Bollinger Bands Strategi Penunjuk Teknikal Berdasarkan Penguraian Siri Masa dan Pemberatan Isipadu

Gambaran keseluruhan

Strategi ini menggabungkan penguraian siri masa, harga purata bertimbangan kuantiti, jalur Brin dan delta (OBV-PVT) 4 petunjuk teknikal untuk membuat penilaian multidimensi mengenai trend harga, overbought dan oversold.

Prinsip Strategi

- Menggunakan pembahagian urutan masa untuk menghapuskan kebisingan dan kekerapan dalam harga, untuk menilai trend dengan lebih tepat;

- Berdasarkan garis trend ini, harga baru dikira dengan berat kuantiti transaksi;

- Mengira harga penutupan dengan peratusan lebar jalur Brin BB%B untuk menilai overbought dan oversold;

- Hitung peratusan lebar jalur Brin bagi Delta ((OBV-PVT) yang berubah-ubah sebagai kriteria untuk penyesuaian nilai;

- Isyarat dagangan dihasilkan berdasarkan penyambungan pelbagai ruang dalam penunjuk harga dan penyambungan penyambungan dalam penunjuk Brin.

Analisis kelebihan

- Strategi ini mempunyai kekuatan yang baik, digabungkan dengan pelbagai penilaian mengenai harga, kuantiti dan ciri-ciri statistik.

- Gabungan BB%B dan Delta (OBV-PVT) lebih baik untuk menilai fenomena jual beli dalam jangka pendek;

- Sinyal persilangan kuantiti dan harga menapis sebahagian daripada bunyi bising di tempat-tempat dagangan.

Analisis risiko

- Tetapan parameter terlalu rumit dan tidak mudah disesuaikan;

- Dalam tempoh yang singkat, gempa bumi boleh menyebabkan kerugian yang lebih besar.

- Harga yang tidak sesuai dengan kuantiti tidak dapat menyaring sepenuhnya isyarat yang salah.

Anda boleh mengoptimumkan strategi dengan menyesuaikan kitaran garis rata-rata, lebar Brin dan nisbah risiko-keuntungan, mengurangkan kekerapan dagangan dan meningkatkan kadar keuntungan dagangan tunggal.

ringkaskan

Strategi ini menggunakan pelbagai alat analisis seperti pemisahan urutan masa, indikator Brin, indikator OBV, dan lain-lain, untuk mengenal pasti kejutan jangka pendek dan menangkap trend utama pasaran melalui kombinasi organik hubungan kuantitatif, ciri statistik dan penghakiman trend. Namun, terdapat risiko tertentu yang perlu disesuaikan dengan parameter untuk mencapai keadaan optimum.

