Strategi trend jangka pendek berdasarkan pembuatan keputusan penunjuk pelbagai dimensi

Gambaran keseluruhan

Strategi ini menggabungkan tiga dimensi yang berbeza dalam indikator teknikal, iaitu sokongan rintangan, sistem garis rata dan indikator overbought dan oversold, berdasarkan isyarat gabungan mereka untuk menentukan arah trend jangka pendek untuk mendapatkan kadar kemenangan yang lebih tinggi.

Prinsip Strategi

Kod pertama mengira tahap sokongan dan rintangan harga, termasuk Axis Standard Oscillation dan tahap sokongan Fibonacci, dan menggambarnya di carta. Apabila harga menembusi tahap penting ini, ia dianggap sebagai isyarat trend yang penting.

Kemudian, VWAP dan harga purata bergerak bertimbangan dikira untuk menilai isyarat silang emas dan silang mati. Ia adalah penilaian trend jangka panjang dan sederhana.

Akhir sekali, perhitungan Stochastic RSI untuk menentukan apakah tanda-tanda cross dan dead fork emasnya termasuk dalam tanda-tanda overbought dan oversold.

Dengan menggabungkan ketiga-tiga dimensi ini, jika sokongan rintangan, garis rata-rata VWAP, dan Stochastic RSI menghantar isyarat beli pada masa yang sama, maka ia akan membuka lebih banyak pesanan; jika ketiga-tiga menghantar isyarat jual pada masa yang sama, maka ia akan membuka kosong.

Analisis kelebihan

Kelebihan terbesar strategi ini adalah menggabungkan tiga dimensi yang berbeza untuk membuat keputusan yang lebih tepat dan lebih tepat. Pertama, ia menyokong kedudukan rintangan untuk menentukan trend besar; kedua, VWAP untuk menentukan trend garis panjang tengah; dan terakhir, Stochastic RSI untuk menentukan overbought dan oversold.

Di samping itu, strategi ini mempunyai fungsi penangguhan, yang membolehkan anda mengunci peratusan keuntungan, yang membantu dalam pengurusan wang.

Analisis risiko

Risiko utama strategi ini adalah bahawa keputusan yang bergantung pada indikator yang bersinggungan dengan indikator yang bersinggungan, dan jika beberapa indikator mengeluarkan isyarat yang salah, ia boleh menyebabkan kesilapan keputusan. Contohnya, Stochastic RSI mengeluarkan isyarat overbought, tetapi penilaian VWAP dan rintangan sokongan masih bullish, pada masa ini ia mungkin terlepas titik beli dan tidak masuk ke dalam pasaran.

Selain itu, parameter penunjuk yang tidak betul juga boleh menyebabkan kesalahan penilaian isyarat, perlu mencari parameter optimum melalui pengukuran berulang.

Di samping itu, pasaran saham sering mengalami peristiwa black swan dalam jangka pendek, yang menyebabkan indikator gagal. Untuk mengelakkan risiko ini, anda boleh memasukkan strategi hentikan kerugian, untuk mengelakkan kerugian tunggal yang terlalu besar.

Arah pengoptimuman

Strategi ini boleh terus dioptimumkan dalam beberapa aspek:

Menambahkan lebih banyak isyarat indikator, seperti penunjuk jumlah transaksi, untuk menilai kekuatan dan kelemahan trend, meningkatkan ketepatan keputusan.

Menambah model pembelajaran mesin, melatih indikator pelbagai dimensi, dan secara automatik mencari strategi perdagangan yang optimum.

Optimumkan mengikut parameter varieti yang berbeza, set parameter penyesuaian.

Menambah strategi henti rugi dan mengawal risiko dengan lebih baik berdasarkan saiz kedudukan kawalan penarikan balik.

