Gambaran keseluruhan

Strategi utama strategi ini adalah mencari garis K yang tidak dipimpin sebagai isyarat membeli, dan menutup posisi apabila harga jatuh di bawah garis K yang rendah. Strategi ini memanfaatkan ciri-ciri yang dipimpin oleh garis K yang kecil, yang menunjukkan kekuatan pelbagai pihak yang kuat, kemungkinan harga saham terus meningkat.

Prinsip Strategi

- Menentukan sama ada garis K semasa adalah garis K bullish ((harga penutupan lebih tinggi daripada harga bukaan)

- Hitung nisbah panjang garis panduan K semasa kepada panjang entiti K

- Jika nisbah penunjuk atas kurang daripada 5%, ia dianggap berkesan tanpa penunjuk atas untuk melihat garis K, dan menghantar isyarat beli

- Rekodkan harga terendah untuk baris K terdahulu yang dibeli sebagai titik henti

- Apabila harga jatuh di bawah titik henti kerugian, keluar dari kedudukan kosong

Kelebihan Strategik

- K-Line, trend yang lebih kuat dan lebih berjaya

- Menggunakan titik K terendah sebelumnya sebagai stop loss, risiko boleh dikawal

- Logik mudah, mudah dilaksanakan dan dioptimumkan

- Sesuai untuk digunakan dalam keadaan trend

Risiko Strategik

- Kemungkinan berlaku penarikan balik yang mencetuskan stop loss segera selepas isyarat beli

- Bagi varieti yang mempunyai kadar turun naik yang tinggi, titik hentian mungkin ditetapkan terlalu dekat dengan harga beli, menyebabkan hentian awal

- Kurangnya sasaran keuntungan, sukar untuk mengetahui masa terbaik untuk meletakkan jawatan

Arah pengoptimuman strategi

- Boleh digabungkan dengan petunjuk lain seperti MA, MACD dan lain-lain untuk mengesahkan kekuatan trend, meningkatkan keberkesanan isyarat masuk

- Untuk varieti yang bergelombang tinggi, anda boleh menetapkan titik hentian di lokasi yang lebih jauh, seperti titik terendah di garis N-root K depan, untuk mengurangkan frekuensi hentian

- Memperkenalkan sasaran keuntungan, seperti N kali ATR atau peratusan keuntungan, untuk mengunci keuntungan

- Pertimbangkan untuk menambah pengurusan kedudukan, seperti menyesuaikan saiz kedudukan mengikut kekuatan isyarat dan sebagainya

ringkaskan

Strategi ini boleh digunakan untuk menangkap keuntungan dalam keadaan trend dengan mengambil garis K yang tidak mempunyai panduan, menggunakan titik rendah K yang terdahulu. Tetapi strategi ini juga mempunyai beberapa batasan, seperti kedudukan berhenti tidak cukup fleksibel, kekurangan sasaran keuntungan, dan lain-lain.

Overview

The main idea of this strategy is to find bullish candles without upper wicks as buy signals and close positions when the price breaks below the low of the previous candle. The strategy utilizes the characteristic of bullish candles with very small upper wicks, indicating strong bullish momentum and a higher probability of continued price increases. At the same time, using the low of the previous candle as a stop-loss level can effectively control risk.

Strategy Principles

- Determine if the current candle is a bullish candle (close price higher than open price)

- Calculate the ratio of the current candle’s upper wick length to its body length

- If the upper wick ratio is less than 5%, consider it a valid bullish candle without an upper wick and generate a buy signal

- Record the lowest price of the previous candle after buying as the stop-loss level

- When the price breaks below the stop-loss level, close the position and exit

Strategy Advantages

- Selecting bullish candles without upper wicks for entry, the trend strength is greater and the success rate is higher

- Using the low of the previous candle as the stop-loss level, risks are controllable

- Simple logic, easy to implement and optimize

- Suitable for use in trending markets

Strategy Risks

- There may be cases where a buy signal is followed by an immediate pullback triggering the stop-loss

- For highly volatile instruments, the stop-loss level may be set too close to the buy price, leading to premature stop-outs

- Lack of profit targets, making it difficult to grasp the optimal exit timing

Strategy Optimization Directions

- Combine with other indicators such as MA, MACD, etc., to confirm trend strength and improve the effectiveness of entry signals

- For highly volatile instruments, set the stop-loss level at a further position, such as the lowest point of the previous N candles, to reduce the stop-loss frequency

- Introduce profit targets, such as N times ATR or percentage gains, to lock in profits in a timely manner

- Consider adding position management, such as adjusting position size based on signal strength

Summary

This strategy captures profits effectively in trending markets by selecting bullish candles without upper wicks for entry and using the low of the previous candle for stop-loss. However, the strategy also has certain limitations, such as inflexible stop-loss placement and lack of profit targets. Improvements can be made by introducing other indicators to filter signals, optimizing stop-loss positions, and setting profit targets to make the strategy more robust and effective.

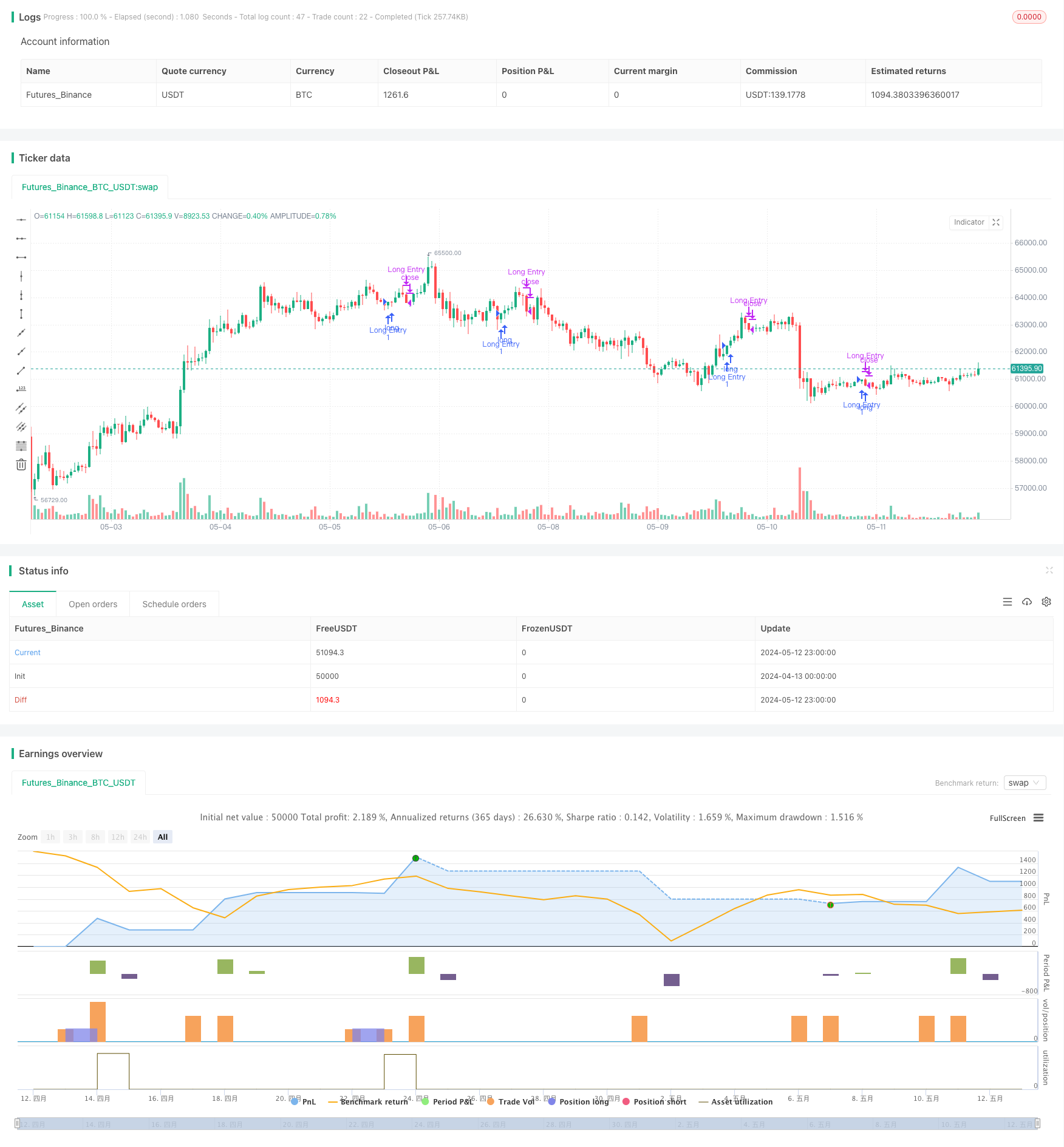

/*backtest

start: 2024-04-13 00:00:00

end: 2024-05-13 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © nagpha

//@version=5

strategy("My strategy", overlay=true, margin_long=100, margin_short=100)

candleBodySize = math.abs(open - close)

// Calculate candle wick size

candleWickSize = high - close

// Calculate percentage of wick to candle body

wickPercentage = (candleWickSize / candleBodySize) * 100

// Check if candle is bullish and wick is less than 1% of the body

isBullish = close > open

isWickLessThan5Percent = wickPercentage < 5

longCondition = isBullish and isWickLessThan5Percent

if (longCondition)

// log.info("long position taken")

strategy.entry("Long Entry", strategy.long)

float prevLow = 0.0

prevLow := request.security(syminfo.tickerid, timeframe.period, low[1], lookahead=barmerge.lookahead_on)

float closingPrice = close

//plot(closingPrice, "Close Price", color.purple, 3)

//plot(prevLow, "Previous Low", color.red, 3)

//log.info("Outside: {0,number,#}",closingPrice)

//log.info("Outside: {0,number,#}",prevLow)

if closingPrice < prevLow and strategy.position_size > 0

//log.info("inside close: {0,number} : {0,number}",closingPrice,prevLow)

// log.info("position exited")

strategy.close("Long Entry")

longCondition := false

prevLow := 0

isBullish := false

//plot(series=strategy.position_size > 0 ? prevLow : na, color = color.new(#40ccfb,0), style=plot.style_cross,linewidth = 5)