Strategi perdagangan kuantitatif tiga musketeer bergerak purata

Ringkasan: Strategi ini adalah strategi analisis teknikal yang tipikal, menggunakan beberapa petunjuk EMA rata-rata yang biasa digunakan dan petunjuk tambahan seperti RSI, MACD, PSR, untuk membentuk peraturan masuk dan berhenti untuk mencari peluang untuk membeli dan menjual dengan harga rendah melalui kombinasi konfigurasi rata-rata dan isyarat indikator yang berbeza.

Prinsip strategi: Inti strategi ini adalah 5, 9, dan 21 hari rata-rata. Apabila rata-rata jangka pendek berada di atas rata-rata jangka panjang, ia lebih baik, dan apabila rata-rata jangka pendek berada di bawah rata-rata jangka panjang, ia tidak baik. Selain itu, kombinasi RSI untuk menentukan overbought dan oversold, MACD untuk menentukan trend, dan PSR untuk mengenal pasti rintangan sokongan untuk perdagangan gabungan.

Analisis kelebihan strategi:

- Penunjuk garis rata-rata jelas dan intuitif, mudah untuk menilai arah trend.

- RSI boleh mengenal pasti fenomena overbought dan oversold, MACD menentukan trend panjang dan pendek, PSR mencari harga utama, dan gabungan indikator saling melengkapi.

- Pelbagai peraturan masuk dan parameter yang fleksibel.

- Terdapat banyak kombinasi parameter dan indikator yang boleh dioptimumkan, yang boleh disesuaikan dan dioptimumkan mengikut pasaran.

Analisis risiko:

- Operasi kitaran pendek sukar untuk memahami trend besar, dan terdapat risiko kehilangan pembalikan.

- Tetapan parameter yang tidak betul boleh menyebabkan terlalu banyak isyarat palsu atau isyarat yang hilang.

- Indeks teknikal mudah digunakan oleh agensi-agensi arbitraj yang menyebabkan kerugian.

- Ia juga boleh menyebabkan kerosakan yang teruk apabila berlaku gempa bumi.

Cara untuk menangani masalah ini:

- Memahami trend garis panjang dengan betul, untuk mengelakkan operasi garis pendek yang berlawanan.

- Mengoptimumkan kombinasi parameter, menetapkan stop loss, mengawal risiko.

- Berhati-hati dengan kemungkinan pengembalian gear tinggi dan rebound rendah.

Arah untuk dioptimumkan:

- Sesuaikan parameter garis purata untuk menguji kombinasi terbaik.

- Menambah isyarat penapisan penunjuk lain.

- Peningkatan kebarangkalian penilaian indikator pembelajaran mesin.

- Meningkatkan ketepatan isyarat dengan perubahan jumlah transaksi.

- Menambah strategi hentikan kerugian untuk mengelakkan kerosakan daripada berkembang.

Ringkasan: Strategi ini mengintegrasikan pelbagai isyarat indikator tambahan, memanfaatkan kelebihan indikator rata-rata, mengeksploitasi peluang untuk membeli atau menjual dengan harga rendah. Dengan pengoptimuman parameter dan kombinasi indikator, anda dapat meningkatkan keberkesanan strategi secara berterusan, tetapi anda perlu mengawal frekuensi dan risiko operasi dengan sederhana, untuk mengelakkan kerugian tunggal yang terlalu banyak mempengaruhi keuntungan keseluruhan.

||

Overview: This strategy is a typical technical analysis strategy that utilizes several common moving average indicators like EMA and auxiliary indicators like RSI, MACD, PSR to form entry and stop loss rules for finding low buy high sell opportunities.

Principle: The core of this strategy is the 5, 9, 21 day moving averages. When the short period MA crosses over the long period one, it signals an uptrend; when the short period MA crosses below the long period one, it signals a downtrend. In addition, RSI is used to determine overbought and oversold levels, MACD to judge the trend, PSR to identify support and resistance for combo trading. The background color shows market sentiment to assist trend judgment. The parameters are customizable for configuring entry rules.

Advantages:

- MA indicators give clear trend direction.

- RSI effectively spots overbought/oversold levels, MACD judges short-long trend, PSR finds key price levels. The indicators are complementary.

- Flexible entry rules and parameter settings.

- Many optimizable indicators and parameter combinations adaptable to varying market conditions.

Risks:

- Short-term operations may fail to capture major trend and miss reversals.

- Improper parameter configuration can lead to too many false signals or missing good signals.

- Pure technical indicators are susceptible to manipulation by arbitrageurs causing losses.

- Prone to being stopped out in high volatile markets.

Solutions:

- Capture mid-long term trend appropriately to avoid trading against major trend.

