Strategi mata utama dagangan dalam sehari

Gambaran keseluruhan

Ini adalah strategi titik-titik penting untuk perdagangan dalam sehari di India, yang menggunakan harga pembukaan, harga tertinggi, harga terendah dan harga penutupan untuk mengira titik sokongan dan rintangan utama, dan berdagang apabila harga pecah di titik-titik ini.

Prinsip Strategi

- Hitung harga tertinggi, terendah dan penutupan pada hari perdagangan sebelumnya

- Hitung titik sokongan utama S1, titik rintangan R1 dan titik kritikal PP mengikut formula

- Apabila harga menembusi titik-titik kritikal ini, masuklah ke dalam kedudukan jual atau jual.

- Tetapkan mekanisme penarikan diri daripada kerugian

Formula untuk mengira titik-titik utama adalah seperti berikut:

PP = (最高价+最低价+收盘价)/3

R1 = 2*PP - 最低价

S1 = 2*PP - 最高价

Analisis kelebihan

- Menggunakan titik-titik utama untuk memberikan peluang keuntungan yang tinggi

- Titik kunci mudah ditentukan, peraturan transaksi jelas

- Titik henti mudah ditetapkan, kawalan risiko yang berkesan

Analisis risiko

- Kemungkinan pecah palsu di titik-titik kritikal, menyebabkan kerugian

- Titik penting perlu disahkan dan tidak semestinya berkesan setiap kali

- Setting Stop Loss yang tidak betul boleh meningkatkan kerugian

Penyelesaian risiko:

- combining with other indicators to filter false breakouts

- backtesting to validate strategy over long timeframes

- optimize stop loss placement

Arah pengoptimuman

- Penapisan isyarat penembusan palsu yang digabungkan dengan petunjuk teknikal lain

