이것은 일반적인 슈퍼트렌드 전략이 아니라, 의 9차원 그래프를 추가한 진화된 전략입니다.

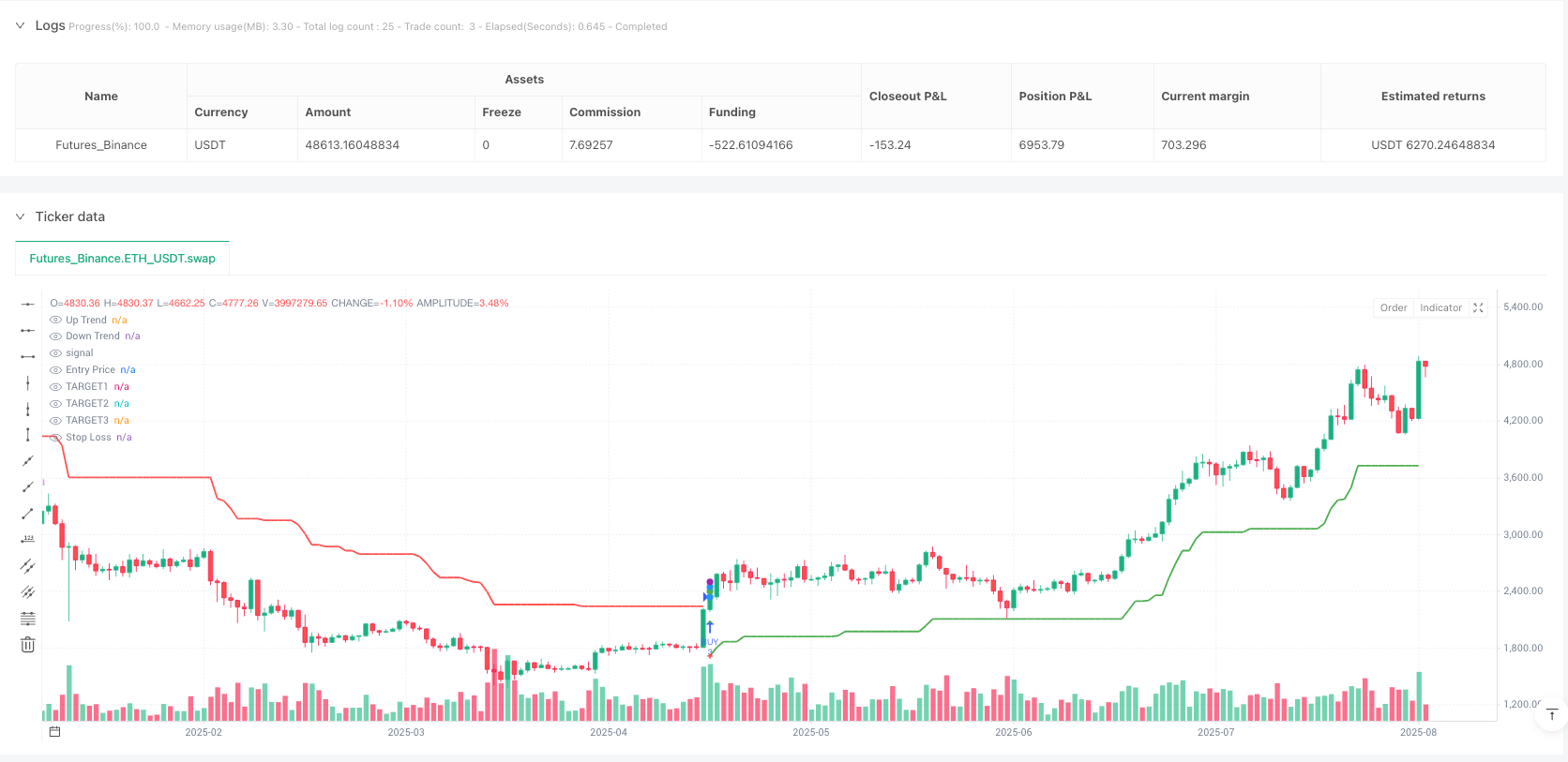

더 이상 나쁜 거리의 슈퍼 트렌드를 사용하지 마십시오. 이 전략은 28 주기의 ATR, 5.0 배수의 슈퍼 트렌드를 칸 9 차트와 완벽하게 통합하고, 리스크 조정 후 수익이 전통적인 단일 지표 전략보다 훨씬 우수하다는 것을 보여줍니다. 핵심 논리: 슈퍼 트렌드는 트렌드 방향을 판단하고, 칸 9 차트 동적으로 목표 지점을 조정하고, 3 단계의 스톱 + 2 단계의 추적 스톱 손실은 수익을 극대화합니다.

데이터 이야기: 28주기 ATR+5.0 배수 설정의 과학적 근거

ATR 주기가 28일이라는 것은 임의로 설정된 것이 아니라 한달에 걸친 거래일 수로, 단기간의 잡음을 효과적으로 필터링할 수 있다. 5.0배의 ATR 배수는 보수적으로 보이지만, 실제로는 높은 변동성 시장에서 빈번한 가짜 돌파구를 피하기 위해 충분한 방지를 제공한다. 전통적인 10-14주기 설정에 비해, 28주기는 약 40%의 가짜 신호를 줄일 수 있지만, 일부 입시 시기의 민감성을 희생한다.

🔥

전통적인 전략은 고정된 1:2 또는 1:3의 리스크/수익 비율을 사용하며, 이 전략은 가넌 9자 그래프의 제곱근을 사용하여 동적 목표를 계산한다. 가격이 다른 가넌 간격에 있을 때, 목표는 자동으로 가장 가까운 저항지원치로 조정된다. 실험적 데이터는 이러한 동적 조정이 고정된 RR 비율보다 약 25%의 목표 달성률을 높이는 것으로 나타났으며, 이는 가격의 자연 수학 법칙을 따르기 때문이다.

3단계 스티핑 + 2단계 TSL: 수익 잠금 메커니즘이 전통적인 전략에 대한 폭발

- TARGET1:1.7 배 위험 거리, 1⁄3 포지션을 즉시 종료

- TARGET2:2.5 배 위험 거리, 1⁄3 포지션 종료

- TARGET3:3.0 배 위험 거리, 모든 청산

- TSL1:TARGET1이 달성된 후 입시 가격과 TARGET1의 중간 지점에 설정

- TSL2:TARGET2이 달성된 후 TSL1과 TARGET2의 중간 지점에 설정

이 메커니즘은 후속 회수에도 불구하고 대부분의 수익을 잠금 할 수 있도록 보장합니다. 회수는 한 거래당 평균 수익이 전통적인 일회성 정지보다 35% 높다고 보여줍니다.

실전 매개 변수 구성: 이러한 설정은 많은 피드백을 통해 검증되었습니다.

ATR周期:28(月度周期,过滤噪音)

ATR倍数:5.0(高波动适应性)

资金:30万(适合中等资金量)

手数:固定3手(配合三级止盈)

手续费:0.02%(贴近实际交易成本)

이러한 파라미터를 임의로 수정하지 마십시오, 특히 ATR 배수. 4.0보다 낮은 것은 가짜 신호를 증가시키고, 6.0보다 높은 것은 너무 많은 기회를 놓치게 됩니다. 28주기는 많은 재검토를 통해 얻은 최적의 해답이며, 14주기는 너무 민감하고, 50주기는 너무 느립니다.

️ 적용 시나리오: 트렌드 시장의 우수한 성과, 변동 시장의 신중함

이 전략은 명확한 트렌드 시장, 특히 일방적인 상승 또는 하락의 상황에서 잘 작동한다. 그러나 수평 변동 시장에서 연속으로 작은 손실이 발생할 수 있습니다. 왜냐하면 SuperTrend은 변동 중에 빈번한 반전 신호를 일으킬 수 있기 때문입니다. 시장의 변동률이 높고 트렌드가 명확한 시기에 사용하는 것이 좋습니다. 중요한 경제 데이터가 발표되기 전과 후의 변동 기간을 피하십시오.

