Strategi Dagangan Pintar Kedudukan Niaga Hadapan Bitcoin

Tarikh penciptaan:

2024-01-26 15:01:24

Akhirnya diubah suai:

2024-01-26 15:01:24

Salin:

1

Bilangan klik:

718

1

fokus pada

1664

Pengikut

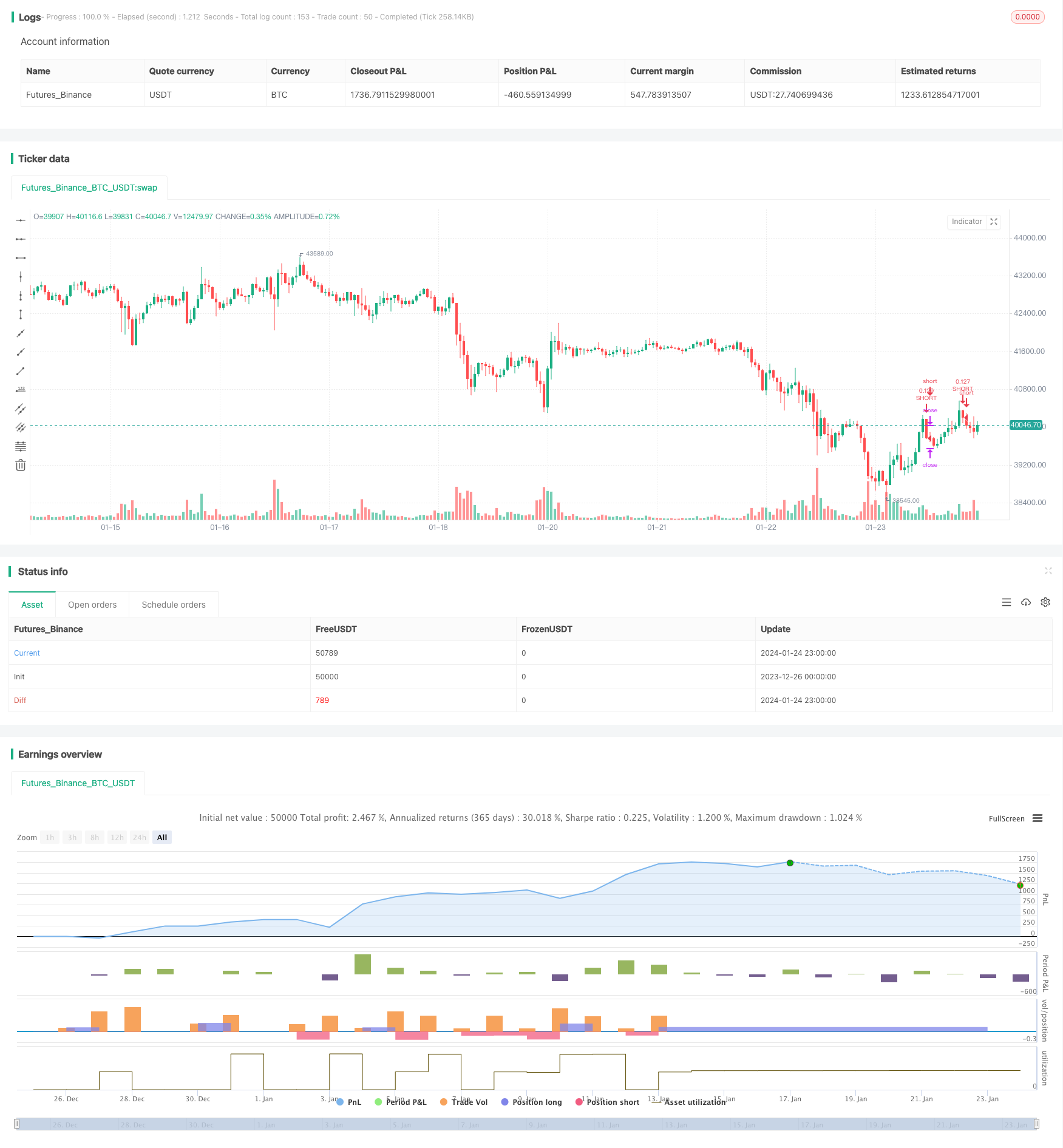

Ringkasan: Strategi ini menggunakan data kedudukan BTC Futures Bitfinex untuk membimbing dagangan. Buat kosong apabila jumlah kedudukan pendek meningkat, dan buat lebih banyak apabila jumlah kedudukan pendek menurun.

Prinsip-prinsip strategi:

- Menggunakan jumlah kedudukan pendek BTC berjangka Bitfinex sebagai penunjuk. Bitfinex dianggap sebagai pertukaran yang didominasi oleh institusi dan kumpulan pemikir.

