Strategi gabungan purata bergerak pembalikan momentum

Gambaran keseluruhan

Strategi ini menggabungkan strategi 123 berbalik dan strategi CMO rata-rata, membentuk gabungan isyarat jual beli. Strategi 123 berbalik membentuk titik tinggi atau rendah baru melalui harga saham yang ditutup selama dua hari berturut-turut, menggabungkan indikator rawak untuk menentukan kekuatan jual beli pasaran, menghasilkan isyarat perdagangan. Strategi CMO rata-rata menggunakan indikator CMO untuk menentukan pergerakan harga, menghasilkan perdagangan. Isyarat gabungan kedua-dua isyarat strategi, membentuk isyarat gabungan yang lebih dipercayai.

Prinsip Strategi

Strategi pembalikan 123 menggunakan prinsip berikut untuk menghasilkan isyarat perdagangan:

- Apabila harga penutupan meningkat selama dua hari berturut-turut, dan pada hari ke-9 indikator rawak berada di bawah 50.

- Apabila harga penutupan turun dua hari berturut-turut dan pada hari ke-9 indikator rawak lebih tinggi daripada 50, buat shorting

Strategi ini menghasilkan isyarat dagangan dengan menilai sama ada harga akan membentuk puncak atau titik rendah baru dalam jangka masa pendek, digabungkan dengan indikator polygonal dengan penunjuk rawak.

Strategi CMO Garis Persamaan menggunakan prinsip berikut untuk menghasilkan isyarat dagangan:

- Hitung nilai CMO pada hari ke-5, ke-10 dan ke-20

- Cari nilai purata

- Apabila purata CMO melebihi 70 tahun, buat lebih

- Apabila purata CMO adalah di bawah 70, kosong

Strategi ini menghasilkan isyarat dagangan dengan mengkaji jumlah nilai CMO untuk tempoh yang berbeza.

Strategi gabungan menjalankan operasi AND terhadap isyarat kedua-dua strategi, iaitu apabila isyarat kedua-dua strategi melakukan lebih banyak atau kosong pada masa yang sama, strategi gabungan menghasilkan isyarat perdagangan sebenar.

Kelebihan Strategik

Strategi ini mempunyai kelebihan berikut:

- Isyarat gabungan lebih dipercayai dan mengurangkan isyarat palsu

- 123 Strategi pembalikan sesuai untuk menangkap trend selepas penyesuaian jangka pendek

- Strategi CMO untuk menilai pergerakan harga peringkat besar

- Kebolehan menyesuaikan diri dengan keadaan pasaran yang berbeza

Analisis risiko

Strategi ini juga mempunyai risiko:

- 123 Strategi pembalikan bergantung kepada bentuk harga yang lebih tinggi dan mungkin tidak berkesan

- Indeks CMO sensitif terhadap kejutan pasaran dan boleh memberi isyarat yang salah

- Sinyal strategi gabungan mungkin terlalu konservatif, kehilangan peluang perdagangan

- Parameter yang perlu disesuaikan dengan baik untuk menyesuaikan diri dengan keadaan kitaran dan pasaran yang berbeza

Kaedah pencegahannya ialah:

- Peraturan penilaian bentuk untuk mengoptimumkan strategi pembalikan

- Menambah metrik tambahan dalam strategi CMO

- Penilaian kesan strategi dalam tempoh yang baru-baru ini, parameter penyesuaian dinamik

Arah pengoptimuman

Strategi ini boleh dioptimumkan dengan:

- Mengoptimumkan berat gabungan secara automatik menggunakan algoritma pembelajaran mesin

- Tambah modul penyesuaian parameter untuk mengoptimumkan parameter dasar secara dinamik

- Tambah modul stop loss untuk mengawal risiko

- Kajian kebolehan strategi dan penambahbaikan algoritma pengenalan bentuk

- Faktor-faktor seperti pilihan industri, asas-asas

ringkaskan

Strategi ini membentuk strategi perdagangan gabungan yang berkesan melalui 123 reverse dan CMO linear yang saling melengkapi. Dengan risiko yang terkawal, keuntungan tambahan yang stabil dapat dihasilkan. Dengan pengoptimuman algoritma dan model yang berterusan, kami menjangkakan keuntungan dan kestabilan strategi ini akan meningkat.

