Strategi mengikut aliran berdasarkan QQE dan MA

Gambaran keseluruhan

Strategi ini adalah strategi untuk mengesan trend berdasarkan QQE dan purata bergerak. Ia menilai arah trend dengan menyeberang indikator QQE pantas dan penapis arah purata bergerak, menghasilkan isyarat beli dan jual.

Strategi ini boleh memilih antara tiga penyambungan QQE untuk menilai isyarat: 1) penyambungan RSI yang lancar dengan 0; 2) penyambungan RSI yang lancar dengan garis QQE yang cepat; 3) penyambungan RSI yang lancar keluar dari saluran penurunan RSI. Secara lalai, penyambungan ketiga digunakan untuk membuka kedudukan, dan penyambungan kedua untuk melonggarkan kedudukan.

Sinyal beli dan jual boleh memilih sama ada untuk melakukan penapisan tambahan melalui purata bergerak: harga penutupan lebih tinggi daripada (<) purata bergerak cepat, dan isyarat dihasilkan apabila purata bergerak cepat lebih tinggi daripada (<) purata bergerak perlahan.

Strategi ini sesuai untuk digunakan dalam mod isyarat ke isyarat perdagangan automasi.

Prinsip

Indikator utama strategi ini ialah QQE, yang dikira dengan formula berikut:

Wilders_Period = RSILen * 2 - 1

Rsi = rsi(close,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex - RSIndex[1])

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

Di mana RSILen adalah tempoh panjang RSI, SF adalah faktor penyejukan RSI. QQE pada dasarnya adalah RSI yang diproses dengan lancar. Ia mengira saluran ke atas dan ke bawah melalui ATR pantas, yang dianggap sebagai peluang untuk membeli atau menjual apabila harga melebihi saluran.

Strategi ini menggunakan silang tiga jenis QQE untuk mengenal pasti isyarat dagangan:

- Penunjuk RSI yang rata berpusat pada XZ

QQEzlong = RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort = RSIndex < 50 ? QQEzshort + 1 : 0

- Penunjuk RSI yang rata bercampur dengan penunjuk QQE yang cepat (XQ), menyerupai isyarat ayunan yang lebih awal

QQExlong = FastAtrRsiTL < RSIndex ? QQExlong + 1 : 0

QQExshort = FastAtrRsiTL > RSIndex ? QQExshort + 1 : 0

- RSI melonggarkan keluar dari saluran terhad (XC), menyerupai isyarat berayun yang disahkan

threshhold = 10

QQEclong = RSIndex > (50 + threshhold) ? QQEclong + 1 : 0

QQEcshort = RSIndex < (50 - threshhold) ? QQEcshort + 1 : 0

Anda boleh memilih untuk mengenal pasti isyarat beli / jual dan isyarat kosong dengan satu atau lebih daripada tiga persilangan di atas.

Sinyal beli dan jual boleh dipilih untuk penapisan tambahan melalui purata bergerak:

// 过滤条件

QQEflong = close > ma_medium 和

ma_medium > ma_slow 和

ma_fast > ma_medium

QQEfshort = close < ma_medium 和

ma_medium < ma_slow 和

ma_fast < ma_medium

Ini adalah untuk mengelakkan isyarat yang salah dalam keadaan gegaran.

Strategi ini sesuai untuk perdagangan automatik, untuk membuka kedudukan aman melalui penyambungan QQE yang berbeza:

开仓信号 = XC 或 XQ 或 XZ

平仓信号 = XQ 或 XZ

Kelebihan

Strategi ini mempunyai kelebihan berikut:

Menggunakan indikator QQE untuk menilai trend dan isyarat silang, QQE sendiri mempunyai ciri-ciri yang halus untuk menghilangkan bunyi bising, yang dapat mengurangkan isyarat yang salah.

Penapisan yang digabungkan dengan purata bergerak dapat mengelakkan lebih banyak isyarat palsu dari pasaran yang bergolak dan meningkatkan kualiti isyarat.

Anda boleh memilih pelbagai QQE crossover untuk membuka dan memadamkan simpanan, untuk mencapai perdagangan automatik.

Indeks RSI yang rata tidak akan berubah kerana ketinggalan, jadi sinyal beli dan jual tidak akan berubah.

