Strategi penjejakan harga ayunan penunjuk MA berganda

Strategi ini dikenali sebagai strategi pengesanan harga pergerakan indikator MA berganda, yang menggunakan kombinasi pelbagai purata bergerak MA seperti SMA dan EMA untuk mengesan harga pasaran secara langsung dengan menetapkan beberapa indikator laju dan perlahan, yang dapat memberi isyarat perdagangan ketika pasaran bergolak.

Gambaran Strategik: Strategi ini dengan membina tiga kumpulan parameter yang berbeza MA garis petunjuk, masing-masing mewakili pasaran cepat, sederhana, perlahan, dan sambil membantu menetapkan penunjuk gelombang penyaring untuk menyaring isyarat kesilapan, membentuk panjang atau kosong keputusan asas. Strategi logik mengoptimumkan penyaringan kaedah pelbagai, menggunakan garis purata persilangan, overbought oversell indikator RSI, Brin garis pecah dan lain-lain petunjuk teknikal untuk membuat keputusan komposit, boleh berkesan menentukan harga kritikal titik beli dan jual, menangkap keadaan yang bergolak dan mengurangkan risiko pasaran, strategi mempunyai kelebihan yang ketara.

Prinsip-prinsip strategi: 1. Satu set tiga garis penunjuk MA (cepat (21 kitaran), sederhana (55 kitaran) dan perlahan (89 kitaran) mewakili tahap harga purata bagi tempoh masa yang berbeza; 2. menilai apakah keadaan semasa berada dalam fasa naik atau turun dengan menilai hubungan susunan tiga garis indikator MA ((cepat>sedang>lambat atau cepatlambat); 3. Meningkatkan ketepatan isyarat dengan menggunakan kaedah seperti SuperTrend dan lain-lain; 4. Memilih masa untuk berdagang berdasarkan isyarat ini dan perubahan keadaan penapis, dan menghantar isyarat beli/jual.

Kelebihan strategi: 1. Menggunakan pelbagai kumpulan indikator MA untuk menilai pergerakan jangka pendek dan jangka panjang pasaran, meningkatkan ketepatan penilaian; 2. Menggunakan pelbagai kaedah penyaringan untuk mengoptimumkan pilihan tempat membeli dan menjual untuk meningkatkan peluang keuntungan; 3. Menggunakan indikator teknikal seperti garis Brin dan RSI untuk membantu terobosan, dan mengambil peluang untuk mendapatkan sokongan dan perubahan; 4. Memilih arah membeli dan menjual mengikut perubahan arah MA yang cepat, tanpa berkelahi untuk berbalik, mengejar pergerakan yang bergolak, dan menghasilkan keuntungan; 5. isyarat dagangan dengan visual panah dan penanda jelas, mudah difahami, mudah untuk beroperasi.

Risiko dan pencegahan: 1. Strategi MA rata-rata lemah terhadap kebarangkalian penembusan palsu; 2. Kemungkinan terdapat perbezaan masa antara indikator komposit, yang membawa kepada risiko ketinggalan isyarat; 3. Selepas pembelian terobosan, lebih banyak penilaian diperlukan untuk menilai kekuatan pasaran pasca untuk mengelakkan kebocoran; 4. Pertimbangkan untuk menambah syarat-syarat stop loss untuk mengawal kerugian maksimum dalam satu dagangan.

Pengoptimuman strategi: Ujian pelbagai jenis dan parameter MA untuk mencari kombinasi MA yang optimum; 2. Meningkatkan modul penghakiman terbalik, seperti penggunaan penunjuk KD yang lebih baik; 3. Menentukan trend sebenar, berserta analisis indikator jumlah urus niaga; 4. Meluaskan Indeks BIAS untuk menilai kawasan jual beli berlebihan.

