Menggabungkan trend dan strategi dagangan kuantitatif turun naik

Gambaran keseluruhan

Strategi goyah trend ganda adalah strategi perdagangan kuantitatif yang menggabungkan trend dan goyah. Ia menggunakan gabungan dua indikator untuk mengenal pasti arah dan kekuatan trend, dan mencari masa masuk yang lebih baik apabila trend goyah.

Prinsip Strategi

Strategi ini menggunakan dua penunjuk terbuka: Trend Surfers dan Mawreez’s Trend Oscillator.

Trend Surfers adalah penunjuk berhenti yang mengikuti trend. Ia menilai pergerakan harga dengan mengira harga tertinggi dan terendah dalam tempoh tertentu dan memberi saranan mengenai kedudukan berhenti. Sebagai contoh, apabila harga menembusi harga tertinggi dari 168 garis K terkini, itu adalah isyarat bullish; apabila harga jatuh dari harga terendah dari 168 garis K terkini, itu adalah isyarat bullish.

Mawreez’s Trend Oscillator adalah penunjuk gegaran dua baris. Ia serupa dengan MACD, yang menilai arah dan kekuatan trend melalui perbezaan nilai DI.

Peraturan perdagangan untuk strategi ini ialah:

Permulaan berganda: Trend Surfers melepasi garis tertinggi dan Mawirez’s Trend Oscillator indicator untuk membeli semasa bullish Kemasukan kosong: Trend Surfers menjual apabila jatuh ke bawah garis bawah dan penunjuk Mawirez’s Trend Oscillator turun

Stop loss adalah stop loss mengikut trend ditambah dengan stop loss tetap.

Analisis kelebihan

Strategi ini menggabungkan trend dan indikator goyah, yang dapat menangkap trend dan mencari harga masuk yang lebih baik dalam goyah, dengan kelebihan berikut:

- Penapisan dua arah yang berkesan untuk mengelakkan penembusan palsu

- Gabungan trend dan guncangan, mudah untuk menangkap harga dalam julat guncangan dalam susunan suap rendah atau serangan ringan tinggi

- Menggunakan pelbagai cara untuk menghentikan kerugian, anda dapat mengawal risiko dengan baik

Analisis risiko

Strategi ini mempunyai beberapa risiko:

- Kombinasi Indeks Ganda, Mudah Terlewat

- Penunjuk trend dan penunjuk gegaran mungkin memberi isyarat bertentangan

- Hentian tetap mungkin berhenti terlalu awal

Mengenai risiko ini, langkah-langkah berikut boleh diambil untuk mengelakkannya:

- Melegakan parameter penunjuk dengan sewajarnya, mengurangkan kadar gelombang

- Menambah peraturan penilaian trend, mengelakkan pertentangan penunjuk

- Dinamika penyesuaian kedudukan berhenti

Arah pengoptimuman

Strategi ini masih boleh dioptimumkan lagi:

- Uji kombinasi parameter yang berbeza dan parameter kitaran untuk mencari parameter terbaik

- Peningkatan kadar turun naik, jumlah dagangan dan lain-lain.

- Penunjuk dan parameter pengoptimuman dinamik menggunakan teknologi pembelajaran mesin

ringkaskan

Keuntungan strategi goyah dua arah adalah penggunaan trend yang komprehensif dan indikator goyah, yang dapat mengenal pasti arah trend, dan dapat memanfaatkan peluang goyah, dengan mengoptimumkan parameter dan peraturan, dapat meningkatkan keuntungan strategi lebih lanjut. Strategi ini mempunyai prospek pembangunan yang baik.

