Strategi arah aliran kuantitatif yang menggabungkan pelbagai faktor

Gambaran keseluruhan

Strategi ini merangkumi pelbagai faktor seperti jumlah transaksi, ketinggian turun naik, kedudukan penutupan, trend, dan sebagainya untuk mengenal pasti peluang perdagangan.

Prinsip Strategi

Idea utama strategi ini adalah menggabungkan pelbagai faktor seperti penembusan yang luar biasa, kedudukan penutupan, dan kelajuan turun naik untuk mengenal pasti titik jual beli.

Khususnya, strategi akan mengira jumlah transaksi rata-rata dalam tempoh masa yang lalu, apabila jumlah transaksi dalam kitaran semasa berlaku secara luar biasa, ia mungkin menunjukkan perubahan trend. Selain itu, jika harga penutupan berhampiran dengan garis atas atau bawah dari amplitudo turun naik, ia juga bermaksud bahawa trend semasa mungkin berbalik.

Untuk mengesahkan titik jual beli, strategi ini juga akan digabungkan dengan indikator amplitud turun naik untuk menilai. Jika turun naik menembusi nilai rata-rata untuk tempoh masa yang lalu, maka akan terbentuk syarat pertama untuk isyarat jual beli. Kemudian, jika harga penutupan kitaran kenaikan berada di bahagian bawah amplitud turun naik, dan jumlah urus niaga meningkat, maka akan dihasilkan isyarat jual. Sebaliknya, jika harga penutupan kitaran turun naik berada di bahagian atas amplitud turun naik, dan jumlah urus niaga berkurang, maka akan dihasilkan isyarat beli.

Selain itu, strategi ini juga akan digabungkan dengan penunjuk garis rata untuk menentukan trend keseluruhan, dan jika terdapat perubahan trend pada garis tengah dan panjang, ia juga akan berfungsi sebagai syarat untuk menghasilkan isyarat beli dan jual.

Dengan menggabungkan pelbagai indikator yang disebutkan di atas, strategi ini dapat menilai sepenuhnya masa pasaran untuk membeli atau menjual.

Kelebihan Strategik

Kelebihan utama strategi ini adalah mempertimbangkan pelbagai faktor untuk membuat keputusan secara menyeluruh, menjadikan hasilnya lebih dipercayai. Secara khusus, terdapat beberapa kelebihan utama:

- Berfikir tentang penembusan lalu lintas yang luar biasa, tanda-tanda perubahan trend dapat dikesan lebih awal.

- Untuk mengesan trend sebenar melalui ketinggian turun naik dan kedudukan penutupan, jangan tertipu oleh bunyi pasaran jangka pendek.

- Menggabungkan garis purata jangka panjang untuk menilai arah trend keseluruhan, memastikan strategi sesuai dengan trend pasaran besar.

- Keputusan komprehensif pelbagai faktor menjadikan strategi lebih stabil dan boleh dipercayai, mengelakkan kerugian besar.

Risiko Strategik

Strategi ini juga mempunyai risiko yang perlu diperhatikan:

- Penghakiman gabungan pelbagai faktor lebih rumit, dan penyesuaian parameter lebih sukar.

- Tidak dapat sepenuhnya mengelakkan transaksi yang tidak perlu daripada disesatkan oleh serangan palsu.

- Jika anda salah menilai trend utama, anda akan kehilangan kesan keseluruhan.

- Tetapan parameter kadar turun naik perlu disesuaikan dengan keadaan pasaran yang berbeza.

Arah pengoptimuman

Strategi ini mempunyai beberapa penambahbaikan utama:

- Mengoptimumkan parameter secara automatik menggunakan kaedah pembelajaran mesin.

- Menyertai strategi pengurusan risiko Stop Loss.

- Ia juga boleh digunakan untuk mengkaji aliran dana dan lain-lain.

- Reka bentuk menyesuaikan parameter kadar turun naik.

ringkaskan

Strategi ini mengambil kira pelbagai faktor untuk mengenal pasti peluang perdagangan. Kelebihan strategi adalah untuk menilai secara menyeluruh, stabil dan boleh dipercayai. Risiko utama adalah kesalahan dalam menentukan parameter dan menilai trend utama.

