️ 이것은 일반적인 일률적인 전략이 아니라 “기후를 보는” 지능형 거래 시스템입니다!

대부분의 거래자들은 EMA를 단일 시간 프레임으로 교차하고 있습니다. 오늘 날씨를 보고 일주일 동안 무엇을 입어야할지 결정하는 것과 마찬가지로 신뢰할 수 없습니다. 이 전략이 얼마나 강력한가? 1분과 5분 EMA 클라우드 그래프를 동시에 모니터링하는 것은 마치 날씨 예보 + 실시간 기상 스테이션의 이중 보장이있는 것과 같습니다.

세 개의 필터링 메커니즘으로 가짜 돌파구 함정을 피하세요.

구덩이 안내서가 왔어요!이 전략의 가장 똑똑한 부분은 거래 거부 기능입니다.

- 수량 검증: 증폭이 없는 신호는 “카지 호랑이”이며, 20주기 평균의 1.3배를 넘어야 승인된다.

- 격차 진동 필터시장이 지루한 수평 모드로 들어갔을 때, 전략은 자동으로 “스트라이크”하고, 진흙 속에서 돌아가는 것을 피합니다.

- RSI가 과매매하고: 70 이상과 30 이하의 자동 제동, “판을 잡는 사람”이 아닙니다.

이것은 마치 슈퍼-논리적 거래 보조자가 시장의 감정이 통제되지 않을 때 “아, 지금은 아니야!“라고 말하는 것과 같다고 상상해보세요.

4가지 시장 상태, 전략에 대해 정확하게 파악할 수 있다

이 전략은 시장을 4단계로 나누고, 마치 시장에 대한 ‘감정 분석’을 하는 것과 같습니다.

- TRENDING (트렌딩 기간)“그린 라이트, 정상 거래”

- RANGE BOUND (중간 진동)노란색 신호, 거래 중단

- COILING (축전기): 불을 끄고 준비해

- LOADING (배치 기간)🔴

“RANGE BOUND”이 표시되면 커피 한 잔을 마시고 더 나은 기회를 기다려야 한다는 것을 알 수 있습니다.

실전 앱: 거래를 더 똑똑하게 한다

이 전략이 어떤 문제를 해결하는 데 도움이 될까요?

- 은 은여러번 확인을 통해 가짜 신호를 크게 줄입니다.

- 승률을 높여라“쓰레기 시간” 거래를 거부하고, 오직 확률이 높은 경우에만 투자하십시오.

- 감정 조절“시스템화된 출입규칙, 감정에 의존하지 말고 거래하라”

기억하세요, 최고의 거래 전략은 더 많이 거래하는 것이 아니라 더 정확하게 거래하는 것입니다. 이 클라우드 이 전략은 당신에게 기회를 잡을 수 있고 위험으로부터 보호할 수 있는 전문적인 ‘거래 수호자’를 부여하는 것과 같습니다.

