Strategi Mengikuti Trend Crossover DEMA

Gambaran keseluruhan

Strategi ini adalah berdasarkan crossover dari moving averages dua indeks ((DEMA) sebagai isyarat perdagangan, menggunakan kaedah trend track, secara automatik menetapkan stop loss dan berhenti. Strategi ini mempunyai kelebihan bahawa isyarat perdagangan adalah jelas, stop loss stop setting fleksibel, dapat mengawal risiko dengan berkesan.

Prinsip Strategi

Hitung talian cepat DEMA ((8 hari), talian perlahan DEMA ((24 hari) dan talian tambahan DEMA ((boleh dikonfigurasi)

Apabila melintasi jalur lambat menghasilkan isyarat garpu emas, lakukan lebih banyak; apabila melintasi jalur lambat menghasilkan isyarat garpu mati, lakukan kosong.

Menambah penapis isyarat perdagangan, hanya menghasilkan isyarat jika nilai hari ini pada baris tambahan lebih tinggi daripada hari sebelumnya, untuk mengelakkan penembusan palsu.

Menggunakan mekanisme penyekatan trend, garis penyekatan akan disesuaikan dengan pergerakan harga, memastikan titik penyekatan mengunci sebahagian daripada keuntungan.

Pada masa yang sama, anda boleh menetapkan stop loss dan stop loss dalam peratusan tetap untuk mengawal kerugian dan keuntungan maksimum dalam satu perdagangan.

Kelebihan Strategik

Isyarat dagangan jelas, mudah untuk menentukan masa masuk dan keluar.

Algoritma DEMA berganda lebih lancar, mengelakkan pengoptimuman berlebihan, dan isyarat lebih dipercayai.

Penapisan saluran bantu meningkatkan keputusan isyarat dan mengurangkan isyarat palsu.

Menggunakan trend tracking stop loss, boleh mengunci sebahagian daripada keuntungan, dan mengawal risiko dengan berkesan.

Tetapkan peratusan yang tetap untuk menghentikan kerugian, mengawal kerugian maksimum dalam satu perdagangan, dan mengelakkan risiko melebihi had.

Risiko Strategik

Dalam keadaan yang tidak menentu, ia boleh menyebabkan perdagangan yang kerap, mudah untuk meningkatkan kedudukan, dan menyebabkan kerugian strategi.

Tetapan persentasikan kerugian tetap terlalu besar, yang boleh mencetuskan kerugian besar dalam keadaan yang tidak biasa.

DEMA berselang dengan isyarat ketinggalan, membeli berhampiran dengan harga tinggi dalam keadaan pantas akan meningkatkan risiko kerugian.

Kos slippage akan mempengaruhi keuntungan semasa menggunakan cakera keras, dan parameter stop-loss perlu disesuaikan.

Pengoptimuman Strategi

Parameter DEMA boleh disesuaikan mengikut keadaan pasaran untuk mencari titik keseimbangan terbaik.

Dalam cakera keras, pertimbangkan kos slippage dan perlu meluaskan jangkauan stop loss tetap.

Indikator penilaian tambahan seperti MACD boleh ditambah untuk meningkatkan kesan isyarat.

Anda boleh menetapkan tahap stop loss untuk mengesan dan mengoptimumkan logik stop loss.

ringkaskan

Strategi ini menggunakan keupayaan penghakiman trend DEMA, digabungkan dengan mekanisme pengesanan trend untuk mengawal risiko, merupakan wakil yang sangat tipikal dalam sistem strategi perdagangan untuk menentukan arah trend. Secara keseluruhannya, strategi ini memberi isyarat yang jelas, penempatan stop loss yang munasabah, dan merupakan strategi perdagangan yang mudah dikuasai dan berisiko.

