개요

이 전략은 여러 통계 대역과 트렌드 분석을 기반으로 한 거래 전략이다. 이 전략은 브린 대역, 분기 대역, 그리고 律을 사용하여 중요한 지지/저항 지역을 식별하고, 상위 분기 대역의 하위 표준 차이를 트리거 신호로 사용하여 입출시와 출출시를 결정한다. 전략 설계는 시장의 변동성을 충분히 고려하여 여러 통계 방법을 중첩하여 신호의 신뢰성을 높인다.

전략 원칙

전략의 핵심 원칙은 여러 통계 대역의 교차로 시장 추세를 포착하는 것입니다. 주로 다음과 같은 몇 가지 핵심 구성 요소를 포함합니다.

- 브린 밴드 시스템 - 가격 변동 영역을 판단하기 위해 사용되며, 가격이 경로를 돌파했을 때 노란색 경보로 전환한다.

- 소수지수대 시스템 - 가격의 상하 소수를 계산하여 가격의 극한값 확률을 평가한다.

- 律帶系統 - 역사적인 수익을 바탕으로 계산되는 显著性水平, 오버 바이 오버 셀을 측정하기 위해 사용된다.

- 트리거 시스템 - 위의 분기 띠 아래의 표준 격차선은 주요 트리거 신호로, 가격이 이 라인 이상에서 유지되는 것은 시선 신호로 간주한다.

- 확인 시스템 - 연속 확인 K 라인을 설정하여 거짓 신호를 필터링한다.

전략적 이점

- 신호 안정성 - 복수의 통계 대역의 중첩 사용은 가짜 신호를 효과적으로 감소시킨다.

- 잘 적응 - 전략은 다른 시간 주기 및 시장 조건에 적응 할 수 있습니다.

- 리스크 관리가 완벽하다 - 다중 통계로 리스크 구역을 구분하고, 손해 막기 장치가 있다.

- 매개 변수 유연성 - 다양한 시장 특성에 따라 최적화 할 수있는 풍부한 매개 변수 옵션을 제공합니다.

- 시각화 명확함 - 각종 지표 선의 색상은 명확하게 구분되며 거래 신호는 직관적이다.

전략적 위험

- 지연 위험 - 통계적 지표는 모두 지연되어 있고, 최적의 입시 지점을 놓칠 수 있습니다.

- 흔들림 시장은 좋지 않다 - 수평 흔들림 시장에서 과도한 거래 신호가 발생할 수 있다.

- 매개 변수 감수성 - 다양한 매개 변수 조합의 효과에 큰 차이는 있어 반복적으로 최적화가 필요하다.

- 계산 부하가 크다 - 여러 통계 지표의 실시간 계산은 더 많은 컴퓨팅 자원이 필요합니다.

- 시장 환경 의존성 - 극단적인 시장 환경에서는 통계 법칙이 유효하지 않을 수 있다.

전략 최적화 방향

- 동적 파라미터를 도입 - 시장의 변동에 따라 파라미터를 자동으로 조정한다.

- 시장 환경 판단을 높여 - 동향 강도 지표를 추가하여 흔들리는 시장 신호를 필터링하십시오.

- 컴퓨팅 효율을 최적화 - 일부 컴퓨팅 프로세스를 간소화하여 리소스 사용량을 줄인다.

- 리스크 관리를 개선 - 더 많은 스톱 로드 조건과 포지션 관리 전략이 추가되었습니다.

- 적응력을 강화 - 적응형 변수 최적화 시스템을 개발한다.

요약하다

이것은 여러 가지 통계적 방법을 결합한 통합적 트렌드 추적 전략이다. 브린 밴드, 분수 밴드 및 律 밴드의 연동 작용을 통해 시장 추세를 더 잘 파악할 수 있으며, 동시에 좋은 위험 제어 능력을 갖추고 있다. 약간의 낙후성과 매개 변수 최적화 어려움이 있음에도 불구하고, 지속적인 개선과 최적화를 통해 이 전략은 더 나은 실용적 가치와 발전 전망을 가지고 있다.