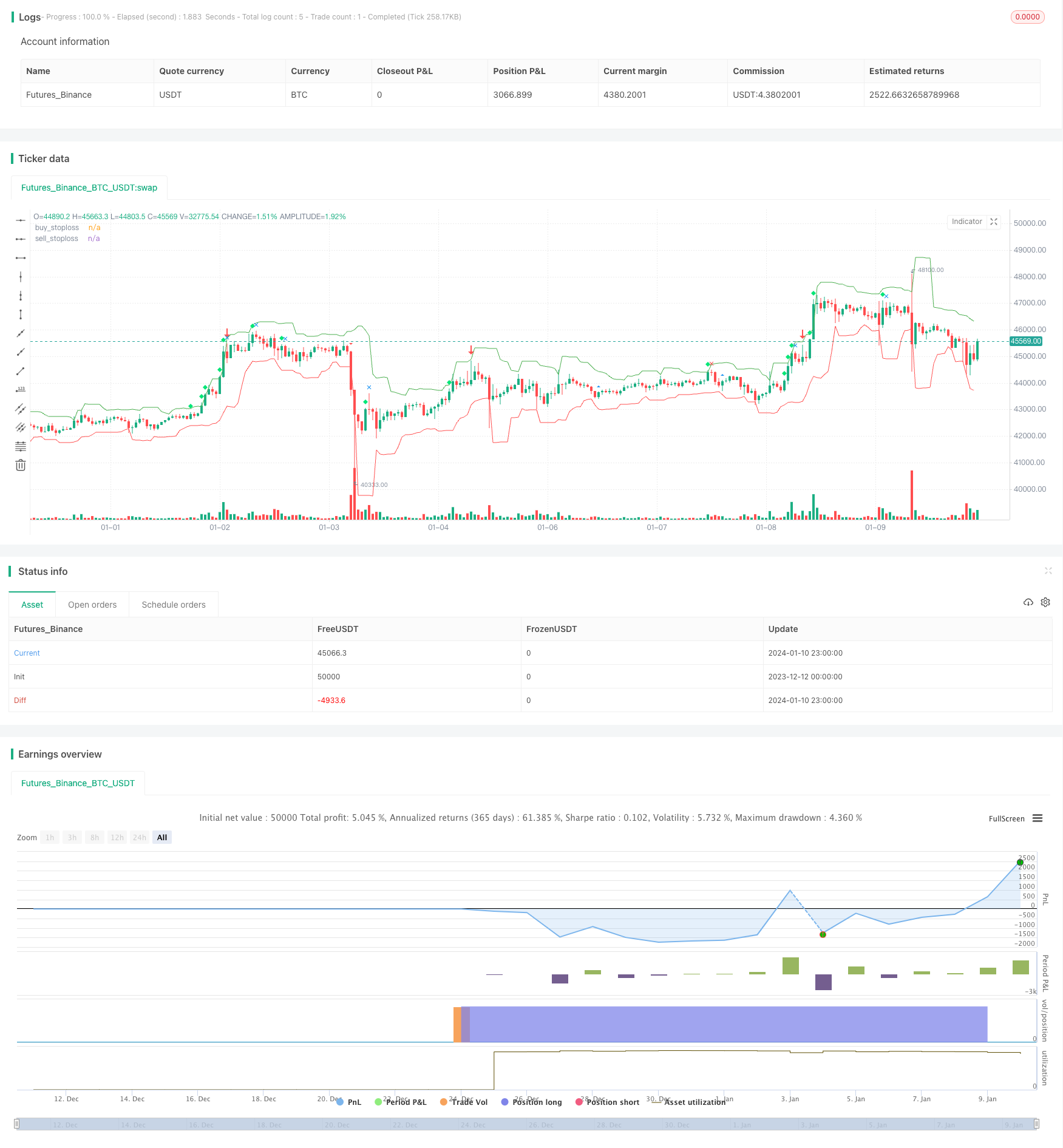

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("volume spread analysis ", overlay=true)

volavg = sma(volume,40)

c= close

l=low

h=high

v=volume

volmean = stdev(volavg,30)