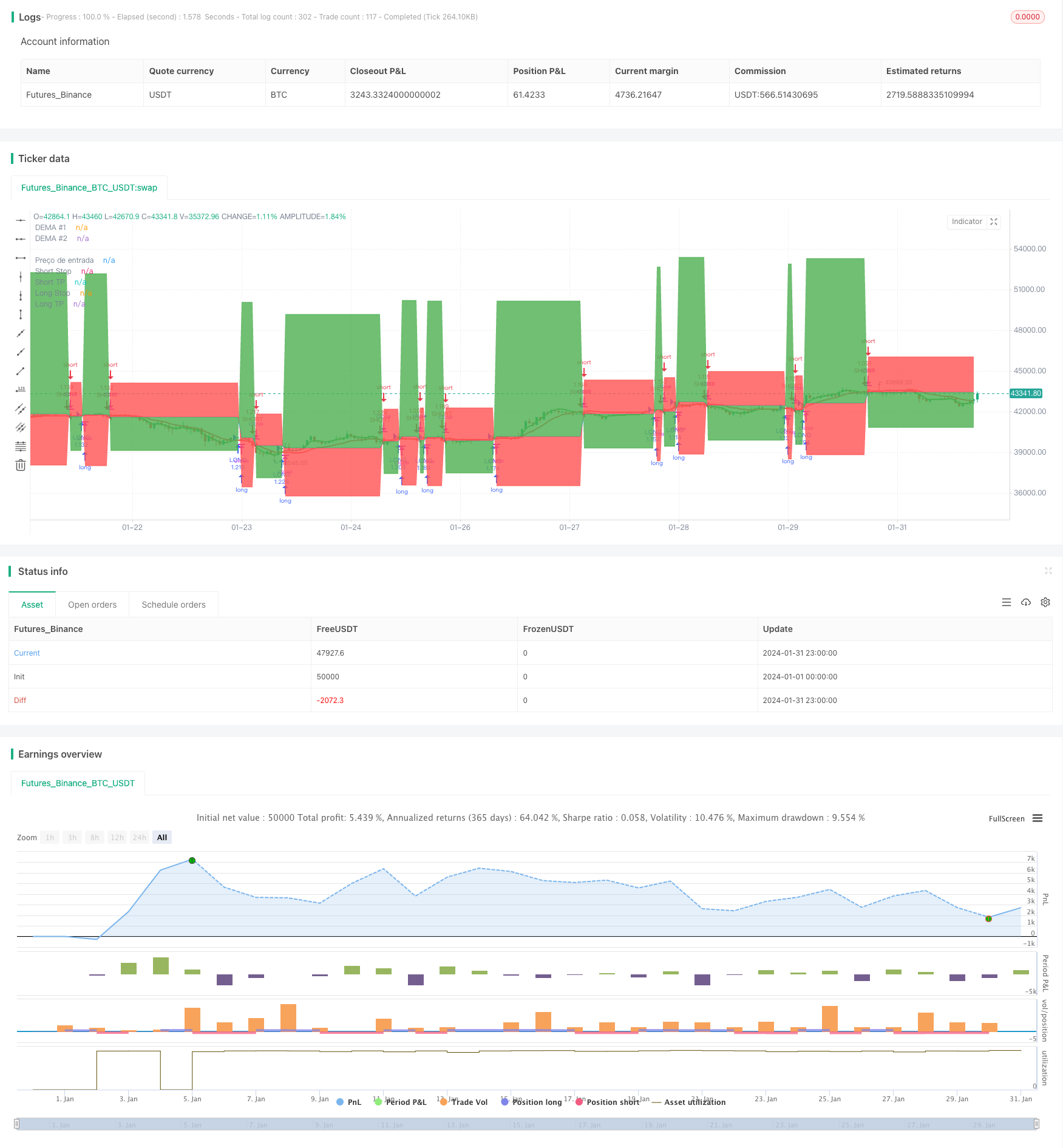

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © zeguela

//@version=4

strategy(title="ZEGUELA DEMABOT", commission_value=0.063, commission_type=strategy.commission.percent, initial_capital=100, default_qty_value=90, default_qty_type=strategy.percent_of_equity, overlay=true, process_orders_on_close=true)

// Step 1. Script settings

// Input options

srcData = input(title="Source Data", type=input.source, defval=close)

// Length settings

len1 = input(title="Length DEMA #1", type=input.integer, defval=8, minval=1)

len2 = input(title="Length DEMA #2", type=input.integer, defval=24, minval=0)

len3 = input(title="Length DEMA #3", type=input.integer, defval=0, minval=0)

// Step 2. Calculate indicator values

// Function that calculates the DEMA

DEMA(series, length) =>

if (length > 0)

emaValue = ema(series, length)

2 * emaValue - ema(emaValue, length)

else

na

// Calculate the DEMA values

demaVal1 = DEMA(srcData, len1)

demaVal2 = DEMA(srcData, len2)

demaVal3 = DEMA(srcData, len3)

// Step 3. Determine indicator signals

// See if there's a DEMA crossover

demaCrossover = if (len2 > 0) and (len3 > 0)

crossover(demaVal1, demaVal2) and (demaVal3 > demaVal3[1])

else

if (len2 > 0) and (len3 == 0)

crossover(demaVal1, demaVal2)

else

if (len3 > 0) and (len2 == 0)

crossover(demaVal1, demaVal3)

else

crossover(close, demaVal1)