/*backtest

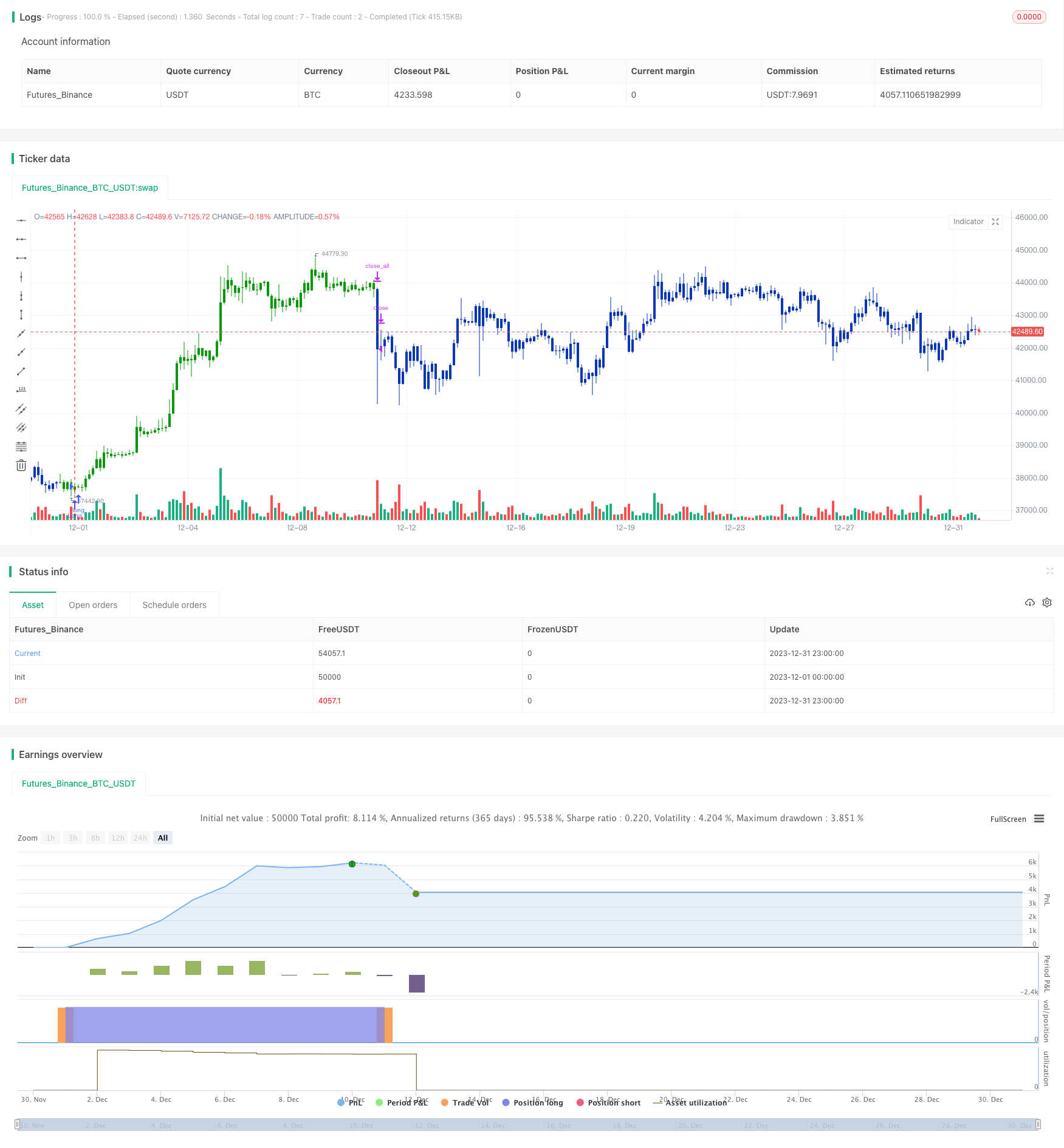

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 19/09/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator plots average of three different length CMO's. This indicator

// was developed by Tushar Chande. A scientist, an inventor, and a respected

// trading system developer, Mr. Chande developed the CMO to capture what he

// calls "pure momentum". For more definitive information on the CMO and other

// indicators we recommend the book The New Technical Trader by Tushar Chande

// and Stanley Kroll.

// The CMO is closely related to, yet unique from, other momentum oriented

// indicators such as Relative Strength Index, Stochastic, Rate-of-Change, etc.

// It is most closely related to Welles Wilder?s RSI, yet it differs in several ways:

// - It uses data for both up days and down days in the numerator, thereby directly

// measuring momentum;

// - The calculations are applied on unsmoothed data. Therefore, short-term extreme

// movements in price are not hidden. Once calculated, smoothing can be applied to

// the CMO, if desired;

// - The scale is bounded between +100 and -100, thereby allowing you to clearly see

// changes in net momentum using the 0 level. The bounded scale also allows you to

// conveniently compare values across different securities.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

CMOav(Length1,Length2,Length3, TopBand, LowBand) =>

pos = 0

xMom = close - close[1]

xMomabs = abs(close - close[1])

nSum1 = sum(xMom, Length1)

nSumAbs1 = sum(xMomabs, Length1)

nSum2 = sum(xMom, Length2)

nSumAbs2 = sum(xMomabs, Length2)

nSum3 = sum(xMom, Length3)

nSumAbs3 = sum(xMomabs, Length3)

nRes = 100 * (nSum1 / nSumAbs1 + nSum2 / nSumAbs2 + nSum3 / nSumAbs3 ) / 3

pos := iff(nRes > TopBand, 1,

iff(nRes < LowBand, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & CMOav", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Length1 = input(5, minval=1)

Length2 = input(10, minval=1)

Length3 = input(20, minval=1)

TopBand = input(70, minval=1)

LowBand = input(-70, maxval=-1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posCMOav = CMOav(Length1,Length2,Length3, TopBand, LowBand)

pos = iff(posReversal123 == 1 and posCMOav == 1 , 1,

iff(posReversal123 == -1 and posCMOav == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )