전략의 핵심: 주말 시장의 똑똑한 돈

월스트리트의 거장들이 주말에 휴가를 보내면서 암호화폐 시장은 문을 닫습니다. 이 전략은 기관투자자들이 “근무중”일 때 튀어나오는 야간 경비원과 비슷합니다.

비중을 맞추세요!이 전략은 토요일, 특히 일요일 0시부터 8시까지 UTC 시간대에만 거래된다. 왜? 왜냐하면 그때는 유동성이 상대적으로 낮고, 기술 분석의 효과는 오히려 높기 때문이다. 마치 조용한 도서관에서 작은 소리가 들리는 것처럼.

다중 지표 통합: 단독 투쟁이 아니다

이 전략은 복수자 연합을 구성하는 것과 같습니다.

- RSI (8주기)이 기사를 통해, 그는 “

- MACD(8,17,9)트렌드 동력을 확인합니다.

- 브린 벨트가격 극한 지역

- CVD의 탈퇴“현명한 돈의 진정한 의도를 발견하라”

구덩이 피하기 위한 지침단 하나의 지표는 혼자 영화를 보는 것과 같고, 스토리텔링으로 인해 오해의 소지가 있다.

스마트 자금 관리: 500달러도 쓸 수 있다

이 시스템은 소액 투자자를 위해 설계되었습니다.

- 최소 120달러“아뇨, 아뇨, 아녜요.

- 최대 4개의 동시 포지션위험 분산, 한 바구니에 달걀을 넣지 않는다.

- 5-20배의 동적 레버리시장의 변동성에 따라 자동 조정

고속도로에서 운전하는 것처럼, 고속도로에서 운전하면 빠르게 운전할 수 있고, 작은 동굴에서는 천천히 운전해야 합니다. 시스템은 다른 화폐의 위험 특성에 따라 포지션 크기를 조정합니다.

️위험관리: 엄마보다 더 걱정이 많아요

삼중보호제도:

- 일일 손실 최대 5%오늘 너무 많이 잃었나요? 내일 다시 오세요.

- 주말 손실 최대 15%######################################## #######################################################################################################################################################################################################################

- 4번 연속으로 손실이 멈췄다감정적 거래를 막기 위해:

긴급 브레이크 시스템만약 계좌가 30% 이상 손실되면 모든 거래가 즉시 중단됩니다. 이것은 자동차의 ABS 시스템과 같습니다. 중요한 순간에 생명을 구할 수 있습니다!

전략 소스 코드

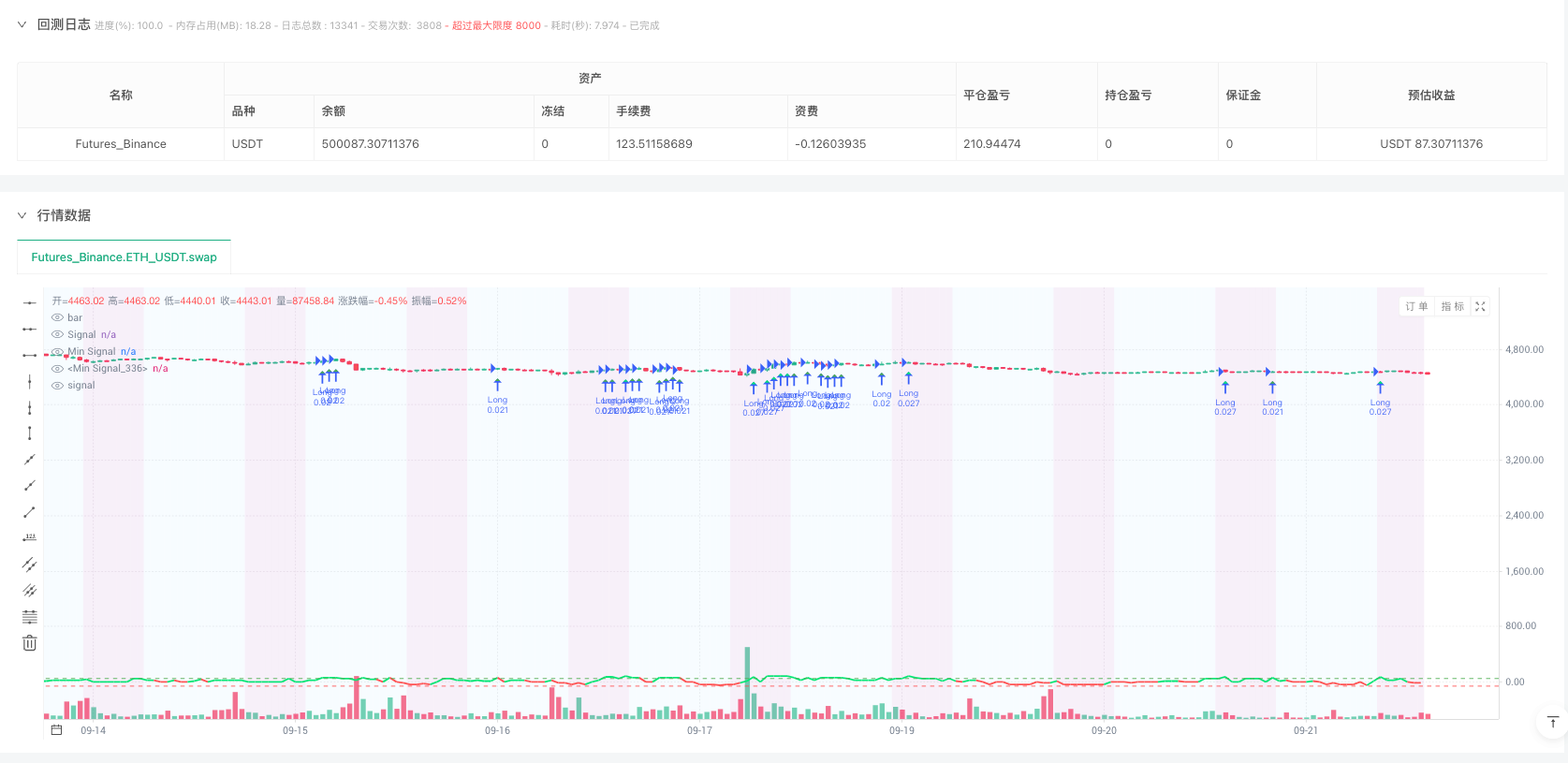

/*backtest

start: 2024-09-24 00:00:00

end: 2025-09-22 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=6

strategy("Weekend Hunter Ultimate v6.2 [PRODUCTION READY]",

overlay=true,

pyramiding=0,

calc_bars_count=5000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

commission_type=strategy.commission.percent,

commission_value=0.075,

slippage=3,

initial_capital=500)

// ========================================

// WEEKEND-ONLY CONFIGURATION

// ========================================

enable_weekend_only = input.bool(true, "WEEKEND TRADING ONLY", tooltip="Saturday-Sunday when institutions are offline")

weekend_start_day = input.string("Saturday", "Weekend Start", options=["Friday", "Saturday"])

weekend_end_day = input.string("Sunday", "Weekend End", options=["Sunday", "Monday"])

// Optimal Weekend Windows (Research-Based)

optimal_saturday_start = input.int(0, "Saturday Start Hour (UTC)", minval=0, maxval=23)

optimal_sunday_end = input.int(23, "Sunday End Hour (UTC)", minval=0, maxval=23)

prime_sunday_window = input.bool(true, "Enable Prime Sunday Window (0-8 UTC)")

// Weekend Detection Logic

is_saturday = dayofweek == dayofweek.saturday

is_sunday = dayofweek == dayofweek.sunday

is_weekend = is_saturday or is_sunday

current_hour = hour(time)

// Prime Weekend Window

in_prime_window = is_sunday and current_hour >= 0 and current_hour <= 8

in_weekend_hours = (is_saturday and current_hour >= optimal_saturday_start) or

(is_sunday and current_hour <= optimal_sunday_end)

weekend_trading_active = enable_weekend_only ? (is_weekend and in_weekend_hours) : true

// ========================================

// POSITION & CAPITAL MANAGEMENT

// ========================================

var float daily_pnl = 0.0

var float weekend_pnl = 0.0

var int last_day = 0

var int consecutive_losses = 0

// Maximum concurrent positions with $500

max_concurrent_positions = 4

current_positions = strategy.opentrades

// Smart Capital Management

available_capital = strategy.equity - (strategy.position_size * close)

min_capital_per_trade = 120.0

safety_buffer = 50.0

can_afford_position = available_capital > (min_capital_per_trade + safety_buffer)

position_available = current_positions < max_concurrent_positions

// ========================================

// AGGRESSIVE 65% WIN RATE CONFIGURATION

// ========================================

historical_win_rate = input.float(65.0, "Target Win Rate %", minval=60.0, maxval=70.0) / 100

avg_win_percent = input.float(5.5, "Average Win %", minval=4.0, maxval=7.0) / 100

avg_loss_percent = input.float(1.8, "Average Loss %", minval=1.5, maxval=2.5) / 100

