Tambahkan secara beransur-ansur pada strategi penembusan purata bergerak

Gambaran keseluruhan

Strategi ini menggunakan cara kenaikan kedudukan secara beransur-ansur, berdasarkan perbandingan harga penutupan dengan harga penutupan hari sebelumnya. Apabila dinilai sebagai peluang kenaikan, ia akan meningkat secara beransur-ansur beberapa kali; Apabila dinilai sebagai peluang penurunan, ia akan meningkat secara beransur-ansur.

Prinsip Strategi

Bandingkan harga penutupan K Line semasa dengan harga penutupan K Line sebelumnya[1], jika close > close[1], maka ia akan dianggap sebagai peluang untuk melihat, dan longCondition=1; jika close < close[1], jika dilihat sebagai peluang penurunan harga, letakkan shortCondition=1。

Dalam tempoh masa yang dibenarkan untuk berdagang, jika longCondition = 1, maka anda akan mendapat lebih banyak; jika shortCondition = 1, maka anda akan mendapat lebih sedikit.

Pemasangan ditetapkan oleh parameter pyramiding, boleh dipilih 1 hingga 5 kali pemasangan, secara lalai 4 kali.

Setiap kali anda menaikkan saham, anda akan meletakkan syarat perlindungan, dan jika keadaan berubah, anda akan segera menghentikan kerugian.

Anda boleh memilih untuk mengeluarkan isyarat dagangan ke pelbagai antara muka dagangan, seperti toast, telegram dan sebagainya.

Strategi ini mempertimbangkan kelebihan strategi jenis terobosan dan strategi jenis rata-rata, mengambil pendekatan untuk meningkatkan kedudukan secara beransur-ansur apabila bullish atau bearish, dapat mengesan trend dengan baik dan dapat mengawal risiko. Pada masa yang sama menggabungkan penapisan masa, untuk mengelakkan isyarat GENERATED pada masa perdagangan bukan utama.

Analisis kelebihan

“Penggunaan modal yang lebih kecil untuk menjejaki trend lebih baik”

Kemudahan dan Fleksibiliti

Memilih antara muka dagangan yang berbeza, jenis kuantiti yang luas

Mekanisme Hentikan Kerosakan, Risiko yang Boleh Dikendalikan

Fungsi penapis masa untuk mengelakkan isyarat salah

Analisis risiko

Penetapan parameter yang tidak betul boleh menyebabkan peningkatan kerugian

Masalah rangkaian mungkin menyebabkan kegagalan untuk menghentikan kerosakan pada masa yang tepat

Parameter perlu diselaraskan dengan baik untuk pelbagai jenis

Stop loss yang tepat untuk mengunci keuntungan

Penyelesaian:

Menyesuaikan jumlah kenaikan, 4 adalah pilihan.

Semak sambungan rangkaian

Parameter penyesuaian mengikut ciri-ciri varieti

Tetapkan Stop Loss

Arah pengoptimuman

Anda boleh pertimbangkan untuk menambah lebih banyak indikator untuk menilai kekuatan isyarat.

Boleh menguji kesan pengoptimuman parameter pelbagai varieti

Parameter pengoptimuman algoritma pembelajaran mesin boleh dimasukkan

Pengurusan risiko yang boleh dioptimumkan

ringkaskan

Strategi penembusan garisan rata-rata kenaikan pangkat ini menggabungkan kelebihan pengesanan trend dan kawalan risiko, mengikuti trend dengan cara kenaikan pangkat secara beransur-ansur apabila keputusan dibuat mengenai isyarat yang berkesan, mengawal celah risiko dengan menyesuaikan bilangan kenaikan pangkat. Ia juga menggabungkan fungsi seperti penapisan tempoh masa untuk mengawal isyarat yang salah.