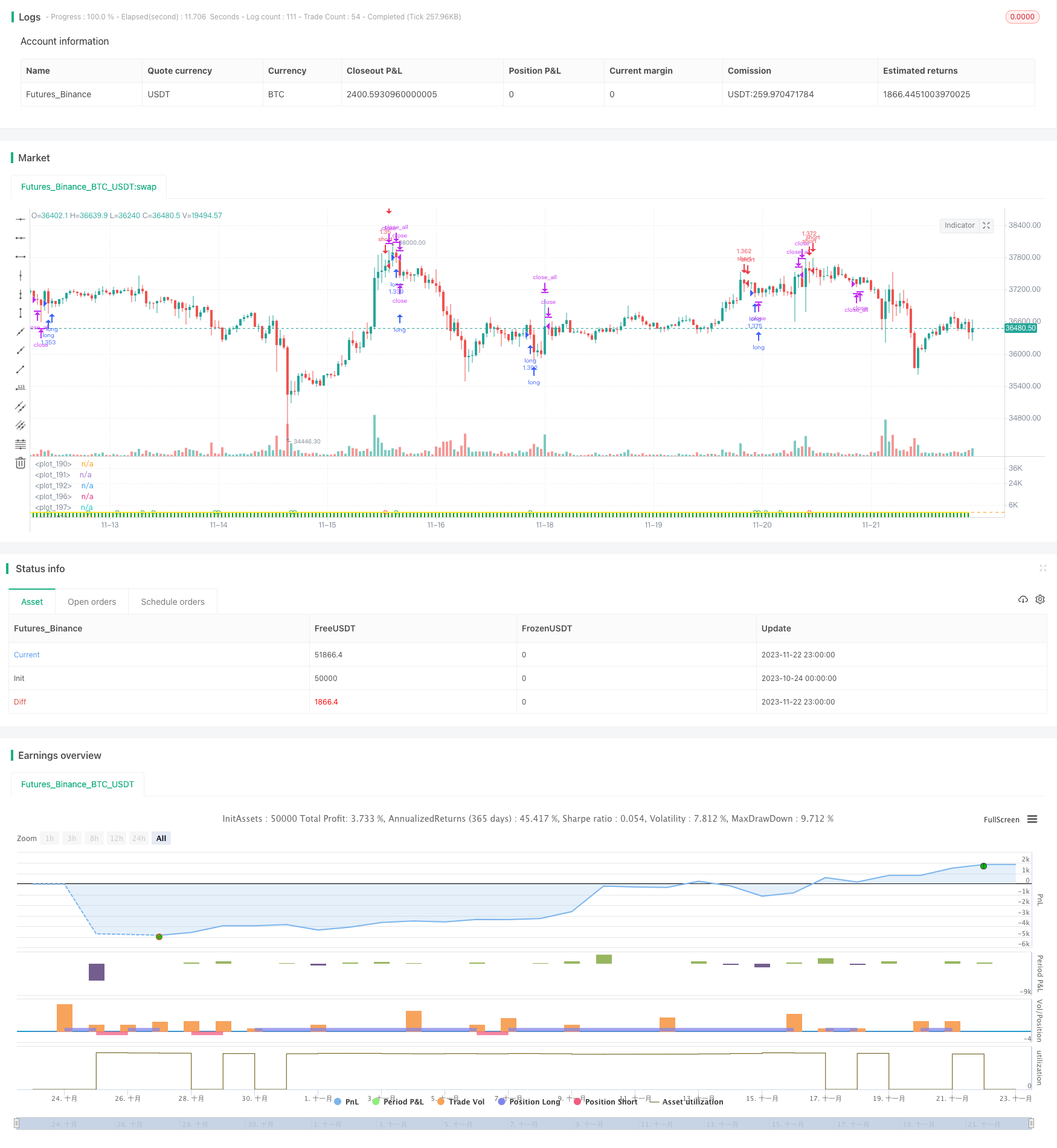

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © oakwhiz and tathal

//@version=4

strategy("BBPBΔ(OBV-PVT)BB", default_qty_type=strategy.percent_of_equity, default_qty_value=100)

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2010, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100)

// Normalize Function

normalize(_src, _min, _max) =>

// Normalizes series with unknown min/max using historical min/max.

// _src : series to rescale.

// _min, _min: min/max values of rescaled series.

var _historicMin = 10e10

var _historicMax = -10e10

_historicMin := min(nz(_src, _historicMin), _historicMin)

_historicMax := max(nz(_src, _historicMax), _historicMax)

_min + (_max - _min) * (_src - _historicMin) / max(_historicMax - _historicMin, 10e-10)

// STEP 2:

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

// Stop loss & Take Profit Section

sl_inp = input(2.0, title='Stop Loss %')/100

tp_inp = input(4.0, title='Take Profit %')/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

icreturn = false

innercandle = if (high < high[1]) and (low > low[1])

icreturn := true

src = close

float change_src = change(src)

float i_obv = cum(change_src > 0 ? volume : change_src < 0 ? -volume : 0*volume)

float i_pvt = pvt

float result = change(i_obv - i_pvt)

float nresult = ema(normalize(result, -1, 1), 20)

length = input(20, minval=1)

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ema(nresult, length)

dev = mult * stdev(nresult, length)

upper = basis + dev

lower = basis - dev

bbr = (nresult - lower)/(upper - lower)

////////////////INPUTS///////////////////

lambda = input(defval = 1000, type = input.float, title = "Smoothing Factor (Lambda)", minval = 1)

leng = input(defval = 100, type = input.integer, title = "Filter Length", minval = 1)

srcc = close

///////////Construct Arrays///////////////

a = array.new_float(leng, 0.0)

b = array.new_float(leng, 0.0)

c = array.new_float(leng, 0.0)

d = array.new_float(leng, 0.0)

e = array.new_float(leng, 0.0)

f = array.new_float(leng, 0.0)

/////////Initialize the Values///////////

//for more details visit:

// https://asmquantmacro.com/2015/06/25/hodrick-prescott-filter-in-excel/

ll1 = leng-1

ll2 = leng-2

for i = 0 to ll1

array.set(a,i, lambda*(-4))

array.set(b,i, src[i])

array.set(c,i, lambda*(-4))

array.set(d,i, lambda*6 + 1)

array.set(e,i, lambda)

array.set(f,i, lambda)

array.set(d, 0, lambda + 1.0)

array.set(d, ll1, lambda + 1.0)

array.set(d, 1, lambda * 5.0 + 1.0)

array.set(d, ll2, lambda * 5.0 + 1.0)

array.set(c, 0 , lambda * (-2.0))

array.set(c, ll2, lambda * (-2.0))

array.set(a, 0 , lambda * (-2.0))

array.set(a, ll2, lambda * (-2.0))

//////////////Solve the optimization issue/////////////////////

float r = array.get(a, 0)

float s = array.get(a, 1)

float t = array.get(e, 0)

float xmult = 0.0

for i = 1 to ll2

xmult := r / array.get(d, i-1)

array.set(d, i, array.get(d, i) - xmult * array.get(c, i-1))

array.set(c, i, array.get(c, i) - xmult * array.get(f, i-1))

array.set(b, i, array.get(b, i) - xmult * array.get(b, i-1))

xmult := t / array.get(d, i-1)

r := s - xmult*array.get(c, i-1)

array.set(d, i+1, array.get(d, i+1) - xmult * array.get(f, i-1))

array.set(b, i+1, array.get(b, i+1) - xmult * array.get(b, i-1))

s := array.get(a, i+1)

t := array.get(e, i)

xmult := r / array.get(d, ll2)

array.set(d, ll1, array.get(d, ll1) - xmult * array.get(c, ll2))

x = array.new_float(leng, 0)

array.set(x, ll1, (array.get(b, ll1) - xmult * array.get(b, ll2)) / array.get(d, ll1))

array.set(x, ll2, (array.get(b, ll2) - array.get(c, ll2) * array.get(x, ll1)) / array.get(d, ll2))

for j = 0 to leng-3

i = leng-3 - j

array.set(x, i, (array.get(b,i) - array.get(f,i)*array.get(x,i+2) - array.get(c,i)*array.get(x,i+1)) / array.get(d, i))

