Sistem pengesanan arah aliran kotak berganda

Gambaran keseluruhan

Sistem pengesanan trend adalah strategi pengesanan trend berdasarkan sistem dua kotak. Ia menggunakan kotak kitaran jangka panjang untuk menentukan arah trend keseluruhan, dan apabila kotak jangka pendek menghasilkan isyarat, ia memilih isyarat perdagangan yang sesuai dengan arah trend jangka panjang.

Prinsip Strategi

Strategi ini menggunakan dua kotak untuk menilai trend. Kotak jangka panjang menggunakan kitaran yang lebih panjang untuk menentukan arah trend utama, dan kotak jangka pendek menggunakan kitaran yang lebih pendek untuk menentukan isyarat perdagangan tertentu.

Strategi pertama mengira harga tertinggi dan terendah bagi badan jangka panjang untuk menentukan arah trend utama. Arah trend terbahagi kepada tiga jenis:

- Harga tertinggi di atas satu garis K harga tertinggi, ditakrifkan sebagai trend ke atas, nilai 1

- Harga terendah di bawah harga terendah memakai garis K, yang ditakrifkan sebagai trend menurun, dengan nilai -1

- Jika tidak, mengekalkan trend asal

Setelah menentukan arah trend utama, strategi bermula dengan masuk ke dalam kotak jangka pendek.

- Melakukan lebih banyak apabila trend utama adalah ke atas, dan harga minimum dalam kotak jangka pendek adalah sama dengan harga minimum dalam garis K di atas, dan lebih rendah daripada harga minimum dalam kotak jangka pendek semasa

- Apabila trend utama adalah menurun dan harga tertinggi dalam kotak pendek adalah sama dengan harga tertinggi dalam garis K di atas dan lebih tinggi daripada harga tertinggi dalam kotak pendek semasa, buat shortcut

Di samping itu, strategi ini juga menetapkan hentian dan penangguhan:

- Stop loss berganda adalah harga terendah untuk kotak jangka panjang, stop loss kosong adalah harga tertinggi untuk kotak jangka panjang

- Harga tertinggi untuk kotak pendek dengan pelbagai penutup tunggal, harga terendah untuk kotak pendek dengan penutup tunggal kosong

Apabila trend utama bertukar, semua kedudukan akan ditutup.

Analisis kelebihan

Strategi ini mempunyai kelebihan berikut:

- Menggunakan sistem penghakiman dua kotak, dapat mengenal pasti arah trend dengan berkesan, mengurangkan kebarangkalian perdagangan yang salah

- Hanya masuk jika isyarat pembalikan jangka pendek selaras dengan arah trend jangka panjang, untuk mengelakkan gangguan pasaran jangka pendek

- Menggunakan jangka masa panjang dan jangka masa pendek untuk memastikan keupayaan untuk menangkap trend utama dan mempunyai fleksibiliti untuk menyesuaikan kedudukan dengan betul

- Tetapan titik henti rugi adalah lebih munasabah dan dapat mengawal risiko semasa trend berjalan

- Pelancaran cepat ketika trend utama bertukar, kawalan kerugian dalam masa yang tepat

Analisis risiko

Strategi ini juga mempunyai risiko:

- Perancangan jangka pendek yang tidak betul, mudah menyebabkan perdagangan yang kerap atau kehilangan peluang

- Kejadian-kejadian yang tidak dijangka yang menyebabkan trend berbalik dalam jangka pendek tidak semestinya bermakna trend berbalik dalam jangka panjang, di mana terdapat risiko kerugian.

- Stop loss terlalu dekat, pasaran mungkin terguncang

- “Penghentian terlalu longgar dan mungkin tidak dapat memaksimumkan keuntungan”.

- Kesilapan dalam penilaian trend jangka panjang menyebabkan kerugian perdagangan seterusnya berkembang

- Kaedah untuk menangani risiko ini merangkumi: menyesuaikan parameter jangka panjang dan pendek, mengoptimumkan kedudukan henti rugi, meningkatkan syarat penapisan dan sebagainya.

