Strategi Perundingan Momentum

Gambaran keseluruhan

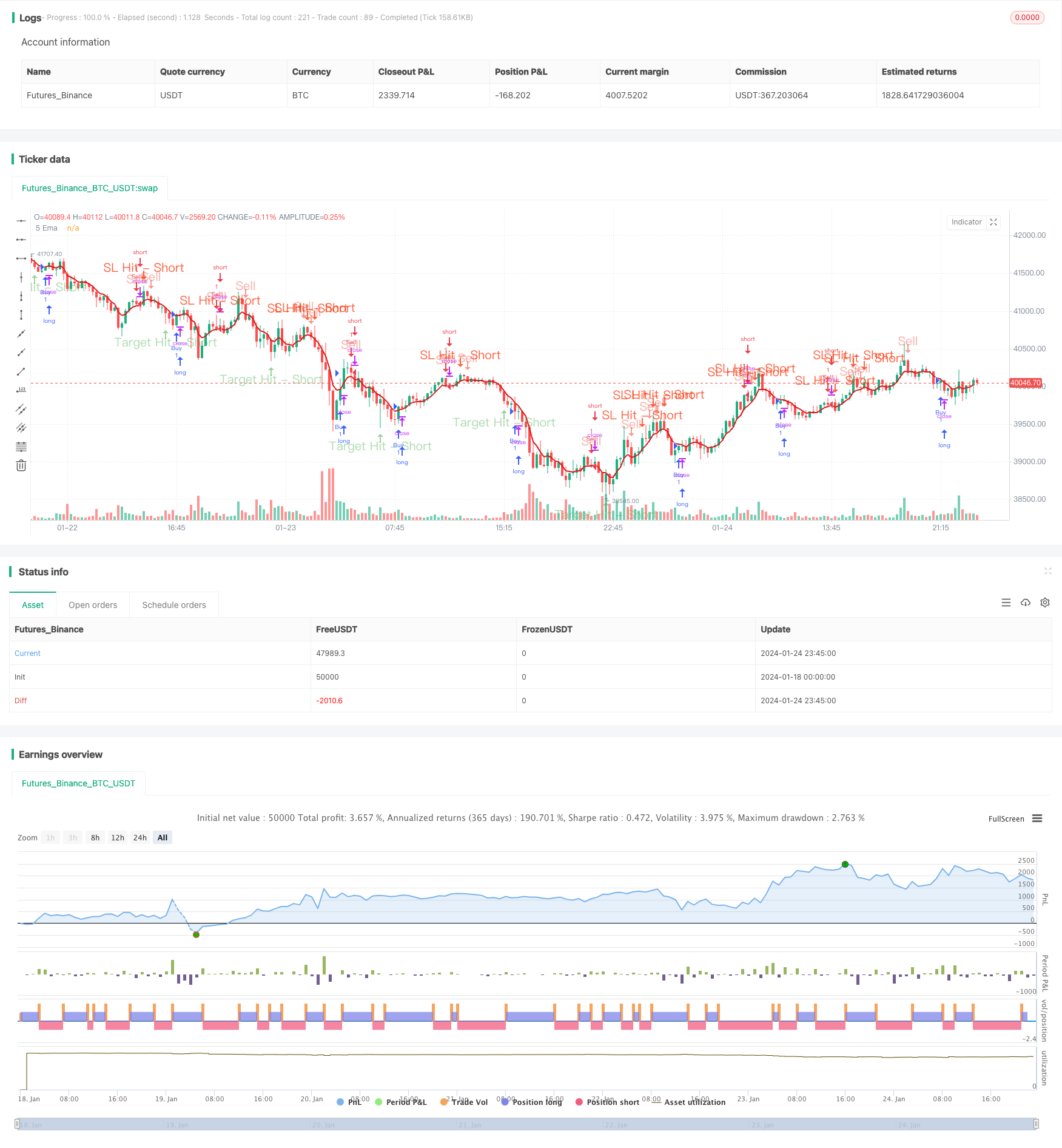

Strategi tawar-menawar dinamik adalah strategi perdagangan garis pendek dan tengah yang menggabungkan penunjuk purata bergerak dan model bentuk garis K untuk mencari peluang perdagangan dengan mengenal pasti titik pecah dan titik penyesuaian. Strategi ini sesuai untuk perdagangan produk kewangan yang sangat leverage seperti opsyen bullish, opsyen bearish, dan futures.