volupband3 = volavg + 3*volmean

volupband2 = volavg + 2*volmean

volupband1 = volavg + 1*volmean

voldnband1 = volavg -1*volmean

voldnband2 = volavg -2*volmean

midprice = (high+low)/2

spread = (high-low)

avgspread = sma(spread,80)

avgspreadbar = spread > avgspread

widerangebar = spread>(1.5*avgspread)

narrowrangebar = spread<(0.7*avgspread)

lowvolume = volume<volume[1] and volume<volume[2]

upbar = close>close[1]

downbar = close<close[1]

highvolume = volume>volume[1] and volume[1]>volume[2]

closefactor = close-low

clsposition = spread/closefactor

closeposition = iff(closefactor==0,avgspread,clsposition)

vb = volume>volavg or volume>volume[1]

upclose = close>=((spread*0.7)+low)// close is above 70% of the bar

downclose = close<=((spread*0.3)+low)// close is below the 30% of the bar

aboveclose = close>((spread*0.5)+low)// close is between 50% and 70% of the bar

belowclose = close<((spread*0.5)+low)// close is between 50% and 30% of the bar

midclose = close>((spread*0.3)+low) and c<((spread*0.7)+l)// close is between 30% and 70% of the bar

verylowclose = closeposition>4//close is below 25% of the bar

veryhighclose = closeposition<1.35// close is above 80% of the bar

closepos = iff(close<=((spread*0.2)+low),1,iff(close<=((spread*0.4)+low),2,iff(close<=((spread*0.6)+low),3,iff(close<=((spread*0.8)+low),4,5))))

// 1 = downclose, 2 = belowclose, 3 = midclose, 4 = aboveclose, 5 = upclose

volpos = iff(volume>volavg*2,1,iff(volume>volavg*1.3,2,iff(volume>volavg,3,iff(volume<volavg and volume>volavg*0.7,4,5))))

//// 1 = very high, 2 = high, 3 = above average, 4 = less than average, 5 = low

freshgndhi = close > highestbars(h,5)

freshgndlo = close < lowestbars(l,5)

//========================trend estimation =========================

//jtrend=sma(close,5)

//trendlongterm = linreg(jtrend,40)

//trendmediumterm = linreg(jtrend,10)

//trendshortterm = linreg(jtrend,3)

//tls=linreg(jtrend,3)

minperiodsrwist = input(title="short term min periods", defval=2, minval=1)

maxperiodsrwist = input(title="short term max periods", defval=8, minval=1)

minperiodsrwilt = input(title="long term min periods", defval=10, minval=1)

maxperiodsrwilt = input(title="long term max periods", defval=40, minval=1)

rwhmins = (high - nz(low[minperiodsrwist])) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwhmaxs = (high - nz(low[maxperiodsrwist])) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwhs = max( rwhmins, rwhmaxs )

rwlmins = (nz(high[minperiodsrwist]) - low) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwlmaxs = (nz(high[maxperiodsrwist]) - low) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwls = max( rwlmins, rwlmaxs )

rwhminl = (high - nz(low[minperiodsrwilt])) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwhmaxl = (high - nz(low[maxperiodsrwilt])) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwhl = max( rwhminl, rwhmaxl )

rwlminl = (nz(high[minperiodsrwilt]) - low) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwlmaxl = (nz(high[maxperiodsrwilt]) - low) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwll = max( rwlminl, rwlmaxl )

ground = rwhs

sky = rwls

j = rwhs-rwls

k = rwhl-rwll

j2 = rwhl

k2 = rwll

ja = cross(j,1)

jb = cross(1,j)

jc = cross(-1,j)

jd = cross(j,-1)

j2a = cross(j2,1)

j2b = cross(1,j2)

k2a = cross(k2,1)

k2b = cross(1,k2)

upmajoron = j > 1 and ja[1]

upmajoroff = j < 1 and jb[1]

upminoron = j2 > 1 and j2a[1]

upminoroff = j2 < 1 and j2b[1]

dnmajoron = j < -1 and jc[1]

dnmajoroff = j > -1 and jd[1]

dnminoron = k2 > 1 and k2a[1]

dnminoroff = k2 < 1 and k2b[1]

upimd = iff(ground > 1, 1,0)

dnimd = iff(sky > 1, 1, 0)

upmajor = iff(j>1,1,iff(j<(-1),-1,0))

upminor = iff(j2>1,1,-1)

dnminor = iff(k2>1,1,-1)