전략 소스 코드

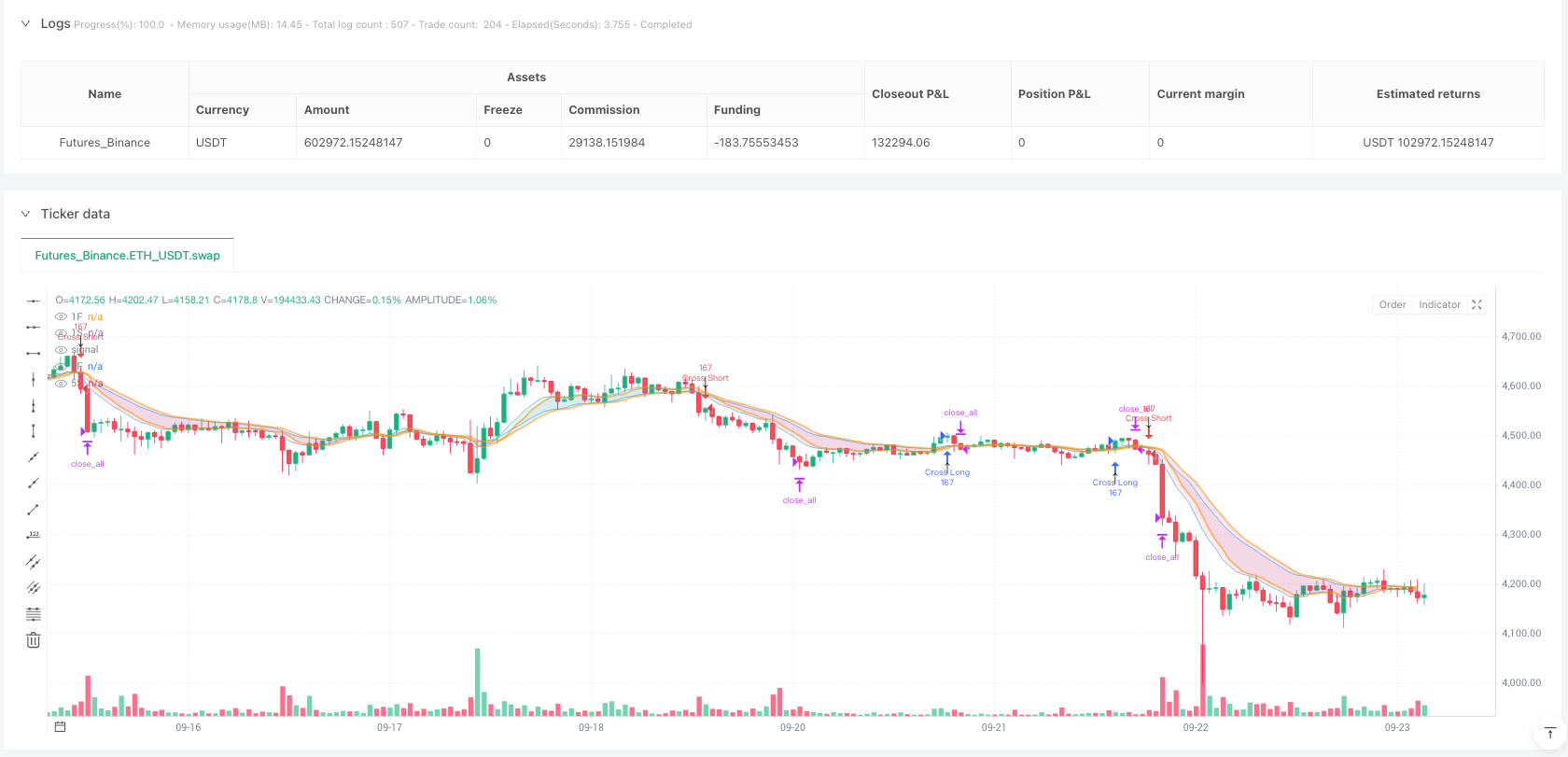

/*backtest

start: 2025-01-01 00:00:00

end: 2025-09-24 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=5

strategy("EMA Crossover Cloud w/Range-Bound Filter", overlay=true, default_qty_type=strategy.fixed, default_qty_value=500, initial_capital=50000)

// === INPUTS ===

rsi_length = input.int(14, "RSI Length")

rsi_overbought = input.int(70, "RSI Overbought Level")

rsi_oversold = input.int(30, "RSI Oversold Level")

ema_fast_1m = input.int(10, "1m Cloud Fast EMA")

ema_slow_1m = input.int(20, "1m Cloud Slow EMA")

ema_fast_5m = input.int(10, "5m Cloud Fast EMA")

ema_slow_5m = input.int(20, "5m Cloud Slow EMA")

volume_multiplier = input.float(1.3, "Volume Multiplier (vs 20-bar avg)")

// === STAY OUT FILTER INPUTS ===

enable_stay_out_filter = input.bool(true, "Enable Stay Out Filter", group="Range-Bound Filter")

enable_filter_for_backtest = input.bool(false, "Apply Filter to Backtest", group="Range-Bound Filter")

range_threshold_pct = input.float(0.5, "Max Range % for Stay Out", group="Range-Bound Filter")

range_period = input.int(60, "Period to Check Range (bars)", group="Range-Bound Filter")

min_bars_in_range = input.int(25, "Min Bars in Range to Trigger", group="Range-Bound Filter")

