Strategi Breakout Momentum MA Berganda

Gambaran keseluruhan

Strategi penembusan pergerakan MA berganda adalah strategi perdagangan kuantitatif yang menggabungkan purata bergerak ganda dan RSI. Strategi ini menetapkan paras overbought dan oversold pada RSI dengan mengira purata bergerak cepat, purata bergerak perlahan dan RSI, melakukan overbought apabila terdapat persilangan emas pada MA berganda, dan melakukan overbought apabila terdapat persilangan mati, untuk menangkap pergerakan tren di pasaran.

Prinsip Strategi

Strategi penembusan MA bergerak berganda adalah berdasarkan dua purata bergerak dan RSI. Pertama, dua purata bergerak dikira secara perlahan-lahan, garis cepat adalah purata bergerak bertimbangan 10 hari, garis perlahan adalah purata bergerak beradaptasi 100 hari. Kemudian, RSI 14 hari dikira, dan menetapkan had overbought dan oversold.

Khususnya, apabila diadili sebagai pergerakan overhead, jika indikator RSI pada masa ini lebih tinggi daripada garis beli-belah, maka kedudukan terbuka akan dibuka; apabila diadili sebagai pergerakan kosong, jika indikator RSI lebih rendah daripada garis jual-belah, maka kedudukan terbuka akan dibuka. Selepas membuka kedudukan, kedudukan terbuka akan dibuka apabila isyarat perdagangan berbalik.

Kelebihan Strategik

Strategi penembusan MA berganda yang dinamika menggabungkan kedua-dua MA dan RSI untuk mengenal pasti trend pasaran dengan berkesan dan menggunakan RSI untuk menyaring penembusan palsu, meningkatkan kebolehpercayaan isyarat perdagangan. Berbanding dengan sistem MA tunggal, strategi ini dapat mengurangkan jumlah perdagangan yang tidak sah. Selain itu, pengoptimuman parameter RSI juga membawa fleksibiliti kepada strategi.

Risiko Strategik

Strategi penembusan MA ganda juga mempunyai risiko tertentu. Sistem MA ganda sangat sensitif terhadap parameter dan memerlukan kombinasi parameter yang diuji dengan berhati-hati untuk pasaran yang berbeza. Selain itu, paras yang ditetapkan oleh penunjuk RSI jika tidak sesuai juga boleh menyebabkan peluang perdagangan yang salah.

Pengoptimuman Strategi

Strategi penembusan MA berganda boleh dioptimumkan dalam beberapa aspek:

- Mengoptimumkan parameter MA perlahan-lahan untuk mencari kombinasi parameter yang optimum;

- Mengoptimumkan parameter RSI, menyesuaikan paras paras terhad untuk membeli dan menjual;

- Meningkatkan mekanisme penangguhan kerugian bergerak beradaptasi untuk mengawal risiko;

- Menambah modul pengoptimuman jumlah simpanan dan meningkatkan kecekapan penggunaan dana.

ringkaskan

Strategi pemecahan dinamik MA ganda menilai arah trend melalui sistem MA ganda, dan menggunakan isyarat penapis RSI, yang dapat memperbaiki kelemahan sistem MA tunggal. Strategi ini mempunyai ruang untuk mengoptimumkan parameter dan dapat menyesuaikan diri, dan merupakan strategi pemantauan trend yang sangat baik.

