Strategi perdagangan pelbagai jangka masa berdasarkan penunjuk turun naik dan penunjuk stokastik

Gambaran keseluruhan

Strategi ini menggabungkan penunjuk turun naik VIX dan penunjuk RSI secara rawak, melalui kombinasi penunjuk tempoh masa yang berbeza, untuk mencapai penembusan yang sangat cekap untuk membeli dan membeli lebih banyak daripada penarikan yang berlebihan.

Prinsip Strategi

Mengira Indeks Volatiliti VIX: Mengambil harga tertinggi dan harga terendah dalam 20 hari terakhir untuk mengira kadar turun naik. Apabila kadar turun naik lebih tinggi daripada laluan atas, ia menunjukkan Market Panic; Apabila ia lebih rendah daripada laluan bawah, ia menunjukkan Market Complacency.

Mengira RSI secara rawak: Mengambil kenaikan dan penurunan dalam 14 hari terakhir, RSI lebih tinggi daripada 70 adalah kawasan membeli, dan lebih rendah daripada 30 adalah kawasan menjual.

Menggabungkan dua jenis penunjuk, melakukan lebih banyak apabila kadar turun naik lebih tinggi daripada tren atas atau peratusan tertinggi; bertenang apabila RSI lebih tinggi daripada 70.

Kelebihan Strategik

- Menggabungkan pelbagai petunjuk untuk menilai masa pasaran secara menyeluruh

- Indikator kitaran masa yang berbeza saling mengesahkan antara satu sama lain untuk meningkatkan ketepatan keputusan.

- Parameter penyesuaian boleh dioptimumkan untuk menyesuaikan dengan pelbagai jenis perdagangan.

Analisis risiko

- Parameter yang tidak betul boleh menyebabkan beberapa isyarat palsu.

- Indeks kedudukan kosong tunggal mudah terlepas daripada perubahan harga.

Cadangan Optimasi

- Menambah lebih banyak penunjuk pengesahan, seperti garis purata, garis putar dan lain-lain untuk menentukan masa kemasukan.

- Tambah lebih banyak penunjuk kedudukan rata, seperti bentuk garis K terbalik.

ringkaskan

Strategi ini menilai masa dan tahap risiko pasaran melalui indikator VIX, bekerjasama dengan indikator RSI untuk menyaring titik perdagangan yang tidak menguntungkan yang terlalu banyak membeli dan menjual, sehingga membeli dan menghentikan kerugian tepat pada masanya. Strategi ini mempunyai ruang untuk pengoptimuman yang lebih besar dan dapat disesuaikan dengan persekitaran pasaran yang lebih luas.