전략 소스 코드

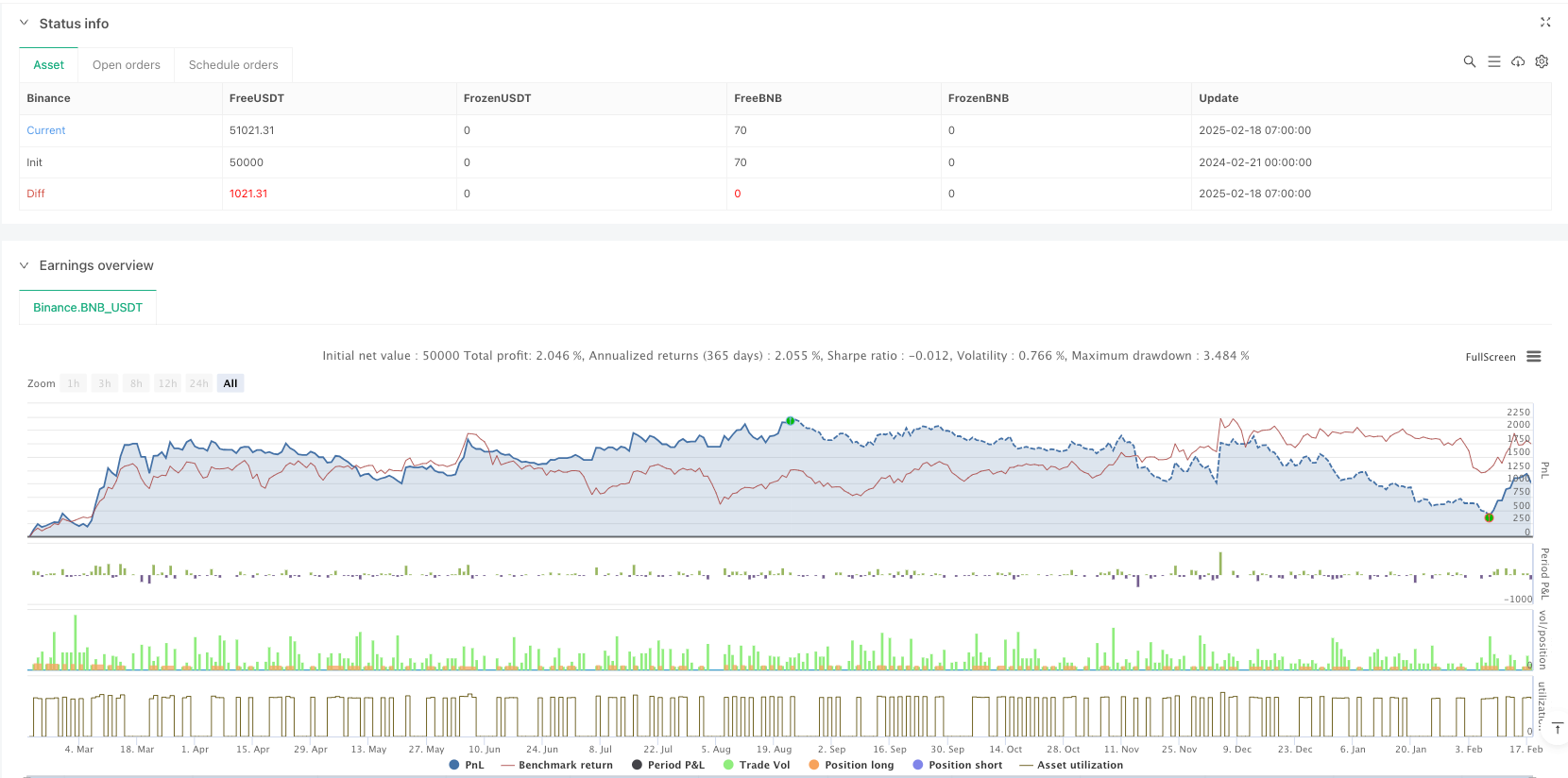

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"BNB_USDT"}]

*/

//@version=6

strategy("Multi-Band Comparison Strategy with Separate Entry/Exit Confirmation", overlay=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=10,

initial_capital=5000, currency=currency.USD)

// === Inputs ===

// Basic Parameters

length = input.int(20, "Length (SMA)", minval=1)

boll_mult = input.float(1.0, "Bollinger Band Multiplier", minval=0.1, step=0.1)

upper_quantile = input.float(0.95, "Upper Quantile (0.0-1.0)", minval=0.0, maxval=1.0)

lower_quantile = input.float(0.05, "Lower Quantile (0.0-1.0)", minval=0.0, maxval=1.0)

// Separate confirmation inputs

entry_confirmBars = input.int(1, "Entry Confirmation Bars", minval=1, tooltip="Number of consecutive bars the entry condition must hold")

exit_confirmBars = input.int(1, "Exit Confirmation Bars", minval=1, tooltip="Number of consecutive bars the exit condition must hold")

