Strategi Imbangan Kawalan Psikologi Perdagangan

Gambaran keseluruhan

Strategi ini bertujuan untuk menyeimbangkan psikologi dan prestasi perdagangan pedagang dengan menetapkan parameter yang berbeza untuk mendapatkan pulangan yang lebih stabil. Ia menggunakan indikator seperti garis rata-rata, Brin Belt, dan Saluran Keltner untuk menilai trend dan turun naik pasaran, digabungkan dengan indikator PSAR untuk menilai isyarat reversal, dan menggunakan indikator TTM untuk menilai momentum. Isyarat perdagangan dihasilkan oleh kombinasi indikator ini.

Prinsip Strategi

Logik utama strategi ini ialah:

Penilaian Trend: Menggunakan EMA rata-rata untuk menilai arah trend harga, harga di atas EMA adalah kenaikan, di bawahnya adalah penurunan

Penilaian pembalikan: menggunakan PSAR untuk menentukan titik pembalikan harga. Titik PSAR muncul di atas harga sebagai isyarat bullish, muncul di bawah harga sebagai isyarat bearish

Penilaian pergerakan: Menggunakan TTM Squeeze untuk menilai kadar turun naik dan pergerakan pasaran. TTM Squeeze mengukur kadar turun naik dengan membandingkan lebar jalur Brin dan saluran Keltner. Penekanan bermaksud turun naik yang sangat rendah.

Menjana isyarat perdagangan: apabila harga di atas melintasi garis EMA rata-rata, titik PSAR, dan penunjuk TTM Squeeze melepaskan tekanan, menghasilkan isyarat melihat lebih; apabila harga di bawah melintasi garis EMA rata-rata, titik PSAR, dan penunjuk TTM Squeeze memasuki tekanan, menghasilkan isyarat melihat kosong

Cara berhenti: menggunakan titik berhenti yang tinggi atau rendah. Berkalikan kelipatan yang ditetapkan sebagai titik berhenti berdasarkan harga tertinggi atau terendah dalam tempoh tertentu yang terakhir

Cara berhenti: Menggunakan stop automatik berbanding ganjaran dan risiko. Stop berdasarkan nisbah jarak dari titik berhenti kepada harga semasa dengan parameter ganjaran dan risiko yang ditetapkan

Dengan parameter yang ditetapkan, anda boleh mengawal frekuensi perdagangan, pengurusan kedudukan, titik berhenti dan titik berhenti, keseimbangan psikologi perdagangan.

Analisis kelebihan

Strategi ini mempunyai kelebihan berikut:

Penghakiman berbilang indikator untuk meningkatkan ketepatan isyarat

Berbalik ke arah utama, ke arah tambahan, menangkap titik balik, mengurangkan kebarangkalian untuk menaiki dan menaiki dan menaiki dan menaiki

Indikator TTMSqueeze berkesan menilai penyesuaian dalam trend, mengelakkan perdagangan yang tidak sah pada tempoh penyesuaian

Pendekatan H&L mudah digunakan, jarak H&L boleh disesuaikan mengikut pasaran

Pembaharuan risiko berbanding penangguhan kaedah akan menomborkan nisbah keuntungan dan kerugian untuk memudahkan penyesuaian

Pelbagai parameter yang fleksibel, boleh disesuaikan dengan keutamaan risiko peribadi

Analisis risiko

Strategi ini juga mempunyai risiko:

Penghakiman gabungan pelbagai indikator, walaupun meningkatkan ketepatan isyarat, tetapi juga meningkatkan kemungkinan melangkau titik Entry

Strategi yang didominasi oleh pembalikan, mungkin tidak berfungsi dengan baik dalam keadaan trend

Stop loss rendah dan tinggi kadang-kadang dapat diatasi, tidak dapat mengelakkan risiko sepenuhnya

Risiko-reward berbanding stop-loss juga boleh hilang akibat kenaikan harga atau penyesuaian.