- Optimize parameters, use stop loss to control risks.

- Watch out the possibilities of pullback from highs and bounce from lows.

Optimization:

- Fine tune MA parameters for best combo.

- Add more indicators to filter signals.

- Increase machine learning metrics for probability estimate.

- Combine volume changes to enhance signal accuracy.

- Add stop loss to restrict loss expansion.

Summary: This strategy integrates multiple auxiliary signals, leverages the strength of MA indicators to identify short-term low buy high sell chances. Parameters and indicators combinations may be optimized continuously to improve strategy efficacy, but operation frequency and risks should be moderated to prevent oversized single trade loss from eroding overall profitability.

[/trans]

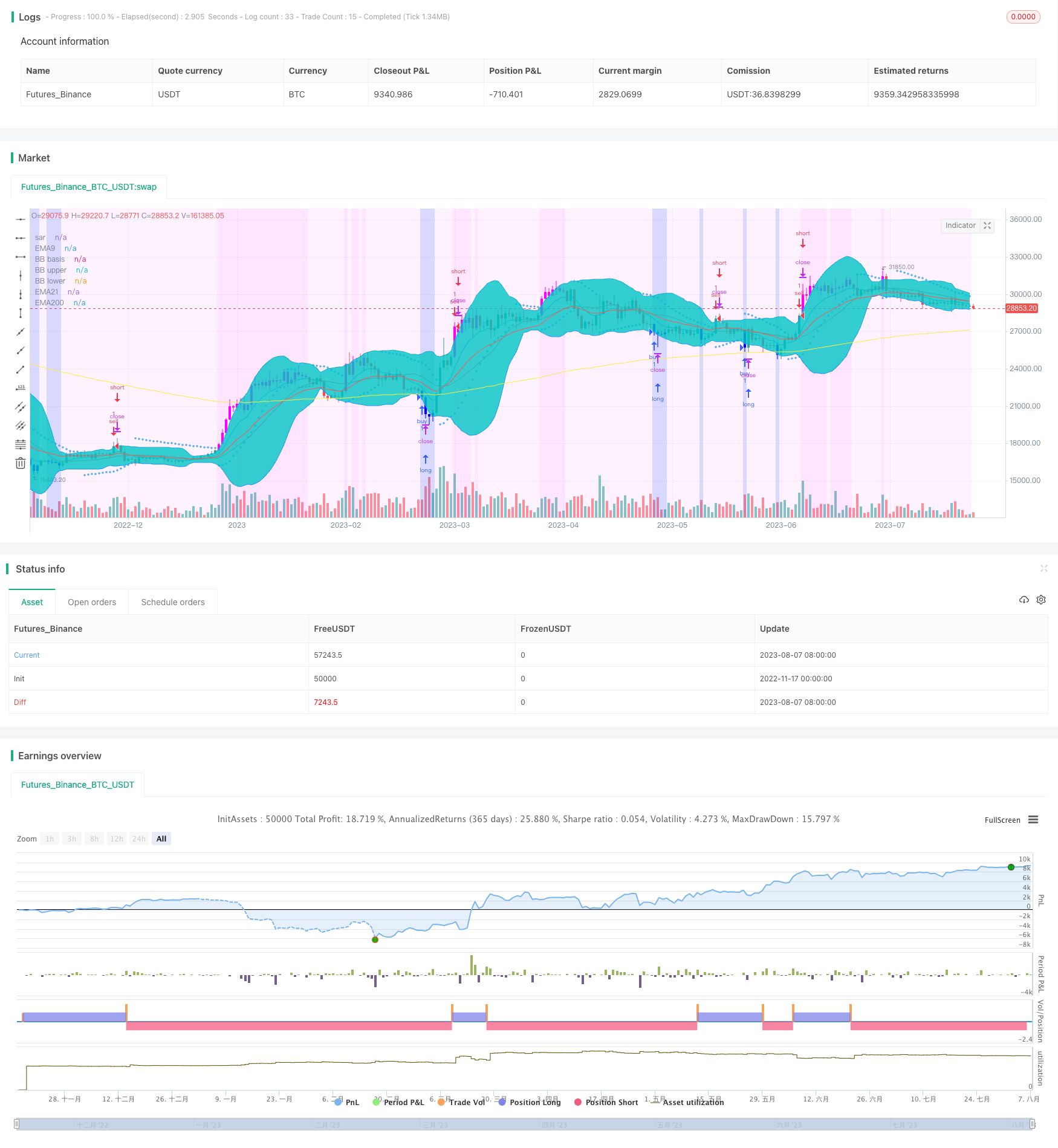

/*backtest

start: 2022-11-17 00:00:00

end: 2023-08-08 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("f.society v7", title="f.society v7", overlay=true)