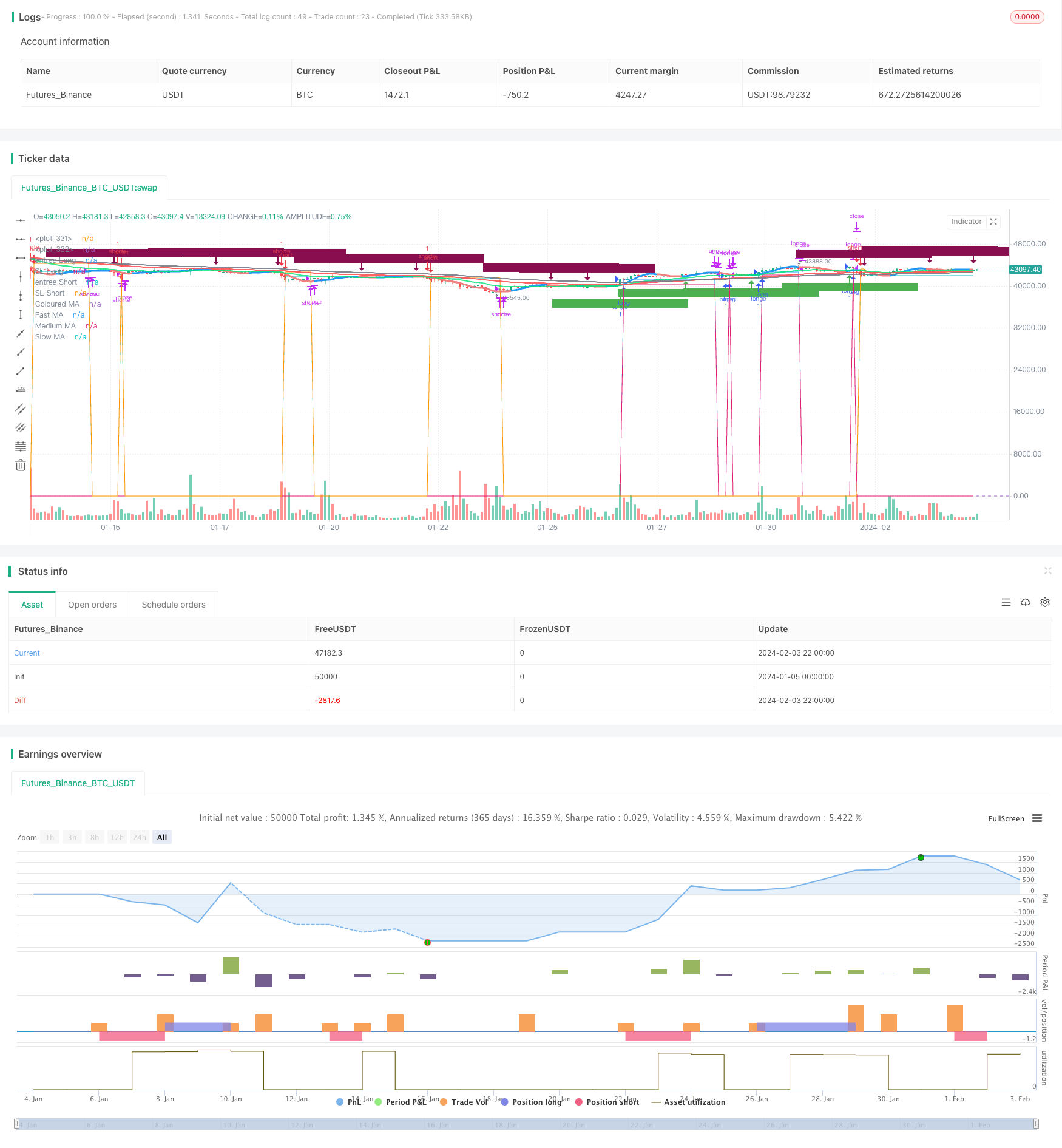

Kesimpulannya: Dalam pasaran mata wang digital yang sentiasa bergolak, strategi ini menggunakan peluang untuk berdagang berulang-ulang dalam gelombang gelombang, melakukan peralihan multi-kawasan melalui penunjuk MA yang ditetapkan dan penilaian gelombang gelombang tambahan, untuk menangkap masa-masa pembalikan pasaran yang penting. Ia juga boleh dioptimumkan lebih jauh, menambah modul stop-loss untuk mengurangkan kerugian tunggal, dan mendapatkan keuntungan positif dari garis panjang melalui strategi automatik.

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// Bannos

// #NotTradingAdvice #DYOR

// Disclaimer.

// I AM NOT A FINANCIAL ADVISOR.

// THESE IDEAS ARE NOT ADVICE AND ARE FOR EDUCATION PURPOSES ONLY.