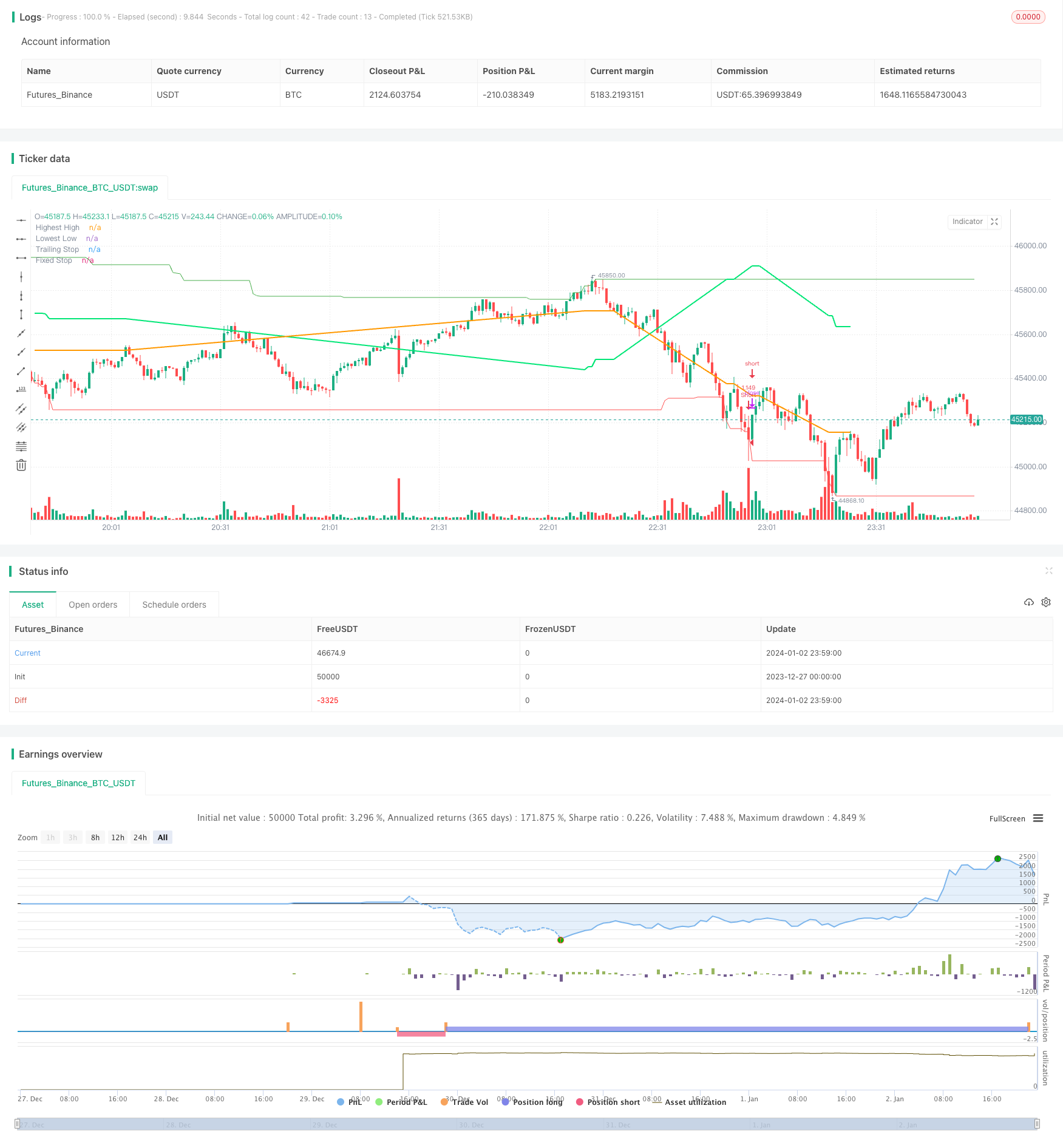

/*backtest

start: 2023-12-27 00:00:00

end: 2024-01-03 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © myn

//@version=5

strategy('Strategy Myth-Busting #8 - TrendSurfers+TrendOsc - [MYN]', max_bars_back=5000, overlay=true, pyramiding=0, initial_capital=20000, currency='USD', default_qty_type=strategy.percent_of_equity, default_qty_value=100.0, commission_value=0.075, use_bar_magnifier = false)

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

//cAe9It4ynO4

// Strategies

// Trend Surfers - Premium Indicator

// Mawreez' Trend Oscillator Indicator

// Trading Setup / Rules

// Long Condition

// Trend Surfers Trailing stop line goes below (Crosses) lowest low

// Bullish Candle (red)