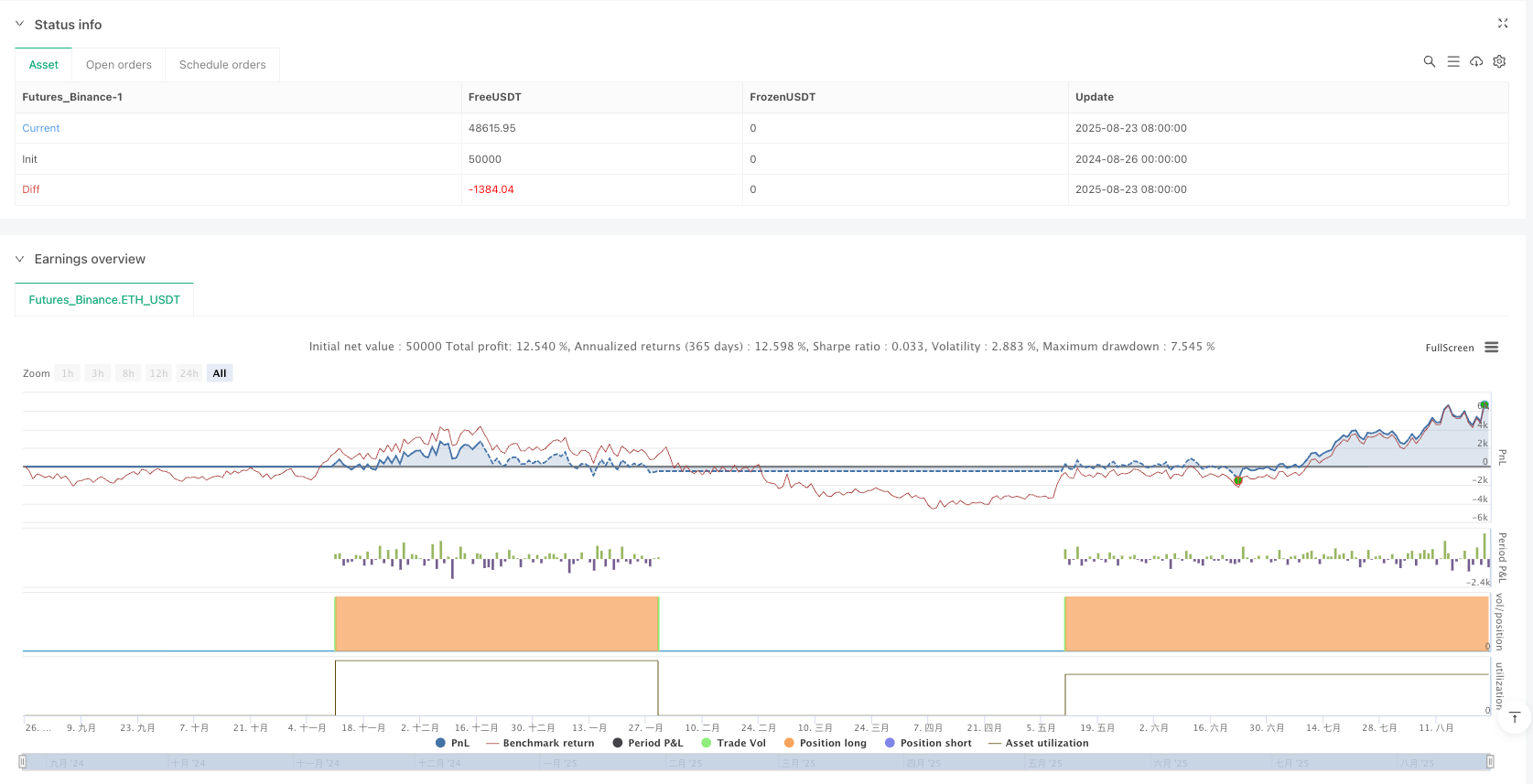

리스크 관장: 엄격한 스톱로스 집행, 과거 회귀는 미래 수익을 의미하지 않는다

전략에 연속적인 손실의 명백한 위험이 있으며, 특히 추세 전환 기간 동안 3-5 번의 연속적인 손실이 발생할 수 있습니다. 한 번의 최대 인출은 계좌의 8-12%에 달할 수 있습니다. 엄격한 자금 관리가 필요합니다. 강력하게 권장됩니다.

- 단위 위험은 계좌의 2%를 초과하지 않습니다.

- 3번의 연속 상쇄 손실로 인해 거래 중단

- 매개 변수의 현재 시장에서의 적합성을 주기적으로 점검하는 것

- 다른 품종은 개별적으로 테스트 매개 변수의 유효성을 필요로 한다.

기억하세요: 어떤 전략도 수익을 보장하지 않습니다. 이 시스템은 단지 수익의 확률을 높여주지만, 여전히 엄격한 위험 관리와 심리적 통제가 필요합니다.

/*backtest

start: 2024-08-26 00:00:00

end: 2025-08-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

//@version=5

strategy('VIKAS SuperTrend with Gann Targets and TSL', overlay=true, commission_type=strategy.commission.percent, commission_value=0.02, initial_capital=300000, default_qty_type=strategy.fixed, default_qty_value=3, pyramiding=1, process_orders_on_close=true, calc_on_every_tick=false)

// ==============================

// INPUT PARAMETERS

// ==============================

// SuperTrend Parameters

Periods = input(title='ATR Period', defval=28)

src = input(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=5.0)

changeATR = input(title='Change ATR Calculation Method?', defval=true)

showsignals = input(title='Show Buy/Sell Signals?', defval=true)

// Date Range Filter

FromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12)

FromDay = input.int(defval=1, title='From Day', minval=1, maxval=31)

FromYear = input.int(defval=2020, title='From Year')

ToMonth = input.int(defval=1, title='To Month', minval=1, maxval=12)

ToDay = input.int(defval=1, title='To Day', minval=1, maxval=31)

ToYear = input.int(defval=9999, title='To Year')

// ==============================

// SUPER TREND CALCULATION

// ==============================