// ALWAYS DO YOUR OWN RESEARCH

//

// Author: Adaptation from JustUncleL Big Snapper by Bannos

// Date: May-2022

// Version: R1.0

//Description of this addon - Script using several new conditions to give Long/short and SL levels which was not proposed in the Big Snapper strategy "Big Snapper Alerts R3.0"

//"

//This strategy is based on the use of the Big Snapper outputs from the JustUncleL script and the addition of several conditions to define filtered conditions selecting signal synchrones with a trend and a rise of the volatility.

//Also the strategy proposes to define proportional stop losses and dynamic Take profit using an RSI strategy.

// After delivering the temporary ong/short signal and ploting a green or purple signal, several conditions are defined to consider a Signal is Long or short.

//Let s take the long signal as example(this is the same process with the opposite values for a short).

//step 1 - Long Definition:

// Snapper long signal stored in the buffer variable Longbuffer to say that in a close future, we could have all conditions for a long

// Now we need some conditions to combine with it:

//the second one is to be over the Ma_medium(55)

//and because this is not selective enough, the third one is a Volatility indicator "Chaikin Volatility" indicator giving an indication about the volatility of the price compared to the 10 last values

// -> Using the volatility indicator gives the possibility to increase the potential rise if the volatility is higher compared to the last periods.

//With these 3 signals, we get a robust indication about a potential long signal which is then stored in the variable "Longe"

//Now we have a long signal and can give a long signal with its Stop Loss

// The Long Signal is automatically given as the 3 conditions above are satisfied.

// The Stop loss is a function of the last Candle sizes giving a stop below the 70% of the overall candle which can be assimilated to a Fibonacci level. Below this level it makes sense to stop the trade as the chance to recover the complete Candle is more than 60%

//Now we are in an open Long and can use all the mentioned Stop loss condition but still need a Take Profit condition

//The take profit condition is based on a RSI strategy consisting in taking profit as soon as the RSI come back from the overbought area (which is here defined as a rsi over 70) and reaching the 63.5 level to trigger the Take Profit

//This TP condition is only active when Long is active and when an entry value as been defined.

//Entry and SL level appreas as soon as a Long or short arrow signal does appears. The Take profit will be conidtioned to the RSI.

//The final step in the cycle is a reinitialization of all the values giving the possibility to detect and treat any long new signal coming from the Big Snapper signal.

//-------------------------------------------------------------------------------------------------------

strategy(title='Big Snapper Alerts R3.0 + Chaiking Volatility condition + TP RSI', shorttitle='SNAPPER Bannos', overlay=true)

// === INPUTS ===

// Coloured MA - type, length, source

typeColoured = input.string(defval='HullMA', title='Coloured MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenColoured = input.int(defval=18, title='Coloured MA - Length', minval=1)

srcColoured = input(close, title='Coloured MA - Source')

// Fast MA - type, length

typeFast = input.string(defval='EMA', title='Fast MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenFast = input.int(defval=21, title='Fast MA - Length', minval=1)

// Medium MA - type, length

typeMedium = input.string(defval='EMA', title='Medium MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenMedium = input.int(defval=55, title='Medium MA - Length', minval=1)

// Slow MA - type, length

typeSlow = input.string(defval='EMA', title='Slow MA Type: ', options=['SMA', 'EMA', 'WMA', 'VWMA', 'SMMA', 'DEMA', 'TEMA', 'HullMA', 'ZEMA', 'TMA', 'SSMA'])

lenSlow = input.int(defval=89, title='Slow MA Length', minval=1)

// 3xMA source

ma_src = input(close, title='3xMA and Bollinger Source')

//

filterOption = input.string('SuperTrend', title='Signal Filter Option : ', options=['3xMATrend', 'SuperTrend', 'SuperTrend+3xMA', 'ColouredMA', 'No Alerts', 'MACross', 'MACross+ST', 'MACross+3xMA', 'OutsideIn:MACross', 'OutsideIn:MACross+ST', 'OutsideIn:MACross+3xMA'])

//

hideMALines = input(false)

hideSuperTrend = input(true)

hideBollingerBands = input(true)

hideTrendDirection = input(true)

//

disableFastMAFilter = input(false)

disableMediumMAFilter = input(false)

disableSlowMAFilter = input(false)