Arah pengoptimuman

Strategi ini boleh dioptimumkan dalam beberapa aspek:

- Menambah syarat penapisan untuk mengelakkan isyarat yang disesatkan oleh gangguan palsu jangka pendek

- Optimumkan parameter jangka panjang dan pendek untuk menyesuaikan diri dengan ciri-ciri varieti yang berbeza

- Mengubah kedudukan penghentian kerosakan secara dinamik untuk memastikan penghentian kerosakan lebih tepat dan lebih lengkap

- Menambah strategi pengurusan kedudukan untuk menjadikan saiz kedudukan lebih munasabah

- Kebolehpercayaan pembalikan trend dengan penunjuk seperti volume

- Mengoptimumkan parameter dan syarat penapisan secara automatik menggunakan kaedah pembelajaran mesin

ringkaskan

Sistem pengesanan trend secara keseluruhannya adalah strategi pengesanan trend yang sangat praktikal. Ia mempunyai keupayaan untuk menilai trend dan menyesuaikan diri dalam jangka pendek, dan dapat mengawal risiko semasa mengikuti trend. Dengan pengoptimuman berterusan, strategi ini boleh menjadi sistem perdagangan trend automatik yang kuat.

||

Overview

The Trend Following System is a trend tracking strategy based on a double box system. It uses a long-term box to determine the overall trend direction and takes signals that align with the major trend when the short-term box triggers. This strategy follows trends while managing risks.

Strategy Logic

The strategy uses two boxes to determine the trend. The long-term box uses a longer period to judge the major trend direction, and the short-term box uses a shorter period to generate trading signals.

First, the strategy calculates the highest and lowest prices of the long-term box to determine the major trend direction. The trend direction can be:

- If the highest price crosses above the highest price of the previous bar, it is defined as an uptrend, assigned a value of 1

- If the lowest price crosses below the lowest price of the previous bar, it is defined as a downtrend, assigned a value of -1

- Otherwise, maintain the original trend direction

After determining the major trend, the strategy starts taking positions based on the short-term box signals. Specifically:

- When the major trend is up and the short-term box’s lowest price equals the previous bar’s lowest price and is lower than the current short-term box’s lowest price, go long.

- When the major trend is down and the short-term box’s highest price equals the previous bar’s highest price and is higher than the current short-term box’s highest price, go short.

In addition, stop loss and take profit are configured:

- Long stop loss is the lowest price of the long-term box, short stop loss is the highest price of the long-term box

- Long take profit is the highest price of the short-term box, short take profit is the lowest price of the short-term box

When the major trend reverses, close all positions.

Advantage Analysis

The advantages of this strategy include:

- The double box system effectively identifies trend directions and reduces incorrect trades

- Only taking reversal signals that align with the major trend avoids being misled by short-term market noise

- The combination of long and short periods ensures capturing major trends while maintaining position adjustment flexibility

- Reasonable stop loss and take profit points control risk while following trends

- Quickly flattening all positions when the major trend reverses minimizes losses

Risk Analysis

The risks of this strategy include:

- Improper long and short period settings may cause overtrading or missing opportunities

- Short-term reversals may not represent long-term trend changes, still posing loss risks

- Stop loss too close may get stopped out prematurely

- Take profit too loose may not maximize profits

- Wrong judgment of the major trend leads to losses

- Solutions include adjusting periods, optimizing stops/targets, adding filters etc.

Optimization Directions

The strategy can be improved by:

- Adding filters to avoid false breakouts

- Optimizing long and short periods for different products

- Dynamically adjusting stop loss and take profit levels

- Incorporating position sizing rules

- Using volume etc. to judge reliability of trend changes

- Utilizing machine learning to auto-optimize parameters and filters

Summary

The Trend Following System is a practical trend trading strategy combining trend determination and short-term adjustments. With continuous optimizations, it can become a robust automated system that tracks trends while controlling risks. It contains the core philosophies of trend trading and is worth in-depth studying.

[/trans]