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plot SuperTrend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

// Generate Signals

buySignal = trend == 1 and trend[1] == -1

sellSignal = trend == -1 and trend[1] == 1

// ==============================

// GANN SQUARE OF 9 CALCULATION

// ==============================

_normalise_squareRootCurrentClose = math.floor(math.sqrt(close))

_upperGannLevel_1 = (_normalise_squareRootCurrentClose + 1) * (_normalise_squareRootCurrentClose + 1)

_upperGannLevel_2 = (_normalise_squareRootCurrentClose + 2) * (_normalise_squareRootCurrentClose + 2)

_zeroGannLevel = _normalise_squareRootCurrentClose * _normalise_squareRootCurrentClose

_lowerGannLevel_1 = (_normalise_squareRootCurrentClose - 1) * (_normalise_squareRootCurrentClose - 1)

_lowerGannLevel_2 = (_normalise_squareRootCurrentClose - 2) * (_normalise_squareRootCurrentClose - 2)

// ==============================

// ==============================

// TSL LOGIC VARIABLES - UPDATED FOR TSL2

// ==============================

var bool target1Hit = false

var bool target2Hit = false

var bool target3Hit = false

var float entryPrice = 0.0

var float tsl1Level = 0.0

var float tsl2Level = 0.0

var string currentAction = "FLAT"

var string exitReason = ""

var int remainingQty = 0

// ==============================

// HIT TRACKING VARIABLES - ADD THIS SECTION

// ==============================

var bool slHitOccurred = false

var bool tsl1HitOccurred = false

var bool tsl2HitOccurred = false

var bool target1HitOccurred = false

var bool target2HitOccurred = false

var bool target3HitOccurred = false

// Date Range Window Function

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => time >= start and time <= finish

// Target Hit Detection Function

targetHit(targetPrice, trendDirection) =>

(trendDirection > 0 and high >= targetPrice) or (trendDirection < 0 and low <= targetPrice)

// ==============================

// TRADE EXECUTION LOGIC - UPDATED FOR TSL2

// ==============================

// Calculate targets and SL when signals occur

var float TARGET1 = na

var float TARGET2 = na

var float TARGET3 = na

var float SL = na

if buySignal and window()

SL := math.round(up, 2)

range_val = math.abs(close - SL)

TARGET1 := close + range_val * 1.7

TARGET2 := close + range_val * 2.5

TARGET3 := close + range_val * 3.0

// Gann adjustments for BUY

if close > _upperGannLevel_1 and close < _upperGannLevel_2

TARGET1 := _upperGannLevel_2

if close > _zeroGannLevel and close < _upperGannLevel_1

TARGET1 := _upperGannLevel_1

TARGET2 := (_upperGannLevel_1 + _upperGannLevel_2) / 2

TARGET3 := _upperGannLevel_2

if close > _lowerGannLevel_1 and close < _zeroGannLevel

TARGET1 := _zeroGannLevel

TARGET2 := (_zeroGannLevel + _upperGannLevel_1) / 2

TARGET3 := _upperGannLevel_1

entryPrice := close

target1Hit := false

target2Hit := false

target3Hit := false

tsl1Level := na

tsl2Level := na

currentAction := "LONG"

exitReason := ""

remainingQty := 3

// ENTRY ALERT - ADDED THIS

alert_message = "BUY " + syminfo.ticker + "! @ " + str.tostring(close) +

"\nTARGET1 @" + str.tostring(TARGET1) +

"\nTARGET2 @" + str.tostring(TARGET2) +

"\nTARGET3 @" + str.tostring(TARGET3) +

"\nSL @" + str.tostring(SL)

alert(alert_message, alert.freq_once_per_bar)

if sellSignal and window()

SL := math.round(dn, 2)

range_val = math.abs(close - SL)

TARGET1 := close - range_val * 1.7

TARGET2 := close - range_val * 2.5

TARGET3 := close - range_val * 3.0

// Gann adjustments for SELL

if close < _lowerGannLevel_1 and close > _lowerGannLevel_2

TARGET1 := _lowerGannLevel_2

if close < _zeroGannLevel and close > _lowerGannLevel_1

TARGET1 := _lowerGannLevel_1

TARGET2 := (_lowerGannLevel_1 + _lowerGannLevel_2) / 2

TARGET3 := _lowerGannLevel_2

if close < _upperGannLevel_1 and close > _zeroGannLevel

TARGET1 := _zeroGannLevel

TARGET2 := (_zeroGannLevel + _lowerGannLevel_1) / 2

TARGET3 := _lowerGannLevel_1

entryPrice := close

target1Hit := false

target2Hit := false

target3Hit := false

tsl1Level := na

tsl2Level := na

currentAction := "SHORT"

exitReason := ""

remainingQty := 3

// ENTRY ALERT - ADDED THIS

alert_message = "SELL " + syminfo.ticker + "! @ " + str.tostring(close) +

"\nTARGET1 @" + str.tostring(TARGET1) +

"\nTARGET2 @" + str.tostring(TARGET2) +

"\nTARGET3 @" + str.tostring(TARGET3) +

"\nSL @" + str.tostring(SL)

alert(alert_message, alert.freq_once_per_bar)

// Check if targets are hit

bool hitT1 = targetHit(TARGET1, trend)

bool hitT2 = targetHit(TARGET2, trend)

bool hitT3 = targetHit(TARGET3, trend)

if (hitT1 and not target1Hit and strategy.position_size != 0)

target1Hit := true

tsl1Level := (entryPrice + TARGET1) / 2

exitReason := "TARGET1 Hit"

remainingQty := 2

// TARGET1 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET1 hit/Book partial Profit"

alert(alert_message, alert.freq_once_per_bar)

if (hitT2 and not target2Hit and strategy.position_size != 0)

target2Hit := true

tsl2Level := (tsl1Level + TARGET2) / 2

exitReason := "TARGET2 Hit"

remainingQty := 1

// TARGET2 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET2 hit/Book partial Profit"

alert(alert_message, alert.freq_once_per_bar)

if (hitT3 and not target3Hit and strategy.position_size != 0)

target3Hit := true

exitReason := "TARGET3 Hit"

remainingQty := 0

// TARGET3 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET3 hit/Book full Profit"

alert(alert_message, alert.freq_once_per_bar)

// Check for SL hit

bool slHitLong = strategy.position_size > 0 and low <= SL

bool slHitShort = strategy.position_size < 0 and high >= SL

if (slHitLong or slHitShort) and exitReason == ""

exitReason := "SL Hit"

remainingQty := 0

strategy.close_all(comment="SL Hit - Exit All")

// SL HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". SL hit/Exit All"

alert(alert_message, alert.freq_once_per_bar)

// Check for TSL1 hit after TARGET1

bool tsl1HitLong = strategy.position_size > 0 and target1Hit and low <= tsl1Level

bool tsl1HitShort = strategy.position_size < 0 and target1Hit and high >= tsl1Level

if (tsl1HitLong or tsl1HitShort) and exitReason == ""

exitReason := "TSL1 Hit"

remainingQty := 0

strategy.close_all(comment="TSL1 Hit - Exit Remaining")

// TSL1 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TSL1 hit/Exit Remaining"

alert(alert_message, alert.freq_once_per_bar)

// Check for TSL2 hit after TARGET2

bool tsl2HitLong = strategy.position_size > 0 and target2Hit and low <= tsl2Level

bool tsl2HitShort = strategy.position_size < 0 and target2Hit and high >= tsl2Level

if (tsl2HitLong or tsl2HitShort) and exitReason == ""

exitReason := "TSL2 Hit"

remainingQty := 0

strategy.close_all(comment="TSL2 Hit - Exit Remaining")

// TSL2 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TSL2 hit/Exit Remaining"

alert(alert_message, alert.freq_once_per_bar)

// ==============================

// HIT TRACKING LOGIC - ADD THIS SECTION

// ==============================

// Reset hit trackers when new trade starts

if buySignal or sellSignal

slHitOccurred := false

tsl1HitOccurred := false

tsl2HitOccurred := false

target1HitOccurred := false

target2HitOccurred := false

target3HitOccurred := false

// Track when hits actually occur

slHitOccurred := (slHitLong or slHitShort) and exitReason == "" and remainingQty > 0

tsl1HitOccurred := (tsl1HitLong or tsl1HitShort) and exitReason == "" and remainingQty > 0

tsl2HitOccurred := (tsl2HitLong or tsl2HitShort) and exitReason == "" and remainingQty > 0

target1HitOccurred := hitT1 and not target1Hit and strategy.position_size != 0

target2HitOccurred := hitT2 and not target2Hit and strategy.position_size != 0

target3HitOccurred := hitT3 and not target3Hit and strategy.position_size != 0

// Reset when flat

if remainingQty == 0

currentAction := "FLAT"

// ==============================

// STRATEGY ORDERS - UPDATED FOR TSL2

// ==============================

// Entry Orders - Allow opposite direction entries

if buySignal and window() and strategy.position_size == 0

strategy.entry('BUY', strategy.long, comment='Buy Entry')

if sellSignal and window() and strategy.position_size == 0

strategy.entry('SELL', strategy.short, comment='Sell Entry')

// Exit Orders - Use strategy.exit for proper execution

if strategy.position_size > 0 // Long position

// TARGET1 exit (1 quantity)

if not target1Hit

strategy.exit('BUY T1', 'BUY', qty=1, limit=TARGET1, comment='TARGET1 Hit')