// Mawreeze Trend Oscilator Indicator is green

// Short Condition

// Trend Surfers Trailing stop line goes above (Crosses) highest high

// Bearish Candle (red)

// Mawreeze Trend Oscilator Indicator is red

// Stop loss middle between high and low Risk 1:2

//@version=5

//strategy(shorttitle='Trend Surfers - Breakout', title='Trend Surfers - Premium Breakout', overlay=true, calc_on_every_tick=false, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type='percent', commission_value=0.04)

// Risk for position and pyramid

maxriskval = input.float(2, 'Max % risk', tooltip='Risk % over total equity / Position', group='Risk Management')

pairnumber = input.int(title='How many pairs', defval=1, tooltip='How many pairs are you trading with the strategy?', group='Risk Management')

// Emtry Exit

highPeriod = input.int(title='Highest High Period', defval=168, tooltip='Highest High of X bars - This will trigger a Long Entry when close is above. (Thin Green Line)', group='Entry Condition')

lowPeriod = input.int(title='Lowest Low Period', defval=168, tooltip='Lowest low of X bars - This will trigger a Short Entry when close is under. (Thin Red Line)', group='Entry Condition')

// Stoploss

trailingAtrPeriod = input.int(title='Trailing ATR Pediod', defval=10, tooltip='Average True Range for the Trailing Stop. (Thick Green Line) ', group='Exit Condition')

trailingAtrMultiplier = input.float(title='Trailing ATR Multiplier', defval=8, group='Exit Condition')

fixAtrPeriod = input.int(title='Fix ATR Pediod', defval=10, tooltip='Average True Range for the Fix Stoloss. (Thick Yellow Line)', group='Exit Condition')

fixAtrMultiplier = input.float(title='Fix ATR Multiplier', defval=2, group='Exit Condition')

// Pair info

pair = syminfo.basecurrency + syminfo.currency

// High Low Variable

highestHigh = ta.highest(high, highPeriod)[1]

lowestLow = ta.lowest(low, lowPeriod)[1]

trailingAtr = ta.atr(trailingAtrPeriod) * trailingAtrMultiplier

// Trade Condition

longConditionTrendSurfers = ta.crossover(close, highestHigh)

shortConditionTrendSurfers = ta.crossunder(close, lowestLow)

// Risk Variable

fixAtr = ta.atr(fixAtrPeriod) * fixAtrMultiplier

stopvaluelong = close[1] - fixAtr[1]

stopvalueshort = close[1] + fixAtr[1]

// Position size Long

maxpossize = strategy.equity / close

positionsizelong = maxriskval / 100 * strategy.equity / (close - stopvaluelong)

stopperclong = (close - stopvaluelong) / close * 100

leveragelong = math.max(1, math.ceil(positionsizelong / maxpossize)) * 2

posperclong = positionsizelong * close / strategy.equity * 100 / leveragelong / pairnumber

realposlong = posperclong / 100 * strategy.equity * leveragelong / close

// Position size Short

positionsizeshort = maxriskval / 100 * strategy.equity / (stopvalueshort - close)

stoppercshort = (close - stopvalueshort) / close * 100

leverageshort = math.max(1, math.ceil(positionsizeshort / maxpossize)) * 2

pospercshort = positionsizeshort * close / strategy.equity * 100 / leverageshort / pairnumber

realposshort = pospercshort / 100 * strategy.equity * leverageshort / close

// Alert Message

entry_long_message = '\nGo Long for ' + pair + 'NOW!' + '\nPosition Size % =' + str.tostring(posperclong) + '\nLeverage' + str.tostring(leveragelong) + '\nStoploss Price =' + str.tostring(stopvaluelong) + '\nClose any Short position that are open for ' + pair + '!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

entry_short_message = '\nGo Short for ' + pair + 'NOW!' + '\nPosition Size % =' + str.tostring(pospercshort) + '\nLeverage' + str.tostring(leverageshort) + '\nStoploss Price =' + str.tostring(stopvalueshort) + '\nClose any Long position that are open for ' + pair + '!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

exit_short_message = '\nExit Short for ' + pair + 'NOW!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

exit_long_message = '\nExit Long for ' + pair + 'NOW!' + '\n\nVisit TrendSurfersSignals.com' + '\nFor automated premium signals (FREE)'

