Gambaran keseluruhan

Strategi purata bergerak yang berasaskan persimpangan dua garis rata-rata adalah kaedah perdagangan dalam hari yang mudah dan berkesan yang bertujuan untuk mengenal pasti peluang membeli dan menjual yang berpotensi di pasaran dengan menganalisis hubungan antara purata bergerak dua kitaran yang berbeza. Strategi ini menggunakan purata bergerak sederhana jangka pendek (SMA) dan purata bergerak sederhana jangka panjang, yang menunjukkan isyarat kenaikan harga yang menunjukkan peluang membeli yang berpotensi apabila rata-rata jangka pendek melintasi garis rata-rata jangka panjang; sebaliknya, apabila rata-rata garis rata-rata jangka pendek melintasi garis rata-rata jangka panjang, menunjukkan isyarat penurunan harga yang menunjukkan peluang menjual yang berpotensi.

Prinsip Strategi

Prinsip teras strategi ini adalah menggunakan ciri-ciri trend dan keterlambatan rata-rata bergerak yang berkala untuk menilai arah trend pasaran semasa dengan membandingkan rata-rata jangka pendek dan rata-rata jangka panjang, dan membuat keputusan perdagangan yang sesuai. Apabila pasaran mengalami trend naik, harga akan menembusi rata-rata jangka panjang, rata-rata jangka pendek kemudian menembusi rata-rata jangka panjang membentuk garpu emas, menghasilkan isyarat beli; apabila pasaran mengalami trend menurun, harga akan menembusi rata-rata jangka panjang, rata-rata jangka pendek kemudian menembusi garpu mati membentuk garpu panjang, menghasilkan isyarat jual.

Kelebihan Strategik

- Mudah difahami: Strategi ini berdasarkan teori purata bergerak klasik, logikannya jelas, mudah difahami dan dilaksanakan.

- Kebolehsuaian: Strategi ini boleh digunakan untuk pelbagai pasaran dan pelbagai jenis perdagangan, dengan menyesuaikan parameter yang boleh bertindak balas secara fleksibel terhadap ciri-ciri pasaran yang berbeza.

- Tangkap Trend: Mengetahui arah trend melalui persilangan dua garis sejajar membantu peniaga mengikuti trend utama dalam masa yang tepat dan meningkatkan peluang keuntungan.

- Kawalan risiko: Strategi ini memperkenalkan konsep pengurusan risiko, mengawal risiko setiap perdagangan dengan menyesuaikan kedudukan, dan menguruskan potensi kerugian dengan berkesan.

- Mengurangkan bunyi bising: Menggunakan ciri-ciri ketinggalan garis rata untuk menyaring secara berkesan bunyi bising rawak di pasaran, meningkatkan kebolehpercayaan isyarat perdagangan.

Risiko Strategik

- Pilihan parameter: Tetapan parameter yang berbeza mempunyai kesan penting terhadap prestasi strategi, dan pilihan yang salah boleh menyebabkan kegagalan atau prestasi yang buruk.

- Trend pasaran: Strategi ini mungkin mengalami kerugian berturut-turut di pasaran yang bergolak atau di titik perubahan trend.

- Kos tergelincir: Perdagangan yang kerap boleh menyebabkan kos tergelincir yang lebih tinggi, yang menjejaskan keuntungan keseluruhan strategi.

- Black Swan: Strategi ini kurang sesuai untuk keadaan yang melampau, dan Black Swan boleh menyebabkan kerugian besar kepada strategi tersebut.

- Risiko overfit: Jika parameter yang dioptimumkan terlalu bergantung pada data sejarah, ia boleh menyebabkan strategi tidak berfungsi dengan baik dalam perdagangan sebenar.

Arah pengoptimuman strategi

- Pengoptimuman parameter dinamik: menyesuaikan parameter strategi secara dinamik mengikut perubahan keadaan pasaran, meningkatkan daya serap.

- Pengesahan trend: Selepas menghasilkan isyarat perdagangan, memperkenalkan petunjuk lain atau corak tingkah laku harga untuk mengesahkan trend, meningkatkan kebolehpercayaan isyarat.

- Hentikan Kerosakan: Memperkenalkan mekanisme Hentikan Kerosakan yang munasabah untuk mengawal lebih jauh risiko perdagangan tunggal.

- Pengurusan kedudukan: kaedah untuk mengoptimumkan penyesuaian kedudukan, seperti memperkenalkan indikator kadar turun naik, menyesuaikan kedudukan secara dinamik mengikut tahap turun naik pasaran.