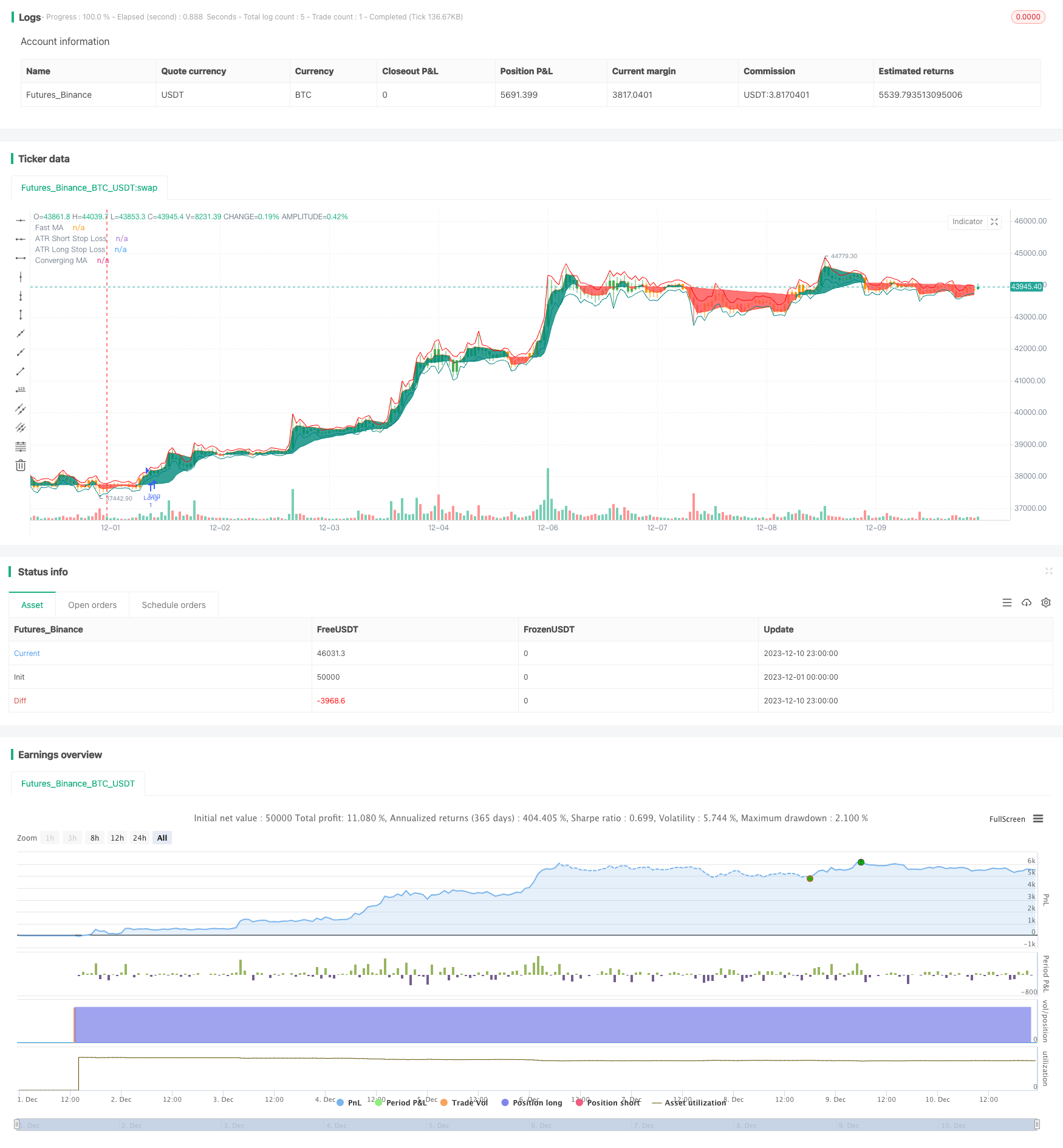

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-10 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © Salman4sgd

//@version=5

strategy("MAConverging + QQE Threshold Strategy", overlay = true)

//------------------------------------------------------------------------------

//Settings

//-----------------------------------------------------------------------------{

length = input(100)

incr = input(10, "Increment")

fast = input(10)

src = input(close)

//-----------------------------------------------------------------------------}

//Calculations

//-----------------------------------------------------------------------------{

var ma = 0.

var fma = 0.

var alpha = 0.

var k = 1 / incr

upper = ta.highest(length)

lower = ta.lowest(length)

init_ma = ta.sma(src, length)

cross = ta.cross(src,ma)

alpha := cross ? 2 / (length + 1)

: src > ma and upper > upper[1] ? alpha + k

: src < ma and lower < lower[1] ? alpha + k

: alpha

ma := nz(ma[1] + alpha[1] * (src - ma[1]), init_ma)

fma := nz(cross ? math.avg(src, fma[1])

: src > ma ? math.max(src, fma[1]) + (src - fma[1]) / fast

: math.min(src, fma[1]) + (src - fma[1]) / fast,src)

//-----------------------------------------------------------------------------}

//Plots

//-----------------------------------------------------------------------------{

css = fma > ma ? color.teal : color.red

plot0 = plot(fma, "Fast MA"

, color = #ff5d00

, transp = 100)

plot1 = plot(ma, "Converging MA"

