Strategi perdagangan kuantitatif berbilang faktor

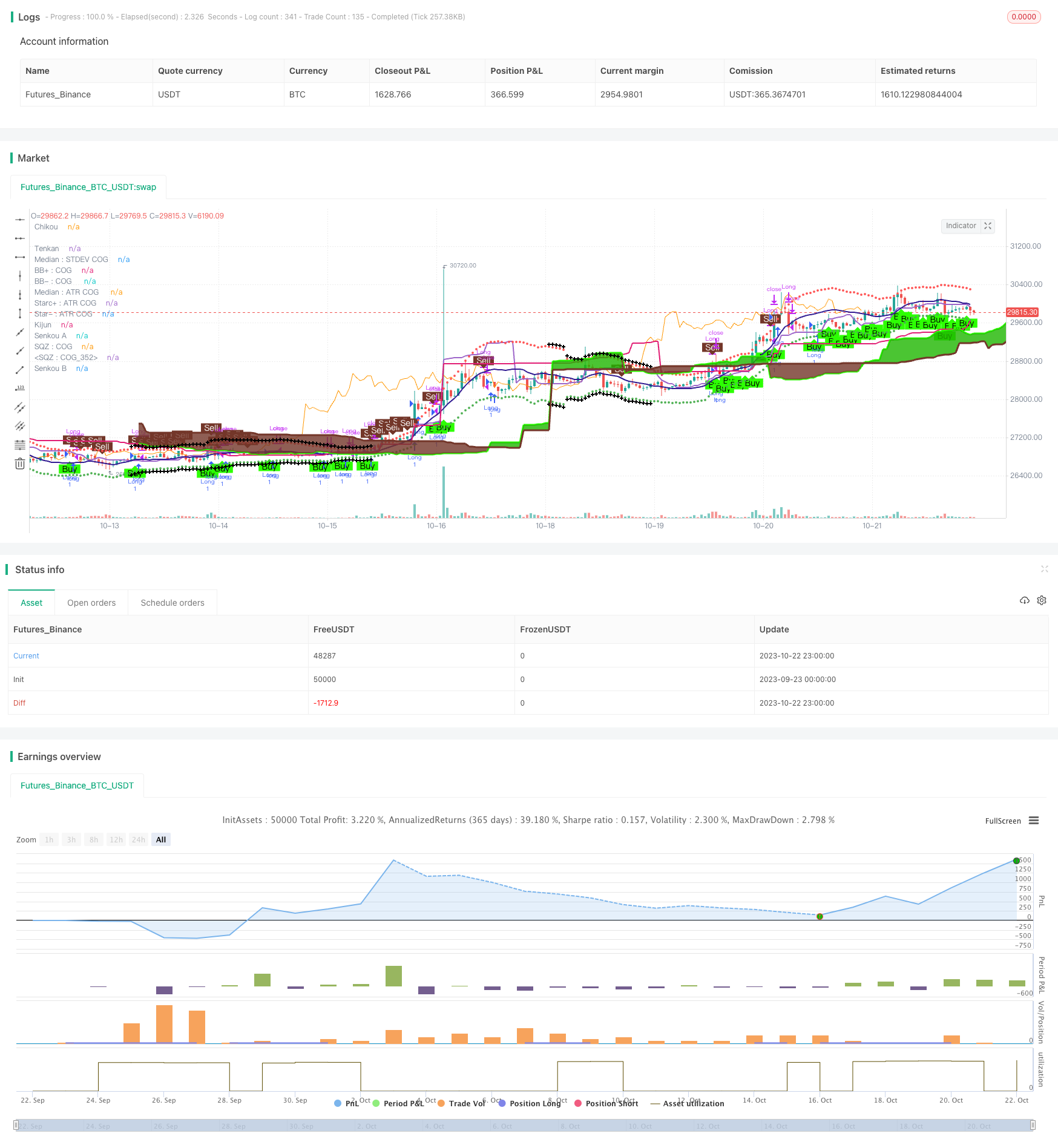

Ini adalah strategi perdagangan kuantitatif yang menggabungkan pelbagai petunjuk teknikal untuk membuat keputusan kosong. Strategi ini mempertimbangkan pelbagai faktor seperti indikator momentum, indikator trend, dan grafik awan Ichimoku untuk membentuk keputusan pembelian akhir. Strategi ini mempunyai kestabilan dan ketahanan risiko yang kuat.