Ia boleh dioptimumkan pada kitaran masa yang berbeza untuk mencari kombinasi parameter terbaik.

Risiko

Strategi ini juga mempunyai risiko:

Apabila trend berbalik, isyarat yang salah akan dihasilkan, dan anda perlu menetapkan stop loss untuk mengawal risiko.

Tetapan parameter yang tidak betul juga boleh menjejaskan prestasi strategi, memerlukan pengoptimuman ujian berulang untuk mencari parameter terbaik.

Pelbagai varieti dan parameter kitaran masa perlu diuji dan dioptimumkan.

Perdagangan automatik mempunyai risiko penarikan balik dan kerugian berterusan yang memerlukan pengurusan wang.

Penyelesaian yang sesuai adalah seperti berikut:

Tetapkan hentian kerugian, hentikan kerugian apabila kerugian mencapai jumlah tertentu.

Uji dengan teliti kombinasi parameter yang berbeza untuk mencari parameter terbaik.

Sesuaikan parameter mengikut ciri-ciri varieti dan kitaran.

Manajemen kewangan yang baik, membina gudang secara berturut-turut, mengawal kedudukan tunggal.

Arah pengoptimuman

Strategi ini boleh dioptimumkan dalam beberapa arah:

Mengoptimumkan parameter QQE, termasuk panjang RSI, panjang RSI lancar, panjang ATR cepat, dan lain-lain, untuk mencari kombinasi parameter yang optimum.

Mengoptimumkan parameter purata bergerak, kitaran penyesuaian, jenis dan lain-lain untuk membuat perlawanan terbaik dengan penunjuk QQE.

Uji silang QQE yang berbeza untuk mencari kombinasi yang paling stabil.

Parameter yang disempurnakan mengikut pelbagai jenis dan kitaran dagangan. Dagangan dalam hari dapat memendekkan kitaran dan meningkatkan getParameter.

Menambah mekanisme hentian kerugian. Hentikan kerugian apabila kerugian mencapai peratusan tertentu.

Mengurangkan saiz kedudukan dengan sewajarnya, menguji pelbagai cara pengurusan kedudukan.

ringkaskan

Strategi ini mengintegrasikan trend dan isyarat silang penilaian indikator QQE, dan rata-rata bergerak untuk memfilter dan menghasilkan isyarat perdagangan. Kualiti isyarat dapat dioptimumkan dengan menyesuaikan parameter di ruang nyata; dan dikombinasikan dengan pengurusan dana yang ketat untuk mengawal risiko. Strategi ini sesuai untuk digunakan sebagai model isyarat isyarat untuk perdagangan automatik, dan juga dapat membantu keputusan dalam perdagangan discretionary.

