Strategi penjejakan aliran terobosan gabungan penunjuk

Gambaran keseluruhan

Strategi ini dinamakan sebagai strategi penjejakan trend memecah gabungan indikator. Strategi ini menggunakan pelbagai indikator secara komprehensif, mengenal pasti arah trend pasaran, melakukan operasi penjejakan trend.

- Menggunakan penunjuk trend gelombang untuk menilai trend utama pasaran

- Gabungan RSI dan Capital Flow Filter sebahagian daripada isyarat palsu

- Indeks EMA menilai arah tindakan tertentu

- Pendaftaran menggunakan kaedah pengesanan terobosan untuk memastikan trend berjalan.

Prinsip Strategi

Strategi ini terutamanya menilai arah dan kekuatan trend besar, dan menetapkan perdagangan dua hala yang banyak. Prinsip operasi khusus adalah sebagai berikut:

Isyarat masuk pelbagai arah:

- Harga lebih tinggi daripada EMA 200 hari, menunjukkan di pasaran yang lebih tinggi

- Harga kembali ke EMA 50 hari untuk membentuk sokongan

- Indeks gelombang berbalik ke arah naik dan isyarat beli muncul

- RSI dan MFI menunjukkan kelebihan beli

- 3 Garis K Berturut-turut Menembusi EMA 50 Hari

Isyarat kemasukan: Berbeza dengan isyarat masuk berbilang arah

Cara untuk menghentikan kerugian: Terdapat dua pilihan: harga terendah / harga teratas terhad, ATR terhad

Analisis kelebihan strategi

Strategi ini mempunyai kelebihan berikut:

- Menggabungkan pelbagai petunjuk untuk menilai trend utama dan mengelakkan terobosan palsu

- Menggunakan EMA untuk menilai arah operasi, mudah untuk mengesan trend

- Menjejaki Hentikan Kerugian untuk Menjana Keuntungan Berterusan

- Ia boleh melakukan lebih banyak shorting pada masa yang sama, mengikut arah pasaran.

Analisis risiko strategi

Strategi ini mempunyai beberapa risiko:

- Kebarangkalian penunjuk memberi isyarat salah

- Tetapan titik henti terlalu kecil, meningkatkan risiko henti

- Lebih banyak transaksi, kos transaksi adalah kerugian tersembunyi

Untuk mengurangkan risiko di atas, anda boleh mengoptimumkan dalam beberapa aspek:

- Menyesuaikan parameter penunjuk, menapis isyarat silap

- Melepaskan titik hentian yang sesuai

- Optimumkan parameter penunjuk untuk mengurangkan jumlah transaksi

Arah pengoptimuman strategi

Dari segi kod, strategi ini boleh dioptimumkan dengan cara berikut:

- Menyesuaikan parameter RSI dan MFI untuk memilih kombinasi parameter terbaik

- Uji prestasi pelbagai parameter kitaran EMA

- Menyesuaikan Factor Rasio Risiko Keuntungan Stop Loss untuk mendapatkan konfigurasi yang optimum

Dengan penyesuaian dan ujian parameter, strategi dapat meminimumkan risiko dan penarikan balik sambil memaksimumkan keuntungan.

ringkaskan

Strategi ini menggunakan pelbagai indikator untuk menentukan arah trend besar, menggunakan indikator EMA sebagai isyarat operasi khusus, dan menggunakan kaedah berhenti kehilangan untuk mengunci keuntungan. Dengan mengoptimumkan parameter, keuntungan yang lebih stabil dapat diperoleh. Tetapi juga harus berhati-hati dengan risiko sistem tertentu, perlu sentiasa memperhatikan kesan indikator dan perubahan keadaan pasaran.