Analisis asas

Strategi ini terdiri daripada beberapa bahagian:

Penunjuk momentum: Parabolic SAR, Penunjuk intensiti Leledc, Kaufman Adaptive Moving Average dan lain-lain

Indikator Trend: Rahul Mohindar Vibrator, Trend Magic dan sebagainya

Imej Awan Ichimoku: termasuk Jalur Tenkan, Jalur Kijun dan lain-lain

Penunjuk Aliran Jilid

Penunjuk turun naik: Wave Trend Oscillator

Siri TD

Indikator-indikator ini menilai trend dan kekuatan pasaran semasa dari sudut yang berbeza. Parabolic SAR menilai titik perubahan trend, indikator kekuatan Ledc menilai momentum, dan grafik awan Ichimoku menilai tekanan sokongan. Apabila kebanyakan indikator memberikan isyarat arah, keputusan pembelian atau penjualan akhirnya dibentuk.

Strategi ini juga menetapkan syarat penapisan untuk berdagang hanya pada tarikh yang ditetapkan setiap bulan, setiap hari, untuk mengurangkan jumlah perdagangan yang tidak sah.

Analisis kelebihan

Keputusan komprehensif pelbagai faktor, peningkatan ketepatan, dan ketahanan terhadap risiko yang lebih kuat

Memperkenalkan pelbagai jenis penunjuk untuk disahkan, mengelakkan risiko kegagalan satu penunjuk

Tetapkan syarat penapisan untuk mengelakkan perdagangan yang tidak sah pada masa yang tidak sesuai

Penulisan menggunakan Pine Script, mudah dan cepat untuk digunakan secara langsung di platform TradingView

Parameter penunjuk boleh disesuaikan dan boleh dioptimumkan untuk pasaran yang berbeza

Memaparkan isyarat penunjuk secara visual, menilai struktur pasaran secara intuitif

Analisis risiko

Kombinasi multifaktor memerlukan penyesuaian berat dan parameter, dan terdapat kesukaran untuk mengoptimumkannya

Indeks tunggal mungkin tidak berkesan dalam keadaan pasaran tertentu

Kaedah penapisan yang tidak betul boleh menyebabkan peluang terlewat

Berhati-hati untuk mengelakkan optimasi yang berlebihan

Pedagang perlu memberi perhatian kepada risiko kegagalan penunjuk dan menyesuaikan strategi dengan segera

Kaedah pencegahan:

Mengoptimumkan parameter penyesuaian penunjuk untuk menjadikannya lebih berkesan untuk pasaran semasa

Menyesuaikan berat badan, meningkatkan peranan penunjuk berkesan, mengurangkan peranan penunjuk tidak berkesan

Menyesuaikan keadaan penapisan mengikut peluang dan risiko

Optimum idea

Menambah algoritma pembelajaran mesin untuk menyesuaikan berat indeks secara automatik

Meningkatkan faktor-faktor seperti sentimen, aliran wang dan sebagainya

Uji varieti dan tempoh perdagangan untuk menetapkan parameter optimum

Uji Kesan Berbeza Waktu Pemilihan

Dengan penapisan tambahan seperti data bermusim, ekonomi dan sebagainya

Tambah strategi henti kerugian

ringkaskan

Strategi ini menggabungkan beberapa indikator untuk membentuk keputusan akhir, dengan kelebihan ketahanan risiko yang kuat. Pada masa yang sama, anda juga perlu memberi perhatian kepada risiko kegagalan indikator tunggal, terus mengoptimumkan dan menyesuaikan parameter. Pada masa akan datang, anda boleh mengoptimumkan lagi penentuan berat indikator, menambah lebih banyak faktor, menguji tempoh memegang kedudukan yang optimum, dan sebagainya.