// Order

// if longCondition

// strategy.entry('Long', strategy.long, stop=highestHigh, comment='Long', qty=realposlong, alert_message=entry_long_message)

// if shortCondition

// strategy.entry('Short', strategy.short, stop=lowestLow, comment='Short', qty=realposshort, alert_message=entry_short_message)

// Stoploss Trailing

longTrailing = close - trailingAtr

shortTrailing = close + trailingAtr

var longTrailingStop = 0.0

var shortTrailingStop = 999999.9

trailingStopLine = 0.0

trailingStopLine := na

fixedStopLine = 0.0

fixedStopLine := na

var inTrade = 0

if longConditionTrendSurfers or shortConditionTrendSurfers

if 0 == inTrade

if longConditionTrendSurfers

inTrade := 1

inTrade

else

inTrade := -1

inTrade

if 1 == inTrade and (shortConditionTrendSurfers or low <= math.max(fixedStopLine[1], longTrailingStop))

inTrade := 0

inTrade

if -1 == inTrade and (longConditionTrendSurfers or high >= math.min(fixedStopLine[1], shortTrailingStop))

inTrade := 0

inTrade

longTrailingStop := if 1 == inTrade

stopValue = longTrailing

math.max(stopValue, longTrailingStop[1])

else

0

shortTrailingStop := if -1 == inTrade

stopValue = shortTrailing

math.min(stopValue, shortTrailingStop[1])

else

999999

// Fix Stoploss

firstPrice = 0.0

firstFixAtr = 0.0

firstPrice := na

firstFixAtr := na

if 0 != inTrade

firstPrice := ta.valuewhen(inTrade != inTrade[1] and 0 != inTrade, close, 0)

firstFixAtr := ta.valuewhen(inTrade != inTrade[1] and 0 != inTrade, fixAtr, 0)

if 1 == inTrade

fixedStopLine := firstPrice - firstFixAtr

trailingStopLine := longTrailingStop

trailingStopLine

else

fixedStopLine := firstPrice + firstFixAtr

trailingStopLine := shortTrailingStop

trailingStopLine

// if strategy.position_size > 0

// strategy.exit(id='L Stop', stop=math.max(fixedStopLine, longTrailingStop), alert_message=exit_long_message)

// if strategy.position_size < 0

// strategy.exit(id='S Stop', stop=math.min(fixedStopLine, shortTrailingStop), alert_message=exit_short_message)

// Plot

plot(highestHigh, color=color.new(color.green, 0), linewidth=1, title='Highest High')

plot(lowestLow, color=color.new(color.red, 0), linewidth=1, title='Lowest Low')

plot(trailingStopLine, color=color.new(color.lime, 0), linewidth=2, offset=1, title='Trailing Stop')

plot(fixedStopLine, color=color.new(color.orange, 0), linewidth=2, offset=1, title='Fixed Stop')

// Trend Surfers Trailing stop line goes above (Crossesover) highest high

// Bearish Candle (red)

// Mawreeze Trend Oscilator Indicator is red

trendSurfersShortEntry = trailingStopLine > highestHigh and close < close[1]

trendSurfersLongEntry = trailingStopLine < lowestLow and close > close[1]

//@version=5

// Taken from the TradingView house rules regarding scripts:

// "All open source scripts that do not mention a specific open source license

// in their comments are licensed under the Mozilla Public License 2.0.

// Following the Mozilla License, any script reusing open source code originally

// published by someone else must also be open source, unless specific

// permission is granted by the original author."