, color = css)

fill(plot0, plot1, css

, "Fill"

, transp = 80)

//-----------------------------------------------------------------------------}

RSI_Period = input(14, title='RSI Length')

SF = input(5, title='RSI Smoothing')

QQE = input(4.238, title='Fast QQE Factor')

ThreshHold = input(10, title='Thresh-hold')

//

sQQEx = input(false, title='Show Smooth RSI, QQE Signal crosses')

sQQEz = input(false, title='Show Smooth RSI Zero crosses')

sQQEc = input(false, title='Show Smooth RSI Thresh Hold Channel Exits')

ma_type = input.string(title='MA Type', defval='EMA', options=['ALMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'VWMA', 'SMA', 'SMMA', 'HMA', 'LSMA', 'PEMA'])

lsma_offset = input.int(defval=0, title='* Least Squares (LSMA) Only - Offset Value', minval=0)

alma_offset = input.float(defval=0.85, title='* Arnaud Legoux (ALMA) Only - Offset Value', minval=0, step=0.01)

alma_sigma = input.int(defval=6, title='* Arnaud Legoux (ALMA) Only - Sigma Value', minval=0)

inpDrawBars = input(true, title='color bars?')

ma(type, src, len) =>

float result = 0

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VWMA' // Volume Weighted

result := ta.vwma(src, len)

result

if type == 'SMMA' // Smoothed

w = ta.wma(src, len)

result := na(w[1]) ? ta.sma(src, len) : (w[1] * (len - 1) + src) / len

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'LSMA' // Least Squares

result := ta.linreg(src, len, lsma_offset)

result

if type == 'ALMA' // Arnaud Legoux

result := ta.alma(src, len, alma_offset, alma_sigma)

result

if type == 'PEMA'

// Copyright (c) 2010-present, Bruno Pio

// Copyright (c) 2019-present, Alex Orekhov (everget)

// Pentuple Exponential Moving Average script may be freely distributed under the MIT license.

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

ema4 = ta.ema(ema3, len)

ema5 = ta.ema(ema4, len)

ema6 = ta.ema(ema5, len)

ema7 = ta.ema(ema6, len)

ema8 = ta.ema(ema7, len)

pema = 8 * ema1 - 28 * ema2 + 56 * ema3 - 70 * ema4 + 56 * ema5 - 28 * ema6 + 8 * ema7 - ema8

result := pema

result

result

src := input(close, title='RSI Source')

//

//

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(src, RSI_Period)

RsiMa = ma(ma_type, Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ma(ma_type, AtrRsi, Wilders_Period)

dar = ma(ma_type, MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

//

// Find all the QQE Crosses

QQExlong = 0

QQExlong := nz(QQExlong[1])

QQExshort = 0

QQExshort := nz(QQExshort[1])

QQExlong := sQQEx and FastAtrRsiTL < RSIndex ? QQExlong + 1 : 0

QQExshort := sQQEx and FastAtrRsiTL > RSIndex ? QQExshort + 1 : 0

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := sQQEz and RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := sQQEz and RSIndex < 50 ? QQEzshort + 1 : 0

//

// Thresh Hold channel Crosses give the BUY/SELL alerts.

QQEclong = 0

QQEclong := nz(QQEclong[1])

QQEcshort = 0

QQEcshort := nz(QQEcshort[1])

QQEclong := sQQEc and RSIndex > 50 + ThreshHold ? QQEclong + 1 : 0

QQEcshort := sQQEc and RSIndex < 50 - ThreshHold ? QQEcshort + 1 : 0

// // QQE exit from Thresh Hold Channel

// plotshape(sQQEc and QQEclong == 1 ? RsiMa - 50 : na, title='QQE XC Over Channel', style=shape.diamond, location=location.absolute, color=color.new(color.olive, 0), size=size.small, offset=0)

// plotshape(sQQEc and QQEcshort == 1 ? RsiMa - 50 : na, title='QQE XC Under Channel', style=shape.diamond, location=location.absolute, color=color.new(color.red, 0), size=size.small, offset=0)

// // QQE crosses

// plotshape(sQQEx and QQExlong == 1 ? FastAtrRsiTL[1] - 50 : na, title='QQE XQ Cross Over', style=shape.circle, location=location.absolute, color=color.new(color.lime, 0), size=size.small, offset=-1)