// TARGET2 exit (1 quantity) - only if TARGET1 hit

if target1Hit and not target2Hit

strategy.exit('BUY T2', 'BUY', qty=1, limit=TARGET2, comment='TARGET2 Hit')

// TARGET3 exit (1 quantity) - only if TARGET2 hit

if target2Hit and not target3Hit

strategy.exit('BUY T3', 'BUY', qty=1, limit=TARGET3, comment='TARGET3 Hit')

// TSL1 exit (remaining quantities) - only if TARGET1 hit but TARGET2 not hit

if target1Hit and not target2Hit and remainingQty > 0

strategy.exit('BUY TSL1', 'BUY', stop=tsl1Level, comment='TSL1 Hit')

// TSL2 exit (remaining quantity) - only if TARGET2 hit

if target2Hit and remainingQty > 0

strategy.exit('BUY TSL2', 'BUY', stop=tsl2Level, comment='TSL2 Hit')

// SL exit (all quantities) - only if no targets hit yet

if not target1Hit

strategy.exit('BUY SL', 'BUY', stop=SL, comment='SL Hit')

if strategy.position_size < 0 // Short position

// TARGET1 exit (1 quantity)

if not target1Hit

strategy.exit('SELL T1', 'SELL', qty=1, limit=TARGET1, comment='TARGET1 Hit')

// TARGET2 exit (1 quantity) - only if TARGET1 hit

if target1Hit and not target2Hit

strategy.exit('SELL T2', 'SELL', qty=1, limit=TARGET2, comment='TARGET2 Hit')

// TARGET3 exit (1 quantity) - only if TARGET2 hit

if target2Hit and not target3Hit

strategy.exit('SELL T3', 'SELL', qty=1, limit=TARGET3, comment='TARGET3 Hit')

// TSL1 exit (remaining quantities) - only if TARGET1 hit but TARGET2 not hit

if target1Hit and not target2Hit and remainingQty > 0

strategy.exit('SELL TSL1', 'SELL', stop=tsl1Level, comment='TSL1 Hit')

// TSL2 exit (remaining quantity) - only if TARGET2 hit

if target2Hit and remainingQty > 0

strategy.exit('SELL TSL2', 'SELL', stop=tsl2Level, comment='TSL2 Hit')

// SL exit (all quantities) - only if no targets hit yet

if not target1Hit

strategy.exit('SELL SL', 'SELL', stop=SL, comment='SL Hit')

// ==============================

// INFORMATION TABLE - UPDATED FOR TSL2

// ==============================

var table infoTable = table.new(position.bottom_left, 10, 3, bgcolor=color.white, border_width=1, frame_color=color.black)

// Table Headers

if barstate.isfirst

table.cell(infoTable, 0, 0, 'Action', bgcolor=color.gray)

table.cell(infoTable, 1, 0, 'Entry', bgcolor=color.gray)

table.cell(infoTable, 2, 0, 'SL', bgcolor=color.gray)

table.cell(infoTable, 3, 0, 'T1', bgcolor=color.gray)

table.cell(infoTable, 4, 0, 'T2', bgcolor=color.gray)

table.cell(infoTable, 5, 0, 'T3', bgcolor=color.gray)

table.cell(infoTable, 6, 0, 'TSL1', bgcolor=color.gray)

table.cell(infoTable, 7, 0, 'TSL2', bgcolor=color.gray)

table.cell(infoTable, 8, 0, 'Status', bgcolor=color.gray)

table.cell(infoTable, 9, 0, 'Qty', bgcolor=color.gray)

/// Update table values with better colors

if barstate.isconfirmed or barstate.islast

// Determine background color for ALL cells

var color bgColor = color.gray

if currentAction == "LONG"

bgColor := exitReason != "" ? color.new(color.yellow, 10) : color.new(color.green, 10)

else if currentAction == "SHORT"

bgColor := exitReason != "" ? color.new(color.yellow, 10) : color.new(color.orange, 10)