Tetapan parameter yang tidak betul boleh menyebabkan kerugian atau gangguan yang kerap

Arah pengoptimuman

Strategi ini boleh dioptimumkan dengan:

Tambah atau sesuaikan berat penunjuk untuk mendapatkan isyarat yang lebih tepat

Mengoptimumkan parameter indikator untuk membalikkan dan menilai trend, meningkatkan kebarangkalian keuntungan

Mengoptimumkan parameter yang tinggi dan rendah untuk menghentikan kerugian dengan lebih munasabah

Uji balas risiko yang berbeza untuk mencapai hasil yang terbaik

Menyesuaikan parameter nombor kedudukan untuk mengurangkan kesan kerugian tunggal

ringkaskan

Secara keseluruhannya, strategi ini dapat mengimbangi psikologi perdagangan dengan berkesan dan memperoleh keuntungan positif yang stabil melalui penilaian dan penyesuaian parameter kumpulan penunjuk. Walaupun masih ada ruang untuk penambahbaikan, strategi ini mempunyai nilai aplikasi lapangan.

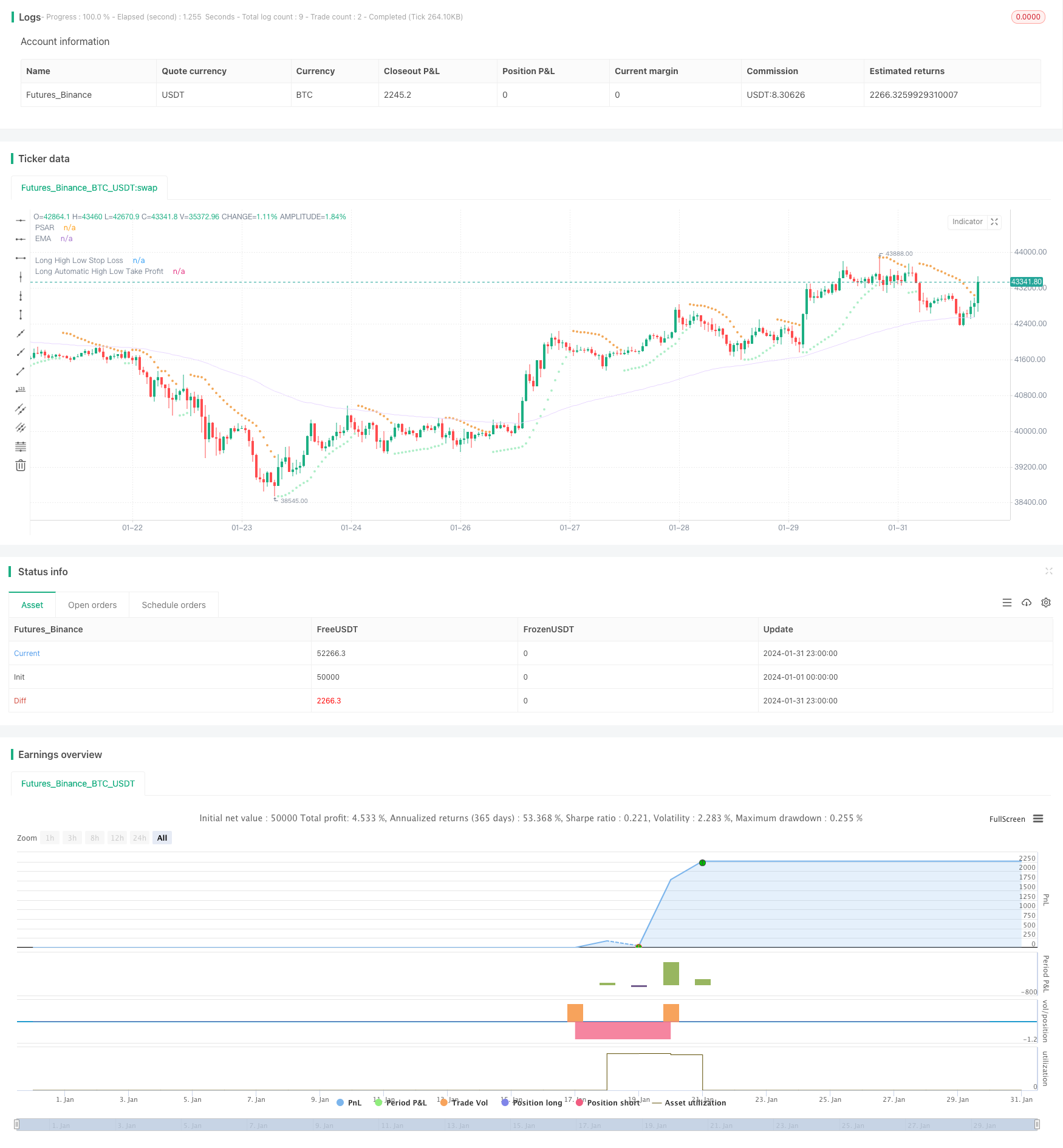

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © simwai

strategy('Octopus Nest Strategy 🐙', shorttitle='🐙', overlay=true )

// -- Colors --

color maximumYellowRed = color.rgb(255, 203, 98) // yellow

color rajah = color.rgb(242, 166, 84) // orange

color magicMint = color.rgb(171, 237, 198)

color languidLavender = color.rgb(232, 215, 255)

color maximumBluePurple = color.rgb(181, 161, 226)

color skyBlue = color.rgb(144, 226, 244)

color lightGray = color.rgb(214, 214, 214)

color quickSilver = color.rgb(163, 163, 163)

color mediumAquamarine = color.rgb(104, 223, 153)

color carrotOrange = color.rgb(239, 146, 46)

// -- Inputs --

float src = input.source(close, 'Choose Source', group='General', inline='1')