- Penilaian kekuatan pelbagai: menilai hubungan kontras antara kekuatan pelbagai kepala dan kepala kosong, campur tangan pada awal trend, meningkatkan ketepatan trend.

ringkaskan

Strategi purata bergerak yang berasaskan persilangan dua garis rata adalah kaedah perdagangan dalam sehari yang mudah dan praktikal, menilai arah trend pasaran, menghasilkan isyarat perdagangan dengan membandingkan hubungan kedudukan antara garis rata-rata kitaran yang berbeza. Logik strategi jelas, kuat beradaptasi, dapat menangkap trend pasaran dengan berkesan, sambil memperkenalkan langkah-langkah pengurusan risiko, mengawal kerugian yang berpotensi. Walau bagaimanapun, strategi ini juga mempunyai parameter, memilih perubahan trend, perdagangan yang kerap dan risiko yang berpotensi. Perlu meningkatkan lagi kestabilan dan keuntungan strategi dengan cara pengoptimuman dinamik, pengesahan isyarat, dan pengurusan kedudukan.

Overview

The Moving Average Crossover Strategy based on dual moving averages is a straightforward and effective intraday trading approach designed to identify potential buy and sell opportunities in the market by analyzing the relationship between two moving averages of different periods. This strategy utilizes a short-term simple moving average (SMA) and a long-term simple moving average. When the short-term moving average crosses above the long-term moving average, it indicates a bullish signal, suggesting a potential buying opportunity. Conversely, when the short-term moving average crosses below the long-term moving average, it indicates a bearish signal, suggesting a potential selling opportunity. This crossover method helps traders capture trending moves in the market while minimizing market noise interference.

Strategy Principle

The core principle of this strategy is to utilize the trend characteristics and lag of moving averages with different periods. By comparing the relative position relationship between the short-term moving average and the long-term moving average, it determines the current market trend direction and makes corresponding trading decisions. When an upward trend emerges in the market, the price will first break through the long-term moving average, and the short-term moving average will subsequently cross above the long-term moving average, forming a golden cross and generating a buy signal. When a downward trend emerges in the market, the price will first break below the long-term moving average, and the short-term moving average will subsequently cross below the long-term moving average, forming a death cross and generating a sell signal. In the parameter settings of this strategy, the period of the short-term moving average is set to 9, and the period of the long-term moving average is set to 21. These two parameters can be adjusted based on market characteristics and personal preferences. Additionally, this strategy introduces the concept of money management by setting the initial capital and risk percentage per trade, using position sizing to control the risk exposure of each trade.

Strategy Advantages

- Simplicity: This strategy is based on the classic moving average theory, with clear logic and easy to understand and implement.

- Adaptability: This strategy can be applied to multiple markets and different trading instruments. By adjusting parameter settings, it can flexibly adapt to different market characteristics.

- Trend Capture: By using the dual moving average crossover to determine the trend direction, it helps traders timely follow the mainstream trend and increase profit opportunities.

- Risk Control: This strategy introduces the concept of risk management, using position sizing to control the risk exposure of each trade, effectively managing potential losses.

- Noise Reduction: By utilizing the lag characteristic of moving averages, it effectively filters out random noise in the market, improving the reliability of trading signals.

Strategy Risks

- Parameter Selection: Different parameter settings can have a significant impact on strategy performance. Improper selection may lead to strategy failure or poor performance.

- Market Trend: In ranging markets or trend turning points, this strategy may experience consecutive losses.

- Slippage Costs: Frequent trading may result in higher slippage costs, affecting the overall profitability of the strategy.

- Black Swan Events: This strategy has poor adaptability to extreme market conditions, and black swan events may cause significant losses to the strategy.

- Overfitting Risk: If parameter optimization relies too heavily on historical data, it may lead to poor performance of the strategy in actual trading.

Strategy Optimization Directions

- Dynamic Parameter Optimization: Dynamically adjust strategy parameters based on changes in market conditions to improve adaptability.

- Trend Confirmation: After generating trading signals, introduce other indicators or price behavior patterns to confirm the trend, improving signal reliability.

- Stop-Loss and Take-Profit: Introduce reasonable stop-loss and take-profit mechanisms to further control the risk exposure of each trade.

- Position Management: Optimize the position sizing method, such as introducing volatility indicators to dynamically adjust positions based on market volatility levels.

- Long-Short Strength Assessment: Assess the comparative relationship between bullish and bearish strengths, entering at the early stage of a trend to improve the accuracy of trend capture.

Summary

The Moving Average Crossover Strategy based on dual moving averages is a simple and practical intraday trading method. By comparing the position relationship of moving averages with different periods, it determines the market trend direction and generates trading signals. This strategy has clear logic, strong adaptability, and can effectively capture market trends while introducing risk management measures to control potential losses. However, this strategy also has potential risks such as parameter selection, trend reversal, frequent trading, etc. It needs to be further improved through dynamic optimization, signal confirmation, position management, and other methods to enhance the robustness and profitability of the strategy. In general, as a classic technical analysis indicator, the basic principles and practical application value of moving averages have been widely verified by the market. It is a trading strategy worthy of in-depth research and continuous optimization.