// Check if there's a DEMA crossunder

demaCrossunder = if (len2 > 0) and (len3 > 0)

crossunder(demaVal1, demaVal2) and (demaVal3 < demaVal3[1])

else

if (len2 > 0) and (len3 == 0)

crossunder(demaVal1, demaVal2)

else

if (len3 > 0) and (len2 == 0)

crossunder(demaVal1, demaVal3)

else

crossunder(close, demaVal1)

// Step 4. Output indicator data

// Plot DEMAs on the chart

plot(series=demaVal1, color=color.green, linewidth=2, title="DEMA #1")

plot(series=demaVal2, color=color.red, linewidth=2, title="DEMA #2")

plot(series=demaVal3, color=color.fuchsia, linewidth=2, title="DEMA #3")

//TRAILING STOP CODE

a = input(title="Usar Trailing Stop?", type=input.bool, defval=false)

stopPerlong = input(9.0, title='Stop Loss Long %', type=input.float, group="Stop Loss & Take Profit Settings") / 100

stopPershort = input(6.0, title='Stop Loss Short %', type=input.float, group="Stop Loss & Take Profit Settings") / 100

take1Perlong = input(25.0, title='Take Profit Long % 1', type=input.float, group="Stop Loss & Take Profit Settings") / 100

take1Pershort = input(6.0, title='Take Profit Short % 1', type=input.float, group="Stop Loss & Take Profit Settings") / 100

// Determine stop loss price

longStopPrice = strategy.position_avg_price * (1 - stopPerlong)

shortStopPrice = strategy.position_avg_price * (1 + stopPershort)

longTake1Price = strategy.position_avg_price * (1 + take1Perlong)

shortTake1Price = strategy.position_avg_price * (1 - take1Pershort)

// Determine trail stop loss prices

longStopPriceTrail = 0.0

longStopPriceTrail := if (strategy.position_size > 0)

stopValue = close * (1 - stopPerlong)

max(stopValue, longStopPriceTrail[1])

else

0

// Determine trailing short price

shortStopPriceTrail = 0.0

shortStopPriceTrail := if (strategy.position_size < 0)

stopValue = close * (1 + stopPershort)

min(stopValue, shortStopPriceTrail[1])

else

999999

//calcular qual stop usar

longStop = a ? longStopPriceTrail : longStopPrice

shortStop = a ? shortStopPriceTrail : shortStopPrice

//calcula o valor do stop e TP pra lançar no alerta

longStopEntrada = close * (1 - stopPerlong)

shortStopEntrada = close * (1 + stopPershort)

longTPEntrada = close * (1 + take1Perlong)

shortTPEntrada = close * (1 - take1Pershort)

//armazena o preço de entrada e valor do SL e TP

price_entryL = 0.0

price_entryL := na(price_entryL) ? na : price_entryL[1]

price_entryS = 0.0

price_entryS := na(price_entryS) ? na : price_entryS[1]

stopL = 0.0

stopL := na(stopL) ? na : stopL[1]

stopS = 0.0

stopS := na(stopS) ? na : stopS[1]

takeL = 0.0

takeL := na(takeL) ? na : takeL[1]

takeS = 0.0

takeS := na(takeS) ? na : takeS[1]

if (demaCrossover)

price_entryL := close

stopL := close * (1 - stopPerlong)

takeL := close * (1 + take1Perlong)

if (demaCrossunder)

price_entryS := close

stopS := close * (1 + stopPershort)

takeS := close * (1 - take1Pershort)

resultadoL = ((close - price_entryL)/price_entryL) * 100

resultadoLexit = "(SL = 1% e TP = 0,5%)"

resultadoS = ((price_entryS - close)/price_entryS) * 100

resultadoSexit = "(SL = 1% e TP = 0,5)%"

// Make input options that configure backtest date range

_startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group="BackTest Period")

_startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group="BackTest Period")

_startYear = input(title="Start Year", type=input.integer,

defval=2018, minval=1800, maxval=2100, group="BackTest Period")

_endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group="BackTest Period")

_endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group="BackTest Period")

_endYear = input(title="End Year", type=input.integer,

defval=2031, minval=1800, maxval=2100, group="BackTest Period")

// Look if the close time of the current bar

// falls inside the date range

_inDateRange = (time >= timestamp(syminfo.timezone, _startYear,

_startMonth, _startDate, 0, 0)) and

(time < timestamp(syminfo.timezone, _endYear, _endMonth, _endDate, 0, 0))