- Optimumkan parameter untuk pelbagai jenis

- Dinamika penyesuaian titik henti

ringkaskan

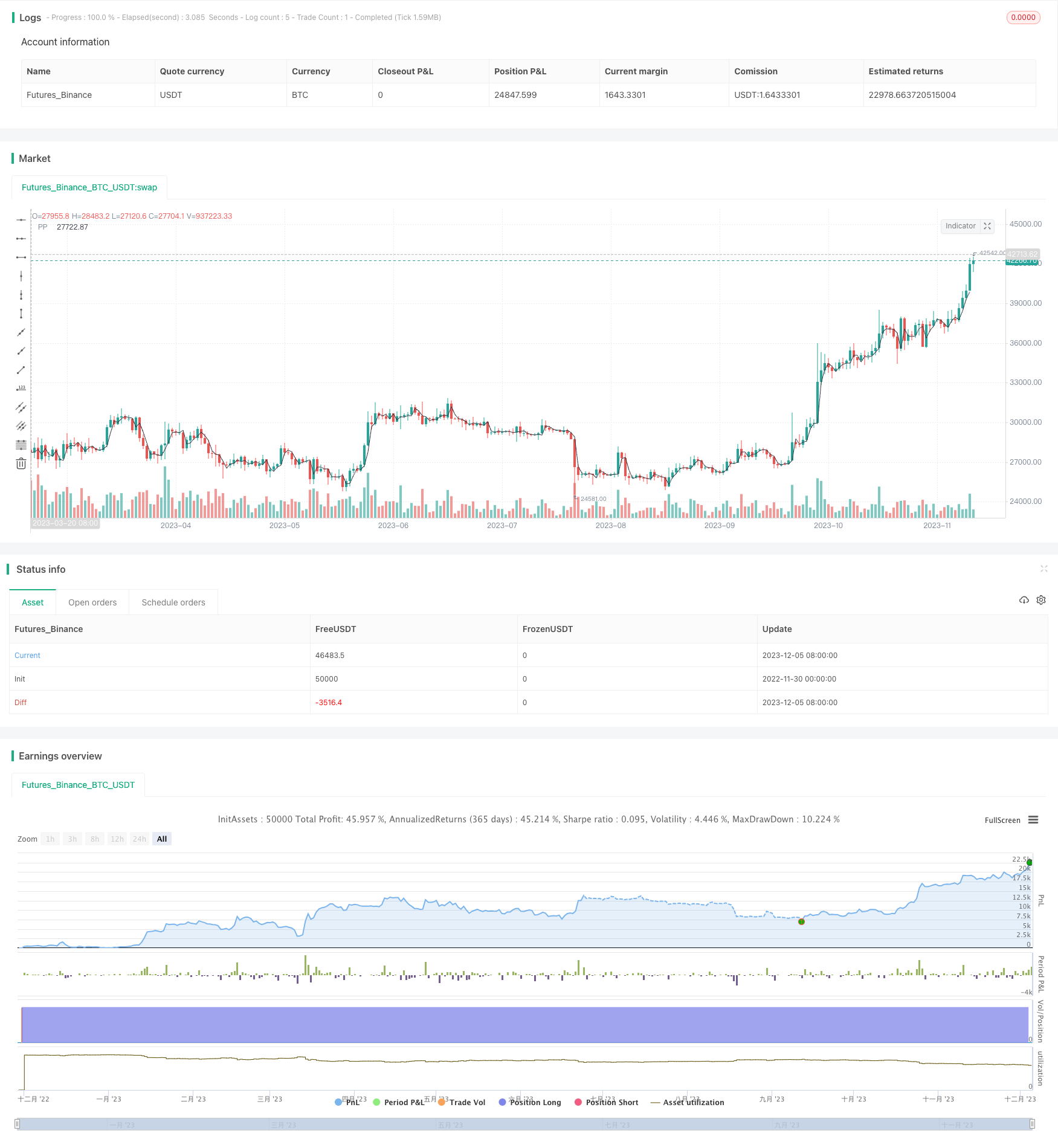

Strategi ini secara keseluruhannya lebih mudah dan mudah untuk mengesahkan keberkesanannya melalui data sejarah. Sebagai strategi perdagangan dalam hari, ia menggunakan titik-titik penting untuk memberikan peluang yang tinggi untuk penembusan, yang boleh mendapat hasil yang baik. Tetapi kerana bergantung pada titik-titik penting, terdapat juga risiko penembusan palsu, yang perlu dioptimumkan lebih lanjut untuk mengurangkan.

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © arameshraju

//Reference credit goes to All

//@version=4

strategy("ARR-Pivote-India-Stategy",shorttitle="ARR-PP-Ind", overlay=true)

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © arameshraju

//User Input

showPrevDayHighLow = input(false, title="Show previous day's High & Low(PDH/PDL)", type=input.bool)

showPivoteLine = input(true, title="Show Pivot Point(PP)", type=input.bool)

showPivoteR1Line = input(false, title="Show Pivot Point Resistance (R1)", type=input.bool)

showPivoteS1Line = input(false, title="Show Pivot Point Support (S1)", type=input.bool)

tradeLong = input(true, title="Trade on Long Entry", type=input.bool)

tradeShort = input(false, title="Trade on Short Entry", type=input.bool)

maxLoss = input(0.5, title="Max Loss on one Trade", type=input.float)

tradeOn=input(title="Trade base Level", type=input.string,

options=["PP", "PDH", "PDL","R1","S1"], defval="PP")

sessSpec = input("0915-1530", title="Session time", type=input.session)

// Defaults

// Colors

cColor = color.black

rColor = color.red

sColor = color.green

// Line style & Transparency

lStyle = plot.style_line

lTransp = 35

// Get High & Low

getSeries(_e, _timeFrame) => security(syminfo.tickerid, _timeFrame, _e, lookahead=barmerge.lookahead_on)

is_newbar(res, sess) =>

t = time(res, sess)

na(t[1]) and not na(t) or t[1] < t

newbar = is_newbar("375", sessSpec)