bool isSignalLabelEnabled = input.bool(title='Show Signal Labels?', defval=true, group='General', inline='2')

bool isPsarAdaptive = input.bool(title='Is PSAR Adaptive?', defval=false, group='General', inline='2')

float highLowStopLossMultiplier = input.float(defval=0.98, step=0.01, minval=0, maxval=1, title='Multiplier', group='High Low Stop Loss', inline='1')

float highLowStopLossBackupMultiplier = input.float(defval=0.98, step=0.01, minval=0, maxval=1, title='Backup Multiplier', group='High Low Stop Loss', inline='1')

int highLowStopLossLookback = input.int(defval=20, step=5, minval=1, title='Lookback', group='High Low Stop Loss', inline='2')

float automaticHighLowTakeProfitRatio = input.float(defval=1.125, step=0.1, minval=0, title='Risk Reward Ratio', group='Automatic High Low Take Profit', inline='2')

int emaLength = input.int(100, minval=2, title='Length', group='EMA', inline='1')

int ttmLength = input.int(title='Length', defval=20, minval=0, group='TTM Squeeze', inline='1')

float psarStart = input.float(0.02, 'Start', step=0.01, minval=0.0, group='PSAR', inline='1')

float psarInc = input.float(0.02, 'Increment', step=0.01, minval=0.01, group='PSAR', inline='1')

float psarMax = input.float(0.2, 'Max', step=0.05, minval=0.0, group='PSAR', inline='2')

startAFactor = input.float(0.02, 'Starting Acceleration Factor', step = 0.001, group='Adaptive PSAR', inline='1')

minStep = input.float(0.0, 'Min Step', step = 0.001, group='Adaptive PSAR', inline='1')

maxStep = input.float(0.02, 'Max Step', step = 0.001, group='Adaptive PSAR', inline='2')

maxAFactor = input.float(0.2, 'Max Acceleration Factor', step = 0.001, group='Adaptive PSAR', inline='2')