// Toggle Visibility for Bands

show_lower_boll = input.bool(false, "Show Lower Bollinger Band", tooltip="Enable or disable the lower Bollinger Band")

show_upper_boll = input.bool(true, "Show Upper Bollinger Band", tooltip="Enable or disable the upper Bollinger Band")

show_lower_quant = input.bool(true, "Show Lower Quantile Band", tooltip="Enable or disable the lower Quantile Band")

show_upper_quant = input.bool(true, "Show Upper Quantile Band", tooltip="Enable or disable the upper Quantile Band")

show_upper_power = input.bool(true, "Show Upper Power-Law Band", tooltip="Enable or disable the upper Power-Law Band")

show_lower_power = input.bool(false, "Show Lower Power-Law Band", tooltip="Enable or disable the lower Power-Law Band")

show_quant_std = input.bool(true, "Show Standard Deviation around Quantile Bands", tooltip="Enable or disable standard deviation lines around Quantile Bands")

// Individual Toggles for Std Dev Lines

show_upper_quant_std_up = input.bool(true, "Show Upper Quantile + Std Dev", tooltip="Enable or disable the Upper Quantile + Std Dev line")

show_upper_quant_std_down = input.bool(true, "Show Upper Quantile - Std Dev", tooltip="Enable or disable the Upper Quantile - Std Dev line")

show_lower_quant_std_up = input.bool(false, "Show Lower Quantile + Std Dev", tooltip="Enable or disable the Lower Quantile + Std Dev line")

show_lower_quant_std_down = input.bool(true, "Show Lower Quantile - Std Dev", tooltip="Enable or disable the Lower Quantile - Std Dev line")

// Moving Average Toggles

show_ema = input.bool(false, "Show EMA", tooltip="Enable or disable the Exponential Moving Average")

show_sma = input.bool(false, "Show SMA", tooltip="Enable or disable the Simple Moving Average")

// EMA Parameters

ema_length = input.int(50, minval=1, title="EMA Length")

ema_source = input.source(close, title="EMA Source")

// === Data Handling ===

// Create persistent arrays to store data

var float[] data_array = array.new_float()

var float[] return_array = array.new_float()

// Update the data array with the latest close prices

if array.size(data_array) < length

array.push(data_array, close)

else

array.shift(data_array)

array.push(data_array, close)

// Update the return array with the latest returns

returns = close / close[1] - 1

if array.size(return_array) < length

array.push(return_array, returns)

else

array.shift(return_array)

array.push(return_array, returns)

// === Helper Function ===

// Function to calculate a custom percentile

f_percentile(arr, quantile) =>

arr_sorted = array.copy(arr)

array.sort(arr_sorted, order.ascending)

index = math.round((array.size(arr_sorted) - 1) * quantile)

array.get(arr_sorted, index)

// === Calculations ===

// Bollinger Bands Calculation

sma = ta.sma(close, length)

stdev = ta.stdev(close, length)

boll_upper = sma + boll_mult * stdev

boll_lower = sma - boll_mult * stdev

// Power-Law Bands Calculation

var float power_upper = na

var float power_lower = na

if array.size(return_array) == length

power_upper := f_percentile(return_array, upper_quantile)

power_lower := f_percentile(return_array, lower_quantile)

var float power_upper_band = na

var float power_lower_band = na

if not na(power_upper) and not na(power_lower)

power_upper_band := close * (1 + power_upper)

power_lower_band := close * (1 + power_lower)

// Quantile Bands Calculation

var float quant_upper = na

var float quant_lower = na

if array.size(data_array) == length

quant_upper := f_percentile(data_array, upper_quantile)

quant_lower := f_percentile(data_array, lower_quantile)

// Standard Deviation around Quantile Bands

quant_upper_std_up = quant_upper + stdev

quant_upper_std_down = quant_upper - stdev

quant_lower_std_up = quant_lower + stdev

quant_lower_std_down = quant_lower - stdev

// === Color Calculations ===

// For the upper Bollinger band, color it yellow when price is above it, black otherwise.

upper_boll_color = close > boll_upper ? color.yellow : color.black

// The entry/exit trigger is based on the lower std dev band of the upper quantile band.

