Strategi pelarian adaptif PMax berdasarkan penunjuk RSI dan T3

Gambaran keseluruhan

Strategi ini adalah strategi perdagangan kuantitatif yang menggunakan RSI dan T3 untuk menentukan trend, digabungkan dengan ATR untuk menetapkan garis hentian, untuk mewujudkan PMax yang menyesuaikan diri dengan penembusan. Gagasan utamanya adalah untuk mengoptimumkan penilaian trend dan tetapan hentian untuk meningkatkan keuntungan sambil mengawal risiko.

Prinsip Strategi

Pengiraan RSI dan T3 untuk menentukan trend

- Menggunakan RSI untuk menentukan sama ada saham terbeban atau terbeban

- T3 untuk menilai trend berdasarkan RSI

Tetapkan PMax untuk Stop Loss Line Sesuai Dengan ATR

- Mengira ATR sebagai wakil turun naik

- Tetapkan garisan stop loss di atas dan di bawah T3 dengan lebar garisan adalah beberapa kali ganda ATR

- Mencapai penyesuaian penyesuaian untuk garis henti

Berjaya membeli dan keluar

- Apabila harga naik melalui T3, ia dianggap sebagai isyarat beli

- Keluar dari kedudukan semasa apabila harga menembusi garisan stop loss di bawah

Kelebihan Strategik

Strategi ini mempunyai kelebihan utama:

- Kombinasi RSI dan T3 lebih tepat untuk menilai trend

- PMax mengawal risiko dengan mekanisme penangguhan kerugian

- Penunjuk ATR sebagai wakil turun naik untuk menetapkan lebar garis hentian, mengelakkan terlalu radikal

- Penarikan dan Keuntungan

Risiko Strategik

Strategi ini mempunyai risiko utama:

- Risiko berbalik

Apabila berlaku pembalikan harga dalam jangka pendek, ia boleh menyebabkan penangguhan yang dicetuskan menyebabkan kerugian. Garis penangguhan boleh dikurangkan dengan sewajarnya untuk mengurangkan kesan pembalikan.

- Risiko untuk gagal menilai trend

Kesan penghakiman trend RSI dan T3 tidak 100% boleh dipercayai, jika penghakiman salah juga boleh menyebabkan kerugian. Anda boleh menyesuaikan parameter dengan sewajarnya atau memasukkan indikator lain untuk pengoptimuman.

Arah pengoptimuman strategi

Strategi ini boleh dioptimumkan dengan cara berikut:

- Menambah trend penilaian lain seperti purata bergerak

- Optimumkan parameter panjang RSI dan T3

- Uji perkalian ATR yang berbeza sebagai lebar garisan henti

- Pelancaran garis stop loss mengikut pasaran yang berbeza

ringkaskan

Strategi ini mengintegrasikan kelebihan penggunaan tiga indikator RSI, T3 dan ATR, mewujudkan kombinasi organik penghakiman trend dan kawalan risiko. Berbanding dengan satu indikator, kombinasi ini mempunyai keakuratan penghakiman yang tinggi, pengunduran yang terkawal, dan merupakan strategi pengesanan trend yang boleh dipercayai.