hiloMode = input.string('On', 'HiLo Mode', options = ['Off', 'On'], group='Adaptive PSAR')

adaptMode = input.string('Kaufman', 'Adaptive Mode', options = ['Off', 'Kaufman', 'Ehlers'], group='Adaptive PSAR')

adaptSmth = input.int(5, 'Adaptive Smoothing Period', minval = 1, group='Adaptive PSAR')

filt = input.float(0.0, 'Filter in Pips', group='Adaptive PSAR', minval = 0)

minChng = input.float(0.0, 'Min Change in Pips', group='Adaptive PSAR', minval = 0)

SignalMode = input.string('Only Stops', 'Signal Mode', options = ['Only Stops', 'Signals & Stops'], group='Adaptive PSAR')

// -- Functions --

tr(_high, _low, _close) => math.max(_high - _low, math.abs(_high - _close[1]), math.abs(_low - _close[1]))

// -- Calculation --

var string lastTrade = 'initial'

float _low = low

float _high = high

float _close = close

// -- TTM Squeeze – Credits to @Greeny --

bband(ttmLength, mult) =>

ta.sma(src, ttmLength) + mult * ta.stdev(src, ttmLength)

keltner(ttmLength, mult) =>

ta.ema(src, ttmLength) + mult * ta.ema(tr(_high, _low, _close), ttmLength)

e1 = (ta.highest(_high, ttmLength) + ta.lowest(_low, ttmLength)) / 2 + ta.sma(src, ttmLength)

osc = ta.linreg(src - e1 / 2, ttmLength, 0)

diff = bband(ttmLength, 2) - keltner(ttmLength, 1)

osc_color = osc[1] < osc[0] ? osc[0] >= 0 ? #00ffff : #cc00cc : osc[0] >= 0 ? #009b9b : #ff9bff

mid_color = diff >= 0 ? color.green : color.red

// -- PSAR --

// Credits to @Bjorgum

calcBaseUnit() =>

bool isForexSymbol = syminfo.type == 'forex'

bool isYenPair = syminfo.currency == 'JPY'

float result = isForexSymbol ? isYenPair ? 0.01 : 0.0001 : syminfo.mintick

// Credits to @loxx

_afact(mode,input, per, smooth) =>

eff = 0., seff = 0.

len = 0, sum = 0., max = 0., min = 1000000000.

len := mode == 'Kaufman' ? math.ceil(per) : math.ceil(math.max(20, 5 * per))

for i = 0 to len

if (mode == 'Kaufman')

sum += math.abs(input[i] - input[i + 1])

else

max := input[i] > max ? input[i] : max

min := input[i] < min ? input[i] : min

if (mode == 'Kaufman' and sum != 0)

eff := math.abs(input - input[len]) / sum

else

if (mode == 'Ehlers' and (max - min) > 0)

eff := (input - min) / (max - min)

seff := ta.ema(eff, smooth)

seff

hVal2 = nz(high[2]), hVal1 = nz(high[1]), hVal0 = high

lowVal2 = nz(low[2]), lowVal1 = nz(low[1]), lowVal0 = low

hiprice2 = nz(high[2]), hiprice1 = nz(high[1]), hiprice0 = high

loprice2 = nz(low[2]), loprice1 = nz(low[1]), loprice0 = low

upSig = 0., dnSig = 0.

aFactor = 0., step = 0., trend = 0.

upTrndSAR = 0., dnTrndSAR = 0.

length = (2 / maxAFactor - 1)

if (hiloMode == 'On')

hiprice0 := high

loprice0 := low

else

hiprice0 := src

loprice0 := hiprice0

if bar_index == 1

trend := 1

hVal1 := hiprice1

hVal0 := math.max(hiprice0, hVal1)

lowVal1 := loprice1

lowVal0 := math.min(loprice0, lowVal1)

aFactor := startAFactor

upTrndSAR := lowVal0

dnTrndSAR := 0.

