Strategi pengurusan wang dinamik pelbagai faktor

Gambaran keseluruhan

Strategi ini menggunakan pelbagai petunjuk teknikal seperti MACD, RSI, PSAR dan prinsip pengurusan wang dinamik untuk melakukan trend tracking dan membalikkan perdagangan dalam pelbagai rangka masa. Strategi ini boleh digunakan untuk perdagangan garis pendek, garis tengah dan garis panjang.

Prinsip

Strategi menggunakan indikator PSAR untuk menentukan arah trend. Garis laju EMA yang bersilang dengan garis tengah BB sebagai titik pengesahan pertama. Arah bentuk tiang MACD sebagai titik pengesahan kedua. RSI melalui kawasan jual beli sebagai titik pengesahan ketiga.

Tetapkan titik henti kerugian selepas masuk. Tetapkan titik henti kerugian mengikut kelipatan tertentu dari nilai ATR. Tetapkan titik henti kerugian.

Flips juga mempunyai seting peratus. Ia akan berhenti apabila keuntungan mencapai peratusan tertentu daripada jumlah hak milik akaun.

Pengurusan Dana Dinamik Mengira saiz kedudukan berdasarkan jumlah ekuiti akaun, ATR, dan setelan penggandaan henti rugi. Ia juga menetapkan jumlah dagangan minimum.

Kelebihan

Pengesahan pelbagai faktor, mengelakkan penembusan palsu, meningkatkan ketepatan kemasukan.

Pengurusan wang dinamik mengawal risiko individu, melindungi akaun dengan berkesan.

Hentian kerugian boleh disesuaikan dengan tahap turun naik pasaran.

Peratusan Flutter dan Flutter Setup untuk mengunci keuntungan dan mengelakkan pukulan balik.

Risiko

Portfolio pelbagai faktor mungkin terlepas beberapa peluang perdagangan.

Peratusan yang terlalu tinggi boleh menyebabkan kerugian meningkat.

Tetapan nilai ATR yang tidak betul boleh menyebabkan stop loss terlalu longgar atau terlalu radikal.

Pengaturan pengurusan wang yang tidak betul boleh menyebabkan kedudukan tunggal yang terlalu besar.

Arah pengoptimuman

Menyesuaikan berat faktor kemasukan untuk mengoptimumkan ketepatan isyarat.

Uji peratusan parameter yang berbeza untuk mencari kombinasi terbaik.

Pilih ATR yang munasabah mengikut ciri-ciri pelbagai jenis.

Parameter pengurusan dana disesuaikan secara dinamik mengikut keputusan tinjauan balik.

Optimumkan tetapan tempoh masa, uji tempoh perdagangan.