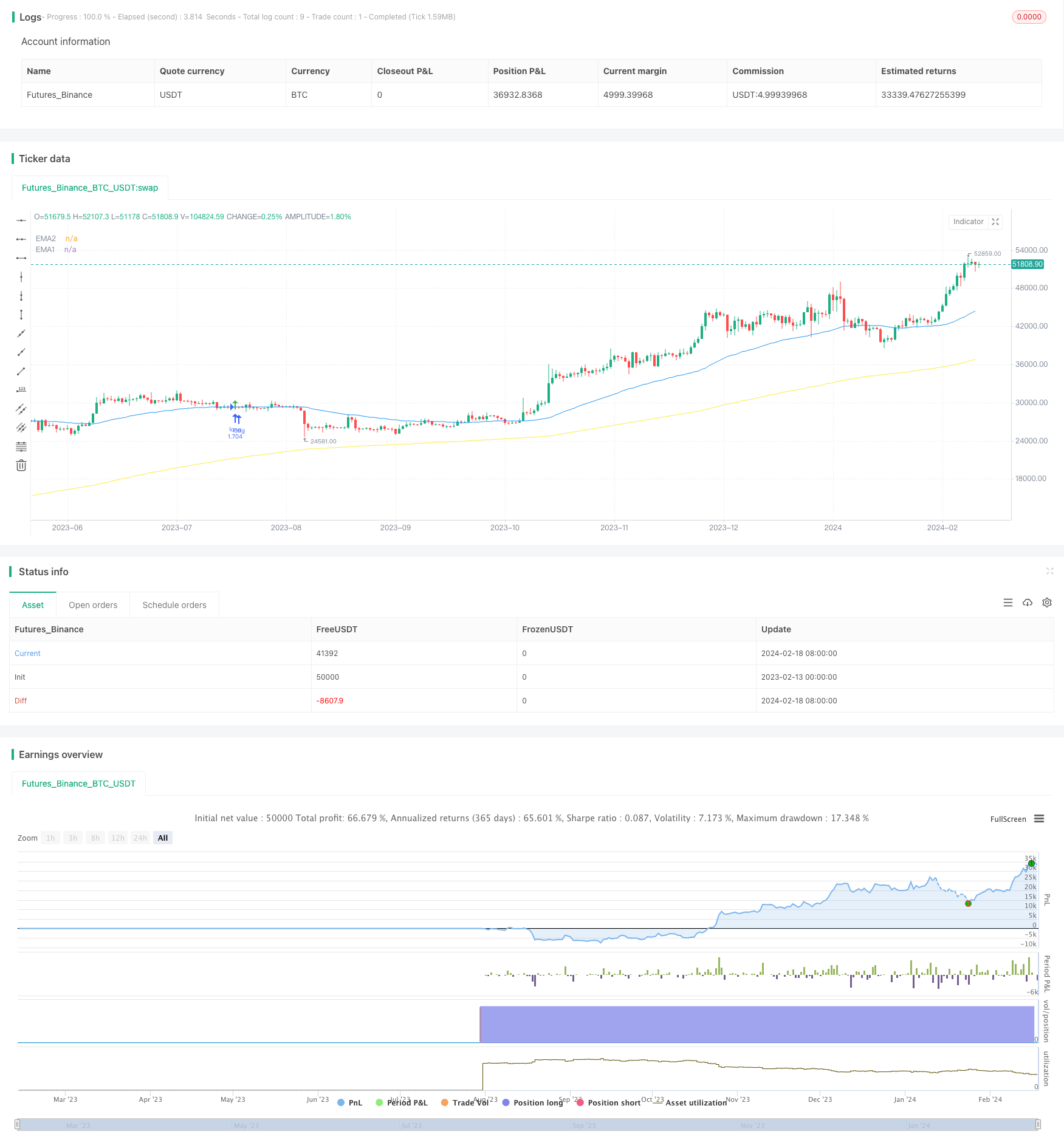

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Lowest Low/ Highest High & ATR Stop Loss/ Take Profit

//Optimized for the 30 minutes chart

strategy(title="TradePro's Trading Idea Cipher B+ Divergence EMA Pullback Strategy", shorttitle="WT MFI RSI EMA PB STRAT", overlay = true, pyramiding = 0, max_bars_back=5000, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=5000, currency=currency.USD)

// { Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2020,title="FromYear",minval=2016)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

zeroline = 0

// } Time Range

// { Wavetrend, RSI, MFI

// WaveTrend

cl = input(12, "Channel Length")

al = input(12, "Average Length")

overbought = input(53, title = 'WT Overbought Level 1', type = input.integer)

oversold = input(-53, title = 'WT Oversold Level 1', type = input.integer)

ap = hlc3

esa = ema(ap, cl)

d = ema(abs(ap - esa), cl)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, al)

wt1 = tci

wt2 = sma(wt1,4)

wtOs = wt2 <= oversold

wtOb = wt2 >= overbought

wtX = cross(wt1, wt2)

wtUp = wt2 - wt1 <= 0

wtDown = wt2 - wt1 >= 0

buySignal = wtX and wtOs and wtUp

sellSignal = wtX and wtOb and wtDown

// RSI & MFI

rsiMFIPosY = input(2, title = 'MFI Area Y Pos', type = input.float)

rsiMFIperiod = input(80,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(200, title = 'MFI Area multiplier', type = input.float)

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

// } Wavetrend, RSI, MFI

// { EMA

emasrc = close

res = input(title="EMA Timeframe", type=input.resolution, defval="30")

len1 = input(title="EMA1 Length", type=input.integer, defval=200)

col1 = color.yellow

len2 = input(title="EMA2 Length", type=input.integer, defval=50)

col2 = color.blue

// Calculate EMA

ema1 = ema(emasrc, len1)

emaSmooth1 = security(syminfo.tickerid, res, ema1, barmerge.gaps_off, barmerge.lookahead_off)

ema2 = ema(emasrc, len2)

emaSmooth2 = security(syminfo.tickerid, res, ema2, barmerge.gaps_off, barmerge.lookahead_off)

// Draw EMA

plot(emaSmooth1, title="EMA1", linewidth=1, color=col1)

plot(emaSmooth2, title="EMA2", linewidth=1, color=col2)

// } EMA

// { Long Entry

enablelong = input(true, title="Enable long?")

