Strategi Mengikuti Trend Pepejal

Gambaran keseluruhan

Idea utama strategi ini adalah menggabungkan 123 bentuk terbalik dan indeks aliran wang pintar (SMI) untuk mencapai perdagangan yang mengikuti trend yang stabil. Strategi ini akan menubuhkan kedudukan multihead atau kosong yang sesuai apabila kedua-dua isyarat mengeluarkan isyarat membeli atau menjual pada masa yang sama.

Prinsip Strategi

Strategi ini terdiri daripada dua bahagian:

123 Strategi pembalikan: Strategi ini berdasarkan harga penutupan saham dan Indeks Stoch ke-9 untuk mencapai perdagangan pembalikan. Khususnya, apabila hubungan harga penutupan dua hari berturut-turut berlaku pembalikan ((iaitu harga penutupan hari sebelumnya lebih tinggi daripada dua hari sebelumnya, harga penutupan hari berikutnya lebih rendah daripada hari sebelumnya), dan garis cepat Stoch lebih tinggi daripada garis perlahan, buat kosong; apabila hubungan harga penutupan dua hari berturut-turut berlaku pembalikan ((iaitu harga penutupan hari sebelumnya lebih rendah daripada dua hari sebelumnya, harga penutupan hari berikutnya lebih tinggi daripada hari sebelumnya), dan garis cepat Stoch lebih rendah daripada garis perlahan, buat lebih banyak.

Strategi SMI: Strategi ini berdasarkan indeks aliran dana pintar untuk trend pelacakan. Indeks SMI dapat mencerminkan permainan dana institusi dan dana runcit, kenaikan SMI menandakan dana institusi sedang disedut, sebaliknya menandakan dana institusi sedang dijual.

Strategi ini akan mengambil kedudukan multihead apabila 123 reversal dan indeks SMI menghantar isyarat beli pada masa yang sama; strategi ini akan mengambil kedudukan kosong apabila kedua-duanya menghantar isyarat jual pada masa yang sama.

Kelebihan Strategik

Strategi ini menggabungkan bentuk pembalikan dan indikator pengesanan trend, yang dapat mengenal pasti titik pembalikan pasaran dengan berkesan dan mengikuti trend, untuk mencapai keuntungan yang stabil. Kelebihan spesifiknya adalah sebagai berikut:

123 bentuk pembalikan mempunyai kadar kemenangan dan keuntungan yang tinggi, yang dapat mengesan peluang pembalikan jangka pendek dengan berkesan.

Indeks SMI dapat mencerminkan aliran dana institusi, dan mengesan dana institusi yang dapat memperoleh keuntungan yang lebih stabil.

Gabungan dengan penggunaan reversals dan trend-tracking indicators, ia dapat meningkatkan kualiti isyarat, mengurangkan perdagangan yang tidak perlu, dan mengawal risiko dengan berkesan.

Risiko Strategik

Strategi ini juga mempunyai beberapa risiko, yang tertumpu kepada beberapa aspek berikut:

123 bentuk pembalikan terdapat risiko isyarat palsu tertentu, tidak dapat sepenuhnya mengelakkan perdagangan yang rugi. Anda boleh mengoptimumkan parameter dengan sewajarnya, meningkatkan kualiti isyarat.

Penunjuk SMI mempunyai ketinggalan tertentu dan tidak dapat mencerminkan aliran dana secara sebenar. Ia boleh digabungkan dengan petunjuk lain untuk mengesahkan dan meningkatkan ketepatan.

Isyarat ganda membawa masalah terlalu konservatif, mungkin terlepas trend unilateral yang lebih kuat. Ia boleh melonggarkan keadaan isyarat dengan sewajarnya, menurunkan standard penapisan.

Arah pengoptimuman

Strategi ini boleh dioptimumkan dengan cara berikut:

Mengoptimumkan parameter, mencari kombinasi parameter yang optimum, meningkatkan keuntungan strategi.

Menambah mekanisme penangguhan kerugian, yang dapat mengawal kerugian tunggal dengan berkesan.

Gabungan dengan penunjuk atau bentuk lain, lebih mengesahkan kualiti isyarat dan meningkatkan ketepatan isyarat.

Optimumkan parameter untuk pelbagai jenis dan meningkatkan kebolehpasaran strategi.

ringkaskan

Strategi ini mempunyai pemikiran keseluruhan yang jelas dan berkesan dalam menggabungkan bentuk pembalikan dan indikator pengesanan trend, yang dapat menstabilkan untuk mengenal pasti peluang pembalikan jangka pendek dan mengesan trend jangka panjang. Dengan pengoptimuman parameter dan penambahbaikan dalam reka bentuk mekanisme, anda dapat meningkatkan lagi keuntungan strategi dan keupayaan kawalan risiko.

