Gambaran keseluruhan

Strategi ini menggabungkan kedua-dua petunjuk teknikal indeks yang agak kuat (RSI) dan Bollinger Bands (Bollinger Bands) untuk menghasilkan isyarat beli apabila harga berada di bawah Bollinger Bands dan isyarat jual apabila harga berada di atas Bollinger Bands. Strategi ini hanya akan mencetuskan isyarat perdagangan apabila RSI dan Bollinger Bands berada dalam keadaan oversold atau overbought pada masa yang sama.

Prinsip Strategi

- Mengira nilai RSI berdasarkan parameter RSI yang ditetapkan.

- Menggunakan formula Brin Belt untuk mengira laluan tengah, atas dan bawah Brin Belt.

- Menentukan sama ada harga penutupan semasa menembusi Bollinger Bands ke atas atau ke bawah.

- Menentukan sama ada nilai RSI semasa adalah lebih tinggi daripada paras overbought atau lebih rendah daripada paras oversold.

- Sinyal dagangan yang sesuai dihasilkan apabila tanda Brin dan RSI memenuhi syarat membeli atau menjual pada masa yang sama.

Kelebihan Strategik

- Dengan menggabungkan trend dan momentum, kedua-dua penunjuk teknikal ini dapat menilai keadaan pasaran secara lebih menyeluruh.

- Menggunakan kedua-dua penunjuk sebagai syarat penapisan secara serentak dapat mengurangkan kemungkinan munculnya isyarat palsu.

- Kod logik yang jelas, parameter yang ditetapkan fleksibel, sesuai dengan persekitaran pasaran yang berbeza dan gaya perdagangan.

Risiko Strategik

- Dalam pasaran yang bergolak, strategi ini mungkin menghasilkan lebih banyak kerugian.

- Tetapan parameter yang tidak betul boleh menyebabkan prestasi strategi yang kurang baik dan perlu dioptimumkan mengikut keadaan sebenar.

- Strategi ini tidak menetapkan hentian kerugian dan mungkin menghadapi risiko penarikan balik yang lebih besar.

Arah pengoptimuman strategi

- Parameter RSI dan pita Brin boleh dioptimumkan mengikut ciri-ciri pasaran dan keutamaan peribadi.

- Pengenalan penunjuk teknikal lain seperti MACD, garis rata-rata dan lain-lain untuk meningkatkan kebolehpercayaan isyarat.

- Menetapkan stop loss dan halangan yang munasabah untuk mengawal risiko transaksi tunggal.

- Untuk pasaran yang bergolak, anda boleh mempertimbangkan untuk menambah syarat penilaian atau mengurangkan kedudukan, mengurangkan kos yang disebabkan oleh perdagangan yang kerap.

ringkaskan

RSI dan strategi ganda Brin Belt dapat menilai keadaan pasaran dengan lebih menyeluruh dan memberi isyarat perdagangan yang sesuai dengan menggabungkan indikator trend dan momentum. Tetapi strategi ini mungkin tidak berfungsi dengan baik di pasaran yang bergolak dan tidak menetapkan langkah-langkah kawalan risiko, jadi berhati-hati semasa operasi di pasaran. Dengan mengoptimumkan parameter, memperkenalkan indikator lain dan menetapkan stop loss yang munasabah, anda dapat meningkatkan lagi kestabilan dan keuntungan strategi ini.