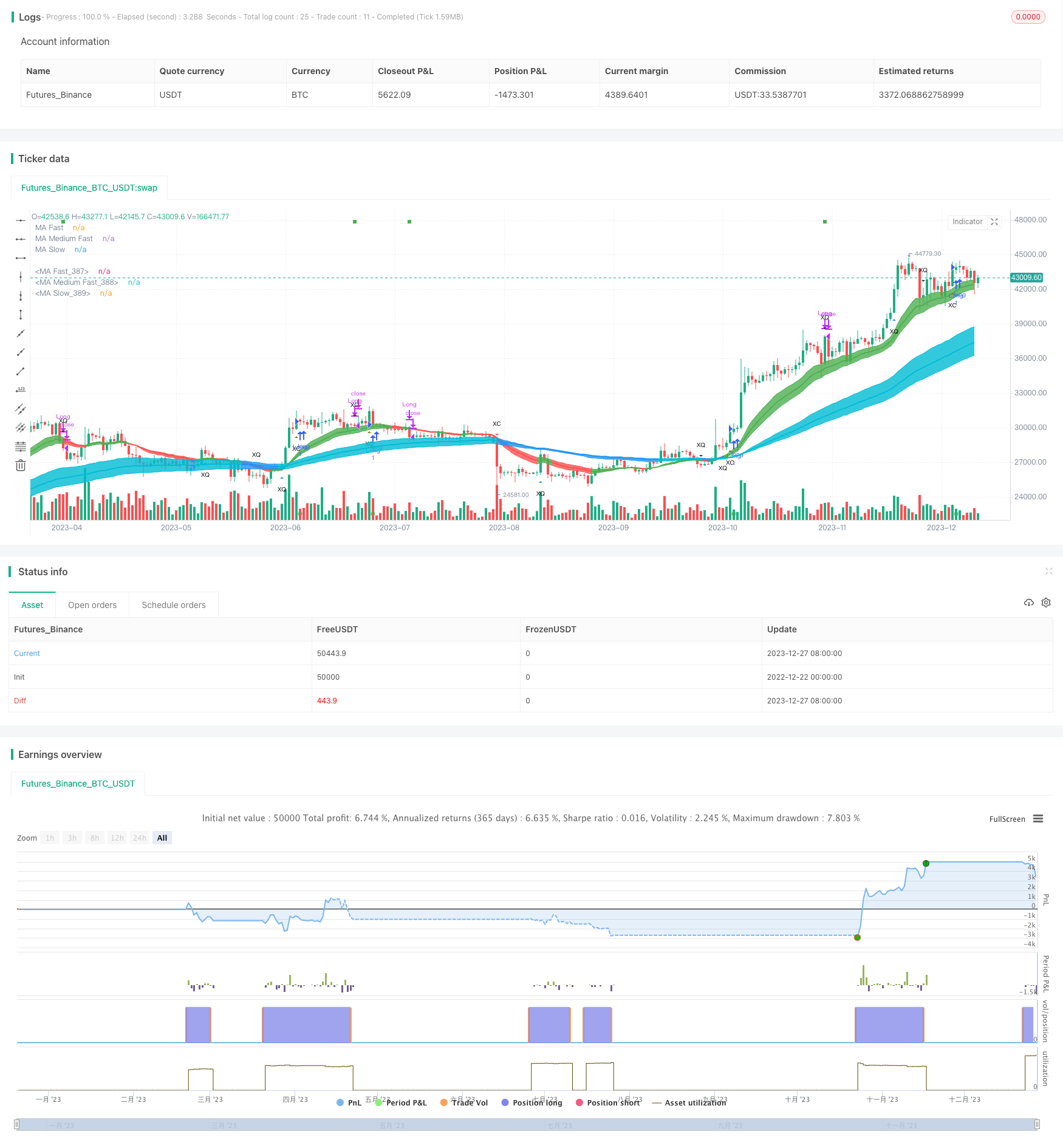

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//

//*** START of COMMENT OUT [Alerts]

strategy(title="[Backtest]QQE Cross v6.0 by JustUncleL", shorttitle="[BT]QQEX v6.0", overlay=true)

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [BackTest]

//study(title="[Alerts]QQE Cross v6.0 by JustUncleL", shorttitle="[AL]QQEX v6.0", overlay=true,max_bars_back=2000)

//*** END of COMMENT OUT [BackTest]

//

// Author: JustUncleL

// Date: 10-July-2016

// Version: v6, Major Release Nov-2018

//

// Description:

// A following indicator is Trend following that uses fast QQE crosses with Moving Averages

// for trend direction filtering. QQE or Qualitative Quantitative Estimation is based

// on the relative strength index (RSI), but uses a smoothing technique as an additional

// transformation. Three crosses can be selected (all selected by default):

// - Smooth RSI signal crossing ZERO (XZ)

// - Smooth RSI signal crossing Fast QQE line (XQ), this is like an early warning swing signal.

// - Smooth RSI signal exiting the RSI Threshhold Channel (XC), this is like a confirmed swing signal.

// An optimumal Smooth RSI threshold level is between 5% and 10% (default=10), it helps reduce

// the false swings.

// These signals can be selected to Open Short/Long and/or Close a trade, default is XC open

// trade and XQ (or opposite open) to Close trade.

//

// The (LONG/SHORT) alerts can be optionally filtered by the Moving Average Ribbons:

// - For LONG alert the Close must be above the fast MA Ribbon and

// fast MA Ribbon must be above the slow MA Ribbon.

// - For SHORT alert the Close must be below the fast MA Ribbon and

// fast MA Ribbon must be below the slow MA Ribbon.