Prinsip Strategi

Logik teras strategi ini adalah berdasarkan purata bergerak sederhana 5 hari. Apabila harga hendak menembusi rata-rata itu, satu titik tertinggi atau garis K terendah yang melangkau akan terbentuk, yang merupakan isyarat yang berpotensi untuk melakukan lebih banyak atau lebih pendek. Apabila harga menembusi rata-rata, garis K kedua ditutup, isyarat masuk terbentuk jika tidak melanggar harga terendah atau tertinggi garis K melangkau sebelumnya.

Apabila harga ke atas memecahkan garis rata-rata 5 hari dan ditutup, harga tertinggi melangkau K garis adalah titik stop loss, harga minimum tolak beberapa julat pemulihan dikalikan dengan nisbah pulangan risiko sebagai sasaran henti. Apabila harga ke bawah memecahkan garis rata-rata 5 hari dan ditutup, harga terendah melangkau K garis adalah titik stop loss, harga tertinggi ditambah beberapa julat pemulihan dikalikan dengan nisbah pulangan risiko sebagai sasaran henti.

Strategi ini juga menyediakan satu syarat penapisan pilihan, iaitu harga penutupan K baris semasa sedikit lebih rendah atau lebih tinggi berbanding K baris melompat, yang dapat mengelakkan beberapa isyarat salah.

Analisis kelebihan strategi

- Strategi yang jelas, ringkas, mudah difahami dan dilaksanakan

- Menggunakan purata bergerak untuk mengenal pasti trend dan pengulangan

- Gabungan K-Line Format untuk Menemukan Waktu Transaksi yang Lebih Tepat

- Menyesuaikan risiko dan ganjaran mengikut prinsip perdagangan yang wajar

- Boleh menyesuaikan parameter mengikut jenis dan kitaran dagangan anda sendiri

- Menyediakan keadaan penapisan pilihan untuk mengurangkan isyarat salah

Analisis risiko strategi

- Seperti strategi penunjuk teknikal yang lain, terdapat juga risiko yang mungkin berlaku seperti penangkapan, penghentian dan pengejaran.

- Penunjuk purata bergerak ketinggalan zaman, mungkin terlepas dari garis pendek

- Dalam trend gempa bumi, terdapat lebih banyak isyarat yang salah

- Tetapan parameter strategi yang tidak betul boleh menyebabkan perdagangan berlebihan

Risiko boleh dikurangkan dengan cara yang munasabah untuk menghentikan kerugian, memegang kedudukan yang sesuai dan memilih perdagangan frekuensi rendah. Anda juga boleh mempertimbangkan penapisan isyarat yang digabungkan dengan petunjuk lain.

Arah pengoptimuman strategi

- Anda boleh menguji kombinasi parameter yang berbeza untuk memilih yang terbaik

- Anda boleh mengoptimumkan penapisan isyarat dalam kombinasi dengan petunjuk atau grafik lain

- Anda boleh mempertimbangkan kaedah seperti hentian dinamik dan hentian bergerak.

- Parameter pengoptimuman automatik yang boleh digabungkan dengan model pembelajaran mesin

- Anda boleh membina plugin untuk menghentikan dan menghentikan kerosakan secara automatik.

- Anda boleh mencuba strategi cross-variety dan cross-cycle validation for robustness

ringkaskan

Strategi ini secara keseluruhannya adalah strategi perdagangan garis pendek yang mudah difahami dan dilaksanakan. Ia menggunakan rata-rata bergerak dan garis K melompat untuk mengenal pasti titik-titik perubahan trend dan beroperasi di bawah kerangka kawalan risiko yang rasional. Walaupun masih ada ruang untuk penambahbaikan, pemikiran utamanya adalah universal dan bernilai belajar dan digunakan.