//@version=2

persistent_bull = nz(persistent_bull[1],0)

persistent_bear = nz(persistent_bear[1],0)

strategy("Strategy for The Bitcoin Buy/Sell Indicator", overlay=true, calc_on_every_tick=true)

// ****************************************Inputs***************************************************************

//@fixme if there is a buy and sell signal on the same bar, then it displays the first one and skips the second one. Fix this issue

buySellSignal = true // Make this false if you do not want to show Buy/Sell signal

inputIndividualSiganlPlot = true // = input (false, "Do you want to display each individual indicator's signal on the chart?")

sp = input (false, "Do you want to display Parabolic SAR?")

spLines = input (false, "Do you want to display Parabolic SAR on the chart?")

sCloud = input(false, "Do you want to display the Tenkan and Kijun lines of Ichimoku lines on the chart?")

sL = input (false, "Do you want to display Leledec Exhausion - Leledc on the chart?")

sTD = false

sRMO = input(false, "Do you want to display Rahul Mohindar Oscillator - RMO on the chart?")

inputAma = input(false, title="Do you want to display Kaufman AMA wave - AMA on the chart?")

tm = input (false, "Do you want to display Trend Magic signals on the chart?")

wtoLB = input (false, "Do you want to display WaveTrend Oscillator - WTO on the chart?")

vfiLB = input (false, "Do you want to display Volume Flow Indicator - VFI on the chart?")

cogRegionFillTransp = 100 // input(false, "Do you want to display COG Region Fill and ATR Starc+/-")

inputNeutralMinorSignals = input (false, title="Do you want to not display the minor or the not so strong signals from Ichimoku")

maj=true // input(true,title="Show Major Leledc Exhausion Bar signal")

min=input(false,title="Show Minor Leledc Exhausion Bar signal")

tenkanPeriods = input(20, minval=9, title="Tenkan Period - Ichimoku [9 or 10 or 20]")

kijunPeriods = input(60, minval=26, title="Kijun Period - Ichimoku [26 or 30 or 60]")

chikouPeriods = input(120, minval=52, title="Chikou - Ichimoku [52 or 60 or 120]")

displacement = input(30, minval=26, title="Displacement - Ichimoku [26 or 30]")

// ****************************************General Color Variables***************************************************************

colorLime = #006400 // Warning sign for long trade

colorBuy= #2DFF03 // Good sign for long trade

colorSell = #733629 // Good sign for short trade

colorMaroon =#8b0000 // Warning sign for short trade

colorBlue =#0000ff // No clear sign

colorGray = #a9a9a9 // Gray Color (For Squeeze momentum indicator)

colorBlack = #000000 // Black

colorWhite = #ffffff // White

colorTenkanViolet = #800000 // Tenkan-sen line color

colorKijun = #0000A6 // Kijun-sen line color

// TD Sequential bar colors

tdSell = #ff6666

tdSellOvershoot = #ff1a1a

tdSellOvershoot1 = #cc0000

tdSellOverShoot2 = #990000

tdSellOverShoot3 = #732626

tdBuy = #80ff80

tdBuyOverShoot = #33ff33

tdBuyOvershoot1 = #00cc00

tdBuyOverShoot2 = #008000

tdBuyOvershoot3 = #004d00

// ****************************************Icons***************************************************************

upSign = '↑' // indicates the indicator shows uptrend

downSign = '↓' // incicates the indicator showing downtrend

exitSign ='x' //indicates the indicator uptrend/downtrend ending

// diamond signals weakBullishSignal or weakBearishsignal

// flag signals neutralBullishSignal or neutralBearishSignal

// ****************************************Parabolic SAR code***************************************************************

start = 2

increment = 2

maximum = 2

sus = true

sds = true

disc = false

startCalc = start * .01

incrementCalc = increment * .01

maximumCalc = maximum * .10

sarUp = sar(startCalc, incrementCalc, maximumCalc)

sarDown = sar(startCalc, incrementCalc, maximumCalc)

colUp = spLines and close >= sarDown ? colorLime : na

colDown = spLines and close <= sarUp ? colorSell : na

//@fixme Does not display the correct values for up and down pSAR

plot(sp and sus and sarUp ? sarUp : na, title="↓ SAR", style=cross, linewidth=3,color=colUp)

plot(sp and sds and sarDown ? sarDown : na, title="↑ SAR", style=circles, linewidth=3,color=colDown)

startSAR = 0.02

incrementSAR = 0.02

maximumSAR = 0.2

psar = sar(startSAR, incrementSAR, maximumSAR)

bullishPSAR = psar < high and psar[1] > low

bearishPSAR= psar > low and psar[1] < high

//***********************Leledc Exhausion Bar***********************************************

maj_qual=6

maj_len=30

min_qual=5

min_len=5

lele(qual,len)=>

bindex=nz(bindex[1],0)