// and/or directional filter:

// - For LONG alert the Close must be above the medium MA and the

// directional of both MA ribbons must be Bullish.

// - For SELL alert the Close must be below the medium MA and the

// directional of both MA ribbons must be Bearish.

//

// This indicator is designed to be used as a Signal to Signal trading BOT

// in automatic or semi-automatic way (start and stop when conditions are suitable).

// - For LONG and SHORT alerts I recommend you use "Once per Bar" alarm option

// - For CLOSE alerts I recommend you use "Once per Bar Close" alarm option

// (* The script has been designed so that long/short signals come at start of candles *)

// (* and close signals come at the end of candles *)

//

// Mofidifications:

// 6.0 - Major Release Version

// - Added second MA ribbon to help filter signals to the trend direction.

// - Modified Alert filtering to include second MA Ribbon

// - Change default settings to reflect Signal to Signal BOT parameters.

// - Removed older redunant alerts.

//

// 5.0 - Development series

//

// 4.1 - Fix bug with painting Buy/Sell arrows when non-repaint shunt mode selected.

// - Added option to alert just the first Buy/Sell alert after a trend swing

// - Added Long and Short Alarms. When combined with the "first Buy/Sell" in trend option,

// It is now possible to use this indicator to interface with AutoView

// or ProfitView. I suggest using the "QQEX XZ Alert" alarm to exit Long or Short

// trade. Use only "Once per bar Close" option for Alarms. This is not a full

// fledged trading BOT though with TP/SL settings.

//

// - Changed QQE defaults to be a bit smoother (8, 5, 3) instead of (6, 3, 2.618).

//

// 4.0 - Added implied GPL copyright notice.

// - Changed defaults to use HullMAs instead of EMAs.

// 3.0 - No repaint on BUY/SELL alert, however, now trades should be taken when the BUY/SELL

// Alert is displayed. The alarm is still generated on the previous candle so you can

// still get a pre-warning, this enables you time to analyse the pending alert.

// - Added option to test success of alerted trades, highlight successful and failed trade bars

// and show simple stats: success rate and number of trades (out of 5000), this will help

// tune the settings for timeframe and currency PAIR.

// 2.0 - Added code to use the medium moving average (EMA20) rising/falling for additional

// trend direction filter.

// - Remove Moving Average cross over signals and other options not used in this indicator.

// - Added code to distinguish between the crosses, now only show Thresh Hold crosses as BUY/SELL

// alerts.

// - Modidied default settings to more well known MA's and slightly different QQE settings, these

// work well at lower timeframes.

// - Added circle plots at bottom of chart to show when actual BUY/SELL alerts occur.

// 1.0 - original

//

// References:

// Some Code borrowed from:

// - "Scalp Jockey - MTF MA Cross Visual Strategizer by JayRogers"

// - "QQE MT4 by glaz"

// Inspiration from:

// - http://www.forexstrategiesresources.com/binary-options-strategies-ii/189-aurora-binary-trading/

// - http://www.forexstrategiesresources.com/metatrader-4-trading-systems-v/652-qqe-smoothed-trading/

// - http://dewinforex.com/forex-indicators/qqe-indicator-not-quite-grail-but-accurately-defines-trend-and-flat.html

// - "Binary option trading by two previous bars" by radixvinni

//

//

// -----------------------------------------------------------------------------

// Copyright 2015 Glaz,JayRogers

//

// Copyright 2016,2017,2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

// Use Alternate Anchor TF for MAs

anchor = input(4,minval=0,maxval=100,title="Relative TimeFrame Multiplier for Second MA Ribbon (0=none, max=100)")

//

// - INPUTS START

// Fast MA - type, source, length

showAvgs = input(true,title="Show Moving Average Lines")

type1 = input(defval="EMA", title="Fast MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len1 = input(defval=16, title="Fast - Length", minval=1)

gamma1 = 0.33

// Medium Fast MA - type, source, length

type2 = input(defval="EMA", title="Medium MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len2 = input(defval=21, title="Medium - Length", minval=1)

gamma2 = 0.55

// Slow MA - type, source, length

type3 = input(defval="EMA", title="Slow MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len3 = input(defval=26, title="Slow Length", minval=1)

gamma3 = 0.77

//

// QQE rsi Length, Smoothing, fast ATR factor, source

RSILen = input(14,title='RSI Length')