//

uKC = false // input(false,title="Use Keltner Channel (KC) instead of Bollinger")

bbLength = input.int(20, minval=2, step=1, title='Bollinge Bands Length')

bbStddev = input.float(2.0, minval=0.5, step=0.1, title='Bollinger Bands StdDevs')

oiLength = input(8, title='Bollinger Outside In LookBack')

//

SFactor = input.float(3.618, minval=1.0, title='SuperTrend Factor')

SPd = input.int(5, minval=1, title='SuperTrend Length')

//

buyColour_ = input.string('Green', title='BUY Marker Colour: ', options=['Green', 'Lime', 'Aqua', 'DodgerBlue', 'Gray', 'Yellow'])

sellColour_ = input.string('Maroon', title='SELL Marker Colour: ', options=['Maroon', 'Red', 'Fuchsia', 'Blue', 'Black', 'Orange'])

// --- Allocate Correct Filtering Choice

// Can only be one choice

uSuperTrendFilter = filterOption == 'SuperTrend' ? true : false

u3xMATrendFilter = filterOption == '3xMATrend' ? true : false

uBothTrendFilters = filterOption == 'SuperTrend+3xMA' ? true : false

//uOIFilter = filterOption == "OutsideIn:ClrMA" ? true : false

uOIMACrossFilter = filterOption == 'OutsideIn:MACross' ? true : false

uOI3xMAFilter = filterOption == 'OutsideIn:MACross+3xMA' ? true : false

uOISTFilter = filterOption == 'OutsideIn:MACross+ST' ? true : false

uMACrossFilter = filterOption == 'MACross' ? true : false

uMACrossSTFilter = filterOption == 'MACross+ST' ? true : false

uMACross3xMAFilter = filterOption == 'MACross+3xMA' ? true : false

// unless all 3 MAs disabled.

disable3xMAFilter = disableFastMAFilter and disableMediumMAFilter and disableSlowMAFilter

u3xMATrendFilter := disable3xMAFilter ? false : u3xMATrendFilter

// if no filters selected then must be "No Filters" option

disableAllFilters = u3xMATrendFilter or uSuperTrendFilter or uBothTrendFilters or uOI3xMAFilter or uOISTFilter or uOIMACrossFilter or uMACrossFilter or uMACrossSTFilter or uMACross3xMAFilter ? false : true

// if "No Alerts" option selected, then disable all selections

disableAllFilters := filterOption == 'No Alerts' ? false : disableAllFilters

uSuperTrendFilter := filterOption == 'No Alerts' ? false : uSuperTrendFilter

u3xMATrendFilter := filterOption == 'No Alerts' ? false : u3xMATrendFilter

uBothTrendFilters := filterOption == 'No Alerts' ? false : uBothTrendFilters

//uOIFilter := filterOption == "No Alerts"? false : uOIFilter

uOIMACrossFilter := filterOption == 'No Alerts' ? false : uOIMACrossFilter

uOI3xMAFilter := filterOption == 'No Alerts' ? false : uOI3xMAFilter

uOISTFilter := filterOption == 'No Alerts' ? false : uOISTFilter

uMACrossFilter := filterOption == 'No Alerts' ? false : uMACrossFilter

uMACrossSTFilter := filterOption == 'No Alerts' ? false : uMACrossSTFilter

uMACross3xMAFilter := filterOption == 'No Alerts' ? false : uMACross3xMAFilter

// --- CONSTANTS ---

dodgerblue = #1E90FF

lightcoral = #F08080

buyColour = color.green // for big Arrows, must be a constant.

sellColour = color.maroon // for big Arrows

// Colour Selectable for Big Fat Bars.

buyclr = buyColour_ == 'Lime' ? color.lime : buyColour_ == 'Aqua' ? color.aqua : buyColour_ == 'DodgerBlue' ? dodgerblue : buyColour_ == 'Gray' ? color.gray : buyColour_ == 'Yellow' ? color.yellow : color.green

sellclr = sellColour_ == 'Red' ? color.red : sellColour_ == 'Fuchsia' ? color.fuchsia : sellColour_ == 'Blue' ? color.blue : sellColour_ == 'Black' ? color.black : sellColour_ == 'Orange' ? color.orange : color.maroon