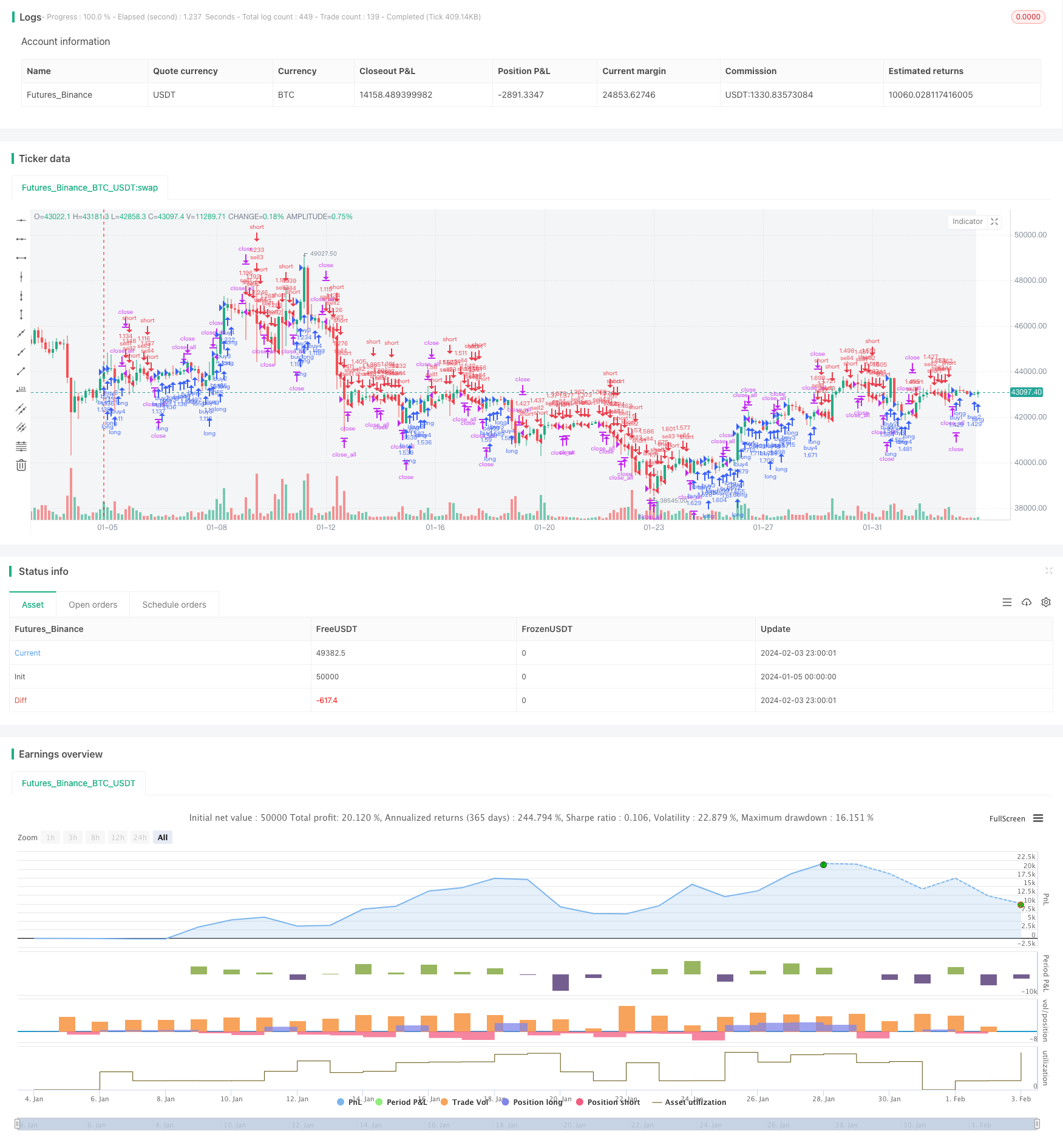

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © torresbitmex

//@version=5

strategy("torres_strategy_real_test_v1.0", process_orders_on_close=true, overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_value=0.03, calc_on_order_fills=false, pyramiding=4)

in_trade(int start_time, int end_time) =>

allowedToTrade = (time>=start_time) and (time<=end_time)

if barstate.islastconfirmedhistory

var myLine = line(na)

line.delete(myLine)

myLine := line.new(start_time, low, start_time, high, xloc=xloc.bar_time, color = color.rgb(255, 153, 0, 50), width = 3, extend = extend.both, style = line.style_dashed)