//indicator('Mawreez\' Trend Oscillator', precision=3)

len = input.int(title='DI Length', minval=1, defval=14)

sens = input.float(title='Sensitivity', defval=25)

// Lag-free smoothing of a given series

smooth(series, len) =>

f28 = ta.ema(series, len)

f30 = ta.ema(f28, len)

vC = f28 * 1.5 - f30 * 0.5

f38 = ta.ema(vC, len)

f40 = ta.ema(f38, len)

v10 = f38 * 1.5 - f40 * 0.5

f48 = ta.ema(v10, len)

f50 = ta.ema(f48, len)

f48 * 1.5 - f50 * 0.5

// Constructing the +DI and -DI

up = ta.change(high)

down = -ta.change(low)

plus_dm = up > 0 and up > down ? up : 0

minus_dm = down > 0 and down > up ? down : 0

range_1 = ta.rma(ta.tr, len)

plus_di = smooth(ta.rma(plus_dm, len) / range_1, 3)

minus_di = smooth(ta.rma(minus_dm, len) / range_1, 3)

// Constructing and plotting the modified ADX

adj_adx = 100 * math.abs(plus_di - minus_di) / (plus_di + minus_di) - sens

adj_adx := (minus_di > plus_di ? -1 : 1) * (adj_adx < 0 ? 0 : adj_adx)

//plot(smooth(adj_adx, 3), color=plus_di > minus_di ? color.green : color.red, style=plot.style_columns)

trendOscShortEntry = plus_di < minus_di

trendOscLongEntry = plus_di > minus_di

//////////////////////////////////////

//* Put your strategy rules below *//

/////////////////////////////////////

longCondition = trendSurfersLongEntry and trendOscLongEntry

shortCondition = trendSurfersShortEntry and trendOscShortEntry

//define as 0 if do not want to use

closeLongCondition = 0

closeShortCondition = 0

// ADX

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

adxEnabled = input.bool(defval = false , title = "Average Directional Index (ADX)", tooltip = "", group ="ADX" )

adxlen = input(14, title="ADX Smoothing", group="ADX")

adxdilen = input(14, title="DI Length", group="ADX")

adxabove = input(25, title="ADX Threshold", group="ADX")

adxdirmov(len) =>

adxup = ta.change(high)

adxdown = -ta.change(low)

adxplusDM = na(adxup) ? na : (adxup > adxdown and adxup > 0 ? adxup : 0)

adxminusDM = na(adxdown) ? na : (adxdown > adxup and adxdown > 0 ? adxdown : 0)

adxtruerange = ta.rma(ta.tr, len)

adxplus = fixnan(100 * ta.rma(adxplusDM, len) / adxtruerange)

adxminus = fixnan(100 * ta.rma(adxminusDM, len) / adxtruerange)

[adxplus, adxminus]

adx(adxdilen, adxlen) =>

[adxplus, adxminus] = adxdirmov(adxdilen)

adxsum = adxplus + adxminus

adx = 100 * ta.rma(math.abs(adxplus - adxminus) / (adxsum == 0 ? 1 : adxsum), adxlen)

adxsig = adxEnabled ? adx(adxdilen, adxlen) : na

isADXEnabledAndAboveThreshold = adxEnabled ? (adxsig > adxabove) : true

//Backtesting Time Period (Input.time not working as expected as of 03/30/2021. Giving odd start/end dates

//░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

useStartPeriodTime = input.bool(true, 'Start', group='Date Range', inline='Start Period')

startPeriodTime = input(timestamp('1 Jan 2019'), '', group='Date Range', inline='Start Period')

useEndPeriodTime = input.bool(true, 'End', group='Date Range', inline='End Period')

endPeriodTime = input(timestamp('31 Dec 2030'), '', group='Date Range', inline='End Period')

start = useStartPeriodTime ? startPeriodTime >= time : false

end = useEndPeriodTime ? endPeriodTime <= time : false

calcPeriod = true

// Trade Direction

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tradeDirection = input.string('Long and Short', title='Trade Direction', options=['Long and Short', 'Long Only', 'Short Only'], group='Trade Direction')

// Percent as Points

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

// Take profit 1

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp1 = input.float(title='Take Profit 1 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 1')

q1 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 1')

// Take profit 2

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp2 = input.float(title='Take Profit 2 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 2')

q2 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 2')