ringkaskan

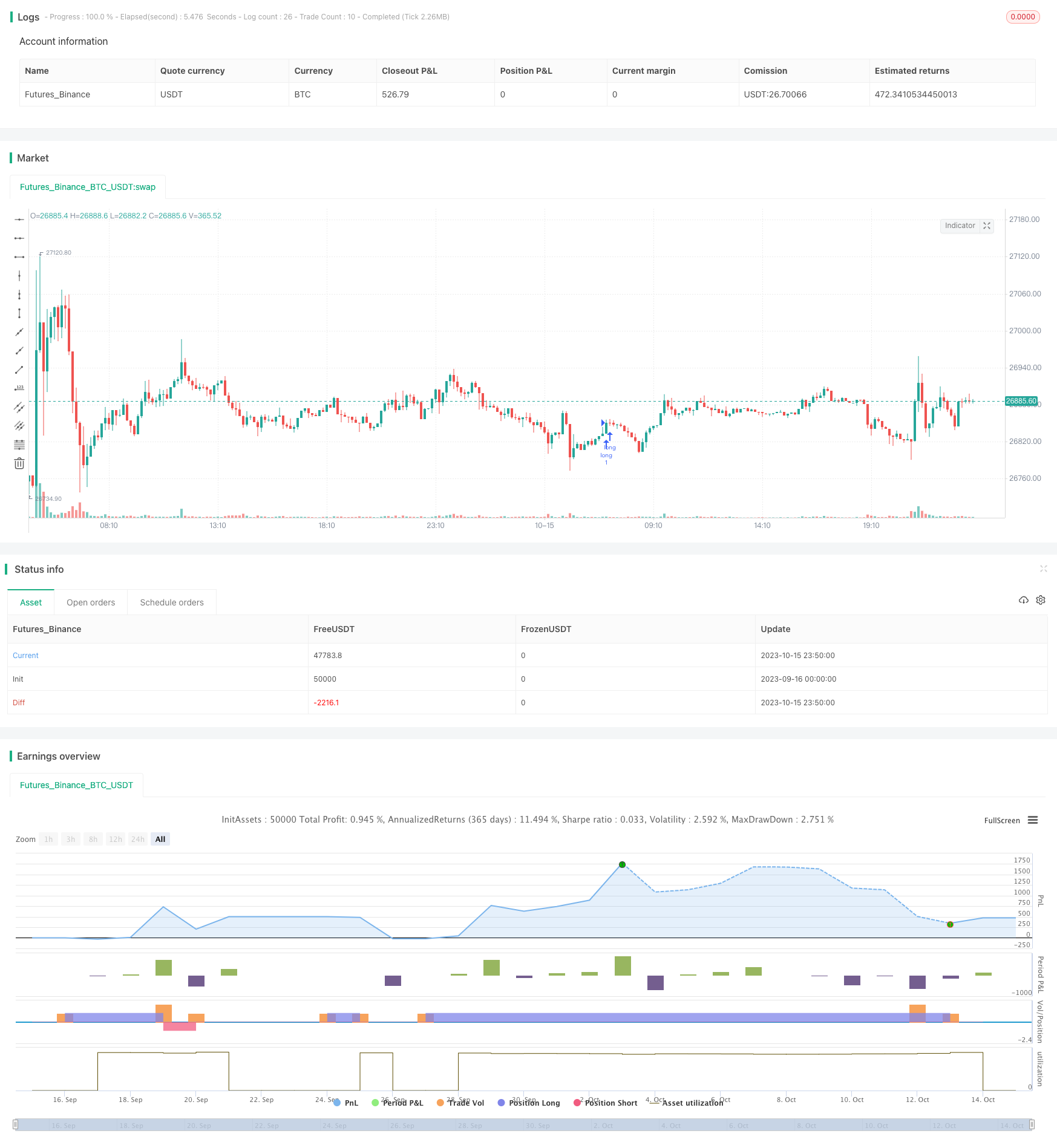

Strategi ini menggunakan pelbagai petunjuk teknikal untuk menilai trend, menggabungkan risiko kawalan pengurusan wang dinamik, dan mencapai keuntungan yang stabil dalam jangka masa yang berbilang. Berdasarkan hasil tinjauan semula, anda boleh terus mengoptimumkan berat faktor, parameter kawalan risiko, dan tetapan pengurusan wang, untuk mendapatkan kesan yang lebih baik.

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("EURUSD 1min strat RISK %% ", overlay=false, initial_capital = 1000)

// BACKTESTING RANGE

// From Date Inputs

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 6, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2020, title = "From Year", minval = 1970)

// To Date Inputs

toDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2020, title = "To Year", minval = 1970)

// Calculate start/end date and time condition

DST = 1 //day light saving for usa

//--- Europe

London = iff(DST==0,"0000-0900","0100-1000")

//--- America

NewYork = iff(DST==0,"0400-1500","0500-1600")

//--- Pacific

Sydney = iff(DST==0,"1300-2200","1400-2300")

//--- Asia

Tokyo = iff(DST==0,"1500-2400","1600-0100")

//-- Time In Range

timeinrange(res, sess) => time(res, sess) != 0

london = timeinrange(timeframe.period, London)

newyork = timeinrange(timeframe.period, NewYork)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

//

//

// rsi

length = input( 5 )

overSold = input( 23 )

overBought = input( 72 )

price = close

vrsi = rsi(price, length)

co = crossover(vrsi, overSold)

cu = crossunder(vrsi, overBought)

// macd

fast_length_macd = input(title="Fast Length", type=input.integer, defval=12)

slow_length_macd = input(title="Slow Length", type=input.integer, defval=26)

src_macd = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=true)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=true)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src_macd, fast_length_macd) : ema(src_macd, fast_length_macd)

slow_ma = sma_source ? sma(src_macd, slow_length_macd) : ema(src_macd, slow_length_macd)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

// sar

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := min(AF + increment, maximum)

else

if low < EP

EP := low

AF := min(AF + increment, maximum)

if uptrend

SAR := min(SAR, low[1])

if bar_index > 1

SAR := min(SAR, low[2])

else

SAR := max(SAR, high[1])

if bar_index > 1

SAR := max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

//plot(SAR, style=plot.style_cross, linewidth=3, color=color.orange)

//plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

//bb

length_bb = input(17, minval=1)

src_bb = input(close, title="Source")

mult_bb = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis_bb = sma(src_bb, length_bb)

dev_bb = mult_bb * stdev(src_bb, length_bb)

upper_bb = basis_bb + dev_bb

lower_bb = basis_bb - dev_bb

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

//plot(basis_bb, "Basis", color=#872323, offset = offset)