// === /INPUTS ===

// === FUNCTIONS ===

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len) =>

v1 = ta.sma(src, len) // Simple

v2 = ta.ema(src, len) // Exponential

v3 = ta.wma(src, len) // Weighted

v4 = ta.vwma(src, len) // Volume Weighted

v5 = 0.0

sma_1 = ta.sma(src, len) // Smoothed

v5 := na(v5[1]) ? sma_1 : (v5[1] * (len - 1) + src) / len

v6 = 2 * v2 - ta.ema(v2, len) // Double Exponential

v7 = 3 * (v2 - ta.ema(v2, len)) + ta.ema(ta.ema(v2, len), len) // Triple Exponential

v8 = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len))) // Hull WMA = (2*WMA (n/2) − WMA (n)), sqrt (n))

v11 = ta.sma(ta.sma(src, len), len) // Triangular

// SuperSmoother filter

// © 2013 John F. Ehlers

a1 = math.exp(-1.414 * 3.14159 / len)

b1 = 2 * a1 * math.cos(1.414 * 3.14159 / len)

c2 = b1

c3 = -a1 * a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1 * (src + nz(src[1])) / 2 + c2 * nz(v9[1]) + c3 * nz(v9[2])

// Zero Lag Exponential

e = ta.ema(v1, len)

v10 = v1 + v1 - e

// return variant, defaults to SMA if input invalid.

type == 'EMA' ? v2 : type == 'WMA' ? v3 : type == 'VWMA' ? v4 : type == 'SMMA' ? v5 : type == 'DEMA' ? v6 : type == 'TEMA' ? v7 : type == 'HullMA' ? v8 : type == 'SSMA' ? v9 : type == 'ZEMA' ? v10 : type == 'TMA' ? v11 : v1

// === /FUNCTIONS ===

// === SERIES VARIABLES ===

// MA's

ma_fast = variant(typeFast, ma_src, lenFast)

ma_medium = variant(typeMedium, ma_src, lenMedium)

ma_slow = variant(typeSlow, ma_src, lenSlow)

ma_coloured = variant(typeColoured, srcColoured, lenColoured)

// Get Direction of Coloured Moving Average

clrdirection = 1

falling_1 = ta.falling(ma_coloured, 2)

clrdirection := ta.rising(ma_coloured, 2) ? 1 : falling_1 ? -1 : nz(clrdirection[1], 1)

// get 3xMA trend direction based on selections.

madirection = ma_fast > ma_medium and ma_medium > ma_slow ? 1 : ma_fast < ma_medium and ma_medium < ma_slow ? -1 : 0

madirection := disableSlowMAFilter ? ma_fast > ma_medium ? 1 : ma_fast < ma_medium ? -1 : 0 : madirection

madirection := disableMediumMAFilter ? ma_fast > ma_slow ? 1 : ma_fast < ma_slow ? -1 : 0 : madirection

madirection := disableFastMAFilter ? ma_medium > ma_slow ? 1 : ma_medium < ma_slow ? -1 : 0 : madirection

madirection := disableFastMAFilter and disableMediumMAFilter ? ma_coloured > ma_slow ? 1 : -1 : madirection

madirection := disableFastMAFilter and disableSlowMAFilter ? ma_coloured > ma_medium ? 1 : -1 : madirection

madirection := disableSlowMAFilter and disableMediumMAFilter ? ma_coloured > ma_fast ? 1 : -1 : madirection

//

// Supertrend Calculations

SUp = hl2 - SFactor * ta.atr(SPd)

SDn = hl2 + SFactor * ta.atr(SPd)

STrendUp = 0.0

STrendDown = 0.0

STrendUp := close[1] > STrendUp[1] ? math.max(SUp, STrendUp[1]) : SUp

STrendDown := close[1] < STrendDown[1] ? math.min(SDn, STrendDown[1]) : SDn

STrend = 0

STrend := close > STrendDown[1] ? 1 : close < STrendUp[1] ? -1 : nz(STrend[1], 1)

Tsl = STrend == 1 ? STrendUp : STrendDown

// Standard Bollinger or KC Bands

basis = ta.sma(ma_src, bbLength)

rangema = ta.sma(ta.tr, bbLength)

stdev_1 = ta.stdev(ma_src, bbLength)

dev = uKC ? bbStddev * rangema : bbStddev * stdev_1

// Calculate Bollinger or KC Channel

upper = basis + dev

lower = basis - dev

// Lookback for previous highest bar index

noiupper = math.abs(ta.highestbars(oiLength))

noilower = math.abs(ta.lowestbars(oiLength))

