Gambaran keseluruhan

Strategi ini menggabungkan indikator teknikal seperti EMA crossing, RSI deviation, 30 minit trend identification dan harga exhaustion untuk menangkap trend pasaran dan harga bending. Strategi ini menentukan arah trend melalui persilangan EMA13 dan EMA26, menggunakan RSI deviation untuk mengenal pasti potensi trend reversal, sambil mempertimbangkan keadaan trend dan harga exhaustion dalam jangka masa 30 minit untuk mengoptimumkan tempat masuk.

Prinsip Strategi

- EMA bersilang: menghasilkan isyarat beli apabila EMA13 melewati EMA26 dan menghasilkan isyarat jual apabila EMA13 melewati EMA26

- RSI berpatah balik: apabila harga berinovasi rendah dan RSI tidak berinovasi rendah, ia menghasilkan berpatah balik bullish; apabila harga berinovasi tinggi dan RSI tidak berinovasi tinggi, ia menghasilkan berpatah balik bearish.

- Pengiktirafan trend 30 minit: menilai status trend dalam jangka masa 30 minit semasa dengan membandingkan hubungan harga penutup dengan EMA5 dan EMA10 30 minit.

- Harga terlampau: menggunakan RSI untuk mengenal pasti keadaan harga yang terlalu beli dan terlalu dijual.

- Isyarat perdagangan: faktor-faktor yang terkandung di atas, menghasilkan isyarat beli apabila EMA bersilang, RSI menyimpang, 30 minit trend naik dan harga melebihi harga; menghasilkan isyarat jual apabila EMA bersilang, RSI menyimpang, 30 minit trend turun dan harga melebihi harga.

Kelebihan Strategik

- Analisis pelbagai dimensi: menggabungkan pelbagai dimensi seperti trend, momentum dan harga untuk meningkatkan ketepatan isyarat.

- Pengesahan trend: menilai trend dalam jangka masa 30 minit untuk mengelakkan perdagangan yang kerap di pasaran yang bergolak.

- Menangkap Titik Pusing: Menggunakan RSI untuk menangkap titik-titik perubahan trend yang berpotensi.

- Kawalan risiko: Berdagang selepas trend disahkan dan isyarat titik balik muncul, mengurangkan risiko.

Risiko Strategik

- Optimasi parameter: parameter yang digunakan dalam strategi seperti kitaran EMA, kitaran RSI mungkin perlu dioptimumkan mengikut pasaran dan aset yang berbeza.

- Perubahan Trend: Pada permulaan perubahan trend, EMA bersilang dan RSI menyimpang dari isyarat mungkin mengalami kelewatan atau kekeliruan.

- Isyarat palsu: Dalam beberapa kes, RSI berpatah balik boleh menghasilkan isyarat palsu, yang menyebabkan perdagangan yang salah.

- Kejadian yang tidak dijangka: Strategi mungkin tidak dapat menangani kejadian yang tidak dijangka dan turun naik yang tidak munasabah di pasaran.

Arah pengoptimuman strategi

- Pengoptimuman parameter dinamik: parameter seperti EMA dan kitaran RSI disesuaikan secara dinamik mengikut keadaan dan turun naik pasaran.

- Penapisan kekuatan trend: memperkenalkan penunjuk kekuatan trend seperti ADX, penapisan trend lemah atau isyarat di pasaran yang bergolak.

- Pengesahan pelbagai bingkai masa: menggabungkan trend dan isyarat dari pelbagai bingkai masa untuk meningkatkan kebolehpercayaan isyarat.

- Hentikan Kerosakan dan Penangguhan: memperkenalkan strategi hentikan dan penangguhan yang sesuai untuk mengawal risiko dan mengoptimumkan keuntungan.

ringkaskan

Strategi ini menganalisis pasaran dalam pelbagai dimensi untuk menangkap trend dan potensi titik balik dengan menggabungkan EMA crossing, RSI deviation, pengiktirafan trend 30 minit dan indikator teknikal harga habis. Kelebihan strategi adalah analisis pelbagai dimensi, pengesahan trend, tangkapan titik balik dan kawalan risiko, tetapi terdapat juga risiko seperti pengoptimuman parameter, perpindahan trend, pertukaran isyarat palsu dan kejadian mengejut.