sindex=nz(sindex[1],0)

ret=0

if (close>close[4])

bindex:=bindex + 1

if(close<close[4])

sindex:=sindex + 1

if (bindex>qual) and (close<open) and high>=highest(high,len)

bindex:=0

ret:=-1

if ((sindex>qual) and (close>open) and (low<= lowest(low,len)))

sindex:=0

ret:=1

return=ret

major=lele(maj_qual,maj_len)

minor=lele(min_qual,min_len)

leledecMajorBullish = maj ? (major==1?low:na) : na

leledecMajorBearish = maj ? (major==-1?high:na) : na

//****************Ichimoku ************************************

donchian(len) => avg(lowest(len), highest(len))

tenkan = donchian(tenkanPeriods)

kijun = donchian(kijunPeriods)

senkouA = avg(tenkan, kijun)

senkouB = donchian(chikouPeriods)

displacedSenkouA = senkouA[displacement]

displacedSenkouB = senkouB[displacement]

bullishSignal = crossover(tenkan, kijun)

bearishSignal = crossunder(tenkan, kijun)

bullishSignalValues = iff(bullishSignal, tenkan, na)

bearishSignalValues = iff(bearishSignal, tenkan, na)

strongBullishSignal = crossover(tenkan, kijun) and bullishSignalValues > displacedSenkouA and bullishSignalValues > displacedSenkouB and low > tenkan and displacedSenkouA > displacedSenkouB

strongBearishSignal = bearishSignalValues < displacedSenkouA and bearishSignalValues < displacedSenkouB and high < tenkan and displacedSenkouA < displacedSenkouB

neutralBullishSignal = (bullishSignalValues > displacedSenkouA and bullishSignalValues < displacedSenkouB) or (bullishSignalValues < displacedSenkouA and bullishSignalValues > displacedSenkouB)

weakBullishSignal = bullishSignalValues < displacedSenkouA and bullishSignalValues < displacedSenkouB

neutralBearishSignal = (bearishSignalValues > displacedSenkouA and bearishSignalValues < displacedSenkouB) or (bearishSignalValues < displacedSenkouA and bearishSignalValues > displacedSenkouB)

weakBearishSignal = bearishSignalValues > displacedSenkouA and bearishSignalValues > displacedSenkouB

//*********************Kaufman AMA wave*********************//

src=close

lengthAMA=20

filterp = 10

d=abs(src-src[1])

s=abs(src-src[lengthAMA])

noise=sum(d, lengthAMA)

efratio=s/noise

fastsc=0.6022

slowsc=0.0645

smooth=pow(efratio*fastsc+slowsc, 2)

ama=nz(ama[1], close)+smooth*(src-nz(ama[1], close))

filter=filterp/100 * stdev(ama-nz(ama), lengthAMA)

amalow=ama < nz(ama[1]) ? ama : nz(amalow[1])

amahigh=ama > nz(ama[1]) ? ama : nz(amahigh[1])

bw=(ama-amalow) > filter ? 1 : (amahigh-ama > filter ? -1 : 0)

s_color=bw > 0 ? colorBuy : (bw < 0) ? colorSell : colorBlue

amaLongConditionEntry = s_color==colorBuy and s_color[1]!=colorBuy

amaShortConditionEntry = s_color==colorSell and s_color[1]!=colorSell

//***********************Rahul Mohindar Oscillator ******************************//

C=close

cm2(x) => sma(x,2)

ma1=cm2(C)

ma2=cm2(ma1)

ma3=cm2(ma2)

ma4=cm2(ma3)

ma5=cm2(ma4)

ma6=cm2(ma5)

ma7=cm2(ma6)

ma8=cm2(ma7)

ma9=cm2(ma8)

ma10=cm2(ma9)

SwingTrd1 = 100 * (close - (ma1+ma2+ma3+ma4+ma5+ma6+ma7+ma8+ma9+ma10)/10)/(highest(C,10)-lowest(C,10))

SwingTrd2=ema(SwingTrd1,30)

SwingTrd3=ema(SwingTrd2,30)

RMO= ema(SwingTrd1,81)

Buy=cross(SwingTrd2,SwingTrd3)

Sell=cross(SwingTrd3,SwingTrd2)

