Strategi saluran berdasarkan penunjuk turun naik ATR

OKEX ATR MyLanguage

Tarikh penciptaan:

2018-11-30 09:19:56

Akhirnya diubah suai:

2018-12-18 12:55:34

Salin:

168

Bilangan klik:

3877

0

fokus pada

18

Pengikut

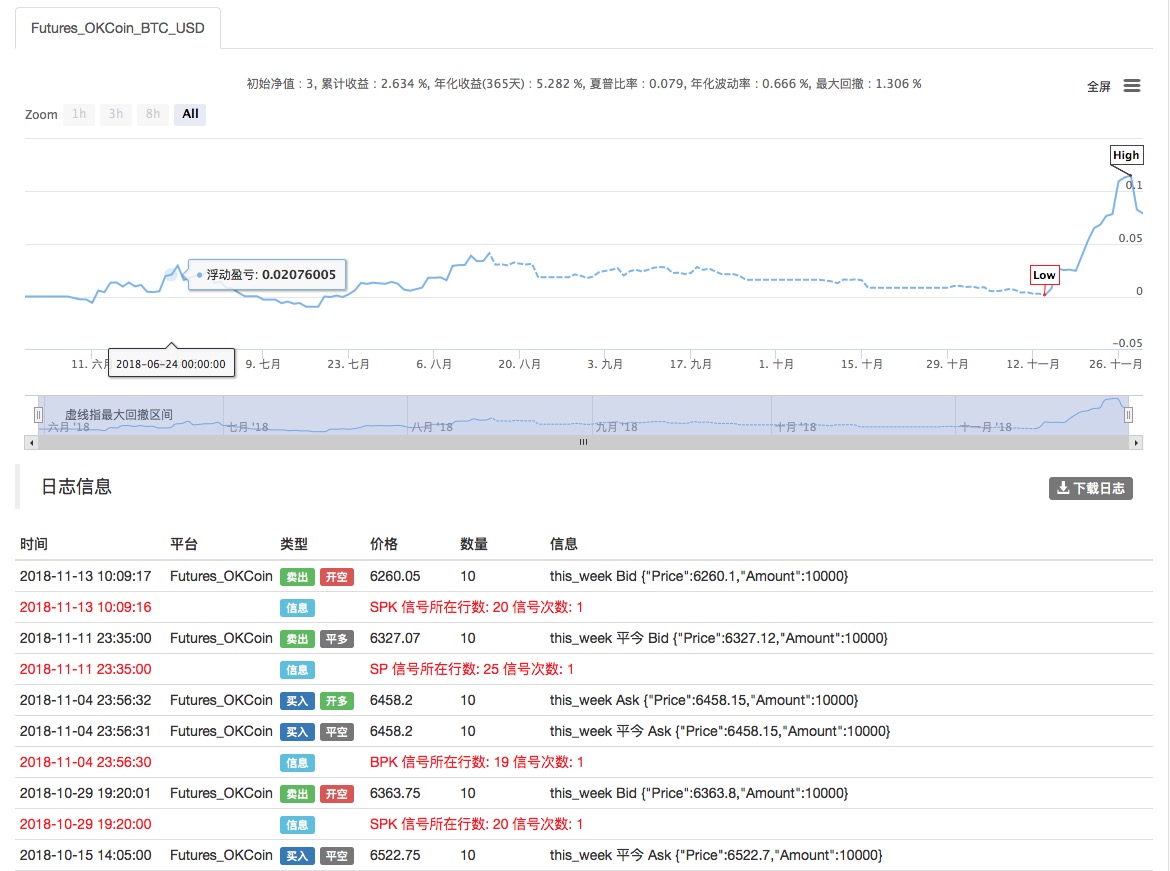

- Nama: Strategi saluran yang dibina berdasarkan ATR

- Idea: Strategi penyesuaian saluran, stop loss tetap + hentian terapung

- Kitaran data: Berbilang kitaran

- OKEX berjangka

- Kontrak: this_week minggu ini

- Laman web rasmi: quantinfo.com

Imej utama: Gambar UBAND, formula: UBAND^^MAC+M*ATR; Gambar DBAND, formula: DBAND^^MAC-M*ATR;

Sub-imej: tiada

Kod sumber strategi

(*backtest

start: 2018-06-01 00:00:00

end: 2018-07-01 00:00:00

period: 1h

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

args: [["TradeAmount",10,126961],["ContractType","this_week",126961]]

*)

TR1:=MAX(MAX((HIGH-LOW),ABS(REF(CLOSE,1)-HIGH)),ABS(REF(CLOSE,1)-LOW));

ATR:=MA(TR1,N);

MAC:=MA(C,N);

UBAND^^MAC+M*ATR;

DBAND^^MAC-M*ATR;

H>=HHV(H,N),BPK;

L<=LLV(L,N),SPK;

(H>=HHV(H,M*N) OR C<=UBAND) AND BKHIGH>=BKPRICE*(1+M*SLOSS*0.01),SP;

(L<=LLV(L,M*N) OR C>=DBAND) AND SKLOW<=SKPRICE*(1-M*SLOSS*0.01),BP;

// 止损

// stop loss

C>=SKPRICE*(1+SLOSS*0.01),BP;

C<=BKPRICE*(1-SLOSS*0.01),SP;

AUTOFILTER;