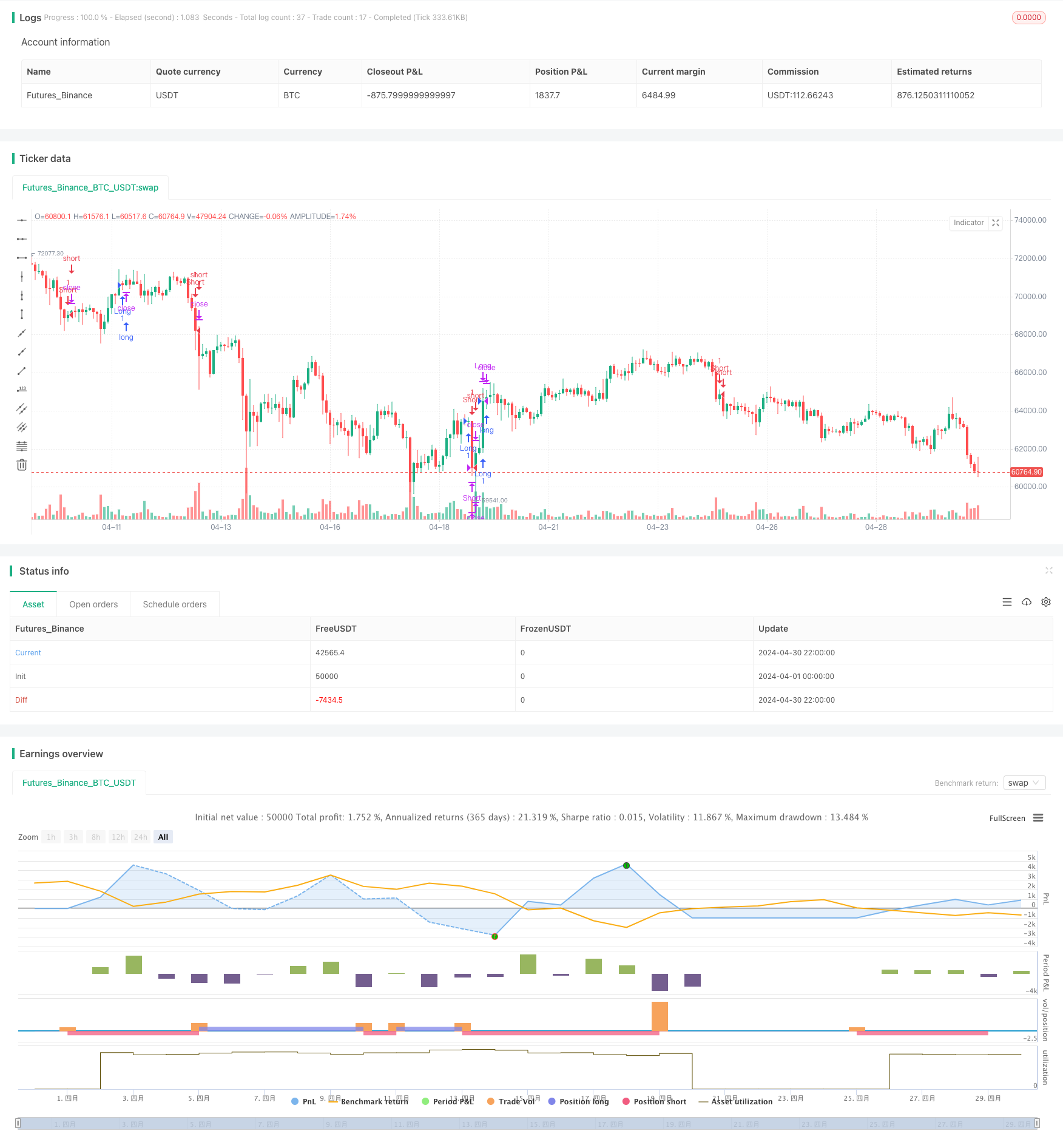

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Cross Strategy with RSI Divergence, 30-Minute Trend Identification, and Price Exhaustion", overlay=true)

// Definição das médias móveis exponenciais para tendência de curto prazo (30 minutos)

EMA5_30min = ta.ema(close, 5)

EMA10_30min = ta.ema(close, 10)

// Definição das médias móveis exponenciais

EMA13 = ta.ema(close, 13)

EMA26 = ta.ema(close, 26)

// RSI com período padrão de 7

rsi = ta.rsi(close, 7)

// Detecção do cruzamento das EMAs

crossUp = ta.crossover(EMA13, EMA26)

crossDown = ta.crossunder(EMA13, EMA26)

// Detecção de divergência no RSI

bullishDivergence = ta.crossunder(close, EMA13) and ta.crossunder(rsi, 30)

bearishDivergence = ta.crossover(close, EMA13) and ta.crossover(rsi, 70)

// Geração de sinais de entrada

entrySignal = crossUp ? 1 : (crossDown ? -1 : 0)

// Abertura da posição

if (entrySignal == 1)

strategy.entry("Long", strategy.long)

else if (entrySignal == -1)

strategy.entry("Short", strategy.short)

// Fechamento da posição

if (entrySignal == 1 and ta.crossover(close, EMA26))

strategy.close("Long")

else if (entrySignal == -1 and ta.crossunder(close, EMA26))

strategy.close("Short")

// Comando de compra e venda

buySignal = crossUp and close > EMA13 and close > EMA26

sellSignal = crossDown and close < EMA13 and close < EMA26

// Aplicando a lógica de divergência RSI

if (bullishDivergence)

strategy.entry("Bullish Divergence", strategy.long)

if (bearishDivergence)

strategy.entry("Bearish Divergence", strategy.short)

// Identificação de tendência nos últimos 30 minutos

isUptrend30min = close > EMA5_30min and close > EMA10_30min

isDowntrend30min = close < EMA5_30min and close < EMA10_30min

// Identificação de exaustão do preço com base no RSI

isOversold = rsi < 30

isOverbought = rsi > 70

// Executando os sinais de compra e venda

if (buySignal and isUptrend30min and isOversold)

strategy.entry("Buy", strategy.long)

if (sellSignal and isDowntrend30min and isOverbought)

strategy.entry("Sell", strategy.short)