else

hVal0 := hVal1

lowVal0 := lowVal1

trend := nz(trend[1])

aFactor := nz(aFactor[1])

inputs = 0.

inprice = src

if (adaptMode != 'Off')

if (hiloMode == 'On')

inprice := src

else

inprice := hiprice0

if (adaptMode == 'Kaufman')

inputs := inprice

else

if (adaptMode == 'Ehlers')

if (nz(upTrndSAR[1]) != 0.)

inputs := math.abs(inprice - nz(upTrndSAR[1]))

else

if (nz(dnTrndSAR[1]) != 0.)

inputs := math.abs(inprice - nz(dnTrndSAR[1]))

step := minStep + _afact(adaptMode, inputs, length, adaptSmth) * (maxStep - minStep)

else

step := maxStep

upTrndSAR := 0., dnTrndSAR := 0., upSig := 0., dnSig := 0.

if (nz(trend[1]) > 0)

if (nz(trend[1]) == nz(trend[2]))

aFactor := hVal1 > hVal2 ? nz(aFactor[1]) + step : aFactor

aFactor := aFactor > maxAFactor ? maxAFactor : aFactor

aFactor := hVal1 < hVal2 ? startAFactor : aFactor

else

aFactor := nz(aFactor[1])

upTrndSAR := nz(upTrndSAR[1]) + aFactor * (hVal1 - nz(upTrndSAR[1]))

upTrndSAR := upTrndSAR > loprice1 ? loprice1 : upTrndSAR

upTrndSAR := upTrndSAR > loprice2 ? loprice2 : upTrndSAR

else

if (nz(trend[1]) == nz(trend[2]))

aFactor := lowVal1 < lowVal2 ? nz(aFactor[1]) + step : aFactor

aFactor := aFactor > maxAFactor ? maxAFactor : aFactor

aFactor := lowVal1 > lowVal2 ? startAFactor : aFactor

else

aFactor := nz(aFactor[1])

dnTrndSAR := nz(dnTrndSAR[1]) + aFactor * (lowVal1 - nz(dnTrndSAR[1]))

dnTrndSAR := dnTrndSAR < hiprice1 ? hiprice1 : dnTrndSAR

dnTrndSAR := dnTrndSAR < hiprice2 ? hiprice2 : dnTrndSAR

hVal0 := hiprice0 > hVal0 ? hiprice0 : hVal0

lowVal0 := loprice0 < lowVal0 ? loprice0 : lowVal0

if (minChng > 0)

if (upTrndSAR - nz(upTrndSAR[1]) < minChng * calcBaseUnit() and upTrndSAR != 0. and nz(upTrndSAR[1]) != 0.)

upTrndSAR := nz(upTrndSAR[1])

if (nz(dnTrndSAR[1]) - dnTrndSAR < minChng * calcBaseUnit() and dnTrndSAR != 0. and nz(dnTrndSAR[1]) != 0.)

dnTrndSAR := nz(dnTrndSAR[1])

dnTrndSAR := trend < 0 and dnTrndSAR > nz(dnTrndSAR[1]) ? nz(dnTrndSAR[1]) : dnTrndSAR

upTrndSAR := trend > 0 and upTrndSAR < nz(upTrndSAR[1]) ? nz(upTrndSAR[1]) : upTrndSAR

if (trend < 0 and hiprice0 >= dnTrndSAR + filt * calcBaseUnit())

trend := 1

upTrndSAR := lowVal0

upSig := SignalMode == 'Signals & Stops' ? lowVal0 : upSig

dnTrndSAR := 0.

aFactor := startAFactor

lowVal0 := loprice0

hVal0 := hiprice0

else if (trend > 0 and loprice0 <= upTrndSAR - filt * calcBaseUnit())

trend := -1

dnTrndSAR := hVal0

dnSig := SignalMode == 'Signals & Stops' ? hVal0 : dnSig

upTrndSAR := 0.