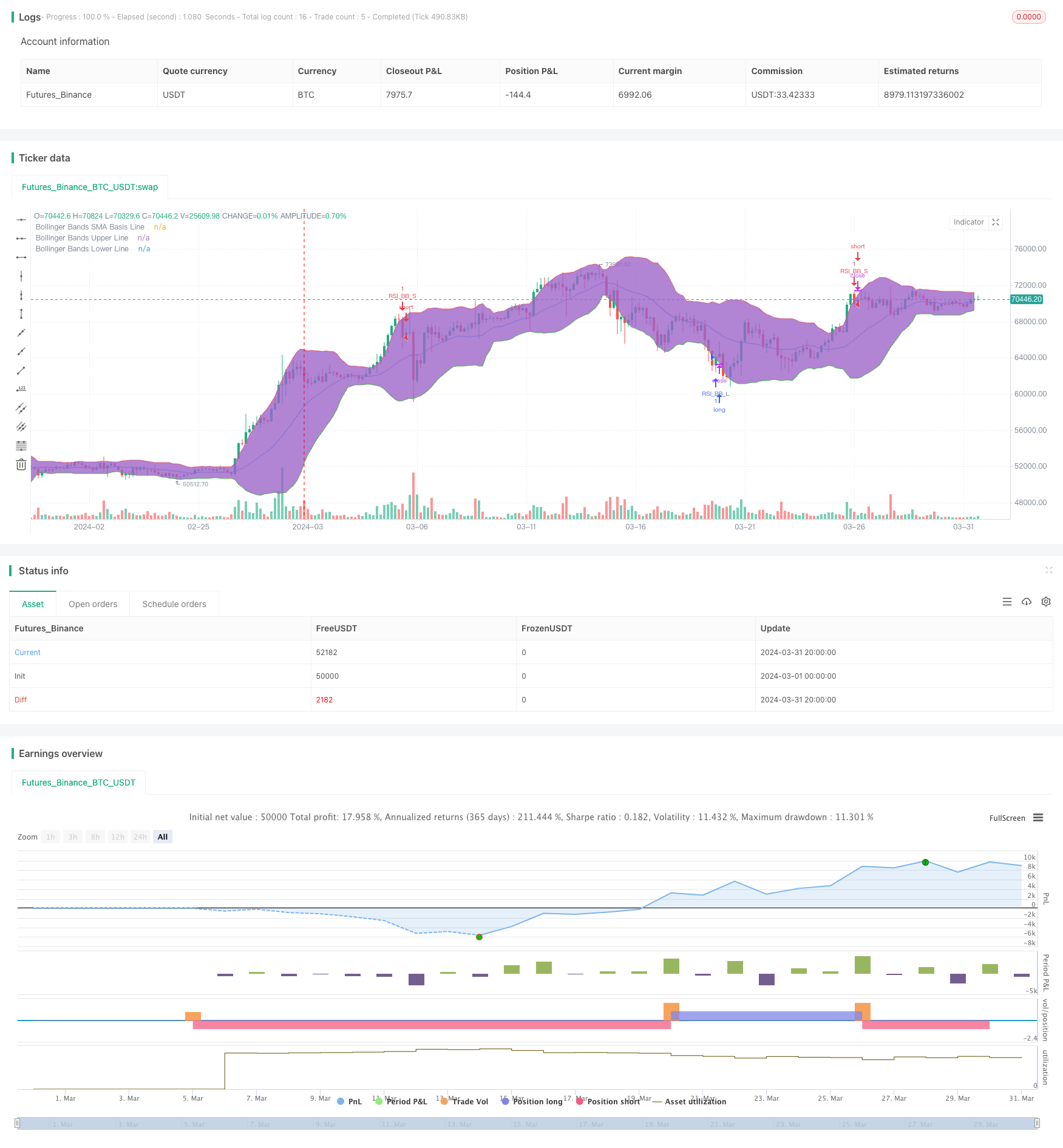

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger + RSI, Double Strategy (by ChartArt) v1.1", shorttitle="CA_-_RSI_Bol_Strat_1.1", overlay=true)

// ChartArt's RSI + Bollinger Bands, Double Strategy - Update

//

// Version 1.1

// Idea by ChartArt on January 18, 2015.

//

// This strategy uses the RSI indicator

// together with the Bollinger Bands

// to sell when the price is above the

// upper Bollinger Band (and to buy when

// this value is below the lower band).

//

// This simple strategy only triggers when

// both the RSI and the Bollinger Bands

// indicators are at the same time in

// a overbought or oversold condition.

//

// In this version 1.1 the strategy was

// both simplified for the user and

// made more successful in backtesting.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

///////////// RSI

RSIlength = input(14,title="RSI Period Length")

RSIoverSold = 30

RSIoverBought = 70

price = close

vrsi = rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input(20, minval=1,title="Bollinger Period Length")

BBmult = input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = sma(price, BBlength)

BBdev = BBmult * stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyEntry = crossover(source, BBlower)

sellEntry = crossunder(source, BBupper)

plot(BBbasis, color=color.blue,title="Bollinger Bands SMA Basis Line")

p1 = plot(BBupper, color=color.red,title="Bollinger Bands Upper Line")

p2 = plot(BBlower, color=color.green,title="Bollinger Bands Lower Line")

fill(p1, p2)

// Entry conditions

crossover_rsi = crossover(vrsi, RSIoverSold) and crossover(source, BBlower)

crossunder_rsi = crossunder(vrsi, RSIoverBought) and crossunder(source, BBupper)

///////////// RSI + Bollinger Bands Strategy

if (not na(vrsi))

if (crossover_rsi)

strategy.entry("RSI_BB_L", strategy.long, comment="RSI_BB_L")

else

strategy.cancel(id="RSI_BB_L")

if (crossunder_rsi)

strategy.entry("RSI_BB_S", strategy.short, comment="RSI_BB_S")

else

strategy.cancel(id="RSI_BB_S")