//Long Signal

upcondition = close > emaSmooth1

wavetrendlong = wt1 and wt2 < zeroline

mfilong = rsiMFI > 0

emapblong1 = (close > emaSmooth2) and (close[1] < emaSmooth2[1])

emapblong2 = ((close[2] > emaSmooth2[2]) and (close[3] > emaSmooth2[3]) and (close[4] > emaSmooth2[4])) or ((close[5] > emaSmooth2[5]) and (close[6] > emaSmooth2[6]) and (close[7] > emaSmooth2[7])) or ((close[8] > emaSmooth2[8]) and (close[9] > emaSmooth2[9]) and (close[10] > emaSmooth2[10]))

longcondition = upcondition and wavetrendlong and buySignal and mfilong and emapblong1 and emapblong2

//strategy buy long

if (longcondition) and (afterStartDate) and strategy.opentrades < 1 and (enablelong == true)

strategy.entry("long", strategy.long)

plotshape(longcondition, style=shape.arrowup,

location=location.abovebar, color=color.green)

// } Long Entry

// { Short Entry

enableshort = input(true, title="Enable short?")

//Short Signal

downcondition = close < emaSmooth1

wavetrendshort = wt1 and wt2 > zeroline

mfishort = rsiMFI < 0

emapbshort1 = (close < emaSmooth2) and (close[1] > emaSmooth2[1])

emapbshort2 = ((close[2] < emaSmooth2[2]) and (close[3] < emaSmooth2[3]) and (close[4] < emaSmooth2[4])) or ((close[5] < emaSmooth2[5]) and (close[6] < emaSmooth2[6]) and (close[7] < emaSmooth2[7])) or ((close[8] < emaSmooth2[8]) and (close[9] < emaSmooth2[9]) and (close[10] < emaSmooth2[10]))

shortcondition = downcondition and wavetrendshort and sellSignal and mfishort and emapbshort1 and emapbshort2

//strategy buy short

if (shortcondition) and (afterStartDate) and strategy.opentrades < 1 and (enableshort == true)

strategy.entry("short", strategy.short)

plotshape(shortcondition, style=shape.arrowdown,

location=location.belowbar, color=color.red)

// } Short Entry

// { Exit Conditions

bought = strategy.position_size[1] < strategy.position_size

sold = strategy.position_size[1] > strategy.position_size

barsbought = barssince(bought)

barssold = barssince(sold)

slbuffer = input(title="SL Buffer", type=input.float, step=0.1, defval=0)

// } Exit Conditions

// { Lowest Low/ Highes High Exit Condition

enablelowhigh = input(false, title="Enable lowest low/ highest high exit?")

//Lowest Low LONG

profitfactorlong = input(title="ProfitfactorLong", type=input.float, step=0.1, defval=2)

loLen = input(title="Lowest Low Lookback", type=input.integer,

defval=50, minval=2)

stop_level_long = lowest(low, loLen)[1]

if enablelowhigh == true and strategy.position_size>0

profit_level_long = strategy.position_avg_price + ((strategy.position_avg_price - stop_level_long[barsbought])*profitfactorlong) + slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_long[barsbought] - slbuffer, limit=profit_level_long)

//Lowest Low SHORT

profitfactorshort = input(title="ProfitfactorShort", type=input.float, step=0.1, defval=2)

highLen = input(title="highest high lookback", type=input.integer,

defval=50, minval=2)

stop_level_short = highest(high, highLen)[1]

if enablelowhigh == true and strategy.position_size<0

profit_level_short = strategy.position_avg_price - ((stop_level_short[barssold] - strategy.position_avg_price)*profitfactorshort) - slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_short[barssold] + slbuffer, limit=profit_level_short)

// } Lowest Low/ Highes High Exit Condition

// { ATR Take Profit/ Stop Loss

enableatr = input(true, title="Enable ATR exit?")

atrprofitfactorlong = input(title="ATR Profitfactor Long", type=input.float, step=0.1, defval=6)

atrstopfactorlong = input(title="ATR Stopfactor Long", type=input.float, step=0.1, defval=5)

atrprofitfactorshort = input(title="ATR Profitfactor Short", type=input.float, step=0.1, defval=3)

atrstopfactorshort = input(title="ATR Stopfactor Short", type=input.float, step=0.1, defval=5)

//ATR

lengthATR = input(title="ATR Length", defval=11, minval=1)

atr = atr(lengthATR)

//LONG EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barsbought1 = barssince(bought)

profit_level = strategy.position_avg_price + (atr*atrprofitfactorlong)

stop_level = strategy.position_avg_price - (atr*atrstopfactorlong)

strategy.exit("Take Profit/ Stop Loss", "long", stop=stop_level[barsbought1], limit=profit_level[barsbought1])

//SHORT EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barssold1 = barssince(sold)

profit_level = strategy.position_avg_price - (atr*atrprofitfactorshort)

stop_level = strategy.position_avg_price + (atr*atrstopfactorshort)

strategy.exit("Take Profit/ Stop Loss", "short", stop=stop_level[barssold1], limit=profit_level[barssold1])

// } ATR Take Profit/ Stop Loss