//Alert configuration

_alertMessageOpenLong="OpenLong"

_alertMessageCloseLong="CloseLong"

_alertmessageExitLong="ExitLong - TP/SL"

_alertMessageOpenShort="OpenShort"

_alertMessageCloseShort="CloseShort"

_alertMessageExitShort="ExitShort - TP/SL"

if (_inDateRange)

//ENTER SOME SETUP TRADES FOR TSL EXAMPLE

if (demaCrossover)

strategy.entry("LONG", strategy.long, comment = _alertMessageOpenLong)

if (demaCrossunder)

strategy.entry("SHORT", strategy.short, comment = _alertMessageOpenShort)

//EXIT TRADE @ TSL

if strategy.position_size > 0

strategy.exit("TP/SL", "LONG", stop=longStop, limit=longTake1Price, comment=_alertmessageExitLong, alert_message=_alertmessageExitLong)

if strategy.position_size < 0

strategy.exit("TP/SL", "SHORT", stop=shortStop, limit=shortTake1Price, comment =_alertMessageExitShort, alert_message=_alertMessageExitShort)

//Look & Feel - Plot stop loss and take profit areas

p1=plot(strategy.position_avg_price, color=color.blue, style=plot.style_linebr, linewidth=1, title="Preço de entrada")

p2=plot(series=strategy.position_size > 0 ? longStop : na, color=color.red, style=plot.style_linebr, linewidth=1, title="Long Stop")

p3=plot(series=strategy.position_size > 0 ? longTake1Price : na, color=color.green, style=plot.style_linebr, linewidth=1, title="Long TP")

p4=plot(series=strategy.position_size < 0 ? shortStop : na, color=color.red, style=plot.style_linebr, linewidth=1, title="Short Stop")

p5=plot(series=strategy.position_size < 0 ? shortTake1Price : na, color=color.green, style=plot.style_linebr, linewidth=1, title="Short TP")

fill(p1, p2, color=color.red)

fill(p1, p3, color=color.green)

fill(p1, p4, color=color.red)

fill(p1, p5, color=color.green)

// Insert label with value

stopLossOnLong = "Stop Loss = " + tostring(longStop)

stopLossOnShort = "Stop Loss = " + tostring(shortStop)

takeprofitOnLong = "Take Profit = " + tostring(longTake1Price)

takeprofitOnShort = "Take Profit = " + tostring(shortTake1Price)

precoentrada = "Entrada = " + tostring(strategy.position_avg_price)

var label FinalLabelpriceL = na

var label FinalLabelpriceS = na

var label slFinalLabelL = na

var label slFinalLabelS = na

var label slFinalLabelTPL = na

var label slFinalLabelTPS = na

//Draw entry and stop loss lines and labels

if strategy.position_size > 0

//write the price above the end of the stoploss line

slFinalLabelL := label.new(bar_index, longStop, stopLossOnLong, style=label.style_none, size=size.normal, textcolor=color.red)

slFinalLabelTPL := label.new(bar_index, longTake1Price, takeprofitOnLong, style=label.style_none, size=size.normal, textcolor=color.green)

FinalLabelpriceL := label.new(bar_index, strategy.position_avg_price, precoentrada, style=label.style_none, size=size.normal, textcolor=color.blue)

// Delete previous label when there is a consecutive new high, as there's no line plot in that case.

if strategy.position_size > 0[1]

label.delete(slFinalLabelL[1])

label.delete(slFinalLabelTPL[1])

label.delete(FinalLabelpriceL[1])

if strategy.position_size < 0

//write the price above the end of the stoploss line

slFinalLabelS := label.new(bar_index, shortStop, stopLossOnShort, style=label.style_none, size=size.normal, textcolor=color.red)

slFinalLabelTPS := label.new(bar_index, shortTake1Price, takeprofitOnShort, style=label.style_none, size=size.normal, textcolor=color.green)

FinalLabelpriceS := label.new(bar_index, strategy.position_avg_price, precoentrada, style=label.style_none, size=size.normal, textcolor=color.blue)

// Delete previous label when there is a consecutive new high, as there's no line plot in that case.

if strategy.position_size < 0[1]

label.delete(slFinalLabelS[1])

label.delete(slFinalLabelTPS[1])

label.delete(FinalLabelpriceS[1])

// Exit open market position when date range ends

if (not _inDateRange)

strategy.close_all()