// Take profit 3

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp3 = input.float(title='Take Profit 3 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit', inline='Take Profit 3')

q3 = input.int(title='% Of Position', defval=100, minval=0, group='Take Profit', inline='Take Profit 3')

// Take profit 4

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

tp4 = input.float(title='Take Profit 4 - Target %', defval=100, minval=0.0, step=0.5, group='Take Profit')

/// Stop Loss

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

stoplossPercent = input.float(title='Stop Loss (%)', defval=999, minval=0.01, group='Stop Loss') * 0.01

slLongClose = close < strategy.position_avg_price * (1 - stoplossPercent)

slShortClose = close > strategy.position_avg_price * (1 + stoplossPercent)

/// Leverage

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

leverage = input.float(1, 'Leverage', step=.5, group='Leverage')

contracts = math.min(math.max(.000001, strategy.equity / close * leverage), 1000000000)

/// Trade State Management

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

isInLongPosition = strategy.position_size > 0

isInShortPosition = strategy.position_size < 0

/// ProfitView Alert Syntax String Generation

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

alertSyntaxPrefix = input.string(defval='CRYPTANEX_99FTX_Strategy-Name-Here', title='Alert Syntax Prefix', group='ProfitView Alert Syntax')

alertSyntaxBase = alertSyntaxPrefix + '\n#' + str.tostring(open) + ',' + str.tostring(high) + ',' + str.tostring(low) + ',' + str.tostring(close) + ',' + str.tostring(volume) + ','

/// Trade Execution

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

longConditionCalc = (longCondition and isADXEnabledAndAboveThreshold)

shortConditionCalc = (shortCondition and isADXEnabledAndAboveThreshold)

if calcPeriod

if longConditionCalc and tradeDirection != 'Short Only' and isInLongPosition == false

strategy.entry('Long', strategy.long, qty=contracts)

alert(message=alertSyntaxBase + 'side:long', freq=alert.freq_once_per_bar_close)

if shortConditionCalc and tradeDirection != 'Long Only' and isInShortPosition == false

strategy.entry('Short', strategy.short, qty=contracts)

alert(message=alertSyntaxBase + 'side:short', freq=alert.freq_once_per_bar_close)

//Inspired from Multiple %% profit exits example by adolgo https://www.tradingview.com/script/kHhCik9f-Multiple-profit-exits-example/

strategy.exit('TP1', qty_percent=q1, profit=per(tp1))

strategy.exit('TP2', qty_percent=q2, profit=per(tp2))

strategy.exit('TP3', qty_percent=q3, profit=per(tp3))

strategy.exit('TP4', profit=per(tp4))

strategy.close('Long', qty_percent=100, comment='SL Long', when=slLongClose)

strategy.close('Short', qty_percent=100, comment='SL Short', when=slShortClose)

strategy.close_all(when=closeLongCondition or closeShortCondition, comment='Close Postion')

/// Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Inspired by https://www.tradingview.com/script/uWqKX6A2/ - Thanks VertMT

showDashboard = input.bool(group="Dashboard", title="Show Dashboard", defval=false)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + "\n" + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// Draw dashboard table

if showDashboard

var bgcolor = color.new(color.black,0)

// Keep track of Wins/Losses streaks

newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

varip int winRow = 0

varip int lossRow = 0

varip int maxWinRow = 0

varip int maxLossRow = 0

if newWin

lossRow := 0

winRow := winRow + 1

if winRow > maxWinRow

maxWinRow := winRow

if newLoss

winRow := 0

lossRow := lossRow + 1

if lossRow > maxLossRow

maxLossRow := lossRow

// Prepare stats table

var table dashTable = table.new(position.bottom_right, 1, 15, border_width=1)

if barstate.islastconfirmedhistory

// Update table

dollarReturn = strategy.netprofit

f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

_profit = (strategy.netprofit / strategy.initial_capital) * 100

f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? color.green : color.red, color.white)

_numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? color.green : color.red, color.white)

_winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? color.red : _winRate < 75 ? #999900 : color.green, color.white)

f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? color.green : color.red, color.white)

f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)