- Apabila jumlah kedudukan pendek meningkat, mereka melakukan shorting BTC tunai. Pada masa ini institusi sedang melakukan shorting BTC.

- Apabila jumlah stok pendek menurun, lebih banyak stok tunai BTC. Pada masa ini, institusi sedang mengurangkan stok, menunjukkan tanda-tanda kenaikan.

- Menggunakan RSI untuk menilai kedudukan tinggi dan rendah dalam jumlah kedudukan pendek. RSI lebih tinggi daripada 75 menandakan kedudukan tinggi, dan lebih rendah daripada 30 menandakan kedudukan rendah.

- Masukkan posisi Do-More atau Do-Low apabila ada isyarat pada titik tinggi atau rendah.

Analisis kelebihan:

- Menggunakan data kedudukan pedagang profesional Bitfinex sebagai isyarat petunjuk, aktiviti perdagangan institusi dapat ditangkap.

- Indeks RSI membantu menentukan kedudukan pendek yang tinggi dan rendah, dan mengawal risiko perdagangan.

- Agensi memantau pergerakan dagangan dalam masa nyata dan menyesuaikan kedudukan mereka.

- Tidak perlu mengkaji indikator teknikal sendiri, anda hanya boleh mengikuti pemikiran perdagangan yang diamalkan oleh kumpulan pemikir.

- Data pengesanan kembali berjalan dengan baik, dengan kadar pulangan yang cukup besar.

Analisis risiko:

- Tidak dapat dipastikan sama ada peningkatan jumlah kedudukan pendek adalah spekulasi atau perlindungan.

- Kemas kini data dagangan Bitfinex mengalami kelewatan dan mungkin terlepas peluang terbaik untuk masuk.

- Ia adalah satu-satunya cara untuk memastikan bahawa anda tidak akan tertipu dengan sesuatu yang tidak dapat dipastikan.

- Penetapan parameter RSI yang tidak betul boleh menyebabkan isyarat palsu atau isyarat hilang.

- Pengaturan Stop Loss terlalu longgar dan boleh menyebabkan kerugian yang besar.

Arah untuk dioptimumkan:

- Mengoptimumkan parameter RSI, menguji kesan tempoh pegangan yang berbeza.

- Cubalah menggunakan penunjuk lain seperti KD, MACD dan lain-lain untuk menilai kedudukan pendek.

- Memperkecil margin stop loss dan mengurangkan kerugian tunggal.

- Menambah isyarat keadaan keluar, seperti pembalikan trend, pemutus.

- Uji kelayakan mata wang yang digunakan, seperti mengikuti perdagangan BTC dalam posisi pendek ETH.

Kesimpulannya: Strategi ini dengan mengikuti pedagang profesional BTC futures Bitfinex, mewujudkan isyarat perdagangan institusi yang tepat pada masanya. Ia membantu pelabur memantau kepanasan pasaran, memahami titik tinggi dan rendah. Ia juga memberi amaran terhadap risiko pelaburan, berhati-hati untuk menurunkan kedudukan berganda apabila pedagang profesional banyak kosong.

Kod sumber strategi

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bitfinex Shorts Strat",

overlay=true,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10, precision=2, initial_capital=1000,

pyramiding=2,

commission_value=0.05)

//Backtest date range

StartDate = input(timestamp("01 Jan 2021"), title="Start Date")

EndDate = input(timestamp("01 Jan 2024"), title="Start Date")

inDateRange = true

symbolInput = input(title="Bitfinex Short Symbol", defval="BTC_USDT:swap")

Shorts = request.security(symbolInput, "", open)

// RSI Input Settings

length = input(title="Length", defval=7, group="RSI Settings" )

overSold = input(title="High Shorts Threshold", defval=75, group="RSI Settings" )

overBought = input(title="Low Shorts Threshold", defval=30, group="RSI Settings" )

// Calculating RSI

vrsi = ta.rsi(Shorts, length)

RSIunder = ta.crossover(vrsi, overSold)

RSIover = ta.crossunder(vrsi, overBought)

// Stop Loss Input Settings

longLossPerc = input.float(title="Long Stop Loss (%)", defval=25, group="Stop Loss Settings") * 0.01

shortLossPerc = input.float(title="Short Stop Loss (%)", defval=25, group="Stop Loss Settings") * 0.01

// Calculating Stop Loss

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// Strategy Entry

if (not na(vrsi))

if (inDateRange and RSIover)

strategy.entry("LONG", strategy.long, comment="LONG")

if (inDateRange and RSIunder)

strategy.entry("SHORT", strategy.short, comment="SHORT")

// Submit exit orders based on calculated stop loss price

if (strategy.position_size > 0)

strategy.exit(id="LONG STOP", stop=longStopPrice)

if (strategy.position_size < 0)

strategy.exit(id="SHORT STOP", stop=shortStopPrice)