// plotshape(sQQEx and QQExshort == 1 ? FastAtrRsiTL[1] - 50 : na, title='QQE XQ Cross Under', style=shape.circle, location=location.absolute, color=color.new(color.blue, 0), size=size.small, offset=-1)

// // Signal crosses zero line

// plotshape(sQQEz and QQEzlong == 1 ? RsiMa - 50 : na, title='QQE XZ Zero Cross Over', style=shape.square, location=location.absolute, color=color.new(color.aqua, 0), size=size.small, offset=0)

// plotshape(sQQEz and QQEzshort == 1 ? RsiMa - 50 : na, title='QQE XZ Zero Cross Under', style=shape.square, location=location.absolute, color=color.new(color.fuchsia, 0), size=size.small, offset=0)

// hcolor = RsiMa - 50 > ThreshHold ? color.green : RsiMa - 50 < 0 - ThreshHold ? color.red : color.orange

// plot(FastAtrRsiTL - 50, color=color.new(color.blue, 0), linewidth=2)

// p1 = plot(RsiMa - 50, color=color.new(color.orange, 0), linewidth=2)

// plot(RsiMa - 50, color=hcolor, style=plot.style_columns, transp=50)

// hZero = hline(0, color=color.black, linestyle=hline.style_dashed, linewidth=1)

// hUpper = hline(ThreshHold, color=color.green, linestyle=hline.style_dashed, linewidth=2)

// hLower = hline(0 - ThreshHold, color=color.red, linestyle=hline.style_dashed, linewidth=2)

// fill(hUpper, hLower, color=color.new(color.gray, 80))

//EOF

length := input.int(title='ATR Length', defval=14, minval=1)

smoothing = input.string(title='ATR Smoothing', defval='RMA', options=['RMA', 'SMA', 'EMA', 'WMA'])

m = input(0.3, 'ATR Multiplier')

src1 = input(high)

src2 = input(low)

pline = input(true, 'Show Price Lines')

col1 = input(color.blue, 'ATR Text Color')

col2 = input.color(color.teal, 'Low Text Color', inline='1')

col3 = input.color(color.red, 'High Text Color', inline='2')

collong = input.color(color.teal, 'Low Line Color', inline='1')

colshort = input.color(color.red, 'High Line Color', inline='2')

ma_function(source, length) =>

if smoothing == 'RMA'

ta.rma(source, length)

else

if smoothing == 'SMA'

ta.sma(source, length)

else

if smoothing == 'EMA'

ta.ema(source, length)

else

ta.wma(source, length)

a = ma_function(ta.tr(true), length) * m

s_sl = ma_function(ta.tr(true), length) * m + src1

l_sl = src2 - ma_function(ta.tr(true), length) * m

p1 = plot(s_sl, title='ATR Short Stop Loss', color=colshort, trackprice=pline ? true : false, transp=20)

p2 = plot(l_sl, title='ATR Long Stop Loss', color=collong, trackprice=pline ? true : false, transp=20)

bgc = RsiMa - 50 > ThreshHold ? color.green : Rsi - 50 < 0 - ThreshHold ? color.red : color.orange

barcolor(inpDrawBars ? bgc : na)

prebuy = RsiMa - 50 > ThreshHold

buy=prebuy and not(prebuy[1]) and fma > ma

var long_tp=0.0

var long_sl=0.0

var short_tp=0.0

var short_sl=0.0

if prebuy

strategy.close("Short")

if buy and strategy.position_size<=0

strategy.entry("Long", strategy.long)

long_sl:=l_sl

long_tp:=close+(close-long_sl)*2

//if strategy.position_size>0

strategy.exit("L_SL","Long",stop=long_sl)

//strategy.exit("L_SL","Long",stop=long_sl)

// if low<long_sl[1]

// strategy.close("Long")

presell=RsiMa - 50 < 0 - ThreshHold // RsiMa - 50 < 0 - ThreshHold

sell= presell and not(presell[1]) and fma < ma

//plotshape(presell)

if presell

strategy.close("Long")

if sell and strategy.position_size>=0

strategy.entry("Short", strategy.short)

short_sl:=s_sl

short_tp:=close-(short_sl-close)*2

//if strategy.position_size<0

strategy.exit("S_SL","Short",stop=short_sl)

//strategy.exit("S_SL","Short",stop=short_sl)