//////////////Construct the output///////////////////

o5 = array.get(x,0)

////////////////////Plottingd///////////////////////

TimeFrame = input('1', type=input.resolution)

start = security(syminfo.tickerid, TimeFrame, time)

//------------------------------------------------

newSession = iff(change(start), 1, 0)

//------------------------------------------------

vwapsum = 0.0

vwapsum := iff(newSession, o5*volume, vwapsum[1]+o5*volume)

volumesum = 0.0

volumesum := iff(newSession, volume, volumesum[1]+volume)

v2sum = 0.0

v2sum := iff(newSession, volume*o5*o5, v2sum[1]+volume*o5*o5)

myvwap = vwapsum/volumesum

dev2 = sqrt(max(v2sum/volumesum - myvwap*myvwap, 0))

Coloring=close>myvwap?color.green:color.red

av=myvwap

showBcol = input(false, type=input.bool, title="Show barcolors")

showPrevVWAP = input(false, type=input.bool, title="Show previous VWAP close")

prevwap = 0.0

prevwap := iff(newSession, myvwap[1], prevwap[1])

nprevwap= normalize(prevwap, 0, 1)

l1= input(20, minval=1)

src2 = close

mult1 = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis1 = sma(src2, l1)

dev1 = mult1 * stdev(src2, l1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

bbr1 = (src - lower1)/(upper1 - lower1)

az = plot(bbr, "Δ(OBV-PVT)", color.rgb(0,153,0,0), style=plot.style_columns)

bz = plot(bbr1, "BB%B", color.rgb(0,125,125,50), style=plot.style_columns)

fill(az, bz, color=color.white)

deltabbr = bbr1 - bbr

oneline = hline(1)

twoline = hline(1.2)

zline = hline(0)

xx = input(.3)

yy = input(.7)

zz = input(-1)

xxx = hline(xx)

yyy = hline(yy)

zzz = hline(zz)

fill(oneline, twoline, color=color.red, title="Sell Zone")

fill(yyy, oneline, color=color.orange, title="Slightly Overbought")

fill(yyy, zline, color=color.white, title="DO NOTHING ZONE")

fill(zzz, zline, color=color.green, title="GO LONG ZONE")

l20 = crossover(deltabbr, 0)

l30 = crossunder(deltabbr, 0)

l40 = crossover(o5, 0)

l50 = crossunder(o5, 0)

z1 = bbr1 >= 1

z2 = bbr1 < 1 and bbr1 >= .7

z3 = bbr1 < .7 and bbr1 >= .3

z4 = bbr1 < .3 and bbr1 >= 0

z5 = bbr1 < 0

a1 = bbr >= 1

a2 = bbr < 1 and bbr >= .7

a4 = bbr < .3 and bbr >= 0

a5 = bbr < 0

b4 = deltabbr < .3 and deltabbr >= 0

b5 = deltabbr < 0

c4 = o5 < .3 and o5 >= 0

c5 = o5 < 0

b1 = deltabbr >= 1

b2 = deltabbr < 1 and o5 >= .7

c1 = o5 >= 1

c2 = o5 < 1 and o5 >= .7

///

n = input(16,"Period")

H = highest(hl2,n)

L = lowest(hl2,n)

hi = H[1]

lo = L[1]

up = high>hi

dn = low<lo

lowerbbh = lowest(10)[1]

bbh = (low == open ? open < lowerbbh ? open < close ? close > ((high[1] - low[1]) / 2) + low[1] :na : na : na)

plot(normalize(av,-1,1), linewidth=2, title="Trendline", color=color.yellow)

long5 = close < av and av[0] > av[1]

sell5 = close > av

cancel = false

if open >= high[1]

cancel = true

long = (long5 or z5 or a5) and (icreturn or bbh or up)

sell = ((z1 or a1) or (l40 and l20)) and (icreturn or dn) and (c1 or b1)

short = ((z1 or z2 or a1 or sell5) and (l40 or l20)) and icreturn

buy= (z5 or z4 or a5 or long5) and (icreturn or dn)

plotshape(long and not sell ? -0.5 : na, title="Long", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(short and not sell? 1 : na, title="Short", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

if (inDateRange)

strategy.entry("long", true, when = long )

if (inDateRange) and (strategy.position_size > 0)

strategy.close_all(when = sell or cancel)

if (inDateRange)

strategy.entry("short", false, when = short )

if (inDateRange) and (strategy.position_size < 0)

strategy.close_all(when = buy)