Mengoptimumkan kumpulan, mencari varieti yang kurang relevan untuk kumpulan, mengurangkan pengambilan kumpulan.

ringkaskan

Strategi ini secara keseluruhannya sangat sesuai untuk perdagangan trend jangka pendek. Ia menggunakan indikator pelbagai dimensi untuk membuat keputusan, dapat menyaring banyak kebisingan, dan mempunyai kadar kemenangan yang tinggi. Tetapi masih perlu berhati-hati dengan risiko indikator menghantar isyarat yang salah, dengan terus mengoptimumkan, strategi ini dijangka menjadi strategi garis pendek yang stabil dan efisien.

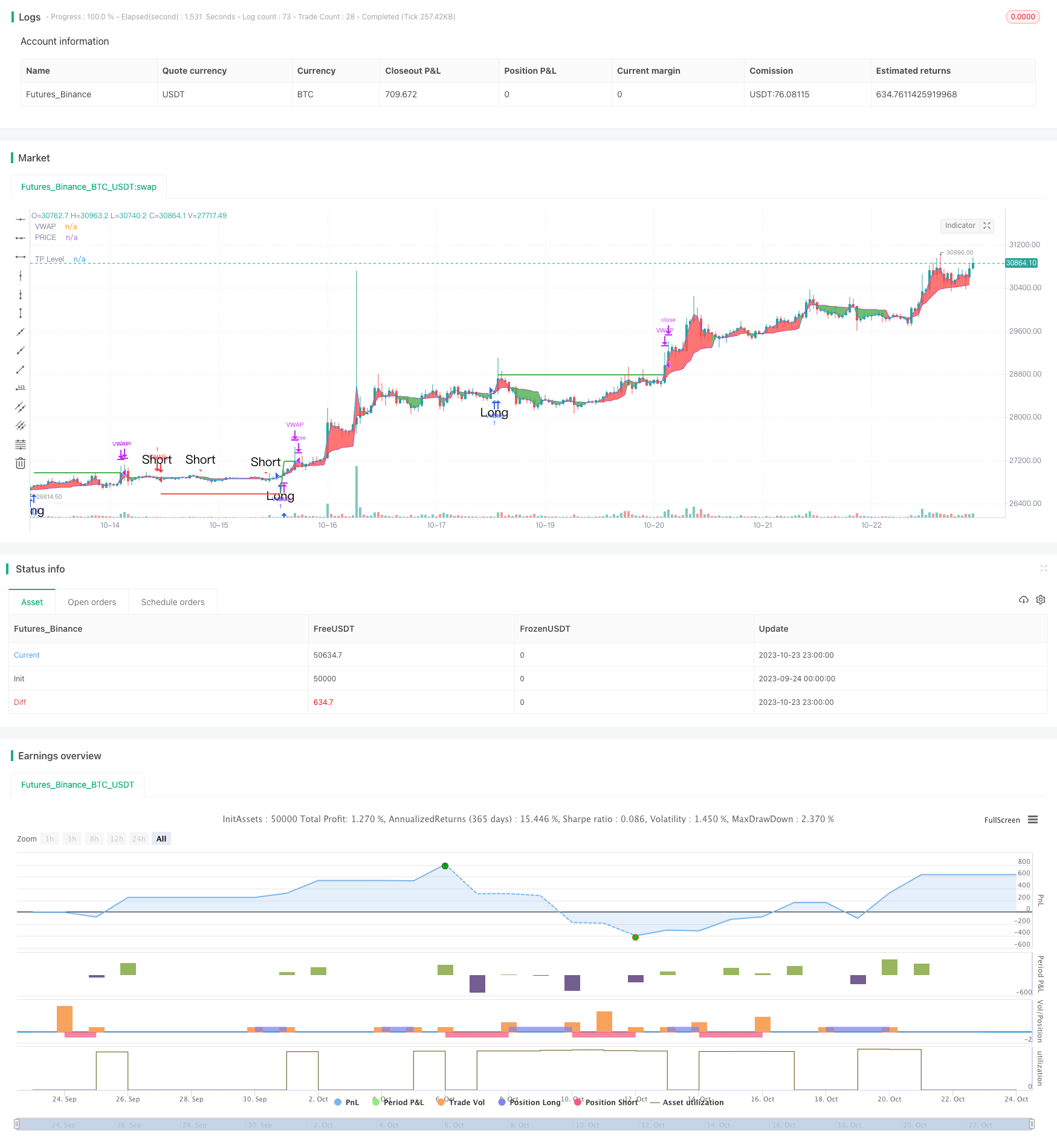

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// EmperorBTC's VWAP Indicator & Strategy

// v2.1

//

// coded by Bogdan Vaida

// This indicator was created after EmperorBTC's conditions on Twitter.