/*backtest

start: 2024-01-18 00:00:00

end: 2024-01-25 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TradingInsights2

//@version=5

strategy("Ultimate 5EMA Strategy By PowerOfStocks", overlay=true)

Eusl = input.bool(false, title="Enable the Extra SL shown below")

usl = input.int(defval=5, title='Value to set SL number of points below-low or above-high', minval=1, maxval=100)

RiRe = input.int(defval=3, title='Risk to Reward Ratio', minval=1, maxval=25)

ShowSell = input.bool(true, 'Show Sell Signals')

ShowBuy = input.bool(false, 'Show Buy Signals')

BSWCon = input.bool(defval=false, title='Buy/Sell with Extra Condition - candle close')

// Moving Average

ema5 = ta.ema(close, 5)

pema5 = plot(ema5, '5 Ema', color=color.new(#da1a1a, 0), linewidth=2)

var bool Short = na

var bool Long = na

var shortC = 0

var sslhitC = 0

var starhitC = 0

var float ssl = na

var float starl = na

var float star = na

var float sellat = na

var float alert_shorthigh = na

var float alert_shortlow = na

var line lssl = na

var line lstar = na

var line lsell = na

var label lssllbl = na

var label lstarlbl = na

var label lselllbl = na

var longC = 0

var lslhitC = 0

var ltarhitC = 0

var float lsl = na

var float ltarl = na

var float ltar = na

var float buyat = na

var float alert_longhigh = na

var float alert_longlow = na

var line llsl = na

var line lltar = na

var line lbuy = na

var label llsllbl = na

var label lltarlbl = na

var label lbuylbl = na

ShortWC = low[1] > ema5[1] and low[1] > low and shortC == 0 and close < close[1]

ShortWOC = low[1] > ema5[1] and low[1] > low and shortC == 0

Short := BSWCon ? ShortWC : ShortWOC

sslhit = high > ssl and shortC > 0 and sslhitC == 0

starhit = low < star and shortC > 0 and starhitC == 0

LongWC = high[1] < ema5[1] and high[1] < high and longC == 0 and close > close[1]

LongWOC = high[1] < ema5[1] and high[1] < high and longC == 0

Long := BSWCon ? LongWC : LongWOC

lslhit = low < lsl and longC > 0 and lslhitC == 0

ltarhit = high > ltar and longC > 0 and ltarhitC == 0

if Short and ShowSell

shortC := shortC + 1

sslhitC := 0

starhitC := 0

alert_shorthigh := high[1]

if Eusl

ssl := high[1] + usl

starl := BSWCon ? ((high[1] - close) + usl) * RiRe : ((high[1] - low[1]) + usl) * RiRe

else

ssl := high[1]

starl := BSWCon ? (high[1] - close) * RiRe : (high[1] - low[1]) * RiRe

star := BSWCon ? close - starl : low[1] - starl

sellat := BSWCon ? close : low[1]

// lssl := line.new(bar_index, ssl, bar_index, ssl, color=color.new(#fc2d01, 45), style=line.style_dashed)

// lstar := line.new(bar_index, star, bar_index, star, color=color.new(color.green, 45), style=line.style_dashed)

// lsell := line.new(bar_index, sellat, bar_index, sellat, color=color.new(color.orange, 45), style=line.style_dashed)

// lssllbl := label.new(bar_index, ssl, style=label.style_none, text='Stop Loss - Short' + ' (' + str.tostring(ssl) + ')', textcolor=color.new(#fc2d01, 35), color=color.new(#fc2d01, 35))

// lstarlbl := label.new(bar_index, star, style=label.style_none, text='Target - Short' + ' (' + str.tostring(star) + ')', textcolor=color.new(color.green, 35), color=color.new(color.green, 35))

// lselllbl := label.new(bar_index, sellat, style=label.style_none, text='Sell at' + ' (' + str.tostring(sellat) + ')', textcolor=color.new(color.orange, 35), color=color.new(color.orange, 35))

if sslhit == false and starhit == false and shortC > 0

// line.set_x2(lssl, bar_index)

// line.set_x2(lstar, bar_index)