// Loss Limits

max_daily_loss = input.float(5.0, "Max Daily Loss %", minval=3.0, maxval=8.0)

max_weekend_loss = input.float(15.0, "Max Weekend Loss %", minval=10.0, maxval=20.0)

max_consecutive_losses_allowed = 4

// ========================================

// DYNAMIC LEVERAGE SYSTEM 5-20x

// ========================================

min_leverage = input.float(5.0, "Minimum Leverage", minval=5.0, maxval=10.0)

max_leverage = input.float(20.0, "Maximum Leverage", minval=15.0, maxval=25.0)

// EXACT COIN-SPECIFIC RISK PROFILES

symbol_risk_profile = syminfo.ticker == "BTCUSDT" ? 0.9 :

syminfo.ticker == "ETHUSDT" ? 0.85 :

syminfo.ticker == "LINKUSDT" ? 0.75 :

syminfo.ticker == "XRPUSDT" ? 0.75 :

syminfo.ticker == "DOGEUSDT" ? 0.6 :

syminfo.ticker == "SOLUSDT" ? 0.7 :

syminfo.ticker == "AVAXUSDT" ? 0.7 :

syminfo.ticker == "1000PEPEUSDT" ? 0.5 :

syminfo.ticker == "TONUSDT" ? 0.65 :

syminfo.ticker == "POLUSDT" ? 0.7 : 0.5

// ========================================

// PROFIT PROTECTION SYSTEM

// ========================================

use_trailing = input.bool(true, "Enable Smart Trailing", tooltip="Protects profits when approaching target")

trailing_activation_percent = input.float(2.5, "Trailing Activation %", minval=2.0, maxval=3.5)

trailing_distance_percent = input.float(1.5, "Trail Distance %", minval=1.0, maxval=2.0)

// ========================================

// MULTI-TIMEFRAME CONFLUENCE

// ========================================

// 4H Trend Bias

htf_4h_close = request.security(syminfo.tickerid, "240", close, lookahead=barmerge.lookahead_off)

htf_4h_ema50 = request.security(syminfo.tickerid, "240", ta.ema(close, 50), lookahead=barmerge.lookahead_off)

// 1H Momentum Confirmation - Fixed MACD

[htf_1h_macd, htf_1h_signal, htf_1h_hist] = request.security(syminfo.tickerid, "60", ta.macd(close, 12, 26, 9), lookahead=barmerge.lookahead_off)

htf_1h_rsi = request.security(syminfo.tickerid, "60", ta.rsi(close, 14), lookahead=barmerge.lookahead_off)

// Trend Alignment Scoring

htf_4h_trend = htf_4h_close > htf_4h_ema50 ? 1 : -1

htf_1h_momentum = htf_1h_macd > htf_1h_signal ? 1 : -1

current_trend = close > ta.ema(close, 20) ? 1 : -1

trend_alignment = (htf_4h_trend + htf_1h_momentum + current_trend) / 3.0

// ========================================

// VOLATILITY & MARKET REGIME

// ========================================

atr_period = 14

atr_value = ta.atr(atr_period)

atr_percentage = (atr_value / close) * 100

volatility_regime = atr_percentage < 2.0 ? "Low" : atr_percentage < 5.0 ? "Medium" : "High"

// Weekend Liquidity Adjustment

volume_sma = ta.sma(volume, 20)

current_liquidity_ratio = volume / volume_sma

weekend_liquidity_adjustment = is_weekend ? math.min(current_liquidity_ratio * 0.8, 1.0) : 1.0

// ========================================

// CVD DIVERGENCE DETECTION

// ========================================

var float cvd = 0.0

bull_volume = close > open ? volume : 0

bear_volume = close < open ? volume : 0

volume_delta = bull_volume - bear_volume

cvd := cvd + volume_delta

// Divergence Detection

price_higher = close > close[10]

cvd_lower = cvd < cvd[10]

bearish_divergence = price_higher and cvd_lower

price_lower = close < close[10]

cvd_higher = cvd > cvd[10]

bullish_divergence = price_lower and cvd_higher

// ========================================

// SIGNAL GENERATION SYSTEM

// ========================================

// Primary Indicators

rsi = ta.rsi(close, 8)

// Fixed MACD unpacking

[macd_line, signal_line, histogram] = ta.macd(close, 8, 17, 9)

// Fixed Bollinger Bands unpacking

[bb_upper, bb_middle, bb_lower] = ta.bb(close, 20, 2.5)