Bull_Trend=ema(SwingTrd1,81)>0

Bear_Trend=ema(SwingTrd1,81)<0

Ribbon_kol=Bull_Trend ? colorBuy : (Bear_Trend ? colorSell : colorBlue)

Impulse_UP= SwingTrd2 > 0

Impulse_Down= RMO < 0

bar_kol=Impulse_UP ? colorBuy : (Impulse_Down ? colorSell : (Bull_Trend ? colorBuy : colorBlue))

rahulMohindarOscilllatorLongEntry = Ribbon_kol==colorBuy and Ribbon_kol[1]!=colorBuy and Ribbon_kol[1]==colorSell and bar_kol==colorBuy

rahulMohindarOscilllatorShortEntry = Ribbon_kol==colorSell and Ribbon_kol[1]!=colorSell and Ribbon_kol[1]==colorBuy and bar_kol==colorSell

//***********************TD Sequential code ******************************//

transp=0

Numbers=false

SR=false

Barcolor=true

TD = close > close[4] ?nz(TD[1])+1:0

TS = close < close[4] ?nz(TS[1])+1:0

TDUp = TD - valuewhen(TD < TD[1], TD , 1 )

TDDn = TS - valuewhen(TS < TS[1], TS , 1 )

priceflip = barssince(close<close[4])

sellsetup = close>close[4] and priceflip

sell = sellsetup and barssince(priceflip!=9)

sellovershoot = sellsetup and barssince(priceflip!=13)

sellovershoot1 = sellsetup and barssince(priceflip!=14)

sellovershoot2 = sellsetup and barssince(priceflip!=15)

sellovershoot3 = sellsetup and barssince(priceflip!=16)

priceflip1 = barssince(close>close[4])

buysetup = close<close[4] and priceflip1

buy = buysetup and barssince(priceflip1!=9)

buyovershoot = barssince(priceflip1!=13) and buysetup

buyovershoot1 = barssince(priceflip1!=14) and buysetup

buyovershoot2 = barssince(priceflip1!=15) and buysetup

buyovershoot3 = barssince(priceflip1!=16) and buysetup

TDbuyh = valuewhen(buy,high,0)

TDbuyl = valuewhen(buy,low,0)

TDsellh = valuewhen(sell,high,0)

TDselll = valuewhen(sell,low,0)

//***********************Volume Flow Indicator [LazyBear] ******************************//

lengthVFI = 130

coefVFI = 0.2

vcoefVFI = 2.5

signalLength= 5

smoothVFI=true

ma(x,y) => smoothVFI ? sma(x,y) : x

typical=hlc3

inter = log( typical ) - log( typical[1] )

vinter = stdev(inter, 30 )

cutoff = coefVFI * vinter * close

vave = sma( volume, lengthVFI )[1]

vmax = vave * vcoefVFI

vc = iff(volume < vmax, volume, vmax)

mf = typical - typical[1]

vcp = iff( mf > cutoff, vc, iff ( mf < -cutoff, -vc, 0 ) )

vfi = ma(sum( vcp , lengthVFI )/vave, 3)

vfima=ema( vfi, signalLength )

dVFI=vfi-vfima

bullishVFI = vfi > 0 and vfi[1] <=0

bearishVFI = vfi < 0 and vfi[1] >=0

//***********************WaveTrend Oscillator [WT] ******************************//

n1 = 10

n2 = 21

obLevel1 = 60

obLevel2 = 53

osLevel1 = -60

osLevel2 = -53

ap = hlc3

esa = ema(ap, n1)

dWTI = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * dWTI)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

wtiSignal = wt1-wt2

bullishWTI = wt1 > osLevel1 and wt1[1] <= osLevel1 and wtiSignal > 0

bearishWTI = wt1 < obLevel1 and wt1[1] >= obLevel1 and wtiSignal < 0

// **************** Trend Magic code adapted from Glaz ********************* /

CCI = 20 // input(20)

ATR = 5 // input(5)