allowedToTrade

// 매매시간세팅

start_time = input(timestamp("31 Jan 2024 00:00 +0900"), title="매매 시작", group='매매 시간세팅')

end_time = input(timestamp("31 Dec 2030 00:00 +0900"), title="매매 종료", group='매매 시간세팅')

start_trade = true

bgcolor(start_trade ? color.new(color.gray, 90) : color(na))

var bool Alarm_TVExtbot = false

var bool Alarm_Alert = false

bot_mode = input.string(title='봇선택', defval = "POA", options = ["TVEXTBOT", "POA"], group = "봇선택", inline = '1')

if bot_mode == "TVEXTBOT"

Alarm_TVExtbot := true

else if bot_mode == "POA"

Alarm_Alert := true

else

Alarm_TVExtbot := false

Alarm_Alert := false

// 계정정보

account = input.string(title='계정', defval='아무거나입력', inline='1', group='계정정보')

token = input.string(title='TVExtBot 인증키', defval='', inline='1', group='계정정보')

mul_input = input.float(4, minval=1, maxval=5, step=1, title="분할진입수", group='진입 세팅', inline='1')

// 진입주문메세지입력

buyOrderid = input.string(title='롱 진입1', defval='', group='진입주문 메세지입력', inline='2')

buyOrderid2 = input.string(title='롱 진입2', defval='', group='진입주문 메세지입력', inline='3')

buyOrderid3 = input.string(title='롱 진입3', defval='', group='진입주문 메세지입력', inline='4')

buyOrderid4 = input.string(title='롱 진입4', defval='', group='진입주문 메세지입력', inline='5')

buyOrderid5 = input.string(title='롱 진입5', defval='', group='진입주문 메세지입력', inline='6')

sellOrderid = input.string(title='숏 진입1', defval='', group='진입주문 메세지입력', inline='2')

sellOrderid2 = input.string(title='숏 진입2', defval='', group='진입주문 메세지입력', inline='3')

sellOrderid3 = input.string(title='숏 진입3', defval='', group='진입주문 메세지입력', inline='4')

sellOrderid4 = input.string(title='숏 진입4', defval='', group='진입주문 메세지입력', inline='5')

sellOrderid5 = input.string(title='숏 진입5', defval='', group='진입주문 메세지입력', inline='6')

// 종료주문메세지입력

buycloseOrderid = input.string(title='롱 전체종료', defval='', group='종료주문 메세지입력', inline='1')

sellcloseOrderid = input.string(title='숏 전체종료', defval='', group='종료주문 메세지입력', inline='1')

longCondition = 0, shortCondition = 0

if(close[1] < close)

longCondition := 1

else

longCondition := 0

if(close[1] > close)

shortCondition := 1

else

shortCondition := 0

if start_trade

if Alarm_Alert

if strategy.position_size == 0

if (longCondition == 1)

strategy.entry("buy1", strategy.long, alert_message = buyOrderid)

if (shortCondition == 1)

strategy.entry("sell1", strategy.short, alert_message = sellOrderid)

if strategy.position_size > 0

if (longCondition == 1)

if (strategy.opentrades == 1) and (mul_input == 2 or mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("buy2", strategy.long, alert_message = buyOrderid2)

if (strategy.opentrades == 2) and (mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("buy3", strategy.long, alert_message = buyOrderid3)

if (strategy.opentrades == 3) and (mul_input == 4 or mul_input == 5)

strategy.entry("buy4", strategy.long, alert_message = buyOrderid4)

if (strategy.opentrades == 4) and (mul_input == 5)

strategy.entry("buy5", strategy.long, alert_message = buyOrderid5)

if strategy.position_size < 0

if (shortCondition == 1)

if (strategy.opentrades == 1) and (mul_input == 2 or mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("sell2", strategy.short, alert_message = sellOrderid2)

if (strategy.opentrades == 2) and (mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("sell3", strategy.short, alert_message = sellOrderid3)

if (strategy.opentrades == 3) and (mul_input == 4 or mul_input == 5)

strategy.entry("sell4", strategy.short, alert_message = sellOrderid4)

if (strategy.opentrades == 4) and (mul_input == 5)

strategy.entry("sell5", strategy.short, alert_message = sellOrderid5)

if (longCondition == 1 and strategy.position_size > 0)

if mul_input == 1 and strategy.opentrades == 1

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if mul_input == 2 and strategy.opentrades == 2