// Volume Confirmation

volume_surge = volume > (volume_sma * 1.5)

min_volume_threshold = ta.sma(volume, 100) * 0.1

valid_volume = volume > min_volume_threshold

volume_confirmation = volume_surge and current_liquidity_ratio > 0.7 and valid_volume

// Signal Strength Calculation

var float signal_strength = 0.0

// Trend Component (40% weight)

trend_score = trend_alignment * 40

// Momentum Component (30% weight)

momentum_bullish = rsi < 30 and rsi > rsi[1]

momentum_bearish = rsi > 70 and rsi < rsi[1]

momentum_score = momentum_bullish ? 30 : momentum_bearish ? -30 : 0

// Volume Component (20% weight)

volume_score = volume_confirmation ? 20 : 0

volume_score := volume_score + (bullish_divergence ? 10 : bearish_divergence ? -10 : 0)

// Weekend Component (10% weight) - Fixed type

weekend_score = is_weekend ? 10.0 : 0.0

if in_prime_window

weekend_score := weekend_score * 1.5

signal_strength := trend_score + momentum_score + volume_score + weekend_score

// Weekend Signal Boost

if is_weekend

signal_strength := signal_strength * 1.2

if in_prime_window

signal_strength := signal_strength * 1.3

// ========================================

// DYNAMIC LEVERAGE CALCULATION

// ========================================

// Safety Score Components

volatility_safety = volatility_regime == "Low" ? 1.0 : volatility_regime == "Medium" ? 0.7 : 0.4

signal_confidence = math.abs(signal_strength) / 100

overall_safety = (volatility_safety + signal_confidence) / 2 * symbol_risk_profile

// Calculate Dynamic Leverage

leverage_range = max_leverage - min_leverage

dynamic_leverage = min_leverage + (leverage_range * overall_safety)

final_leverage = math.round(math.max(min_leverage, math.min(max_leverage, dynamic_leverage)), 1)

// ========================================

// POSITION SIZING WITH CAPITAL CHECK

// ========================================

// Signal Thresholds

min_signal_strength = input.float(55.0, "Minimum Signal Strength", minval=45.0, maxval=65.0)

high_confidence_threshold = input.float(75.0, "High Confidence Threshold", minval=70.0, maxval=85.0)

high_confidence = math.abs(signal_strength) > high_confidence_threshold

position_multiplier = high_confidence ? 1.3 : 1.0

// Calculate Position Size

base_position_usd = 120.0

desired_position_usd = base_position_usd * position_multiplier

// Pair-specific adjustment

pair_multiplier = syminfo.ticker == "1000PEPEUSDT" ? 0.5 : syminfo.ticker == "BTCUSDT" ? 1.0 : syminfo.ticker == "ETHUSDT" ? 1.0 : 0.8

final_position_usd = desired_position_usd * pair_multiplier

contracts = can_afford_position ? final_position_usd / close : 0

// ========================================

// ENTRY CONDITIONS WITH ALL SAFETY CHECKS

// ========================================

// Signal Conditions

strong_bullish_signal = signal_strength > min_signal_strength and trend_alignment > 0

strong_bearish_signal = signal_strength < -min_signal_strength and trend_alignment < 0

// Flash Crash Protection (8%)

flash_crash_detected = math.abs((close - close[4]) / close[4]) > 0.08

// Loss Tracking

if dayofmonth != last_day

daily_pnl := 0.0

if dayofweek == dayofweek.monday

weekend_pnl := 0.0

last_day := dayofmonth

daily_loss_pct = (daily_pnl / strategy.equity) * 100

weekend_loss_pct = (weekend_pnl / strategy.equity) * 100

loss_limits_active = daily_loss_pct <= -max_daily_loss or weekend_loss_pct <= -max_weekend_loss or consecutive_losses >= max_consecutive_losses_allowed

// Emergency Stop at -30% Account Level

account_emergency_stop = strategy.equity < (strategy.initial_capital * 0.7)

// Final Entry Conditions (fixed line continuation)

can_enter_long = strong_bullish_signal and weekend_trading_active and not loss_limits_active and position_available and can_afford_position and strategy.position_size == 0 and not flash_crash_detected and not account_emergency_stop

can_enter_short = strong_bearish_signal and weekend_trading_active and not loss_limits_active and position_available and can_afford_position and strategy.position_size == 0 and not flash_crash_detected and not account_emergency_stop