aFactor := startAFactor

lowVal0 := loprice0

hVal0 := hiprice0

psar = upTrndSAR > 0 ? upTrndSAR : dnTrndSAR

psar := isPsarAdaptive ? psar : ta.sar(psarStart, psarInc, psarMax)

plot(psar, title='PSAR', color=src < psar ? rajah : magicMint, style=plot.style_circles)

// -- EMA --

float ema = ta.ema(src, emaLength)

plot(ema, title='EMA', color=languidLavender)

// -- Signals --

var string isTradeOpen = ''

var string signalCache = ''

bool enterLong = src > ema and ta.crossover(src, psar) and ta.crossover(osc, 0)

bool enterShort = src < ema and ta.crossunder(src, psar) and ta.crossunder(osc, 0)

// bool exitLong = ta.crossunder(src, ema)

// bool exitShort = ta.crossover(src, ema)

if (signalCache == 'long entry')

signalCache := ''

enterLong := true

else if (signalCache == 'short entry')

signalCache := ''

enterShort := true

if (isTradeOpen == '')

if (enterLong)

isTradeOpen := 'long'

else if (enterShort)

isTradeOpen := 'short'

else if (isTradeOpen == 'long')

if (enterLong)

enterLong := false

else if (isTradeOpen == 'short')

if (enterShort)

enterShort := false

plotshape((isSignalLabelEnabled and enterLong and (isTradeOpen == 'long')) ? psar : na, title='LONG', text='L', style=shape.labelup, color=mediumAquamarine, textcolor=color.white, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and enterShort and (isTradeOpen == 'short')) ? psar : na, title='SHORT', text='S', style=shape.labeldown, color=carrotOrange, textcolor=color.white, size=size.tiny, location=location.absolute)

// -- High Low Stop Loss and Take Profit --

bool isHighLowStopLossEnabled = true

bool isAutomaticHighLowTakeProfitEnabled = true

bool recalculateStopLossTakeProfit = false

bool isStrategyEntryEnabled = false

bool isLongEnabled = true

bool isShortEnabled = true

bool isStopLossTakeProfitRecalculationEnabled = true

bool longStopLossTakeProfitRecalculation = isStopLossTakeProfitRecalculationEnabled ? true : (lastTrade == 'short' or lastTrade == 'initial')

bool shortStopLossTakeProfitRecalculation = isStopLossTakeProfitRecalculationEnabled ? true : (lastTrade == 'long' or lastTrade == 'initial')

var float longHighLowStopLoss = 0

var float shortHighLowStopLoss = 0

float highLowStopLossLowest = ta.lowest(_low, highLowStopLossLookback)

float highLowStopLossHighest = ta.highest(_high, highLowStopLossLookback)

if (isHighLowStopLossEnabled)

if (((enterLong and longStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

if (highLowStopLossLowest == _low)

longHighLowStopLoss := _high * highLowStopLossBackupMultiplier

else if (highLowStopLossLowest > 0)

longHighLowStopLoss := highLowStopLossLowest * highLowStopLossMultiplier

if (((enterShort and shortStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size < 0) : true))

if (highLowStopLossHighest == _high)

shortHighLowStopLoss := _high * (1 + (1 - highLowStopLossBackupMultiplier))

else if (highLowStopLossHighest > 0)

shortHighLowStopLoss := highLowStopLossHighest * (1 + (1 - highLowStopLossMultiplier))

plot((isLongEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'long')) ? longHighLowStopLoss : na, 'Long High Low Stop Loss', color=magicMint, style=plot.style_circles, trackprice=false)

plot((isShortEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'short')) ? shortHighLowStopLoss : na, 'Short High Low Stop Loss ', color=rajah, style=plot.style_circles, trackprice=false)

// -- Automatic High Low Take Profit --

var float longAutomaticHighLowTakeProfit = na

var float shortAutomaticHighLowTakeProfit = na

if (isAutomaticHighLowTakeProfitEnabled)

if (((enterLong and longStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

longHighLowStopLossPercentage = 1 - (longHighLowStopLoss / _close)

longAutomaticHighLowTakeProfit := _close * (1 + (longHighLowStopLossPercentage * automaticHighLowTakeProfitRatio))

if (((enterShort and shortStopLossTakeProfitRecalculation) or recalculateStopLossTakeProfit) and (isStrategyEntryEnabled ? not(strategy.position_size > 0) : true))

shortHighLowStopLossPercentage = 1 - (_close / shortHighLowStopLoss)

shortAutomaticHighLowTakeProfit := _close * (1 - (shortHighLowStopLossPercentage * automaticHighLowTakeProfitRatio))

plot((isAutomaticHighLowTakeProfitEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'long')) ? longAutomaticHighLowTakeProfit : na, 'Long Automatic High Low Take Profit', color=magicMint, style=plot.style_circles, trackprice=false)

plot((isAutomaticHighLowTakeProfitEnabled and isHighLowStopLossEnabled and (isTradeOpen == 'short')) ? shortAutomaticHighLowTakeProfit : na, 'Short Automatic High Low Take Profit', color=rajah, style=plot.style_circles, trackprice=false)

// log.info('Automatic Long High Low Take Profit: ' + str.tostring(longAutomaticHighLowTakeProfit))

// log.info('Automatic Short High Low Take Profit: ' + str.tostring(shortAutomaticHighLowTakeProfit))

// log.info('Long High Low Stop Loss: ' + str.tostring(longHighLowStopLoss))

// log.info('Short High Low Stop Loss: ' + str.tostring(shortHighLowStopLoss))

bool longHighLowStopLossCondition = ta.crossunder(_close, longHighLowStopLoss)

bool shortHighLowStopLossCondition = ta.crossover(_close, shortHighLowStopLoss)

bool longAutomaticHighLowTakeProfitCondition = ta.crossover(_close, longAutomaticHighLowTakeProfit)

bool shortAutomaticHighLowTakeProfitCondition = ta.crossunder(_close, shortAutomaticHighLowTakeProfit)

bool exitLong = (longHighLowStopLossCondition or longAutomaticHighLowTakeProfitCondition) and strategy.position_size > 0

bool exitShort = (shortHighLowStopLossCondition or shortAutomaticHighLowTakeProfitCondition) and strategy.position_size < 0

plotshape((isSignalLabelEnabled and exitLong and (isTradeOpen == 'long')) ? psar : na, title='LONG EXIT', style=shape.circle, color=magicMint, size=size.tiny, location=location.absolute)

plotshape((isSignalLabelEnabled and exitShort and (isTradeOpen == 'short')) ? psar : na, title='SHORT EXIT', style=shape.circle, color=rajah, size=size.tiny, location=location.absolute)

// Long Exits

if (exitLong)

strategy.close('long', comment=longAutomaticHighLowTakeProfitCondition ? 'EXIT_LONG_TP' : 'EXIT_LONG_SL')

isTradeOpen := ''

// Short Exits

if (exitShort)

strategy.close('short', comment=shortAutomaticHighLowTakeProfitCondition ? 'EXIT_SHORT_TP' : 'EXIT_SHORT_SL')

isTradeOpen := ''

// Long Entries

if (enterLong and (strategy.position_size == 0))

strategy.entry('long', strategy.long, comment='ENTER_LONG')

// Short Entries

if (enterShort and (strategy.position_size == 0))

strategy.entry('short', strategy.short, comment='ENTER_SHORT')

// Save last trade state

if (enterLong or exitLong)

lastTrade := 'long'

if (enterShort or exitShort)

lastTrade := 'short'

barcolor(color=isTradeOpen == 'long' ? mediumAquamarine : isTradeOpen == 'short' ? carrotOrange : na)