Multiplier=1 // input(1,title='ATR Multiplier')

original=true // input(true,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x=thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

swap=x>x[1]?1:x<x[1]?-1:swap[1]

swap2=swap==1?lime:red

swap3=thisCCI >=0 ?lime:red

swap4=original?swap3:swap2

bullTrendMagic = swap4 == lime and swap4[1] == red

bearTrendMagic = swap4 == red and swap4[1] == lime

// ************ Indicator: Custom COG channel by Lazy Bear **************** //

srcCOG = close

lengthCOG = 34

median=0

multCOG= 2.5 // input(2.5)

offset = 20 //input(20)

tr_custom() =>

x1=high-low

x2=abs(high-close[1])

x3=abs(low-close[1])

max(x1, max(x2,x3))

atr_custom(x,y) =>

sma(x,y)

dev = (multCOG * stdev(srcCOG, lengthCOG))

basis=linreg(srcCOG, lengthCOG, median)

ul = (basis + dev)

ll = (basis - dev)

tr_v = tr_custom()

acustom=(2*atr_custom(tr_v, lengthCOG))

uls=basis+acustom

lls=basis-acustom

// Plot STDEV channel

plot(basis, linewidth=1, color=navy, style=line, linewidth=1, title="Median : STDEV COG")

lb=plot(ul, color=red, linewidth=1, title="BB+ : COG", style=hline.style_dashed)

tb=plot(ll, color=green, linewidth=1, title="BB- : COG ", style=hline.style_dashed)

fill(tb,lb, silver, title="Region fill: STDEV COG", transp=cogRegionFillTransp)

// Plot ATR channel

plot(basis, linewidth=2, color=navy, style=line, linewidth=2, title="Median : ATR COG ")

ls=plot(uls, color=red, linewidth=1, title="Starc+ : ATR COG", style=circles, transp=cogRegionFillTransp)

ts=plot(lls, color=green, linewidth=1, title="Star- : ATR COG", style=circles, transp=cogRegionFillTransp)

fill(ts,tb, green, title="Region fill : ATR COG", transp=cogRegionFillTransp)

fill(ls,lb, red, title="Region fill : ATR COG", transp=cogRegionFillTransp)

// Mark SQZ

plot_offs_high=0.002

plot_offs_low=0.002

sqz_f=(uls>ul) and (lls<ll)

b_color=sqz_f ? colorBlack : na

plot(sqz_f ? lls - (lls * plot_offs_low) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

plot(sqz_f ? uls + (uls * plot_offs_high) : na, color=b_color, style=cross, linewidth=3, title="SQZ : COG", trasp=0)

// ****************************************All the plots and coloring of bars***************************************************************

// Trend Magic

plotchar(tm and bullTrendMagic, title="TM", char=upSign, location=location.belowbar, color=colorBuy, transp=0, text="TM", textcolor=colorBuy, size=size.auto)

plotchar(tm and bearTrendMagic, title="TM", char=downSign, location=location.abovebar, color=colorSell, transp=0, text="TM", textcolor=colorSell, size=size.auto)

// WaveTrend Oscillator

plotshape(wtoLB and bullishWTI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="WTI", location=location.belowbar, transp=0)

plotshape(wtoLB and bearishWTI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="WTI", location=location.abovebar, transp=0)

// VFI

plotshape(vfiLB and bullishVFI, color=colorBuy, style=shape.labelup, textcolor=#000000, text="VFI", location=location.belowbar, transp=0)

plotshape(vfiLB and bearishVFI, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="VFI", location=location.abovebar, transp=0)

// PSAR

plotshape(inputIndividualSiganlPlot and sp and bullishPSAR, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Sar", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sp and bearishPSAR, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Sar", location=location.abovebar, transp=0)

// Leledec

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBearish, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="Leledec", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and sL and leledecMajorBullish, color=colorBuy, style=shape.labelup, textcolor=#000000, text="Leledec", location=location.belowbar, transp=0)

plotshape(min ? (minor==1?low:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Leledec", color=colorLime)

plotshape(min ? (minor==-1?high:na) : na, style=shape.diamond, text="Leledec", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Leleded", color=colorSell)