//@Author: rick#1414

// -----------------------------------------------------

// f.society : Pone 3EMA: 5, 9, 21, 50, 100, 200, SAR,

// velas azules en sobreventa y velas moradas sobre compra

// SAR 0.02, 0.02, 0.2 , Bandas de Bollinger

// estrategia de compra y venta con rsi, macd o psr

// color de fondo: ema, rsi (color azul sobreventa 35, 25 (mas intenso))

// -----------------------------------------------------

// Como agregar a Trading view:

// 1 Cerrar todos los otros indicadores antes de añadirlo

// 2. Ir a la página de inicio TradingView.com

// 3. En la parte inferior, haga clic en Editor Pine // ver imagen: // https://cdn.discordapp.com/attachments/407267549047422976/407393815112974336/unknown.png

// 4. borrar todo el texo y reemplazar con todo el contenido de este archivo

// 5. Pulse el botón "Añadir a trazar" (Add to graph)

// -----------------------------------------------------

// revisar opciones de on y off segun indicadores deseados

// https://cdn.discordapp.com/attachments/405885820114042883/412115277883506700/unknown.png

// se puede cambiar la estrategia desde este menu desplegable para señales buy/sell

// Options

estrategia = input(defval="rsi", title = "Strategy", options=["ema","rsi","macd","psr","off","BB","ema5"])

in_bkcolor = input(defval="rsi", title = "background color", options=["ema","rsi","macd","psr","off","exchange","BB","ema5"])

e5 = input(title="Show ema5?", type=bool, defval=false)

e9 = input(title="Show ema9?", type=bool, defval=true)

e21 = input(title="Show ema21?", type=bool, defval=true)

e50 = input(title="Show ema50?", type=bool, defval=false)

e100 = input(title="Show ema100?", type=bool, defval=false)

e200 = input(title="Show ema200", type=bool, defval=true)

in_rsi = input(title="Color oversold and overbought bars?", type=bool, defval=true)

in_sar = input(title="Show Parabolic Sar", type=bool, defval=true)

in_bb = input(title="Show Bollinger Bands?", type=bool, defval=true)

sd = input(false, title="Show Daily Pivots?")

linew = input(1, title="linewidth", minval=0)

sarw = input(1, title="sar points width", minval=0)

ovs = input(40, title="oversold rsi", minval=0)

ovb = input(65, title="overbought rsi", minval=0)

//pf = input(false,title="Show Filtered Pivots")

pf=false

// 3 ema

src = close // input(close, title="Source")

//len9 = input(9, minval=1, title="ema9 Length")

//len21 = input(21, minval=1, title="ema21 Length")

//len200 = input(200, minval=1, title="ema200 Length")

len5=5

len9=9

len21=21

len50=50

len100=100

len200=200

ema5 = ema(src, len5)

ema9 = ema(src, len9)

ema21 = ema(src, len21)

ema50= ema(src, len50)

ema100 = ema(src, len100)

ema200 = ema(src, len200)

plot(e5? ema5 : na, title="EMA5", linewidth=linew, color=purple)

plot(e9? ema9 : na, title="EMA9", linewidth=linew, color=blue)

plot(e21? ema21 : na, title="EMA21", linewidth=linew, color=red)

plot(e50? ema50 : na, title="EMA50", linewidth=linew, color=green)

plot(e100? ema100 : na, title="EMA100", linewidth=linew, color=lime)

plot(e200? ema200 : na, title="EMA200", linewidth=linew, color=yellow)

// RSI Color

//lenR = input(14, minval=1, title="RSI Length")

lenR=14

//up = rma(max(change(src), 0), lenR)

//down = rma(-min(change(src), 0), lenR)

//vrsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

vrsi=rsi(close,lenR)

//plot(vrsi,title="vrsi")

oversold = vrsi < ovs

overbought = vrsi > ovb

barcolor(in_rsi? oversold? #0000FF : overbought? #ff00ff:na : na)

// SAR

plot(in_sar? sar(0.02, 0.02, 0.2): na, style=cross, linewidth=sarw, color=blue, title="sar")

// BB

//length = input(20, title="Bollinger length", minval=1)

length=20

//mult = input(2.0, title="Bollinger stdDev", minval=0.001, maxval=50)

mult=2.0

basis = sma(src, length)

dev = mult * stdev(src, length)

upper = basis + dev

lower = basis - dev

plot(in_bb? basis :na, color=red, linewidth=linew, title="BB basis")

p1 = plot(in_bb? upper :na, color=blue, linewidth=linew, title="BB upper")

p2 = plot(in_bb? lower :na, color=blue, linewidth=linew, title="BB lower")

fill(p1, p2)