// ColouredMA OutsideIn

//oiupper = clrdirection<0 and noiupper>0 and highest(oiLength)>upper[noiupper]? 1 : 0

//oilower = clrdirection>0 and noilower>0 and lowest(oiLength)<lower[noilower]? 1 : 0

// MACross OutsideIN

oiMACrossupper = ta.crossunder(ma_fast, ma_coloured) and noiupper > 0 and ta.highest(oiLength) > upper[noiupper] ? 1 : 0

oiMACrosslower = ta.crossover(ma_fast, ma_coloured) and noilower > 0 and ta.lowest(oiLength) < lower[noilower] ? 1 : 0

// === /SERIES VARIABLES ===

// === PLOTTING ===

// All the MA's

plot(ma_coloured, title='Coloured MA', color=clrdirection < 0 ? lightcoral : color.blue, linewidth=3, transp=20)

plot(hideMALines ? na : ma_fast, title='Fast MA', color=color.new(color.lime, 20), linewidth=2)

plot(hideMALines ? na : ma_medium, title='Medium MA', color=color.new(color.red, 10), linewidth=2)

plot(hideMALines ? na : ma_slow, title='Slow MA', color=color.new(color.gray, 10), linewidth=2)

// show 3xMA Trend Direction State.

dcolour = madirection == 1 ? color.green : madirection == -1 ? color.red : color.yellow

plotshape(hideTrendDirection ? na : madirection, title='3xMA Trend Direction', location=location.bottom, style=shape.square, color=dcolour, transp=10)

// SuperTrend

plot(hideSuperTrend ? na : Tsl, color=STrend == 1 ? color.green : color.maroon, style=plot.style_line, linewidth=2, title='SuperTrend')

// Bollinger Bands

p1 = plot(hideBollingerBands ? na : upper, title='BB upper', color=color.new(dodgerblue, 20), linewidth=1)

p2 = plot(hideBollingerBands ? na : lower, title='BB lower', color=color.new(dodgerblue, 20), linewidth=1)

fill(p1, p2, color=color.new(dodgerblue, 96), title='BB fill')

// === /PLOTTING ===

// === ALERTING ===

// 3xMA Filtering

_3xmabuy = 0

_3xmasell = 0

_3xmabuy := clrdirection == 1 and close > ma_fast and madirection == 1 ? nz(_3xmabuy[1]) + 1 : clrdirection == 1 and madirection == 1 ? nz(_3xmabuy[1]) > 0 ? nz(_3xmabuy[1]) + 1 : 0 : 0

_3xmasell := clrdirection == -1 and close < ma_fast and madirection == -1 ? nz(_3xmasell[1]) + 1 : clrdirection == -1 and madirection == -1 ? nz(_3xmasell[1]) > 0 ? nz(_3xmasell[1]) + 1 : 0 : 0

//

// SuperTrend Filtering

stbuy = 0

stsell = 0

stbuy := clrdirection == 1 and STrend == 1 ? nz(stbuy[1]) + 1 : 0

stsell := clrdirection == -1 and STrend == -1 ? nz(stsell[1]) + 1 : 0

//

// 3xMA & SuperTrend Filtering

//

st3xmabuy = 0

st3xmasell = 0

st3xmabuy := (disable3xMAFilter or _3xmabuy > 0) and stbuy > 0 ? nz(st3xmabuy[1]) + 1 : 0

st3xmasell := (disable3xMAFilter or _3xmasell > 0) and stsell > 0 ? nz(st3xmasell[1]) + 1 : 0

// Bollinger Outside In using ColuredMA direction Filter.

//oibuy = 0

//oisell = 0

//oibuy := clrdirection == 1 and oilower==1? nz(oibuy[1])+1 : 0

//oisell := clrdirection ==-1 and oiupper==1? nz(oisell[1])+1 : 0

// Bollinger Outside In using MACross signal Filter

oiMACrossbuy = 0

oiMACrosssell = 0

oiMACrossbuy := oiMACrosslower == 1 ? nz(oiMACrossbuy[1]) + 1 : 0

oiMACrosssell := oiMACrossupper == 1 ? nz(oiMACrosssell[1]) + 1 : 0

// Bollinger Outside In + 3xMA Filter

oi3xmabuy = 0

oi3xmasell = 0

oi3xmabuy := oiMACrossbuy > 0 and (disable3xMAFilter or madirection == 1) ? nz(oi3xmabuy[1]) + 1 : 0

oi3xmasell := oiMACrosssell > 0 and (disable3xMAFilter or madirection == -1) ? nz(oi3xmasell[1]) + 1 : 0