SF = input(8,title='RSI Smoothing Factor')

QQEfactor = input(5.0,type=float,title='Fast QQE Factor')

threshhold = input(10, title="RSI Threshhold")

//

sQQEx = input(true,title="Show QQE Signal crosses")

sQQEz = input(false,title="Show QQE Zero crosses")

sQQEc = input(true,title="Show QQE Thresh Hold Channel Exits")

//

tradeSignal = input("XC", title="Select which QQE signal to Buy/Sell", options=["XC","XQ","XZ"])

closeSignal = input("XQ", title="Select which QQE signal to Close Order", options=["XC","XQ","XZ"])

//

xfilter = input(true, title="Filter XQ Buy/Sell Orders by Threshold" )

filter = input(false,title="Use Moving Average Filter")

dfilter = input(true, title="Use Trend Directional Filter" )

ufirst = input(false, title="Only Alert First Buy/Sell in a new Trend")

RSIsrc = input(close,title="Source")

src = RSIsrc // MA source

srcclose= RSIsrc

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [Alerts]

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(6, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(12, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod = time >= testPeriodStart and time <= testPeriodStop ? true : false

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

// - INPUTS END

gold = #FFD700

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier, base on time in mins

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := not isintraday? 1 : mult // Only available Daily or less

// Anchor is a relative multiplier based on current TF.

mult = anchor>0 ? anchor : 1

// - FUNCTIONS END

// - Fast ATR QQE

//

Wilders_Period = RSILen * 2 - 1

//

Rsi = rsi(RSIsrc,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex[1] - RSIndex)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

//

newshortband= RSIndex + DeltaFastAtrRsi

newlongband= RSIndex - DeltaFastAtrRsi

longband = 0.0

shortband=0.0

trend = 0

longband:=RSIndex[1] > longband[1] and RSIndex > longband[1] ? max(longband[1],newlongband) : newlongband

shortband:=RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? min(shortband[1],newshortband) : newshortband

trend:=cross(RSIndex, shortband[1])? 1 : cross(longband[1], RSIndex) ? -1 : nz(trend[1],1)

FastAtrRsiTL = trend==1 ? longband : shortband

// - SERIES VARIABLES

// MA's

ma_fast = variant(type1, srcclose, len1, gamma1)

ma_medium = variant(type2, srcclose, len2, gamma2)

ma_slow = variant(type3, srcclose, len3, gamma3)

// MA's

ma_fast_alt = variant(type1, srcclose, len1*mult, gamma1)

ma_medium_alt = variant(type2, srcclose, len2*mult, gamma2)

ma_slow_alt = variant(type3, srcclose, len3*mult, gamma3)

// Get Direction From Medium Moving Average

direction = rising(ma_medium,3) ? 1 : falling(ma_medium,3) ? -1 : 0

altDirection = rising(ma_medium_alt,3) ? 1 : falling(ma_medium_alt,3) ? -1 : 0

//

// Find all the QQE Crosses

QQExlong = 0, QQExlong := nz(QQExlong[1])

QQExshort = 0, QQExshort := nz(QQExshort[1])

QQExlong := FastAtrRsiTL< RSIndex ? QQExlong+1 : 0

QQExshort := FastAtrRsiTL> RSIndex ? QQExshort+1 : 0

// Zero cross

QQEzlong = 0, QQEzlong := nz(QQEzlong[1])

QQEzshort = 0, QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex>=50 ? QQEzlong+1 : 0

QQEzshort := RSIndex<50 ? QQEzshort+1 : 0

//

// Thresh Hold channel Crosses give the BUY/SELL alerts.

QQEclong = 0, QQEclong := nz(QQEclong[1])

QQEcshort = 0, QQEcshort := nz(QQEcshort[1])

QQEclong := RSIndex>(50+threshhold) ? QQEclong+1 : 0

QQEcshort := RSIndex<(50-threshhold) ? QQEcshort+1 : 0

//

// Check Filtering.