//======================================================================|

Buy_stop = lowest(low[1],5) - atr(20)[1]

plot(Buy_stop, color=red, title="buy_stoploss")

Sell_stop = highest(high[1],5) + atr(20)[1]

plot(Sell_stop, color=green, title="sell_stoploss")

//======================================================================|

//upthrustbar = widerangebar and downclose and upimd==1 and high>high[1] //wrb and uhs and fresh ground

nut = widerangebar and downclose and freshgndhi and highvolume // new signal

bc = widerangebar and aboveclose and volume == highest(volume,60) and upmajor==1 // new signal

upthrustbar = widerangebar and (closepos==1 or closepos==2) and upminor>0 and high>high[1] and (upimd>0or upmajor>0) and volpos <4// after minor up trend

upthrustbartrue = widerangebar and closepos==1 and upmajor>0 and high>high[1] and volpos <4//occurs after a major uptrend

upthrustcond1 = upthrustbar[1] and downbar and not narrowrangebar

upthrustcond2 = upthrustbar[1] and downbar and volpos == 2

upthrustcond3 = upthrustbar and volpos ==1

toprevbar = volume[1]>volavg and upbar[1] and widerangebar[1] and downbar and downclose and widerangebar and upmajor>0 and high==highest(high,10)

pseudoupthrust = upbar[1] and high>high[1] and volume[1]>1.5*volavg and downbar and downclose and not upthrustbar

pseudoutcond = pseudoupthrust[1] and downbar and downclose and not upthrustbar

trendchange = upbar[1] and high==highest(high,5) and downbar and (downclose or midclose) and volume>volavg and upmajor>0 and upimd>0 and not widerangebar and not pseudoupthrust

nodemandbarut = upbar and narrowrangebar and lowvolume and closepos> 3 and ((upminor>0 and upimd>0)or (upminor<0 and upminor>0))//in a up market

nodemandbardt = upbar and narrowrangebar and lowvolume and closepos> 3 and (upminor<=0or upimd<=0)// in a down or sidewayss market

nosupplybar = downbar and narrowrangebar and lowvolume and closepos<3 and ((upminor<1 and upimd<1)or (upminor>0 and upimd<1))

lowvoltest = low==lowest(low,5) and upclose and lowvolume//lowvolume and l<low[1] and upclose

lowvoltest1 = low==lowest(low,5) and volume<volavg and low<low[1] and upclose and upminor>0 and upmajor>0// and widerangebar

lowvoltest2 = lowvoltest[1] and upbar and upclose

sellcond1 = (upthrustcond1 or upthrustcond2 or upthrustcond3)

sellcond2 = sellcond1[1]==0

sellcond = sellcond1 and sellcond2

strengthdown0 = upmajor<0 and volpos<4 and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0// strength after a long down trend

strengthdown = volpos<4 and downbar[1] and upbar and closepos>3 and upimd<=00 and upminor<0// strength after a down trend

strengthdown1 = upmajor<0 and volume>(volavg*1.5) and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0//strength after downtrend . high volume

strengthdown2 = upimd<=0 and volume[1]<volavg and upbar and veryhighclose and volpos<4

buycond1 = strengthdown or strengthdown1

buycond = upbar and buycond1[1]

stopvolume = low==lowest(low,5) and (upclose or midclose) and v>1.5*volavg and upmajor<0

revupthrust = upmajor<0 and upbar and upclose and volume>volume[1] and volume>volavg and widerangebar and downbar[1] and downclose[1] and upminor<0

effortup = high>high[1] and low>low[1] and close>close[1] and close>=((high-low)*0.7+low) and spread>avgspread and volpos<4//and open<=((high-low)*0.3+low)

effortupfail = effortup[1] and (upthrustbar or upthrustcond1 or upthrustcond2 or upthrustcond3 or (downbar and avgspreadbar))

effortdown = high<high[1] and low<low[1] and close<close[1] and close<=((high-low)*0.25+low) and widerangebar and volume>volume[1]//o>=((high-low)*0.75+