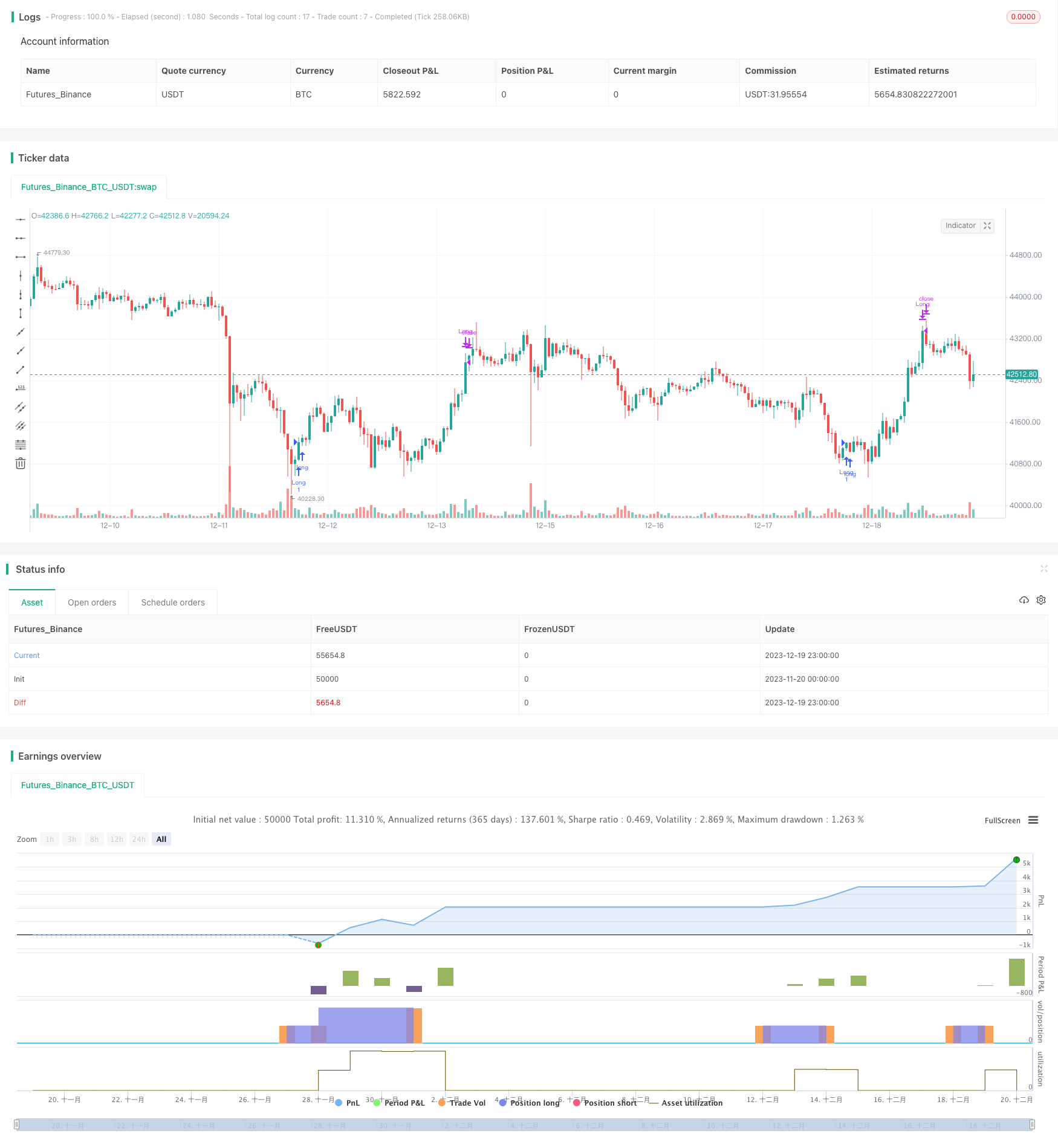

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © timj

strategy('Vix FIX / StochRSI Strategy', overlay=true, pyramiding=9, margin_long=100, margin_short=100)

Stochlength = input.int(14, minval=1, title="lookback length of Stochastic")

StochOverBought = input.int(80, title="Stochastic overbought condition")

StochOverSold = input.int(20, title="Stochastic oversold condition")

smoothK = input(3, title="smoothing of Stochastic %K ")

smoothD = input(3, title="moving average of Stochastic %K")

k = ta.sma(ta.stoch(close, high, low, Stochlength), smoothK)

d = ta.sma(k, smoothD)

///////////// RSI

RSIlength = input.int( 14, minval=1 , title="lookback length of RSI")

RSIOverBought = input.int( 70 , title="RSI overbought condition")

RSIOverSold = input.int( 30 , title="RSI oversold condition")

RSIprice = close

vrsi = ta.rsi(RSIprice, RSIlength)

///////////// Double strategy: RSI strategy + Stochastic strategy

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input.float(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Show Text Plot if WVF WAS True and IS Now False")

sbcc = input(false, title="Show Text Plot if WVF IS True")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input.float(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input.float(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input.int(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title="Show Alert WVF = True?")

sa2 = input(false, title="Show Alert WVF Was True Now False?")

sa3 = input(false, title="Show Alert WVF Filtered?")

sa4 = input(false, title="Show Alert WVF AGGRESSIVE Filter?")

//Williams Vix Fix Formula

wvf = ((ta.highest(close, pd)-low)/(ta.highest(close, pd)))*100

sDev = mult * ta.stdev(wvf, bbl)

midLine = ta.sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (ta.highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

isOverBought = (ta.crossover(k,d) and k > StochOverBought) ? 1 : 0

isOverBoughtv2 = k > StochOverBought ? 1 : 0

filteredAlert = alert3 ? 1 : 0

aggressiveAlert = alert4 ? 1 : 0

if (filteredAlert or aggressiveAlert)

strategy.entry("Long", strategy.long)

if (isOverBought)

strategy.close("Long")