//background

bgcolor(in_bkcolor=="exchange"? #0000FF40 : in_bkcolor=="rsi"? vrsi < (ovs-15) ? #0000FF50 : vrsi < ovs ? #0000FF30 :( vrsi < ovb ? #ff00ff10 : #ff00ff20): in_bkcolor=="ema"?(ema9>ema21?#ff00ff10 : #0000FF20):in_bkcolor=="BB"?(lower>close?#ff00ff10 : close>upper?#0000FF20:#ff00ff10): in_bkcolor=="ema5"?(ema5>ema21?#ff00ff10 : #0000FF20):na)

// Strategy

if estrategia == "ema"

strategy.entry("buy", true, 1, when= crossover(ema9,ema21) ),

strategy.entry("sell", false, 1, when = crossover(ema21,ema9))

else

if estrategia =="rsi"

strategy.entry("buy", true, 1, when= vrsi <ovs),

strategy.entry("sell", false, 1, when = vrsi > ovb or crossover(close,upper))

else

if estrategia =="macd"

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9),

//bgcolor(macdLine > signalLine ? #98c8ff : #ff8b94),

strategy.entry("buy", true, 1, when= macdLine>=signalLine ),

strategy.entry("sell", false, 1, when = macdLine<signalLine)

else

if estrategia=="psr"

leftBars = 4 //input(4)

rightBars = 2 //input(2)

swh = pivothigh(leftBars, rightBars)

swl = pivotlow(leftBars, rightBars)

swh_cond = not na(swh)

hprice = 0.0

hprice := swh_cond ? swh : hprice[1]

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

if (le)

strategy.entry("buy", strategy.long, comment="buy", stop=hprice + syminfo.mintick)

swl_cond = not na(swl)

lprice = 0.0

lprice := swl_cond ? swl : lprice[1]

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

if (se)

strategy.entry("sell", strategy.short, comment="sell", stop=lprice - syminfo.mintick)

else

if estrategia=="BB"

strategy.entry("buy", true, 1, when= crossover(lower,close) ),

strategy.entry("sell", false, 1, when = crossover(close,upper))

else

if estrategia=="ema5"

strategy.entry("buy", true, 1, when= crossover(ema5,ema21) ),

strategy.entry("sell", false, 1, when = crossover(ema21,ema5))

// pivots

// Classic Pivot

pivot = (high + low + close ) / 3.0

// Filter Cr

bull= pivot > (pivot + pivot[1]) / 2 + .0025

bear= pivot < (pivot + pivot[1]) / 2 - .0025

// Classic Pivots

r1 = pf and bear ? pivot + (pivot - low) : pf and bull ? pivot + (high - low) : pivot + (pivot - low)

s1 = pf and bull ? pivot - (high - pivot) : pf and bear ? pivot - (high - low) : pivot - (high - pivot)

r2 = pf ? na : pivot + (high - low)

s2 = pf ? na : pivot - (high - low)

//Pivot Average Calculation

smaP = sma(pivot, 3)

//Daily Pivots

dtime_pivot = request.security(syminfo.tickerid, 'D', pivot[1])

dtime_pivotAvg = request.security(syminfo.tickerid, 'D', smaP[1])

dtime_r1 = request.security(syminfo.tickerid, 'D', r1[1])

dtime_s1 = request.security(syminfo.tickerid, 'D', s1[1])

dtime_r2 = request.security(syminfo.tickerid, 'D', r2[1])

dtime_s2 = request.security(syminfo.tickerid, 'D', s2[1])

offs_daily = 0

plot(sd and dtime_pivot ? dtime_pivot : na, title="Daily Pivot",style=line, color=fuchsia,linewidth=linew)

plot(sd and dtime_r1 ? dtime_r1 : na, title="Daily R1",style=line, color=#DC143C,linewidth=linew)

plot(sd and dtime_s1 ? dtime_s1 : na, title="Daily S1",style=line, color=lime,linewidth=linew)

plot(sd and dtime_r2 ? dtime_r2 : na, title="Daily R2",style=line, color=maroon,linewidth=linew)

plot(sd and dtime_s2 ? dtime_s2 : na, title="Daily S2",style=line, color=#228B22,linewidth=linew)

// References:

// get number of bars since last green bar

//plot(barssince(close >= open), linewidth=3, color=blue)

//bgcolor(close < open ? #ff8b94 : #98c8ff , transp=10)

//http://www.color-hex.com/

// #98c8ff light blue

// #ff8b94 red #b21c0e

// #7d1d90 purple

// #0029ff blue

// #fffa86 yellow