// === MARKET ATTENTION INPUTS ===

volume_attention_multiplier = input.float(2.0, "Volume Multiplier for Attention", group="Market Attention")

range_attention_threshold = input.float(1.5, "Range ($) Threshold for Attention", group="Market Attention")

// === CALCULATIONS ===

rsi = ta.rsi(close, rsi_length)

volume_avg = ta.sma(volume, 20)

volume_surge = volume > (volume_avg * volume_multiplier)

// Multi-timeframe EMAs

ema_fast_1m_val = ta.ema(close, ema_fast_1m)

ema_slow_1m_val = ta.ema(close, ema_slow_1m)

ema_fast_5m_val = request.security(syminfo.tickerid, "5", ta.ema(close, ema_fast_5m))

ema_slow_5m_val = request.security(syminfo.tickerid, "5", ta.ema(close, ema_slow_5m))

// === STAY OUT FILTER ===

// Range-bound detection: Count consecutive tight-range bars

range_threshold_dollar = close * (range_threshold_pct / 100) // Convert % to dollar amount

// Calculate current bar's range

current_bar_range = high - low

// Count consecutive tight-range bars

var int consecutive_tight_bars = 0

// Check if current bar is within tight range threshold

current_bar_tight = current_bar_range <= range_threshold_dollar

if current_bar_tight

consecutive_tight_bars := consecutive_tight_bars + 1

else

consecutive_tight_bars := 0 // Reset counter when range expands

tight_range_bars = consecutive_tight_bars

// Market is range-bound if we've had enough consecutive tight bars

market_range_bound = enable_stay_out_filter and tight_range_bars >= min_bars_in_range

market_ok_to_trade = not market_range_bound

// Separate condition for backtest - can override the filter

backtest_ok_to_trade = enable_filter_for_backtest ? market_ok_to_trade : true

// For display purposes, also calculate recent period range

highest_in_period = ta.highest(high, range_period)

lowest_in_period = ta.lowest(low, range_period)

dollar_range = highest_in_period - lowest_in_period

// Consolidation stage determination

consolidation_stage = tight_range_bars < min_bars_in_range ? "TRENDING" :

tight_range_bars <= 60 ? "RANGE BOUND" :

tight_range_bars <= 90 ? "COILING" : "LOADING"

consolidation_color = consolidation_stage == "TRENDING" ? color.green :

consolidation_stage == "RANGE BOUND" ? color.red :

consolidation_stage == "COILING" ? color.yellow : color.orange

// === MARKET ATTENTION GAUGE ===

// Current bar activity indicators

current_range = high - low

recent_volume_avg = ta.sma(volume, 10)

volume_spike = volume > (recent_volume_avg * volume_attention_multiplier)

range_expansion = current_range > range_attention_threshold

// Activity level determination

market_activity = volume_spike and range_expansion ? "ACTIVE" :

volume_spike or range_expansion ? "BUILDING" :

not market_range_bound ? "QUIET" : "DEAD"

// Cloud Definitions

cloud_1m_bull = ema_fast_1m_val > ema_slow_1m_val

cloud_5m_bull = ema_fast_5m_val > ema_slow_5m_val

// Price position relative to clouds

price_above_5m_cloud = close > math.max(ema_fast_5m_val, ema_slow_5m_val)

price_below_5m_cloud = close < math.min(ema_fast_5m_val, ema_slow_5m_val)

// === CROSSOVER SIGNALS ===

// When 1m fast crosses above/below 1m slow with volume

crossoverBull = ta.crossover(ema_fast_1m_val, ema_slow_1m_val) and volume_surge and backtest_ok_to_trade

crossoverBear = ta.crossunder(ema_fast_1m_val, ema_slow_1m_val) and volume_surge and backtest_ok_to_trade

// Visual warnings for blocked signals (always uses the indicator filter, not backtest filter)

blocked_crossover_bull = ta.crossover(ema_fast_1m_val, ema_slow_1m_val) and volume_surge and market_range_bound

blocked_crossover_bear = ta.crossunder(ema_fast_1m_val, ema_slow_1m_val) and volume_surge and market_range_bound