// Today's Session Start timestamp

y = year(timenow)

m = month(timenow)

d = dayofmonth(timenow)

// Start & End time for Today

start = timestamp(y, m, d, 09, 15)

end = start + 86400000

PrevDayHigh = getSeries(high[1], 'D')

PrevDayLow = getSeries(low[1], 'D')

PrevDayClose = getSeries(close[1], 'D')

PivoteLine=(PrevDayHigh+PrevDayLow+PrevDayClose) /3

PivoteR1=(PivoteLine*2) -PrevDayLow

PivoteS1=(PivoteLine*2) -PrevDayHigh

orbPrevDayOpen = getSeries(open[1], 'D')

orbPrevDayClose = getSeries(close[1], 'D')

// //Preview Day High line

// _pdh = line.new(start, PrevDayHigh, end, PrevDayHigh, xloc.bar_time, color=color.red, style=line.style_solid, width=2)

// line.delete(_pdh[1])

// _pdl = line.new(start, PrevDayLow, end, PrevDayLow, xloc.bar_time, color=color.green, style=line.style_solid, width=2)

// line.delete(_pdl[1])

// _Pp = line.new(start, PrevDayLow, end, PrevDayLow, xloc.bar_time, color=color.green, style=line.style_dashed, width=2)

// line.delete(_Pp[1])

// //Previous Day Low Line

// l_pdh = label.new(start, PrevDayHigh, text="PD", xloc=xloc.bar_time, textcolor=rColor, style=label.style_none)

// label.delete(l_pdh[1])

// l_pdl = label.new(start, PrevDayLow, text="PD", xloc=xloc.bar_time, textcolor=sColor, style=label.style_none)

// label.delete(l_pdl[1])

// //Pivote Line

// l_pp = label.new(start, PivoteLine, text="PP", xloc=xloc.bar_time, textcolor=color.black, style=label.style_none)

// label.delete(l_pp[1])

// l_R1 = label.new(start, PivoteR1, text="R1", xloc=xloc.bar_time, textcolor=color.fuchsia, style=label.style_none)

// label.delete(l_pp[1])

// l_SR = label.new(start, PivoteS1, text="S2", xloc=xloc.bar_time, textcolor=color.navy, style=label.style_none)

// label.delete(l_pp[1])

plot(showPrevDayHighLow?PrevDayHigh:na , title=' PDH', color=rColor)

plot(showPrevDayHighLow?PrevDayLow:na, title=' PDL', color=sColor)

plot(showPivoteLine?PivoteLine:na, title=' PP', color=color.black)

plot(showPivoteR1Line?PivoteR1:na, title=' R1', color=color.fuchsia)

plot(showPivoteS1Line?PivoteS1:na, title=' S1', color=color.navy)

// Today's Session Start timestamp

// Start & End time for Today

//endTime = timestamp(t, m, d, 15, 00)

tradeEventPrice= if string("PDH")==tradeOn

PrevDayHigh

else if string("PDL")==tradeOn

PrevDayLow

else if string("R1")==tradeOn

PivoteR1

else if string("S1")==tradeOn

PivoteS1

else

PivoteLine

//tradeEventPrice=PrevDayHigh

if (open < tradeEventPrice) and ( close >tradeEventPrice ) and ( hour < 13 ) and tradeLong

strategy.entry("buy", strategy.long, 1, when=strategy.position_size <= 0)

if (open > tradeEventPrice) and ( close <tradeEventPrice ) and ( hour < 13 ) and tradeShort

strategy.entry("Sell", strategy.short, 1, when=strategy.position_size <= 0)

mxloss=orbPrevDayClose*maxLoss

strategy.exit("exit", "buy", loss = mxloss)

strategy.exit("exit", "Sell", loss = mxloss)

strategy.close_all(when = hour == 15 , comment = "close all entries")