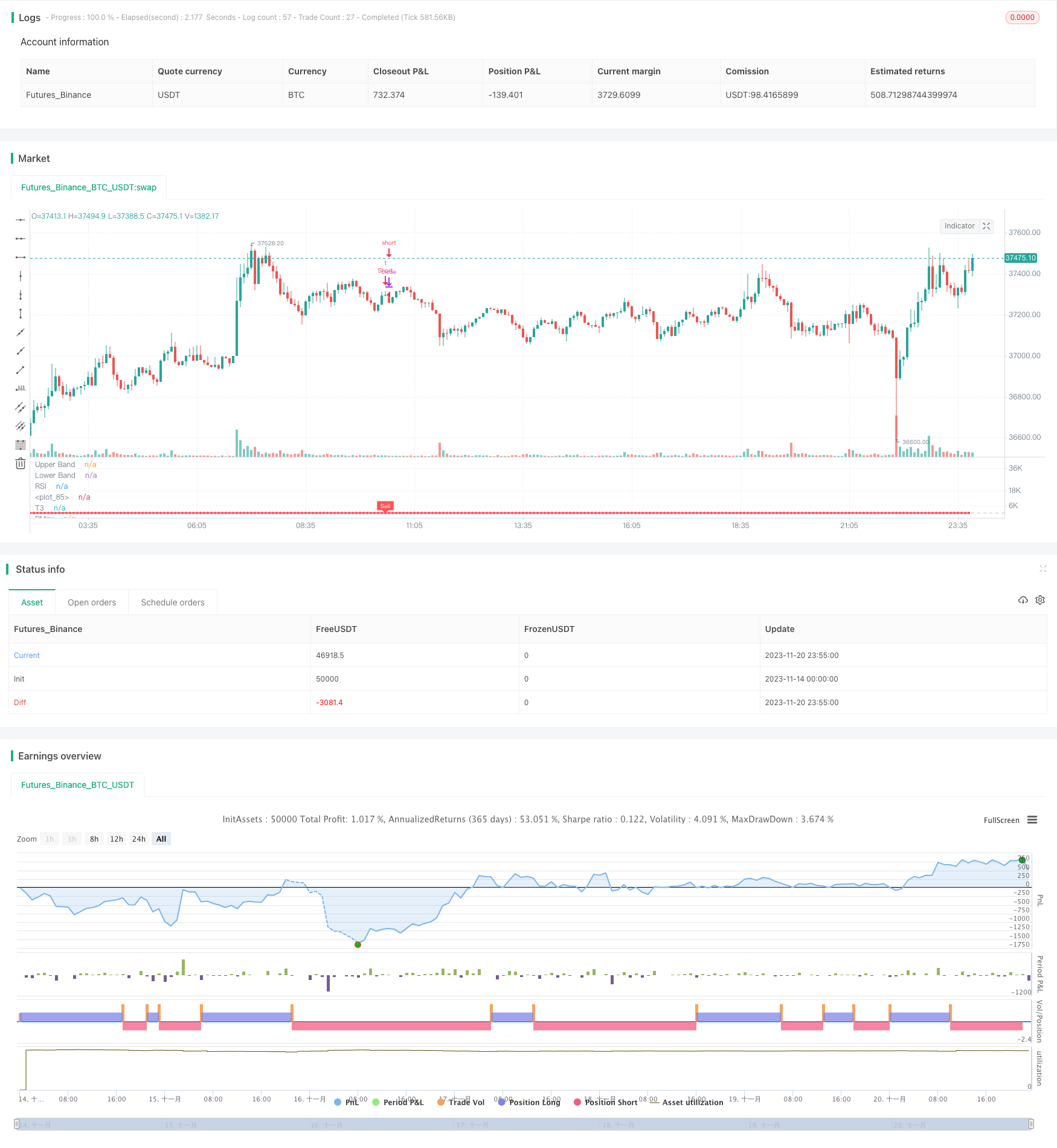

/*backtest

start: 2023-11-14 00:00:00

end: 2023-11-21 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//developer: @KivancOzbilgic

//author: @KivancOzbilgic

strategy("PMax on Rsi w T3 Strategy","PmR3St.", overlay=false, precision=2)

src = input(hl2, title="Source")

Multiplier = input(title="ATR Multiplier", type=input.float, step=0.1, defval=3)

length =input(8, "Tillson T3 Length", minval=1)

T3a1 = input(0.7, "TILLSON T3 Volume Factor", step=0.1)

Periods = input(10,title="ATR Length", type=input.integer)

rsilength = input(14, minval=1, title="RSI Length")

showrsi = input(title="Show RSI?", type=input.bool, defval=true)

showsupport = input(title="Show Moving Average?", type=input.bool, defval=true)

showsignalsk = input(title="Show Crossing Signals?", type=input.bool, defval=true)

highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

i = close>=close[1] ? close-close[1] : 0

i2 = close<close[1] ? close[1]-close : 0

Wwma_Func(src,rsilength)=>

wwalpha = 1/ rsilength

WWMA = 0.0

WWMA := wwalpha*src + (1-wwalpha)*nz(WWMA[1])

WWMA=Wwma_Func(src,rsilength)

AvUp = Wwma_Func(i,rsilength)

AvDown = Wwma_Func(i2,rsilength)

AvgUp = sma(i,rsilength)