// Good timeframes for it: 30', 15', 5'

// To convert from strategy to study switch the commented lines in the beginning

// and at the end of the script and vice versa.

// What this indicator does is to check if:

// o Pivot Point was crossed

// o Stoch-RSI and VWAP were crossed in current or previous candle

// o Candle (or previous candle) close is in the trend direction

// If all these are true then it will go long or short based on direction.

// FUTURE IDEAS:

// - Volume Expansion

// - Candle Stick patterns

//@version=4

// 🔥Uncomment the line below for the indicator and comment the strategy lines

// study(title="EmperorBTC's VWAP Indicator", shorttitle="EMP-VWAP", overlay=true)

// 🔥 Uncomment the line below for the strategy and comment the above line

strategy(title="EmperorBTC's VWAP Strategy", shorttitle="EMP-VWAP", overlay=true, pyramiding=1)

plotAveragePriceCrossedPivotPoint = input(false, title="Plot Close Price Crossing Pivot Points?", group="Pivot Points")

plotPivotPoints = input(false, title="Plot Pivot Points?", group="Pivot Points")

pivotPointsType = input(title="Pivot Points type", defval="Fibonacci", options=["Fibonacci", "Traditional"], group="Pivot Points")

pivotPointCircleWidth = input(2, title="Width of Pivot Point circles", minval=1, group="Pivot Points")

plotVWAP = input(true, title="Plot VWAP?", group="VWAP")

plotAvgPrice = input(true, title="Plot Average Price?", group="VWAP")

plotVWAPCrossPrice = input(false, title="Plot Price Crossing VWAP?", group="VWAP")

reso = input(title="Period", type=input.resolution, defval="D", group="VWAP")

cumulativePeriod = input(14, "VWAP Cumulative Period", group="VWAP")

plotStochRSICross = input(false, title="Plot StochRSI Cross?", group="StochRSI")

smoothK = input(3, "K", minval=1, group="StochRSI", inline="K&D")

smoothD = input(3, "D", minval=1, group="StochRSI", inline="K&D")

lengthRSI = input(14, "RSI Length", minval=1, group="Stochastic-RSI", inline="length")

lengthStoch = input(14, "Stochastic Length", minval=1, group="Stochastic-RSI", inline="length")

rsiSrc = input(close, title="RSI Source", group="Stochastic-RSI")

plotLong = input(true, title="Plot Long Opportunity?", group="Strategy only")

plotShort = input(true, title="Plot Short Opportunity?", group="Strategy only")

tradingDirection = input(title="Strategy trading Direction: ", defval="L&S", options=["L&S", "L", "S"], group="Strategy only")

takeProfit = input(1.0, title='Take Profit %', group="Strategy only") / 100

plotTP = input(true, title="Plot Take Profit?", group="Strategy only")

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group="Backtesting range", inline="Start Date")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group="Backtesting range", inline="Start Date")

startYear = input(title="Start Year", type=input.integer,

defval=2017, minval=1800, maxval=2100, group="Backtesting range", inline="Start Date")

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group="Backtesting range", inline="End Date")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group="Backtesting range", inline="End Date")

endYear = input(title="End Year", type=input.integer,

defval=2050, minval=1800, maxval=2100, group="Backtesting range", inline="End Date")