// Ichimoku

plot(tenkan, color=iff(sCloud, colorTenkanViolet, na), title="Tenkan", linewidth=2, transp=0)

plot(kijun, color=iff(sCloud, colorKijun, na), title="Kijun", linewidth=2, transp=0)

plot(close, offset = -displacement, color=iff(sCloud, colorLime, na), title="Chikou", linewidth=1)

p1 = plot(senkouA, offset=displacement, color=colorBuy, title="Senkou A", linewidth=3, transp=0)

p2 = plot(senkouB, offset=displacement, color=colorSell, title="Senkou B", linewidth=3, transp=0)

fill(p1, p2, color = senkouA > senkouB ? #1eb600 : colorSell)

plotshape(inputIndividualSiganlPlot and strongBearishSignal, color=colorSell, style=shape.labelup, textcolor=#000000, text="Ichimoku", location=location.abovebar, transp=0)

plotshape(inputIndividualSiganlPlot and strongBullishSignal, color=colorBuy, style=shape.labeldown, textcolor=#ffffff, text="Ichimoku", location=location.belowbar, transp=0)

plotshape(inputNeutralMinorSignals and neutralBullishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.belowbar, title="Neutral Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and weakBullishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.belowbar, title="Weak Bullish Signals - Ichimoku", color=colorLime)

plotshape(inputNeutralMinorSignals and neutralBearishSignal, style=shape.flag, text="Ichimoku", size=size.small, location=location.abovebar, title="Neutral Bearish Signals - Ichimoku", color=colorMaroon)

plotshape(inputNeutralMinorSignals and weakBearishSignal, style=shape.diamond, text="Ichimoku", size=size.tiny, location=location.abovebar, title="Weak Bearish Signals - Ichimoku", color=colorMaroon)

// AMA

plotshape(inputIndividualSiganlPlot and inputAma and amaLongConditionEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="AMA", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and inputAma and amaShortConditionEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="AMA", location=location.abovebar, transp=0)

// RMO

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorLongEntry, color=colorBuy, style=shape.labelup, textcolor=#000000, text="RMO", location=location.belowbar, transp=0)

plotshape(inputIndividualSiganlPlot and sRMO and rahulMohindarOscilllatorShortEntry, color=colorSell, style=shape.labeldown, textcolor=#ffffff, text="RMO", location=location.abovebar, transp=0)

// TD

plot(sTD and SR?(TDbuyh ? TDbuyl: na):na,style=circles, linewidth=1, color=red)

plot(sTD and SR?(TDselll ? TDsellh : na):na,style=circles, linewidth=1, color=lime)

barColour = sell? tdSell : buy? tdBuy : sellovershoot? tdSellOvershoot : sellovershoot1? tdSellOvershoot1 : sellovershoot2?tdSellOverShoot2 : sellovershoot3? tdSellOverShoot3 : buyovershoot? tdBuyOverShoot : buyovershoot1? tdBuyOvershoot1 : buyovershoot2? tdBuyOverShoot2 : buyovershoot3? tdBuyOvershoot3 : na

barcolor(color=barColour, title ="TD Sequential Bar Colour")

// ****************************************BUY/SELL Signal ***************************************************************

bull = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

bear = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

if bull

persistent_bull := 1

persistent_bear := 0

if bear

persistent_bull := 0

persistent_bear := 1

plotshape(bull and persistent_bull[1] != 1, style=shape.labelup, location=location.belowbar, color=colorBuy, text="Buy", textcolor=#000000, transp=0)

plotshape(bear and persistent_bear[1] != 1, style=shape.labeldown, color=colorSell, text="Sell", location=location.abovebar, textcolor =#ffffff, transp=0)

// ****************************************Alerts***************************************************************

// For global buy/sell

alertcondition(bull and persistent_bull[1] != 1, title='Buy', message='Buy')

alertcondition(bear and persistent_bear[1] != 1, title='Sell', message='Sell')

// Strategy

longCondition = leledecMajorBullish or bullishPSAR or strongBullishSignal or amaLongConditionEntry or rahulMohindarOscilllatorLongEntry or bullishVFI

closeLongCondition = leledecMajorBearish or bearishPSAR or strongBearishSignal or amaShortConditionEntry or rahulMohindarOscilllatorShortEntry or bearishVFI

monthfrom =input(1)

monthuntil =input(12)

dayfrom=input(1)

dayuntil=input(31)

yearfrom=input(2017)

yearuntil=input(2020)

leverage=input(1)

if (longCondition )

strategy.entry("Long", strategy.long, leverage, comment="Enter Long")

else

strategy.close("Long", when=closeLongCondition)

//if (closeLongCondition and month>=monthfrom and month <=monthuntil and dayofmonth>=dayfrom and dayofmonth <= dayuntil and year <= yearuntil and year>=yearfrom)

// strategy.entry("Short", strategy.short, leverage, comment="Enter Short")

//else

// strategy.close("Short", when=longCondition)