// Bollinger Outside In + SuperTrend Filter

oistbuy = 0

oistsell = 0

oistbuy := oiMACrossbuy > 0 and STrend == 1 ? nz(oistbuy[1]) + 1 : 0

oistsell := oiMACrosssell > 0 and STrend == -1 ? nz(oistsell[1]) + 1 : 0

// FastMA crossover HullMA and SuperTrend

macrossSTbuy = 0

macrossSTsell = 0

macrossSTbuy := ta.crossover(ma_fast, ma_coloured) and STrend == 1 ? nz(macrossSTbuy[1]) + 1 : 0

macrossSTsell := ta.crossunder(ma_fast, ma_coloured) and STrend == -1 ? nz(macrossSTsell[1]) + 1 : 0

// FastMA crossover HullMA and 3xMA

macross3xMAbuy = 0

macross3xMAsell = 0

macross3xMAbuy := ta.crossover(ma_fast, ma_coloured) and (disable3xMAFilter or madirection == 1) ? nz(macross3xMAbuy[1]) + 1 : 0

macross3xMAsell := ta.crossunder(ma_fast, ma_coloured) and (disable3xMAFilter or madirection == -1) ? nz(macross3xMAsell[1]) + 1 : 0

//

// Check any Alerts set

long = u3xMATrendFilter and _3xmabuy == 1 or uSuperTrendFilter and stbuy == 1 or uBothTrendFilters and st3xmabuy == 1 or uOI3xMAFilter and oi3xmabuy == 1 or uOISTFilter and oistbuy == 1 or uOIMACrossFilter and oiMACrossbuy == 1 or uMACrossSTFilter and macrossSTbuy == 1 or uMACross3xMAFilter and macross3xMAbuy == 1

short = u3xMATrendFilter and _3xmasell == 1 or uSuperTrendFilter and stsell == 1 or uBothTrendFilters and st3xmasell == 1 or uOI3xMAFilter and oi3xmasell == 1 or uOISTFilter and oistsell == 1 or uOIMACrossFilter and oiMACrosssell == 1 or uMACrossSTFilter and macrossSTsell == 1 or uMACross3xMAFilter and macross3xMAsell == 1

//

// If Alert Detected, then Draw Big fat liner

plotshape(long ? long : na, title='Long Line Marker', location=location.belowbar, style=shape.arrowup, color=buyclr, size=size.auto, text='████████████████', textcolor=buyclr, transp=20)

plotshape(short ? short : na, title='Short Line Marker', location=location.abovebar, style=shape.arrowdown, color=sellclr, size=size.auto, text='████████████████', textcolor=sellclr, transp=20)

// --- Arrow style signals

// No Filters only Hull Signals

hbuy = 0

hsell = 0

hbuy := clrdirection == 1 ? nz(hbuy[1]) + 1 : 0

hsell := clrdirection == -1 ? nz(hsell[1]) + 1 : 0

// FastMA crossover HullMA

macrossbuy = 0

macrosssell = 0

macrossbuy := ta.crossover(ma_fast, ma_coloured) ? nz(macrossbuy[1]) + 1 : 0

macrosssell := ta.crossunder(ma_fast, ma_coloured) ? nz(macrosssell[1]) + 1 : 0

//

along = disableAllFilters and hbuy == 1 or uMACrossFilter and macrossbuy == 1

ashort = disableAllFilters and hsell == 1 or uMACrossFilter and macrosssell == 1

//

// If ColouredMA or MACross then draw big arrows

plotarrow(along ? 1 : ashort ? -1 : na, title='ColouredMA or MACross Arrow', colorup=color.new(buyColour, 20), colordown=color.new(sellColour, 20), maxheight=100, minheight=50)