// PivotPoint code (PVTvX by DGT has some nice code on PP)

candleHigh = security(syminfo.tickerid,"D", high[1], lookahead=barmerge.lookahead_on)

candleLow = security(syminfo.tickerid,"D", low[1], lookahead=barmerge.lookahead_on)

candleClose = security(syminfo.tickerid,"D", close[1], lookahead=barmerge.lookahead_on)

pivotPoint = (candleHigh+candleLow+candleClose) / 3

float resistance1 = na

float resistance2 = na

float resistance3 = na

float support1 = na

float support2 = na

float support3 = na

if pivotPointsType == "Fibonacci"

resistance1 := pivotPoint + 0.382 * (candleHigh - candleLow)

resistance2 := pivotPoint + 0.618 * (candleHigh - candleLow)

resistance3 := pivotPoint + (candleHigh - candleLow)

support1 := pivotPoint - 0.382 * (candleHigh - candleLow)

support2 := pivotPoint - 0.618 * (candleHigh - candleLow)

support3 := pivotPoint - (candleHigh - candleLow)

else if pivotPointsType == "Traditional"

resistance1 := 2 * pivotPoint - candleLow

resistance2 := pivotPoint + (candleHigh - candleLow)

resistance3 := candleHigh + 2 * (pivotPoint - candleLow)

support1 := 2 * pivotPoint - candleHigh

support2 := pivotPoint - (candleHigh - candleLow)

support3 := candleLow - 2 * (candleHigh - pivotPoint)

plot(series = plotPivotPoints ? support1 : na, color=#ff0000, title="S1", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? support2 : na, color=#800000, title="S2", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? support3 : na, color=#330000, title="S3", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? pivotPoint : na, color=#FFA500, title="PP", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance1 : na, color=#00FF00, title="R1", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance2 : na, color=#008000, title="R2", style = plot.style_circles, linewidth = pivotPointCircleWidth)

plot(series = plotPivotPoints ? resistance3 : na, color=#003300, title="R3", style = plot.style_circles, linewidth = pivotPointCircleWidth)

pivotPointCrossedUp = ((low < support3) and (close > support3)) or ((low < support2) and (close > support2)) or ((low < support1) and (close > support1)) or ((low < pivotPoint) and (close > pivotPoint))

pivotPointCrossedDown = ((high > support3) and (close < support3)) or ((high > support2) and (close < support2)) or ((high > support1) and (close < support1)) or ((high > pivotPoint) and (close < pivotPoint))

plotPPColor = pivotPointCrossedUp ? color.green :

pivotPointCrossedDown ? color.red :

na

plotshape(series = plotAveragePriceCrossedPivotPoint ? (pivotPointCrossedUp or pivotPointCrossedDown) : na, title="PP Cross", style = shape.triangleup, location=location.belowbar, color=plotPPColor, text="PP", size=size.small)

// VWAP (taken from the TV code)

// There are five steps in calculating VWAP:

//

// 1. Calculate the Typical Price for the period. [(High + Low + Close)/3)]

// 2. Multiply the Typical Price by the period Volume (Typical Price x Volume)

// 3. Create a Cumulative Total of Typical Price. Cumulative(Typical Price x Volume)

// 4. Create a Cumulative Total of Volume. Cumulative(Volume)

// 5. Divide the Cumulative Totals.

//

// VWAP = Cumulative(Typical Price x Volume) / Cumulative(Volume)

// Emperor's Edition

t = time(reso)

debut = na(t[1]) or t > t[1]

addsource = ohlc4 * volume

addvol = volume

addsource := debut ? addsource : addsource + addsource[1]

addvol := debut ? addvol : addvol + addvol[1]

vwapValue = addsource / addvol

pVWAP = plot(series = plotVWAP ? vwapValue : na, color=color.purple, title="VWAP")

pAvgPrice = plot(series = plotAvgPrice ? ohlc4 : na, color=color.blue, title="PRICE")

fill(pVWAP, pAvgPrice, color = ohlc4 > vwapValue ? color.red : color.green, title="VWAP PRICE FILL")

vwapCrossUp = (low < vwapValue) and (vwapValue < high) and (close > open) // added green candle check

vwapCrossDown = (high > vwapValue) and (vwapValue > low) and (close < open) // added red candle check

plotVWAPColor = vwapCrossUp ? color.green :

vwapCrossDown ? color.red :

na

plotshape(series = plotVWAPCrossPrice ? (vwapCrossUp or vwapCrossDown) : na, title="VWAP Cross Price", style=shape.triangleup, location=location.belowbar, color=plotVWAPColor, text="VWAP", size=size.small)