AvgDown =sma(i2,rsilength)

k1 = high>close[1] ? high-close[1] : 0

k2 = high<close[1] ? close[1]-high : 0

k3 = low>close[1] ? low-close[1] : 0

k4 = low<close[1] ? close[1]-low : 0

AvgUpH=(AvgUp*(rsilength-1)+ k1)/rsilength

AvgDownH=(AvgDown*(rsilength-1)+ k2)/rsilength

AvgUpL=(AvgUp*(rsilength-1)+ k3)/rsilength

AvgDownL=(AvgDown*(rsilength-1)+ k4)/rsilength

rs = AvUp/AvDown

rsi= rs==-1 ? 0 : (100-(100/(1+rs)))

rsh=AvgUpH/AvgDownH

rsih= rsh==-1 ? 0 : (100-(100/(1+rsh)))

rsl=AvgUpL/AvgDownL

rsil= rsl==-1 ? 0 : (100-(100/(1+rsl)))

TR=max(rsih-rsil,abs(rsih-rsi[1]),abs(rsil-rsi[1]))

atr=sma(TR,Periods)

plot(showrsi ? rsi : na, "RSI", color=#8E1599)

band1 = hline(70, "Upper Band", color=#C0C0C0)

band0 = hline(30, "Lower Band", color=#C0C0C0)

fill(band1, band0, color=#9915FF, transp=90, title="Background")

T3e1=ema(rsi, length)

T3e2=ema(T3e1,length)

T3e3=ema(T3e2,length)

T3e4=ema(T3e3,length)

T3e5=ema(T3e4,length)

T3e6=ema(T3e5,length)

T3c1=-T3a1*T3a1*T3a1

T3c2=3*T3a1*T3a1+3*T3a1*T3a1*T3a1

T3c3=-6*T3a1*T3a1-3*T3a1-3*T3a1*T3a1*T3a1

T3c4=1+3*T3a1+T3a1*T3a1*T3a1+3*T3a1*T3a1

T3=T3c1*T3e6+T3c2*T3e5+T3c3*T3e4+T3c4*T3e3

MAvg=T3

Pmax_Func(rsi,length)=>

longStop = MAvg - Multiplier*atr

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + Multiplier*atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

PMax = dir==1 ? longStop: shortStop

PMax=Pmax_Func(rsi,length)

plot(showsupport ? MAvg : na, color=color.black, linewidth=2, title="T3")

pALL=plot(PMax, color=color.red, linewidth=2, title="PMax", transp=0)

alertcondition(cross(MAvg, PMax), title="Cross Alert", message="PMax - Moving Avg Crossing!")

alertcondition(crossover(MAvg, PMax), title="Crossover Alarm", message="Moving Avg BUY SIGNAL!")

alertcondition(crossunder(MAvg, PMax), title="Crossunder Alarm", message="Moving Avg SELL SIGNAL!")

alertcondition(cross(src, PMax), title="Price Cross Alert", message="PMax - Price Crossing!")

alertcondition(crossover(src, PMax), title="Price Crossover Alarm", message="PRICE OVER PMax - BUY SIGNAL!")

alertcondition(crossunder(src, PMax), title="Price Crossunder Alarm", message="PRICE UNDER PMax - SELL SIGNAL!")

buySignalk = crossover(MAvg, PMax)

plotshape(buySignalk and showsignalsk ? PMax*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallk = crossunder(MAvg, PMax)

plotshape(sellSignallk and showsignalsk ? PMax*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

mPlot = plot(rsi, title="", style=plot.style_circles, linewidth=0,display=display.none)

longFillColor = highlighting ? (MAvg>PMax ? color.green : na) : na

shortFillColor = highlighting ? (MAvg<PMax ? color.red : na) : na

fill(mPlot, pALL, title="UpTrend Highligter", color=longFillColor)

fill(mPlot, pALL, title="DownTrend Highligter", color=shortFillColor)

dummy0 = input(true, title = "=Backtest Inputs=")

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2005, title = "From Year", minval = 2005)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2006)

Start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

Finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

Timerange() =>

time >= Start and time <= Finish ? true : false

if buySignalk

strategy.entry("Long", strategy.long,when=Timerange())

if sellSignallk

strategy.entry("Short", strategy.short,when=Timerange())