Strategi Aliran Super Sunshine

Gambaran keseluruhan

Strategi Sunshine Supertrend adalah strategi trend-tracking berdasarkan ATR dan SuperTrend. Ia boleh meramalkan perubahan trend dengan tepat dan sangat sesuai untuk digunakan sebagai penunjuk masa.

Prinsip Strategi

Strategi ini menggunakan indikator SuperTrend untuk menentukan arah trend semasa. Apabila indikator SuperTrend berubah arah, kami berpendapat bahawa kemungkinan pembalikan trend telah berlaku. Di samping itu, strategi ini juga menggunakan arah entiti K-baris untuk membuat penilaian tambahan.

Secara khusus, strategi menghasilkan isyarat perdagangan berdasarkan logik berikut:

- Menggunakan petunjuk SuperTrend untuk menentukan arah trend utama

- Apabila arah indikator SuperTrend berubah, isyarat pembalikan berpotensi dihasilkan

- Jika arah entiti K line pada masa ini adalah sama dengan yang sebelumnya, filterkan isyarat pembalikan

- Jika arah entiti K Line berubah, mengesahkan isyarat pembalikan, menghasilkan isyarat transaksi

Analisis kelebihan

- Indikator SuperTrend membantu anda menentukan titik perubahan trend dengan tepat

- Gabungan dengan penapis arah entiti K untuk meningkatkan kualiti isyarat

- Sesuai sebagai penunjuk masa, membimbing pelabur untuk memilih masa masuk dan keluar yang munasabah

- Boleh digunakan secara meluas dalam mana-mana tempoh masa dan pelbagai jenis, beradaptasi yang kuat

Risiko dan Penyelesaian

- Indeks SuperTrend mudah menghasilkan isyarat tambahan yang memerlukan penapisan tambahan

Penyelesaian: Strategi ini menggunakan arah entiti K untuk membuat penilaian tambahan, menapis isyarat yang tidak berkesan - Tetapan parameter SuperTrend mudah dioptimumkan atau terlalu dioptimumkan

Penyelesaian: Menggunakan parameter lalai untuk mengelakkan pengoptimuman yang berlebihan - Tidak dapat menangani keadaan yang berubah dengan pantas

Penyelesaian: Sesuaikan parameter kitaran ATR dengan lebih pantas

Arah pengoptimuman

- Cuba kombinasi parameter kitaran ATR yang berbeza

- Tambah petunjuk volum atau kadar turun naik untuk membantu penapisan isyarat

- Gabungan dengan sistem penunjuk lain untuk meningkatkan prestasi strategi

- Membangunkan mekanisme henti kerugian untuk mengawal kerugian tunggal

ringkaskan

Strategi Supertrend Sunshine adalah strategi yang cekap untuk menentukan pembalikan trend berdasarkan indikator SuperTrend. Ia menggabungkan arah entiti K-Line untuk membuat penilaian tambahan, yang dapat menyaring isyarat yang tidak berkesan dengan berkesan, meningkatkan kualiti isyarat. Strategi ini mudah dikendalikan, kuat beradaptasi, dan boleh digunakan secara meluas untuk pelbagai varieti dan tempoh masa.

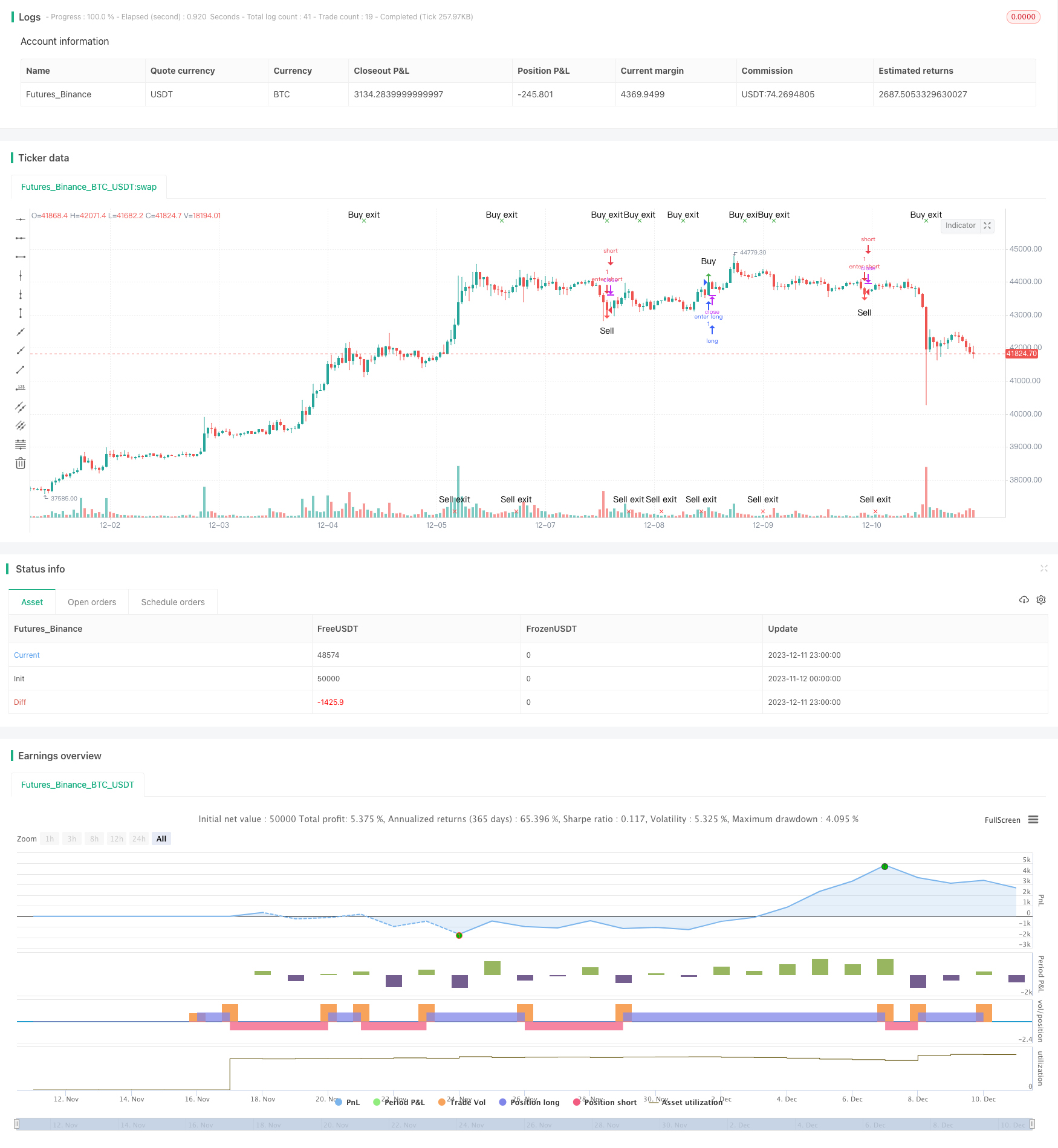

/*backtest

start: 2023-11-12 00:00:00

end: 2023-12-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Sunny Supertrend Strategy", overlay=true, default_qty_type=strategy.percent_of_equity)

atrPeriod = input(10, "ATR Length")

factor = input.float(3.0, "Factor", step = 0.01)

[_, direction] = ta.supertrend(factor, atrPeriod)

shor= close > open and close[1] > open[1] and close[2] > open[2]

lon = open > close and open[1] > close[1] and open[2] > close[2]

tt= ta.change(direction) < 0

ss= ta.change(direction) > 0

long= tt

longexit = lon or ss

short= ss

shortexit = shor or tt

longPosMem = false

longexitPosMem = false

shortPosMem = false

shortexitPosMem = false

longPosMem := long ? true : short ? false : longPosMem[1]

longexitPosMem := longexit ? true : shortexit ? false : longexitPosMem[1]

shortPosMem := short ? true : long ? false : shortPosMem[1]

shortexitPosMem := shortexit ? true : longexit ? false : shortexitPosMem[1]

longy = long and not(longPosMem[1])

longexity = longexit and not(longexitPosMem[1])

shorty = short and not(shortPosMem[1])

shortexity = shortexit and not(shortexitPosMem[1])

//Use this to customize the look of the arrows to suit your needs.

plotshape(longy, location=location.abovebar, color=color.green, style=shape.arrowup, text="Buy")

plotshape(longexity, location=location.top, color=color.green, style=shape.xcross, text="Buy exit")

plotshape(shorty, location=location.belowbar, color=color.red, style=shape.arrowdown, text="Sell")

plotshape(shortexity, location=location.bottom, color=color.red, style=shape.xcross, text="Sell exit")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

// STEP 1:

// Make input options that configure backtest date range

startDate = input.int(title="Start Date", defval=1, minval=1, maxval=31)

startMonth = input.int(title="Start Month",

defval=1, minval=1, maxval=12)

startYear = input.int(title="Start Year",

defval=2021, minval=1800, maxval=2100)

endDate = input.int(title="End Date",

defval=1, minval=1, maxval=31)

endMonth = input.int(title="End Month",

defval=2, minval=1, maxval=12)

endYear = input.int(title="End Year",

defval=2021, minval=1800, maxval=2100)

// STEP 2:

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

// STEP 3:

// Submit entry orders, but only when bar is inside date range

if (inDateRange and longy)

strategy.entry("enter long",strategy.long,when= longy)

strategy.close("long",when=longexity)

if (inDateRange and shorty)

strategy.entry("enter short",strategy.short,when = shorty)

strategy.close("short", when=shortexity)