// Stochastic RSI

rsi1 = rsi(rsiSrc, lengthRSI)

k = sma(stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = sma(k, smoothD)

sRsiCrossUp = k[1] < d[1] and k > d

sRsiCrossDown = k[1] > d[1] and k < d

plotColor = sRsiCrossUp ? color.green :

sRsiCrossDown ? color.red :

na

plotshape(series = plotStochRSICross ? (sRsiCrossUp or sRsiCrossDown) : na, title="StochRSI Cross Up", style=shape.triangleup, location=location.belowbar, color=plotColor, text="StochRSI", size=size.small)

// Long Trades

sRsiCrossedUp = sRsiCrossUp or sRsiCrossUp[1]

vwapCrossedUp = vwapCrossUp or vwapCrossUp[1]

// longCond1 = (sRsiCross and vwapCross) or (sRsiCross[1] and vwapCross) or (sRsiCross and vwapCross[1])

longCond1 = (sRsiCrossedUp[1] and vwapCrossedUp[1])

longCond2 = pivotPointCrossedUp[1]

longCond3 = (close[1] > open[1]) and (close > open) // check this

longCond = longCond1 and longCond2 and longCond3

plotshape(series = plotLong ? longCond : na, title="Long", style=shape.triangleup, location=location.belowbar, color=color.green, text="Long", size=size.normal)

// Short Trades

sRsiCrossedDown = sRsiCrossDown or sRsiCrossDown[1]

vwapCrossedDown = vwapCrossDown or vwapCrossDown[1]

shortCond1 = (sRsiCrossedDown[1] and vwapCrossedDown[1])

shortCond2 = pivotPointCrossedDown[1]

shortCond3 = (close[1] < open[1]) and (close < open)

shortCond = shortCond1 and shortCond2 and shortCond3

plotshape(series = plotShort ? shortCond : na, title="Short", style=shape.triangledown, location=location.abovebar, color=color.red, text="Short", size=size.normal)

// alertcondition(condition=longCond, title="Long", message="Going long")

// alertcondition(condition=shortCond, title="Short", message="Going short")

// 🔥 Uncomment the lines below for the strategy and revert for the study

takeProfitLong = strategy.position_avg_price * (1 + takeProfit)

takeProfitShort = strategy.position_avg_price * (1 - takeProfit)

exitTp = ((strategy.position_size > 0) and (close > takeProfitLong)) or ((strategy.position_size < 0) and (close < takeProfitShort))

strategy.risk.allow_entry_in(tradingDirection == "L" ? strategy.direction.long : tradingDirection == "S" ? strategy.direction.short : strategy.direction.all)

plot(series = (plotTP and strategy.position_size > 0) ? takeProfitLong : na, title="TP Level",color=color.green, style=plot.style_linebr, linewidth=2)

plot(series = (plotTP and strategy.position_size < 0) ? takeProfitShort : na, title="TP Level",color=color.red, style=plot.style_linebr, linewidth=2)

inDateRange = (time >= timestamp(syminfo.timezone, startYear,

startMonth, startDate, 0, 0)) and (time < timestamp(syminfo.timezone, endYear, endMonth, endDate, 0, 0))

strategy.entry("VWAP", strategy.long, comment="Long", when=longCond and inDateRange)

strategy.entry("VWAP", strategy.short, comment="Short", when=shortCond and inDateRange)

strategy.close(id="VWAP", when=exitTp)

if (not inDateRange)

strategy.close_all()