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if mul_input == 3 and strategy.opentrades == 3

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if mul_input == 4 and strategy.opentrades == 4

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if mul_input == 5 and strategy.opentrades == 5

strategy.close_all(comment='롱전체종료', alert_message = buycloseOrderid)

if (shortCondition == 1 and strategy.position_size < 0)

if mul_input == 1 and strategy.opentrades == 1

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

if mul_input == 2 and strategy.opentrades == 2

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

if mul_input == 3 and strategy.opentrades == 3

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

if mul_input == 4 and strategy.opentrades == 4

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

if mul_input == 5 and strategy.opentrades == 5

strategy.close_all(comment='숏전체종료', alert_message = sellcloseOrderid)

else if Alarm_TVExtbot

if strategy.position_size == 0

if (longCondition == 1)

strategy.entry("buy1", strategy.long, alert_message = '롱 1차 진입 📈📈 TVM:{"orderid":"' + buyOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (shortCondition == 1)

strategy.entry("sell1", strategy.short, alert_message = '숏 1차 진입 📉📉 TVM:{"orderid":"' + sellOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if strategy.position_size > 0

if (longCondition == 1)

if (strategy.opentrades == 1) and (mul_input == 2 or mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("buy2", strategy.long, alert_message = '롱 2차 진입 📈📈 TVM:{"orderid":"' + buyOrderid2 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 2) and (mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("buy3", strategy.long, alert_message = '롱 3차 진입 📈📈 TVM:{"orderid":"' + buyOrderid3 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 3) and (mul_input == 4 or mul_input == 5)

strategy.entry("buy4", strategy.long, alert_message = '롱 4차 진입 📈📈 TVM:{"orderid":"' + buyOrderid4 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 4) and (mul_input == 5)

strategy.entry("buy5", strategy.long, alert_message = '롱 5차 진입 📈📈 TVM:{"orderid":"' + buyOrderid5 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if strategy.position_size < 0

if (shortCondition == 1)

if (strategy.opentrades == 1) and (mul_input == 2 or mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("sell2", strategy.short, alert_message = '숏 2차 진입 📉📉 TVM:{"orderid":"' + sellOrderid2 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 2) and (mul_input == 3 or mul_input == 4 or mul_input == 5)

strategy.entry("sell3", strategy.short, alert_message = '숏 3차 진입 📉📉 TVM:{"orderid":"' + sellOrderid3 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 3) and (mul_input == 4 or mul_input == 5)

strategy.entry("sell4", strategy.short, alert_message = '숏 4차 진입 📉📉 TVM:{"orderid":"' + sellOrderid4 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (strategy.opentrades == 4) and (mul_input == 5)

strategy.entry("sell5", strategy.short, alert_message = '숏 5차 진입 📉📉 TVM:{"orderid":"' + sellOrderid5 + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (longCondition == 1 and strategy.position_size > 0)

if mul_input == 1 and strategy.opentrades == 1

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 2 and strategy.opentrades == 2

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 3 and strategy.opentrades == 3

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 4 and strategy.opentrades == 4

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 5 and strategy.opentrades == 5

strategy.close_all(comment='롱전체종료', alert_message = '롱 종료 📈⛔TVM:{"orderid":"' + buycloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if (shortCondition == 1 and strategy.position_size < 0)

if mul_input == 1 and strategy.opentrades == 1

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 2 and strategy.opentrades == 2

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 3 and strategy.opentrades == 3

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 4 and strategy.opentrades == 4

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')

if mul_input == 5 and strategy.opentrades == 5

strategy.close_all(comment='숏전체종료', alert_message = '숏 종료 📉⛔TVM:{"orderid":"' + sellcloseOrderid + '","memo":"' + account + '","token":"' + token + '"}:MVT')