effortdownfail = effortdown[1] and ((upbar and avgspreadbar)or revupthrust or buycond1)

upflag = (sellcond or buycond or effortup or effortupfail or stopvolume or effortdown or effortdownfail or revupthrust or nodemandbardt or nodemandbarut or nosupplybar or lowvoltest or lowvoltest1 or lowvoltest2 or bc)

bullbar = (volume>volavg or volume>volume[1]) and closeposition <2 and upbar and not upflag

bearbar = vb and downclose and downbar and spread>avgspread and not upflag

buy = (upbar and revupthrust[1])or lowvoltest2

burely = strengthdown1 and stopvolume[1]or (upbar and revupthrust[1])or lowvoltest2

//buy = effortup and lowvoltest2[1]

//sell = upthrustbartrue

sell = effortup[1] and effortupfail and upthrustcond3 and upthrustbartrue and toprevbar

strategy.entry("simpleBuy", strategy.long, when= (upbar and revupthrust[1])or lowvoltest2 )

strategy.close("simpleBuy",when=upthrustbartrue )

//strategy.entry("simpleSell", strategy.short,when= upthrustbartrue )

//strategy.close("simpleSell",when= (upbar and revupthrust[1])or lowvoltest2)

//|============================================================================================|

//data = close >= open

//plotshape(true, style=shape.flag, color=data ? green : red)

plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.arrowdown ,size=size.huge,color=red )

//plotshape(toprevbar ,title="toprevbar" ,style=shape.flag ,size=size.small,color=blue )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.circle ,size=size.small,color=blue )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangleup ,size=size.small,color=red )

plotshape(trendchange ,title="trendchange" ,style=shape.xcross ,size=size.small,color=red )

//plotshape((nodemandbardt) ,title="(nodemandbardt" ,style=shape.square ,size=size.small,color=orange )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.cross ,size=size.small,color=blue)

plotshape(revupthrust ,title="revupthrust" ,style=shape.arrowup ,size=size.huge,color=green )

//plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.cross ,size=size.small,color=red )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangledown ,size=size.small,color=white )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.arrowup ,size=size.small,color=blue )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labelup ,size=size.small,color=orange )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labeldown ,size=size.small,color=yellow )

//plotshape(nodemandbardt ,title="nodemandbardt" ,style=shape.diamond ,size=size.small,color=yellow )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.xcross ,size=size.small,color=blue )

plotshape(lowvoltest ,title="lowvoltest" ,style=shape.triangleup ,size=size.small,color=blue )

//plotshape(lowvoltest2 ,title="lowvoltest2" ,style=shape.triangledown ,size=size.small,color=yellow )

//plotshape(strengthdown ,title="strengthdown" ,style=shape.flag ,size=size.small,color=green)

//plotshape(strengthdown ,title="strengthdown" ,style=shape.circle ,size=size.small,color=lime )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowup ,size=size.small,color=silver )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowdown ,size=size.small,color=red )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labelup ,size=size.small,color=green )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labeldown ,size=size.small,color=yellow )

plotshape(effortup ,title="effortup" ,style=shape.diamond ,size=size.small,color=lime )

plotshape(effortupfail ,title="effortupfail" ,style=shape.xcross ,size=size.small,color=blue )

//plotshape(effortupfail ,title="effortupfail" ,style=shape.cross ,size=size.small,color=white )

plotshape(effortdown ,title="effortdown" ,style=shape.triangledown ,size=size.small,color=red )

plotshape(effortdownfail ,title="effortdownfail" ,style=shape.xcross ,size=size.small,color=green )

//plotshape(effortdownfail ,title="effortdownfail" ,style=shape.flag ,size=size.small,color=white )

//plotshape(buycond ,title="buycond" ,style=shape.circle ,size=size.small,color=green )

//plotshape(sellcond ,title="sellcond" ,style=shape.arrowup ,size=size.small,color=orange )

//plotshape((nut) ,title="(nut)" ,style=shape.arrowdown ,size=size.small,color=lime )

//plotshape((bc ) ,title="(bc" ,style=shape.labelup ,size=size.small,color=red )

//plotshape(buy ,title="buy" ,style=shape.labeldown ,size=size.small,color=white )