// === STRATEGY EXECUTION ===

// Crossover entries (original 1/3 size from diamonds)

if crossoverBull

strategy.entry("Cross Long", strategy.long, qty=167)

if crossoverBear

strategy.entry("Cross Short", strategy.short, qty=167)

// === EXIT LOGIC ===

// Conservative stops using recent swing levels (not wide cloud stops)

longStop = ta.lowest(low[3], 10) // Recent swing low

shortStop = ta.highest(high[3], 10) // Recent swing high

// Position management exits

price_above_1m_cloud = close > math.max(ema_fast_1m_val, ema_slow_1m_val)

price_below_1m_cloud = close < math.min(ema_fast_1m_val, ema_slow_1m_val)

// Exit when price breaks opposite cloud structure

longExit = price_below_1m_cloud and price_below_5m_cloud

shortExit = price_above_1m_cloud and price_above_5m_cloud

// Execute exits for all positions

if strategy.position_size > 0

if close <= longStop

strategy.close_all(comment="Stop Loss")

else if longExit or rsi >= rsi_overbought

strategy.close_all(comment="Exit Signal")

if strategy.position_size < 0

if close >= shortStop

strategy.close_all(comment="Stop Loss")

else if shortExit or rsi <= rsi_oversold

strategy.close_all(comment="Exit Signal")

// === VISUAL ELEMENTS ===

plotshape(crossoverBull, "CROSS BULL", shape.triangleup, location.belowbar,

color.new(color.aqua, 50), size=size.small, text="↑")

plotshape(crossoverBear, "CROSS BEAR", shape.triangledown, location.abovebar,

color.new(color.orange, 50), size=size.small, text="↓")

// STAY OUT warnings - signals you should see but not take

plotshape(blocked_crossover_bull, "BLOCKED BULL", shape.triangleup, location.belowbar,

color.new(color.gray, 0), size=size.tiny, text="RANGE")

plotshape(blocked_crossover_bear, "BLOCKED BEAR", shape.triangledown, location.abovebar,

color.new(color.gray, 0), size=size.tiny, text="RANGE")

// Clouds with abbreviated titles

ema1 = plot(ema_fast_1m_val, "1F", color.new(color.blue, 60), linewidth=1, display=display.none)

ema2 = plot(ema_slow_1m_val, "1S", color.new(color.blue, 60), linewidth=1, display=display.none)

fill(ema1, ema2, color=cloud_1m_bull ? color.new(color.green, 85) : color.new(color.red, 85))

ema3 = plot(ema_fast_5m_val, "5F", color.new(color.orange, 40), linewidth=2, display=display.none)

ema4 = plot(ema_slow_5m_val, "5S", color.new(color.orange, 40), linewidth=2, display=display.none)

fill(ema3, ema4, color=cloud_5m_bull ? color.new(color.blue, 85) : color.new(color.purple, 85))

// === ALERTS ===

// Consolidation stage changes

alertcondition(consolidation_stage == "RANGE BOUND" and consolidation_stage[1] == "TRENDING", "Range Bound Alert", "🔴 TSLA RANGE BOUND - Stay Out!")

alertcondition(consolidation_stage == "COILING" and consolidation_stage[1] == "RANGE BOUND", "Coiling Alert", "🟡 TSLA COILING - Watch Close!")

alertcondition(consolidation_stage == "LOADING" and consolidation_stage[1] == "COILING", "Loading Alert", "🟠 TSLA LOADING - Big Move Coming!")

alertcondition(consolidation_stage == "TRENDING" and consolidation_stage[1] != "TRENDING", "Breakout Alert", "🟢 TSLA BREAKOUT - Back to Trading!")

// Market attention changes

alertcondition(market_activity == "ACTIVE" and market_activity[1] != "ACTIVE", "Market Active", "🔥 TSLA ACTIVE - Watch Close!")

alertcondition(market_activity == "DEAD" and market_activity[1] != "DEAD", "Market Dead", "💀 TSLA DEAD - Handle Other Business")

// Blocked signals

alertcondition(blocked_crossover_bull or blocked_crossover_bear, "Signal Blocked", "⚠️ SIGNAL BLOCKED - Range Bound Period")