Overview

The main idea of this strategy is to combine the 123 reversal pattern and the Smart Money Index (SMI) indicator to achieve stable trend tracking trading. The strategy will only establish corresponding long or short positions when both signals issue buy or sell signals at the same time.

Strategy Principle

The strategy consists of two parts:

123 reversal strategy: This strategy implements reversal trading based on the closing price of the stock and the 9-day Stoch indicator. Specifically, go short when the closing price relationship reverses for two consecutive days (i.e. the previous closing price is higher than the one before the previous day, and the next closing price is lower than the previous day), and Stoch fast line is above slow line; go long when the closing price relationship reverses for two consecutive days (i.e. the previous closing price is lower than the one before the previous day, and the next closing price is higher than the previous day), and Stoch fast line is below slow line.

SMI strategy: This strategy implements trend tracking based on the Smart Money Index. The SMI indicator can reflect the game between institutional funds and retail funds. The rise of SMI indicates that institutional funds are absorbing funds, while the fall indicates that institutional funds are selling out. Go long when SMI rises and go short when SMI falls.

The strategy will only take a long position when both the 123 reversal pattern and the SMI indicator issue a buy signal at the same time. It will only take a short position when both issue a sell signal at the same time.

Strategy Advantages

The strategy combines reversal patterns and trend tracking indicators to effectively identify market reversal points and track trends for steady profits. The specific advantages are as follows:

The 123 reversal pattern has a relatively high win rate and profit rate, which can effectively identify short-term reversal opportunities.

The SMI indicator can reflect the direction of institutional funds. Tracking institutional funds can obtain more steady profits.

The combined use of reversal patterns and trend tracking indicators can improve the quality of signals, reduce unnecessary trading, and effectively control risks.

Strategy Risks

The strategy also has some risks, mainly concentrated in the following areas:

The 123 reversal pattern has a certain risk of false signals and cannot completely avoid losing trades. Parameters can be optimized appropriately to improve signal quality.

The SMI indicator has a certain lag and cannot completely reflect the direction of funds in real time. Other indicators can be combined for verification to improve accuracy.

Double signals can lead to over-conservative problems, possibly missing stronger one-sided trending opportunities. Signal conditions can be appropriately relaxed to reduce filtering criteria.

Optimization Directions

The strategy can also be further optimized in the following aspects:

Optimize parameters to find the optimal parameter combination and improve the profitability of the strategy.

Add stop loss mechanisms to effectively control single loss.

Combine other indicators or patterns to further verify signal quality and improve signal accuracy.

Optimize parameters separately for different varieties to improve the adaptability of the strategy.

Summary

The overall idea of the strategy is clear, effectively combining reversal patterns and trend tracking indicators to steadily identify short-term reversal opportunities and track medium-to-long term trends. By improving parameters optimization and mechanism design, the profitability and risk control capabilities of the strategy can be further enhanced.