QQEflong = mult == 1 ? (not filter or (srcclose>ma_medium and ma_medium>ma_slow and ma_fast>ma_medium)) and (not dfilter or (direction>0 )) :

(not filter or (ma_medium>ma_medium_alt and srcclose>ma_fast and ma_fast>ma_medium)) and (not dfilter or (direction>0 and altDirection>0 and srcclose>ma_medium))

QQEfshort = mult == 1 ? (not filter or (srcclose<ma_medium and ma_medium<ma_slow and ma_fast<ma_medium)) and (not dfilter or (direction<0 )) :

(not filter or (ma_medium<ma_medium_alt and srcclose<ma_fast and ma_fast<ma_medium)) and (not dfilter or (direction<0 and altDirection<0 and srcclose<ma_medium))

QQExfilter = (not xfilter or RSIndex>(50+threshhold) or RSIndex<(50-threshhold))

//

// Get final BUY / SELL alert determination

buy_ = 0, buy_ := nz(buy_[1])

sell_ = 0, sell_ := nz(sell_[1])

// Make sure Buy/Sell are non-repaint and occur after close signal.

buy_ := tradeSignal=="XC"? (QQEclong[1]==1 and QQEflong[1] ? buy_+1 : 0) :

tradeSignal=="XQ"? (QQExlong[1]==1 and QQEflong[1] and QQExfilter[1]? buy_+1 : 0) :

tradeSignal=="XZ"? (QQEzlong[1]==1 and QQEflong[1] ? buy_+1 : 0) : 0

sell_ := tradeSignal=="XC"? (QQEcshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) :

tradeSignal=="XQ"? (QQExshort[1]==1 and QQEfshort[1] and QQExfilter[1]? sell_+1 : 0) :

tradeSignal=="XZ"? (QQEzshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) : 0

//

// Find the first Buy/Sell in trend swing.

Buy = 0, Buy := nz(Buy[1])

Sell = 0, Sell := nz(Sell[1])

Buy := sell_>0 ? 0 : buy_==1 or Buy>0 ? Buy+1 : Buy

Sell := buy_>0 ? 0 : sell_==1 or Sell>0 ? Sell+1 : Sell

// Select First or all buy/sell alerts.

buy = ufirst ? Buy : buy_

sell = ufirst ? Sell : sell_

closeLong = 0, closeLong := nz(closeLong[1])

closeShort = 0, closeShort := nz(closeShort[1])

closeLong := closeSignal=="XC" ? (QQEcshort==1 ? closeLong+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExshort==1 ? closeLong+1 : 0) : ((QQExshort==1 or QQEzshort or QQEcshort) ? closeLong+1 : 0) :

closeSignal=="XZ" ? (QQEzshort==1 ? closeLong+1 : 0) : 0

closeShort := closeSignal=="XC" ? (QQEclong==1 ? closeShort+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExlong==1 ? closeShort+1 : 0) : ((QQExlong==1 or QQEzlong or QQEclong==1) ? closeShort+1 : 0) :

closeSignal=="XZ" ? (QQEzlong==1 ? closeShort+1 : 0) : 0

tradestate = 0, tradestate := nz(tradestate[1])

tradestate := tradestate==0 ? (buy==1 ? 1 : sell==1 ? 2 : 0) : (tradestate==1 and closeLong==1) or (tradestate==2 and closeShort==1)? 0 : tradestate

isLong = change(tradestate) and tradestate==1

isShort = change(tradestate) and tradestate==2

isCloseLong = change(tradestate) and tradestate==0 and nz(tradestate[1])==1

isCloseShort = change(tradestate) and tradestate==0 and nz(tradestate[1])==2

// - SERIES VARIABLES END

// - PLOTTING

// Ma's

tcolor = direction<0?red:green

ma1=plot(showAvgs?ma_fast:na, title="MA Fast", color=tcolor, linewidth=1, transp=0)

ma2=plot(showAvgs?ma_medium:na, title="MA Medium Fast", color=tcolor, linewidth=2, transp=0)

ma3=plot(showAvgs?ma_slow:na, title="MA Slow", color=tcolor, linewidth=1, transp=0)

fill(ma1,ma3,color=tcolor,transp=90)

// Ma's

altTcolor=altDirection<0?blue:aqua

ma4=plot(showAvgs and mult>1?ma_fast_alt:na, title="MA Fast", color=altTcolor, linewidth=1, transp=0)

ma5=plot(showAvgs and mult>1?ma_medium_alt:na, title="MA Medium Fast", color=altTcolor, linewidth=2, transp=0)

ma6=plot(showAvgs and mult>1?ma_slow_alt:na, title="MA Slow", color=altTcolor, linewidth=1, transp=0)

fill(ma4,ma6,color=altTcolor,transp=90)

// QQE exit from Thresh Hold Channel

plotshape(sQQEc and QQEclong==1 and not isLong, title="QQE X Over Channel", style=shape.triangleup, location=location.belowbar, text="XC", color=olive, transp=20, size=size.tiny)

plotshape(sQQEc and QQEcshort==1 and not isShort, title="QQE X Under Channel", style=shape.triangledown, location=location.abovebar, text="XC", color=red, transp=20, size=size.tiny)

// QQE crosses

plotshape(sQQEx and QQExlong==1 and QQEclong!=1 and not isLong, title="QQE Cross Over", style=shape.triangleup, location=location.belowbar, text="XQ", color=blue, transp=20, size=size.tiny)

plotshape(sQQEx and QQExshort==1 and QQEcshort!=1 and not isShort, title="QQE Cross Under", style=shape.triangledown, location=location.abovebar, text="XQ", color=black, transp=20, size=size.tiny)

// Signal crosses zero line

plotshape(sQQEz and QQEzlong==1 and QQEclong!=1 and not isLong and QQExlong!=1, title="QQE Zero Cross Over", style=shape.triangleup, location=location.belowbar, text="XZ", color=aqua, transp=20, size=size.tiny)

plotshape(sQQEz and QQEzshort==1 and QQEcshort!=1 and not isShort and QQExshort!=1, title="QQE Zero Cross Under", style=shape.triangledown, location=location.abovebar, text="XZ", color=fuchsia, transp=20, size=size.tiny)

//

//*** START of COMMENT OUT [BackTest]

//plotshape(isLong, title="QQEX Long", style=shape.arrowup, location=location.belowbar, text="Open\nLONG", color=lime, textcolor=green, transp=0, size=size.small)

//plotshape(isShort, title="QQEX Short", style=shape.arrowdown, location=location.abovebar, text="Open\nSHORT", color=red, textcolor=maroon, transp=0, size=size.small)

//plotshape(isCloseLong, title="QQEX Close Long", style=shape.arrowdown, location=location.abovebar, text="Close\nLONG", color=gray, textcolor=gray, transp=0, size=size.small)

//plotshape(isCloseShort, title="QQEX Close Short", style=shape.arrowup, location=location.belowbar, text="Close\nSHORT", color=gray, textcolor=gray, transp=0, size=size.small)

//*** END of COMMENT OUT [BackTest]

// - PLOTTING END

// - ALERTING

//*** START of COMMENT OUT [Alerts]

if testPeriod

strategy.entry("Long", 1, when=isLong)

strategy.close("Long", when=isCloseLong )

strategy.entry("Short", 0, when=isShort)

strategy.close("Short", when=isCloseShort )

//end if

//*** END of COMMENT OUT [Alerts]

//*** START of COMMENT OUT [BackTest]

//

// Signal to Signal BOT Alerts.

//

//alertcondition(isLong, title="QQEX Long", message="QQEX LONG") // use "Once per Bar" option

//alertcondition(isShort, title="QQEX Short", message="QQEX SHORT") // use "Once per Bar" option

//alertcondition(isCloseLong, title="QQEX Close Long", message="QQEX CLOSE LONG") // use "Once per Bar Close" option

//alertcondition(isCloseShort, title="QQEX Close Short", message="QQEX CLOSE SHORT") // use "Once per Bar Close" option

//

//*** END of COMMENT OUT [BackTest]

// show only when alert condition is met and bar closed.

plotshape(isLong or isShort,title= "Cross Alert Completed", location=location.bottom, color=isShort?red:green, transp=0, style=shape.circle,size=size.auto,offset=0)

plotshape(isCloseShort[1] or isCloseLong[1],title= "Close Order", location=location.top, color=isCloseShort[1]?red:green, transp=0, style=shape.square,size=size.auto,offset=-1)

// - ALERTING END

//EOF