// line.set_x2(lsell, bar_index)

sslhitC := 0

starhitC := 0

else

if sslhit

shortC := 0

sslhitC := sslhitC + 1

else

if starhit

shortC := 0

starhitC := starhitC + 1

if Long and ShowBuy

longC := longC + 1

lslhitC := 0

ltarhitC := 0

alert_longlow := low[1]

if Eusl

lsl := low[1] - usl

ltarl := BSWCon ? ((close - low[1]) + usl) * RiRe : ((high[1] - low[1]) + usl) * RiRe

else

lsl := low[1]

ltarl := BSWCon ? (close - low[1]) * RiRe : (high[1] - low[1]) * RiRe

ltar := BSWCon ? close + ltarl : high[1] + ltarl

buyat := BSWCon ? close : high[1]

llsl := line.new(bar_index, lsl, bar_index, lsl, color=color.new(#fc2d01, 45), style=line.style_dotted)

lltar := line.new(bar_index, ltar, bar_index, ltar, color=color.new(color.green, 45), style=line.style_dotted)

lbuy := line.new(bar_index, buyat, bar_index, buyat, color=color.new(color.orange, 45), style=line.style_dotted)

llsllbl := label.new(bar_index, lsl, style=label.style_none, text='Stop Loss - Long' + ' (' + str.tostring(lsl) + ')', textcolor=color.new(#fc2d01, 35), color=color.new(#fc2d01, 35))

lltarlbl := label.new(bar_index, ltar, style=label.style_none, text='Target - Long' + ' (' + str.tostring(ltar) + ')', textcolor=color.new(color.green, 35), color=color.new(color.green, 35))

lbuylbl := label.new(bar_index, buyat, style=label.style_none, text='Buy at' + ' (' + str.tostring(buyat) + ')', textcolor=color.new(color.orange, 35), color=color.new(color.orange, 35))

if lslhit == false and ltarhit == false and longC > 0

// line.set_x2(llsl, bar_index)

// line.set_x2(lltar, bar_index)

// line.set_x2(lbuy, bar_index)

lslhitC := 0

ltarhitC := 0

else

if lslhit

longC := 0

lslhitC := lslhitC + 1

else

if ltarhit

longC := 0

ltarhitC := ltarhitC + 1

strategy.entry("Buy", strategy.long, when=Long)

strategy.entry("Sell", strategy.short, when=Short)

strategy.close("ExitBuy", when=sslhit or starhit)

strategy.close("ExitSell", when=lslhit or ltarhit)

plotshape(ShowSell and Short, title='Sell', location=location.abovebar, offset=0, color=color.new(#e74c3c, 45), style=shape.arrowdown, size=size.normal, text='Sell', textcolor=color.new(#e74c3c, 55))

plotshape(ShowSell and sslhit, title='SL Hit - Short', location=location.abovebar, offset=0, color=color.new(#fc2d01, 25), style=shape.arrowdown, size=size.normal, text='SL Hit - Short', textcolor=color.new(#fc2d01, 25))

plotshape(ShowSell and starhit, title='Target Hit - Short', location=location.belowbar, offset=0, color=color.new(color.green, 45), style=shape.arrowup, size=size.normal, text='Target Hit - Short', textcolor=color.new(color.green, 55))

plotshape(ShowBuy and Long, title='Buy', location=location.belowbar, offset=0, color=color.new(#2ecc71, 45), style=shape.arrowup, size=size.normal, text='Buy', textcolor=color.new(#2ecc71, 55))

plotshape(ShowBuy and lslhit, title='SL Hit - Long', location=location.belowbar, offset=0, color=color.new(#fc2d01, 25), style=shape.arrowdown, size=size.normal, text='SL Hit - Long', textcolor=color.new(#fc2d01, 25))

plotshape(ShowBuy and ltarhit, title='Target Hit - Long', location=location.abovebar, offset=0, color=color.new(color.green, 45), style=shape.arrowup, size=size.normal, text='Target Hit - Long', textcolor=color.new(color.green, 55))

if ShowSell and Short

alert("Go Short@ " + str.tostring(sellat) + " : SL@ " + str.tostring(ssl) + " : Target@ " + str.tostring(star) + " ", alert.freq_once_per_bar )

if ShowBuy and Long

alert("Go Long@ " + str.tostring(buyat) + " : SL@ " + str.tostring(lsl) + " : Target@ " + str.tostring(ltar) + " ", alert.freq_once_per_bar )

///// End of code