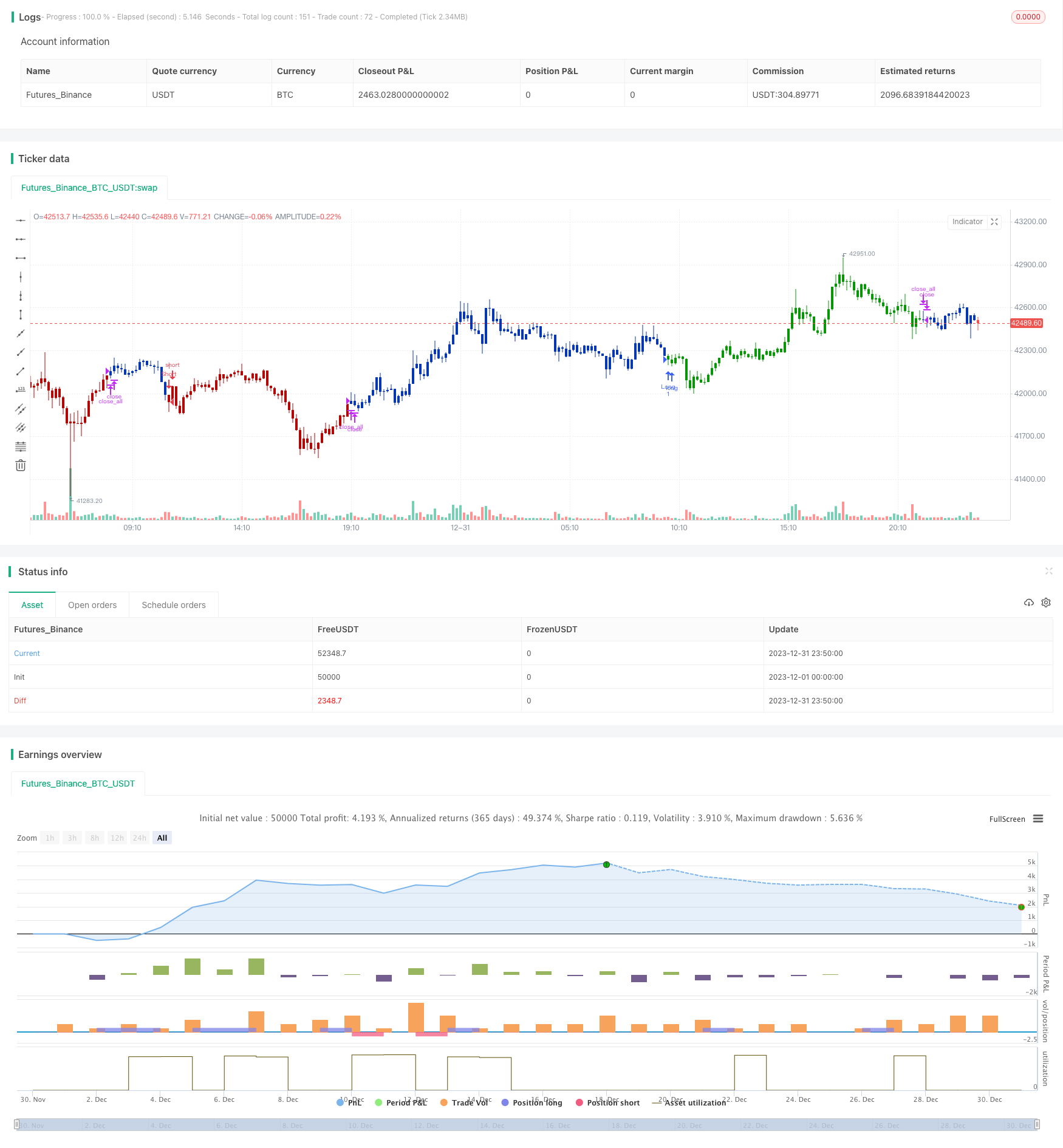

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 10/07/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Smart money index (SMI) or smart money flow index is a technical analysis indicator demonstrating investors sentiment.

// The index was invented and popularized by money manager Don Hays.[1] The indicator is based on intra-day price patterns.

// The main idea is that the majority of traders (emotional, news-driven) overreact at the beginning of the trading day

// because of the overnight news and economic data. There is also a lot of buying on market orders and short covering at the opening.

// Smart, experienced investors start trading closer to the end of the day having the opportunity to evaluate market performance.

// Therefore, the basic strategy is to bet against the morning price trend and bet with the evening price trend. The SMI may be calculated

// for many markets and market indices (S&P 500, DJIA, etc.)

//

// The SMI sends no clear signal whether the market is bullish or bearish. There are also no fixed absolute or relative readings signaling

// about the trend. Traders need to look at the SMI dynamics relative to that of the market. If, for example, SMI rises sharply when the

// market falls, this fact would mean that smart money is buying, and the market is to revert to an uptrend soon. The opposite situation

// is also true. A rapidly falling SMI during a bullish market means that smart money is selling and that market is to revert to a downtrend

// soon. The SMI is, therefore, a trend-based indicator.

// Some analysts use the smart money index to claim that precious metals such as gold will continually maintain value in the future.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

SMI(Length, tf) =>

pos = 0.0

nRes = 0.0

xcloseH1 = security(syminfo.tickerid, tf, close[1])

xopenH1 = security(syminfo.tickerid, tf, open[1])

nRes := nz(nRes[1], 1) - (open - close) + (xopenH1 - xcloseH1)

xSmaRes = sma(nRes, Length)

pos:= iff(xSmaRes > nRes, 1,

iff(xSmaRes < nRes, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Smart Money Index (SMI)", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Smart Money Index (SMI) ----")

LengthSMI = input(18, minval=1)

res = input(title="Resolution", type=input.resolution, defval="D")

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posSMI = SMI(LengthSMI, res)

pos = iff(posReversal123 == 1 and posSMI == 1 , 1,

iff(posReversal123 == -1 and posSMI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )