Strategi dagangan kuantitatif MACD terbalik dwi landasan

Gambaran keseluruhan

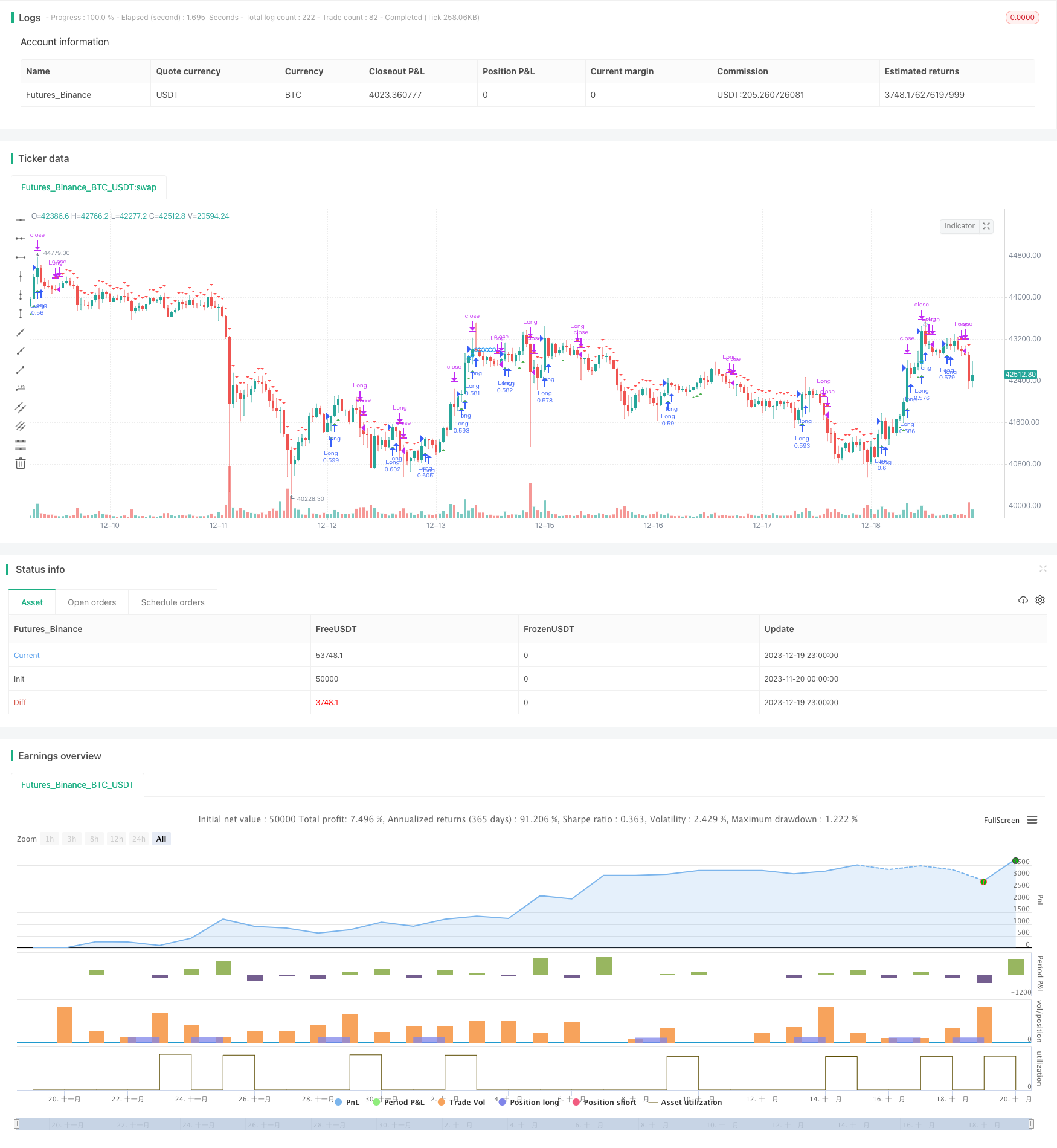

Strategi ini adalah strategi perdagangan kuantitatif MACD reverse dual track. Ia mengambil petunjuk teknikal yang dijelaskan oleh William Blau dalam bukunya, Momentum, Direction and Divergence, dan dielu-elukan. Strategi ini juga mempunyai fungsi pengembalian dan boleh ditambah dengan fungsi tambahan seperti amaran, penapis, dan pengesanan kerugian.

Prinsip Strategi

Indikator teras strategi ini adalah MACD. Ia mengira EMA bergerak cepat ® dan EMA bergerak perlahan (slowMALen) dan kemudian mengira perbezaan mereka xmacd. Ia juga mengira EMA (signalLength) xmacd yang diperoleh oleh xMA_MACD.

Di samping itu, strategi ini juga memperkenalkan penapis trend. Apabila banyak isyarat dikeluarkan, penapis trend bullish akan dikesan jika harga naik; sama, isyarat shorting akan mengesan trend harga turun. Indeks RSI dan MFI juga boleh digunakan untuk penapis konfigurasi isyarat.

Analisis kelebihan

Kelebihan utama strategi ini adalah bahawa ia mempunyai fungsi pengukuran yang kuat. Anda boleh memilih jenis perdagangan yang berbeza, menetapkan jangka masa pengukuran, dan mengoptimumkan strategi untuk data jenis tertentu. Berbanding dengan strategi MACD yang mudah, ia menambah trend, penilaian overbought dan oversold, dan dapat menyaring beberapa isyarat meteorit.

Analisis risiko

Risiko strategi ini berpunca daripada pemikiran perdagangan terbalik. Isyarat terbalik, walaupun dapat memperoleh beberapa peluang, juga bermakna melepaskan beberapa titik jual beli MACD tradisional, yang perlu dinilai dengan berhati-hati. Selain itu, MACD sendiri mudah menimbulkan masalah banyak isyarat palsu.

Untuk mengurangkan risiko, parameter boleh disesuaikan dengan betul, mengoptimumkan panjang purata bergerak; menggabungkan trend dan penapis petunjuk, untuk mengelakkan menghasilkan isyarat di pasaran yang bergolak; Jauhkan jarak stop loss dengan betul, untuk memastikan kawalan kerugian perdagangan individu.

Arah pengoptimuman

Strategi ini boleh dioptimumkan dalam beberapa aspek:

- Menyesuaikan parameter laju lambat, mengoptimumkan panjang purata bergerak, menguji data khusus varieti untuk mencari kombinasi parameter yang optimum

- Menambah atau menyesuaikan penapis trend untuk menilai sama ada terdapat peningkatan dalam kadar pulangan strategi berdasarkan hasil tinjauan balik

- Menguji mekanisme penghentian kerugian yang berbeza, sama ada penghentian kerugian tetap atau penghentian kerugian yang dikesan

- Cuba menggabungkan dengan penunjuk lain seperti KD, Brinband dan sebagainya untuk menetapkan lebih banyak syarat penapisan untuk memastikan kualiti isyarat

ringkaskan

Strategi kuantitatif MACD terbalik dua arah mengambil idea dari penunjuk MACD klasik, dengan asas ini diperluaskan dan diperbaiki. Strategi ini mempunyai kelebihan seperti konfigurasi parameter yang fleksibel, pilihan mekanisme penapisan yang kaya, dan fungsi pengukuran yang kuat. Ini membolehkan pengoptimuman peribadi untuk pelbagai jenis perdagangan, dan merupakan strategi perdagangan kuantitatif yang berpotensi untuk dijelajahi.

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 09/12/2016

// This is one of the techniques described by William Blau in his book

// "Momentum, Direction and Divergence" (1995). If you like to learn more,

// we advise you to read this book. His book focuses on three key aspects

// of trading: momentum, direction and divergence. Blau, who was an electrical

// engineer before becoming a trader, thoroughly examines the relationship

// between price and momentum in step-by-step examples. From this grounding,

// he then looks at the deficiencies in other oscillators and introduces some

// innovative techniques, including a fresh twist on Stochastics. On directional

// issues, he analyzes the intricacies of ADX and offers a unique approach to help

// define trending and non-trending periods.

// Blau`s indicator is like usual MACD, but it plots opposite of meaningof

// stndard MACD indicator.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

//

//

// 2018-09 forked by Khalid Salomão

// - Backtesting

// - Added filters: RSI, MFI, Price trend

// - Trailing Stop Loss

// - Other minor adjustments

//

////////////////////////////////////////////////////////////

strategy(title="Ergotic MACD Backtester [forked from HPotter]", shorttitle="Ergotic MACD Backtester", overlay=true, pyramiding=0, default_qty_type=strategy.cash, default_qty_value=25000, initial_capital=50000, commission_type=strategy.commission.percent, commission_value=0.15, slippage=3)

// === BACKTESTING: INPUT BACKTEST RANGE ===

source = input(close)

strategyType = input(defval="Long Only", options=["Long & Short", "Long Only", "Short Only"])

FromMonth = input(defval = 7, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2018, title = "From Year", minval = 2017)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2030, title = "To Year", minval = 2017)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => true // window of time verification

// === STRATEGY ===

r = input(144, minval=1, title="R (32,55,89,100,144,200)") // default 32

slowMALen = input(6, minval=1) // default 32

signalLength = input(6, minval=1)

reverse = input(false, title="Trade reverse (long/short switch)")

//hline(0, color=blue, linestyle=line)

fastMA = ema(source, r)

slowMA = ema(source, slowMALen)

xmacd = fastMA - slowMA

xMA_MACD = ema(xmacd, signalLength)

pos = 0

pos := iff(xmacd < xMA_MACD, 1,

iff(xmacd > xMA_MACD, -1, nz(pos[1], 0)))

possig = 0

possig := iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

// === FILTER: price trend ====

trending_price_long = input(true, title="Long only if price has increased" )

trending_price_short = input(false, title="Short only if price has decreased" )

trending_price_length = input( 2, minval=1 )

trending_price_with_ema = input( false )

trending_price_ema = input( 3, minval=1 )

price_trend = trending_price_with_ema ? ema(source, trending_price_ema) : source

priceLongTrend() => (trending_price_long ? rising(price_trend, trending_price_length) : true)

priceShortTrend() => (trending_price_short ? falling(price_trend, trending_price_length) : true)

// === FILTER: RSI ===

rsi_length = input( 14, minval=1 )

rsi_overSold = input( 14, minval=0, title="RSI Sell Cutoff (Sell only if >= #)" )

rsi_overBought = input( 82, minval=0, title="RSI Buy Cutoff (Buy only if <= #)" )

vrsi = rsi(source, rsi_length)

rsiOverbought() => vrsi > rsi_overBought

rsiOversold() => vrsi < rsi_overSold

trending_rsi_long = input(false, title="Long only if RSI has increased" )

trending_rsi_length = input( 2 )

rsiLongTrend() => trending_rsi_long ? rising(vrsi, trending_rsi_length) : true

// === FILTER: MFI ===

mfi_length = input(14, minval=1)

mfi_lower = input(14, minval=0, maxval=50)

mfi_upper = input(82, minval=50, maxval=100)

upper_s = sum(volume * (change(source) <= 0 ? 0 : source), mfi_length)

lower_s = sum(volume * (change(source) >= 0 ? 0 : source), mfi_length)

mf = rsi(upper_s, lower_s)

mfiOverbought() => (mf > mfi_upper)

mfiOversold() => (mf < mfi_lower)

trending_mfi_long = input(false, title="Long only if MFI has increased" )

trending_mfi_length = input( 2 )

mfiLongTrend() => trending_mfi_long ? rising(mf, trending_mfi_length) : true

// === SIGNAL CALCULATION ===

long = window() and possig == 1 and rsiLongTrend() and mfiLongTrend() and not rsiOverbought() and not mfiOverbought() and priceLongTrend()

short = window() and possig == -1 and not rsiOversold() and not mfiOversold() and priceShortTrend()

// === trailing stop

tslSource=input(hlc3,title="TSL source")

//suseCurrentRes = input(true, title="Use current chart resolution for stop trigger?")

tslResolution = input(title="Use different timeframe for stop trigger? Uncheck box above.", defval="5")

tslTrigger = input(3.0) / 100

tslStop = input(0.6) / 100

currentPrice = request.security(syminfo.tickerid, tslResolution, tslSource, barmerge.gaps_off, barmerge.lookahead_off)

isLongOpen = false

isLongOpen := nz(isLongOpen[1], false)

entryPrice=0.0

entryPrice:= nz(entryPrice[1], 0.0)

trailPrice=0.0

trailPrice:=nz(trailPrice[1], 0.0)

// update TSL high mark

if (isLongOpen )

if (not trailPrice and currentPrice >= entryPrice * (1 + tslTrigger))

trailPrice := currentPrice

else

if (trailPrice and currentPrice > trailPrice)

trailPrice := currentPrice

if (trailPrice and currentPrice <= trailPrice * (1 - tslStop))

// FIRE TSL SIGNAL

short:=true // <===

long := false

// if short clean up

if (short)

isLongOpen := false

entryPrice := 0.0

trailPrice := 0.0

if (long)

isLongOpen := true

if (not entryPrice)

entryPrice := currentPrice

// === BACKTESTING: ENTRIES ===

if long

if (strategyType == "Short Only")

strategy.close("Short")

else

strategy.entry("Long", strategy.long, comment="Long")

if short

if (strategyType == "Long Only")

strategy.close("Long")

else

strategy.entry("Short", strategy.short, comment="Short")

//barcolor(possig == -1 ? red: possig == 1 ? green : blue )

//plot(xmacd, color=green, title="Ergotic MACD")

//plot(xMA_MACD, color=red, title="SigLin")

plotshape(trailPrice ? trailPrice : na, style=shape.circle, location=location.absolute, color=blue, size=size.tiny)

plotshape(long, style=shape.triangleup, location=location.belowbar, color=green, size=size.tiny)

plotshape(short, style=shape.triangledown, location=location.abovebar, color=red, size=size.tiny)

// === Strategy Alert ===

alertcondition(long, title='BUY - Ergotic MACD Long Entry', message='Go Long!')

alertcondition(short, title='SELL - Ergotic MACD Long Entry', message='Go Short!')

// === BACKTESTING: EXIT strategy ===

sl_inp = input(7, title='Stop Loss %', type=float)/100

tp_inp = input(1.8, title='Take Profit %', type=float)/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

strategy.exit("Stop Loss/Profit", "Long", stop=stop_level, limit=take_level)