sellPrice := close

todaySellDone := true

lastTrade := 0

runup := 0.0

// if ((fastEMA-slowEMA>18 and close>vwap and close[1]>vwap[1] and (not todayBuyDone or candleCount>12)) or (slowEMA-fastEMA>10 and close < vwap and close[1]<vwap[1] and (not todaySellDone or candleCount > 12))) and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(abs(prevDayClose-close)), yloc=yloc.belowbar)

IntraDay_SquareOff = minute >=15 and hour >= 15

if true and (IntraDay_SquareOff or exitPosition)

strategy.close("buy")

strategy.close("sell")

buyPrice := 0

sellPrice := 0

runup := 0.0

if buyexit

strategy.close("buy")

buyPrice := 0

if sellexit

strategy.close("sell")

sellPrice := 0

buy1 = ((dayofweek==dayofweek.thursday and (fastEMA - slowEMA > close*0.001) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.monday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1]) or

(dayofweek==dayofweek.tuesday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and not gapup) or

(dayofweek==dayofweek.wednesday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and close-prevDayClose < close*0.0085) or

(dayofweek==dayofweek.friday and (fastEMA - slowEMA > close*0.0013) and close > vwap1 and close[1] > vwap1[1] and close - todayLow < close*0.012))

and dayofweek!=dayofweek.friday and (not todayBuyDone or lastTrade != 1) and not NoBuySellTime// and not dailyTaskDone //and (dayofweek==dayofweek.friday or (close-prevDayClose)<150)//and not biggapup

sell1= ((dayofweek==dayofweek.thursday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1]) or

(dayofweek==dayofweek.monday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and todayHigh-close < close*0.01 and todayHigh-close[1] < close * 0.01) or

(dayofweek==dayofweek.tuesday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not gapdown and not dragonflyDoji and todayHigh-close < close*0.009 and todayHigh-close[1] < close * 0.009) or

(dayofweek==dayofweek.wednesday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and prevDayClose-close < 0.005*close) or

(dayofweek==dayofweek.friday and (slowEMA - fastEMA > close*0.00079) and close < vwap1 and close[1] < vwap1[1] and not dragonflyDoji and prevDayClose-close < 0.005*close)) and

dayofweek!=dayofweek.friday and (not todaySellDone or lastTrade != 0) and not NoBuySellTime// and not dailyTaskDone

// if buy1 and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(fastEMA - slowEMA), yloc=yloc.belowbar)

// if sell1 and strategy.openprofit==0

// ourlabel = label.new(x=bar_index, y=na, text=tostring(slowEMA - fastEMA), yloc=yloc.belowbar)

// buy = ((fastEMA > slowEMA and fastEMA[1] < slowEMA[1]) and (fastEMA - slowEMA) > 10) or ((fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]) and (fastEMA - slowEMA) > 20)

// sell= ((fastEMA < slowEMA and fastEMA[1] > slowEMA[1] ) and (slowEMA - fastEMA) > 10) or ((fastEMA < slowEMA and fastEMA[1] < slowEMA[1] and fastEMA[2] > slowEMA[2]) and (slowEMA - fastEMA) > 20)

// buy = (fastEMA > slowEMA and fastEMA[1] < slowEMA[1])

// sell= (fastEMA < slowEMA and fastEMA[1] > slowEMA[1] )

// buy = ((fastEMA > slowEMA and fastEMA[1] < slowEMA[1]) and (fastEMA - slowEMA) > 10) or ((fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]) and (fastEMA - slowEMA) > 1)

// sell= ((fastEMA < slowEMA and fastEMA[1] > slowEMA[1] ) and (slowEMA - fastEMA) > 5)

// buy = fastEMA > slowEMA and fastEMA[1] > slowEMA[1] and fastEMA[2] < slowEMA[2]

// sell= fastEMA < slowEMA and fastEMA[1] < slowEMA[1] and fastEMA[2] > slowEMA[2]

//Daily chart

// buyexit = (close + 40 < slowEMA)//rsi > 65 and fastEMA > ema9 // fastEMA > ema9// close < fastEMA//(rsi > 65 and close < fastEMA and fastEMA > ema3 and close > ema200) //strategy.openprofit < -10000 and slowEMA > ema3 and slowEMA[1] < ema3[1] and 1==2

// sellexit = (close - 40 > slowEMA)//rsi < 35 // and close > ema200) or (rsi < 35 and close < ema200 and fastEMA < ema3) //strategy.openprofit < -10000 and fastEMA < ema3 and fastEMA[1] > ema3[1] and 1==2

// buyexit = (close < superTrend)// and (close < vwap1 and close[1] < vwap1[1] and close < close[1])//and close[2] < vwap1[2]//rsi > 65 and close < fastEMA// fastEMA > ema9// close < fastEMA//(rsi > 65 and close < fastEMA and fastEMA > ema3 and close > ema200) //strategy.openprofit < -10000 and slowEMA > ema3 and slowEMA[1] < ema3[1] and 1==2

// sellexit = (close > superTrend)// and (close > vwap1 and close[1] > vwap1[1] and close > close[1]) //and close[2] > vwap1[2]//rsi < 35// and close > ema200) or (rsi < 35 and close < ema200 and fastEMA < ema3) //strategy.openprofit < -10000 and fastEMA < ema3 and fastEMA[1] > ema3[1] and 1==2

// buyexit = (close < superTrend and close < vwap1 and close[1] < vwap1[1] and close[1] < superTrend[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000

// sellexit = (close > superTrend and close > vwap1 and close[1] > vwap1[1] and close[1] > superTrend[1]) //or strategy.openprofit > 400 or strategy.openprofit < -5000