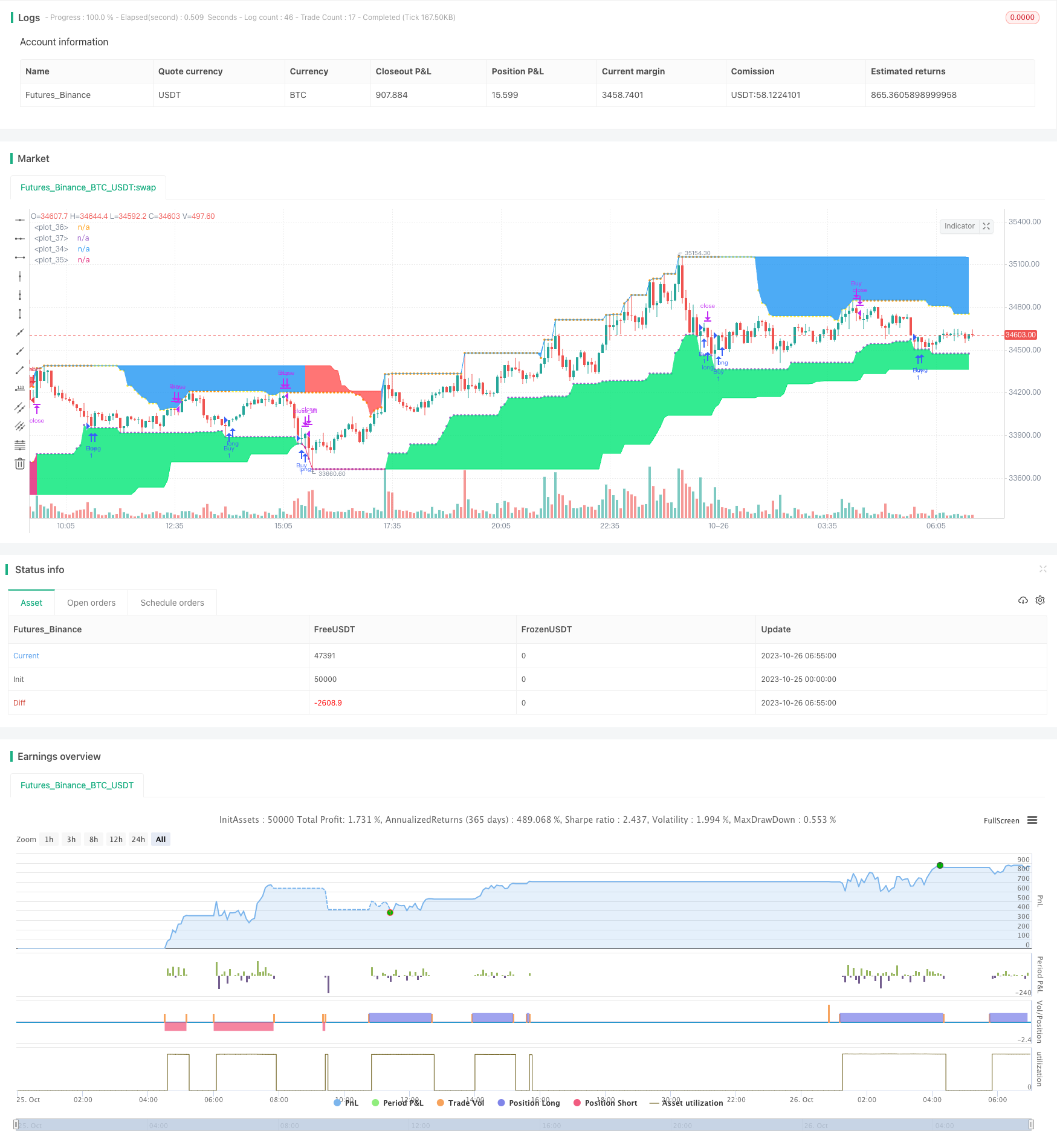

/*backtest

start: 2023-10-25 00:00:00

end: 2023-10-26 07:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeTheBlue

//@version=4

strategy("Grab Trading System", overlay = true)

flb = input(defval = 80, title = "Longterm Period", minval = 1)

slb = input(defval = 21, title = "Shortterm Period", minval = 1)

showtarget = input(defval = true, title = "Show Target")

showtrend = input(defval = true, title = "Show Trend")

major_resistance = highest(flb)

major_support = lowest(flb)

minor_resistance = highest(slb)

minor_support = lowest(slb)

var int trend = 0

trend := high > major_resistance[1] ? 1 : low < major_support[1] ? -1 : trend

strategy.entry("Buy", true, when = trend == 1 and low[1] == minor_support[1] and low > minor_support)

strategy.entry("Sell", false, when = trend == -1 and high[1] == minor_resistance[1] and high < minor_resistance)

if strategy.position_size > 0

strategy.exit("Buy", stop = major_support, comment = "Stop Buy")

if high[1] == minor_resistance[1] and high < minor_resistance

strategy.close("Buy", comment ="Close Buy")

if strategy.position_size < 0

strategy.exit("Sell", stop = major_resistance, comment = "Stop Sell")

if low[1] == minor_support[1] and low > minor_support

strategy.close("Sell", comment ="Close Sell")

if strategy.position_size != 0 and change(trend)

strategy.close_all()

majr = plot(major_resistance, color = showtrend and trend == -1 and trend[1] == -1 ? color.red : na)

majs = plot(major_support, color = showtrend and trend == 1 and trend[1] == 1 ? color.lime : na)

minr = plot(minor_resistance, color = showtarget and trend == 1 and strategy.position_size > 0 ? color.yellow : na, style = plot.style_circles)

mins = plot(minor_support, color = showtarget and trend == -1 and strategy.position_size < 0 ? color.yellow : na, style = plot.style_circles)

fill(majs, mins, color = showtrend and trend == 1 and trend[1] == 1 ? color.lime : na, transp = 85)

fill(majr, minr, color = showtrend and trend == -1 and trend[1] == -1 ? color.red : na, transp = 85)