// It "turns green" (i.e. favorable for entry) when the price is above this level,

// and "turns red" (i.e. unfavorable, triggering an exit) when price is below it.

triggerCondition = close > quant_upper_std_down

// For plotting purposes, define the color of the lower std dev band of the upper quantile band:

triggerColor = triggerCondition ? color.green : color.red

// (Other color definitions remain for the additional bands.)

upper_power_color = (not na(power_upper_band) and not na(quant_upper_std_up) and power_upper_band > quant_upper_std_up) ? color.new(#FF00FF, 0) : color.black

upper_quant_color = (not na(quant_upper) and not na(power_upper_band) and power_upper_band > quant_upper) ? color.new(#FFAE00, 0) : color.rgb(50, 50, 50)

upper_quant_std_down_color = (not na(quant_upper_std_down) and close > quant_upper_std_down) ? color.green : color.red

lower_quant_std_down_color = (not na(quant_lower_std_down) and close > quant_lower_std_down) ? color.rgb(24, 113, 0, 44) : color.red

lower_quant_color = (ta.cross(close, quant_lower) or close == quant_lower) ? color.red : color.rgb(0, 238, 255)

// For demonstration, a variable to toggle a color on the Bollinger crossover.

var color upper_quant_std_up_color = color.black

if ta.crossover(close, boll_upper)

upper_quant_std_up_color := color.yellow

if ta.crossunder(close, boll_upper)

upper_quant_std_up_color := color.black

// === Confirmation Bars Logic with Separate Counters Based on Trigger Condition ===

// Use the trigger condition (based on the lower std dev band of the upper quantile band)

// for entry/exit confirmation.

var int entryCounter = 0

var int exitCounter = 0

// When triggerCondition is true (price above quant_upper_std_down) the "green" state holds.

entryCounter := triggerCondition ? entryCounter + 1 : 0

// When triggerCondition is false (price below quant_upper_std_down) the "red" state holds.

exitCounter := not triggerCondition ? exitCounter + 1 : 0

// === Strategy Orders ===

// Enter long when triggerCondition has been true for at least entry_confirmBars bars and no position is active.

if (entryCounter >= entry_confirmBars) and (strategy.position_size <= 0)

strategy.entry("Long", strategy.long)

// Exit long when triggerCondition has been false for at least exit_confirmBars bars and a long position is active.

if (exitCounter >= exit_confirmBars) and (strategy.position_size > 0)

strategy.close("Long")

// === Plotting ===

// Plot Bollinger Bands

plot(show_upper_boll ? boll_upper : na, color=upper_boll_color, title="Bollinger Upper", linewidth=2)

plot(show_lower_boll ? boll_lower : na, color=color.red, title="Bollinger Lower", linewidth=1)

// Plot Power-Law Bands

plot(show_upper_power ? power_upper_band : na, color=upper_power_color, title="Power-Law Upper", linewidth=1)

plot(show_lower_power ? power_lower_band : na, color=color.rgb(255, 59, 248), title="Power-Law Lower", linewidth=1)

// Plot Quantile Bands

plot(show_upper_quant ? quant_upper : na, color=upper_quant_color, title="Quantile Upper", linewidth=1)

plot(show_lower_quant ? quant_lower : na, color=lower_quant_color, title="Quantile Lower", linewidth=1)

// Plot Standard Deviation around Quantile Bands

plot(show_quant_std and show_upper_quant and show_upper_quant_std_up ? quant_upper_std_up : na, color=upper_quant_std_up_color, title="Quantile Upper + Std Dev", linewidth=2)

plot(show_quant_std and show_upper_quant and show_upper_quant_std_down ? quant_upper_std_down : na, color=upper_quant_std_down_color, title="Quantile Upper - Std Dev", linewidth=2)

plot(show_quant_std and show_lower_quant and show_lower_quant_std_up ? quant_lower_std_up : na, color=color.green, title="Quantile Lower + Std Dev", linewidth=1)

plot(show_quant_std and show_lower_quant and show_lower_quant_std_down ? quant_lower_std_down : na, color=lower_quant_std_down_color, title="Quantile Lower - Std Dev", linewidth=1)

// Also plot the trigger line (lower std dev band of upper quantile band) with its own color

plot(show_quant_std ? quant_upper_std_down : na, color=triggerColor, title="Trigger (Lower Std Dev of Upper Quantile)", linewidth=2)

// Plot SMA for reference

plot(show_sma ? sma : na, color=color.rgb(0, 24, 132), title="SMA", linewidth=3)

// Plot EMA for reference

ema_value = ta.ema(ema_source, ema_length)

plot(show_ema ? ema_value : na, color=color.rgb(147, 0, 0), title="EMA", linewidth=2)