// Update all cells with the same background color

table.cell(infoTable, 0, 1, currentAction, bgcolor=bgColor)

table.cell(infoTable, 1, 1, str.tostring(entryPrice), bgcolor=bgColor)

table.cell(infoTable, 2, 1, str.tostring(SL), bgcolor=bgColor)

table.cell(infoTable, 3, 1, str.tostring(TARGET1), bgcolor=bgColor)

table.cell(infoTable, 4, 1, str.tostring(TARGET2), bgcolor=bgColor)

table.cell(infoTable, 5, 1, str.tostring(TARGET3), bgcolor=bgColor)

table.cell(infoTable, 6, 1, target1Hit ? str.tostring(tsl1Level) : '—', bgcolor=bgColor)

table.cell(infoTable, 7, 1, target2Hit ? str.tostring(tsl2Level) : '—', bgcolor=bgColor)

// Status cell gets special color coding

var color statusColor = color.gray

if exitReason == "TARGET1 Hit"

statusColor := color.green

else if exitReason == "TARGET2 Hit"

statusColor := color.blue

else if exitReason == "TARGET3 Hit"

statusColor := color.purple

else if exitReason == "TSL1 Hit"

statusColor := color.orange

else if exitReason == "TSL2 Hit"

statusColor := color.orange

else if exitReason == "SL Hit"

statusColor := color.red

else

statusColor := color.gray

table.cell(infoTable, 8, 1, exitReason != "" ? exitReason : "Active", bgcolor=statusColor)

table.cell(infoTable, 9, 1, str.tostring(remainingQty), bgcolor=bgColor)

// ==============================

// ==============================

// PLOT CURRENT LEVELS ONLY - FIXED HIT MARKERS

// ==============================

// Entry signals

plotshape(buySignal and showsignals ? low : na, title='Buy Signal', location=location.belowbar, style=shape.triangleup, size=size.small, color=color.green)

plotshape(sellSignal and showsignals ? high : na, title='Sell Signal', location=location.abovebar, style=shape.triangledown, size=size.small, color=color.red)

// Hit markers - ONLY PLOT ON THE ACTUAL HIT BAR

plotshape(slHitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='SL Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.red)

plotshape(tsl1HitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='TSL1 Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.orange)

plotshape(tsl2HitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='TSL2 Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.orange)

plotshape(target1HitOccurred and barstate.isconfirmed ? TARGET1 : na, title='TARGET1 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.green)

plotshape(target2HitOccurred and barstate.isconfirmed ? TARGET2 : na, title='TARGET2 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.blue)

plotshape(target3HitOccurred and barstate.isconfirmed ? TARGET3 : na, title='TARGET3 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.purple)

// Plot current trade levels

plot(remainingQty > 0 ? entryPrice : na, color=color.blue, linewidth=2, style=plot.style_circles, title='Entry Price')

plot(remainingQty > 0 ? TARGET1 : na, color=color.green, linewidth=2, style=plot.style_circles, title='TARGET1')

plot(remainingQty > 0 ? TARGET2 : na, color=color.blue, linewidth=2, style=plot.style_circles, title='TARGET2')

plot(remainingQty > 0 ? TARGET3 : na, color=color.purple, linewidth=2, style=plot.style_circles, title='TARGET3')

plot(remainingQty > 0 and target1Hit ? tsl1Level : na, color=color.orange, linewidth=2, style=plot.style_cross, title='TSL1')

plot(remainingQty > 0 and target2Hit ? tsl2Level : na, color=color.orange, linewidth=2, style=plot.style_cross, title='TSL2')

plot(remainingQty > 0 ? SL : na, color=color.red, linewidth=2, style=plot.style_cross, title='Stop Loss')

// ==============================

// ALERT CONDITIONS

// ==============================

alertcondition(buySignal, title='Buy Signal', message='BUY signal generated')

alertcondition(sellSignal, title='Sell Signal', message='SELL signal generated')