//p1_bb = plot(upper_bb, "Upper", color=color.teal, offset = offset)

//p2_bb = plot(lower_bb, "Lower", color=color.teal, offset = offset)

//fill(p1_bb, p2_bb, title = "Background", color=#198787, transp=95)

//ema

len_ema = input(10, minval=1, title="Length")

src_ema = input(close, title="Source")

offset_ema = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

out_ema = ema(src_ema, len_ema)

//plot(out_ema, title="EMA", color=color.blue, offset=offset_ema)

//out_ema e emaul

//basis_bb e middle de la bb

//hist e histograma

// rsi cu band0 cross pt rsi

// confirmarea

shortCondition = (uptrend==false and crossunder(ema(src_ema, len_ema),sma(src_bb, length_bb)) and hist < 0 and vrsi < overSold) //and time_cond

longCondition = (uptrend==true and crossover(ema(src_ema, len_ema),sma(src_bb, length_bb)) and hist > 0 and vrsi > overBought ) //and time_cond

//tp=input(0.0025,type=input.float, title="tp")

//sl=input(0.001,type=input.float, title="sl")

//INDICATOR---------------------------------------------------------------------

//Average True Range (1. RISK)

atr_period = input(14, "Average True Range Period")

atr = atr(atr_period)

strategy.initial_capital = 50000

//MONEY MANAGEMENT--------------------------------------------------------------

balance = strategy.netprofit + strategy.initial_capital //current balance

floating = strategy.openprofit //floating profit/loss

risk = input(2,type=input.float,title="Risk %")/100 //risk % per trade

isTwoDigit = input(false,"Is this a 2 digit pair? (JPY, XAU, XPD...")

equity_protector = input(1 ,type=input.float, title="Equity Protection %")/100 //equity protection %

equity_protectorTP = input(2 ,type=input.float, title="Equity TP %")/100 //equity protection %

multtp = input(5,type=input.float, title="multi atr tp")

multsl = input(5,type=input.float, title="multi atr sl")

stop = atr*100000*input(1,"SL X")* multsl //Stop level

if(isTwoDigit)

stop := stop/100

target = atr*100000*input(1,"TP X")*multtp //Stop level

//Calculate current DD and determine if stopout is necessary

equity_stopout = false

if(floating<0 and abs(floating/balance)>equity_protector)

equity_stopout := true

equity_stopout2 = false

if(floating>0 and abs(floating/balance)>equity_protectorTP)

equity_stopout2 := true

//Calculate the size of the next trade

temp01 = balance * risk //Risk in USD

temp02 = temp01/stop //Risk in lots

temp03 = temp02*100000 //Convert to contracts

size = temp03 - temp03%1000 //Normalize to 1000s (Trade size)

if(size < 10000)

size := 10000 //Set min. lot size

//TRADE EXECUTION---------------------------------------------------------------

strategy.close_all(equity_stopout, comment="equity sl", alert_message = "equity_sl") //Close all trades w/equity protector

//strategy.close_all(equity_stopout2, comment="equity tp", alert_message = "equity_tp") //Close all trades w/equity protector

is_open = strategy.opentrades > 0

strategy.entry("long",true,oca_name="a",when=longCondition and not is_open) //Long entry

strategy.entry("short",false,oca_name="a",when=shortCondition and not is_open) //Short entry

strategy.exit("exit_long","long",loss=stop, profit=target) //Long exit (stop loss)

strategy.close("long",when=shortCondition) //Long exit (exit condition)

strategy.exit("exit_short","short",loss=stop, profit=target) //Short exit (stop loss)

strategy.close("short",when=longCondition) //Short exit (exit condition)

//strategy.entry("long", strategy.long,size,when=longCondition , comment="long" , alert_message = "long")

//strategy.entry("short", strategy.short, size,when=shortCondition , comment="short" , alert_message = "short")

//strategy.exit("closelong", "long" , profit = close * tp / syminfo.mintick, alert_message = "closelong")

//strategy.exit("closeshort", "short" , profit = close * tp / syminfo.mintick, alert_message = "closeshort")

//strategy.exit("closelong", "long" ,size, profit = close * tp / syminfo.mintick, loss = close * sl / syminfo.mintick, alert_message = "closelong")

//strategy.exit("closeshort", "short" , size, profit = close * tp / syminfo.mintick, loss = close * sl / syminfo.mintick, alert_message = "closeshort")

//strategy.close("long" , when=not (time_cond), comment="time", alert_message = "closelong" )

//strategy.close("short" , when=not (time_cond), comment="time", alert_message = "closeshort")

//strategy.close_all(when=not (time_cond), comment ='time')