// ========================================

// DYNAMIC STOP LOSS & TAKE PROFIT

// ========================================

// ATR-Based with Leverage Adjustment

base_atr_mult_sl = input.float(1.5, "Base ATR Multiplier SL", minval=1.0, maxval=2.0)

base_atr_mult_tp = input.float(4.5, "Base ATR Multiplier TP", minval=3.5, maxval=6.0)

leverage_adjustment = 1.0 + (final_leverage - 5) / 50

atr_mult_sl = base_atr_mult_sl / leverage_adjustment

atr_mult_tp = base_atr_mult_tp * (1.0 + signal_confidence * 0.2)

stop_distance = atr_value * atr_mult_sl

tp_distance = atr_value * atr_mult_tp

long_stop = close - stop_distance

long_tp = close + tp_distance

short_stop = close + stop_distance

short_tp = close - tp_distance

// ========================================

// STRATEGY EXECUTION WITH ALERTS

// ========================================

// Long Entry with alert

if can_enter_long

alert_message = '{"action":"open_long","ticker":"' + syminfo.ticker + '","price":"' + str.tostring(close) + '","leverage":"' + str.tostring(final_leverage) + '","stop_loss":"' + str.tostring(long_stop) + '","take_profit":"' + str.tostring(long_tp) + '"}'

strategy.entry("Long", strategy.long, qty=contracts, comment="L " + str.tostring(final_leverage, "#.#") + "x S:" + str.tostring(signal_strength, "#"))

alert(alert_message, alert.freq_once_per_bar)

if use_trailing

strategy.exit("Long Exit", "Long", stop=long_stop, limit=long_tp, trail_points=close * trailing_activation_percent / 100, trail_offset=close * trailing_distance_percent / 100)

else

strategy.exit("Long Exit", "Long", stop=long_stop, limit=long_tp)

// Short Entry with alert

if can_enter_short

alert_message = '{"action":"open_short","ticker":"' + syminfo.ticker + '","price":"' + str.tostring(close) + '","leverage":"' + str.tostring(final_leverage) + '","stop_loss":"' + str.tostring(short_stop) + '","take_profit":"' + str.tostring(short_tp) + '"}'

strategy.entry("Short", strategy.short, qty=contracts, comment="S " + str.tostring(final_leverage, "#.#") + "x S:" + str.tostring(signal_strength, "#"))

alert(alert_message, alert.freq_once_per_bar)

if use_trailing

strategy.exit("Short Exit", "Short", stop=short_stop, limit=short_tp, trail_points=close * trailing_activation_percent / 100, trail_offset=close * trailing_distance_percent / 100)

else

strategy.exit("Short Exit", "Short", stop=short_stop, limit=short_tp)

// Emergency Exits with alert

if strategy.position_size != 0

entry_price = strategy.position_avg_price

current_profit_pct = strategy.position_size > 0 ? ((close - entry_price) / entry_price * 100) : ((entry_price - close) / entry_price * 100)

// Liquidation Protection

liq_distance = 100 / final_leverage * 0.8

approaching_liquidation = math.abs(current_profit_pct) > liq_distance

if approaching_liquidation or flash_crash_detected or account_emergency_stop

alert('{"action":"close_all","ticker":"' + syminfo.ticker + '"}', alert.freq_once_per_bar)

strategy.close_all(comment="EMERGENCY")

// Weekend End Exit

if dayofweek == dayofweek.monday and hour == 0 and strategy.position_size != 0

alert('{"action":"close_all","ticker":"' + syminfo.ticker + '"}', alert.freq_once_per_bar)

strategy.close_all(comment="Weekend End")

// Weekend Background

bgcolor(is_weekend ? color.new(color.blue, 95) : na, title="Weekend")

bgcolor(in_prime_window ? color.new(color.purple, 90) : na, title="Prime")

// Signal Strength

plot(signal_strength, "Signal", signal_strength > 0 ? color.lime : color.red, 2)

hline(min_signal_strength, "Min Signal", color.green, hline.style_dashed)

hline(-min_signal_strength, "Min Signal", color.red, hline.style_dashed)

// Entry Signals

plotshape(can_enter_long, "Long", shape.triangleup, location.belowbar, high_confidence ? color.lime : color.green, size=size.small)

plotshape(can_enter_short, "Short", shape.triangledown, location.abovebar, high_confidence ? color.red : color.maroon, size=size.small)

// Warnings

bgcolor(loss_limits_active ? color.new(color.red, 80) : na, title="Loss Limit")

bgcolor(account_emergency_stop ? color.new(color.purple, 80) : na, title="Emergency")