//----------Input Bannos----------------------------------------------------------------------------------------------------------//

var triggerlong = 0

var triggershort = 0

var up = 0

var down = 0

var bool longe = 0

var bool shorte = 0

var SL = 0

var entryvalueup = 0.00

var entryvaluedown = 0.00

var SLfactor = 0.5/100

var SLup = 0.00

var SLdown = 0.00

var longbuffer = 0

var shortbuffer = 0

//RSI parameters

overbought = input(70, title="overbought value")

oversold = input(30, title="oversold value")

sellRsi = ta.rsi(close, 11) > overbought

buyRsi = ta.rsi(close, 11) < oversold

var tampon_overbought = 0

var tampon_oversold = 0

//condition to use RSI

if sellRsi

tampon_overbought := 1

if buyRsi

tampon_oversold := 1

//close condition SL

if entryvalueup > 0 and low < SLup

SL := 1

//Chaikin Volatility Strategy indicator if Volatility > 0 then Long or short, otherweise no

Length = input.int(10, '', minval=1)

ROCLength = input.int(12, '',minval=1)

Trigger = input.int(0, '',minval=0)

hline(0)

hline(Trigger)

xPrice1 = high

xPrice2 = low

xPrice = xPrice1 - xPrice2

xROC_EMA = ta.roc(ta.ema(xPrice, Length), ROCLength)

var pos = 0

if xROC_EMA < Trigger

pos := 1

nz(pos[1], 0)

if xROC_EMA > Trigger

pos := -1

nz(pos[1], 0)

//-----------------------------------------------------------------------------

// plot(xROC_EMA, title="Chaikin Volatility Strategy")

// plot(longe ? 1 : 0, 'longe')

// plot(shorte ? 1 : 0, 'shorte')

plot(entryvalueup, 'entree Long')

plot(SLup, 'SL Long')

plot(entryvaluedown, 'entree Short')

plot(SLdown, 'SL Short')

// plot(entryvalueup, 'entrryvalueup')

// plot(entryvaluedown, 'entrryvaluedown')

// plot(up, 'up')

//plot(down, 'down')

// plot(ta.rsi(close, 11), 'RSI')

// plot(tampon_overbought, 'tampon Overbought')

// plot(tampon_oversold, 'tampon Oversold')

// plot( triggerlong, ' triggerlong')

//plot( triggershort, ' triggershort')

// plot(sellRsi ? 1 : 0, 'sellRsi')

//close condition TP

closelong = (tampon_overbought == 1 and ta.rsi(close, 11) < 63.8 or shorte or SL == 1)

closeshort = (tampon_oversold == 1 and ta.rsi(close, 11) > 36.2 or longe or SL == 1)

//reinit after long Close

if closelong

up := 0

longe := 0

tampon_overbought := 0

triggerlong := 0

SL := 0

entryvalueup := 0

SLup := 0

//reinit after short Close

if closeshort

down := 0

shorte := 0

tampon_oversold := 0

triggershort := 0

SL := 0

entryvaluedown := 0

SLdown := 0

//condition sous sur MA SLOW to start

if close < ma_medium

triggerlong := 0

triggershort := 1

if close > ma_medium

triggershort := 0

triggerlong := 1

// Update alarm conditions

if long or along

longbuffer := 1

if short or ashort

shortbuffer := 1

longe := longbuffer and triggerlong and xROC_EMA > 3.5

shorte := shortbuffer and triggershort and xROC_EMA > 3.5

// // var longe = long ? 1 : 0

// // var shorte = short ? 1 : 0

if longe == 1 and close > open

up := 1

down := 0

entryvalueup :=close

SLup := close - 0.7*(high - low)

SLdown := 0

longbuffer := 0

if shorte == 1 and close < open

down := 1

up := 0

entryvaluedown := close

SLdown := close + 0.7*(high - low)

SLup := 0

shortbuffer := 0

strategy.entry('longe', strategy.long, 1, when = up)

strategy.entry('shorte', strategy.short, 1, when = down)

strategy.close('longe', when= closelong)

strategy.close('shorte', when= closeshort)

// === /ALERTING ===

// === ALARMS ===

//

alertcondition(up or down or closelong or closeshort, title='Signal Alert', message='SIGNAL')

alertcondition(up, title='Long Alert', message='LONG')

alertcondition(down, title='Short Alert', message='SHORT')

alertcondition(closelong, title='close Long Alert', message='Close LONG')

alertcondition(closeshort, title='close Short Alert', message='Close SHORT')

// === /ALARMS ===

//EOF