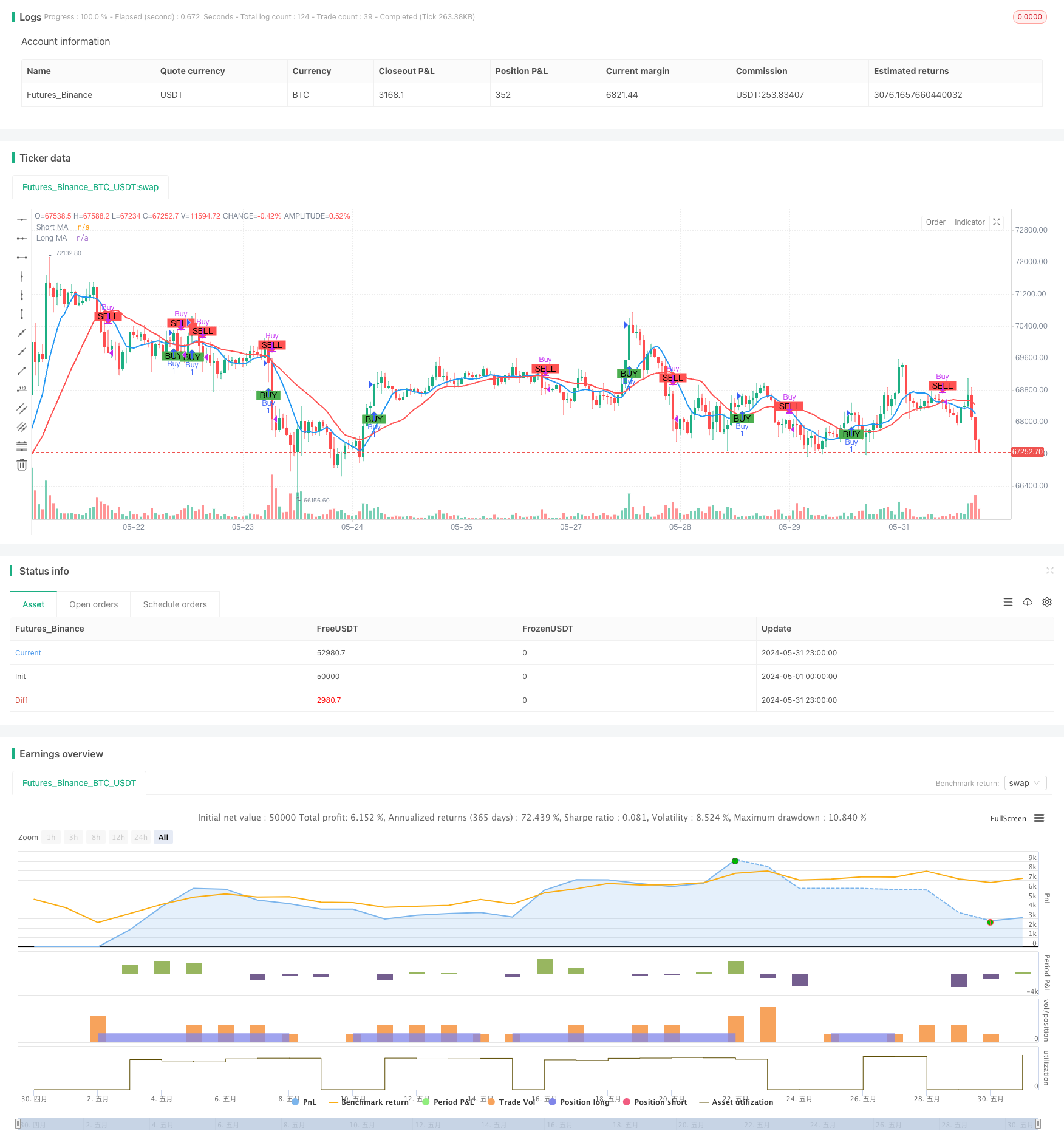

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average Crossover Strategy", overlay=true)

// Input parameters

shortLength = input.int(9, title="Short Moving Average Length")

longLength = input.int(21, title="Long Moving Average Length")

capital = input.float(100000, title="Initial Capital")

risk_per_trade = input.float(1.0, title="Risk Per Trade (%)")

// Calculate Moving Averages

shortMA = ta.sma(close, shortLength)

longMA = ta.sma(close, longLength)

// Plot Moving Averages

plot(shortMA, title="Short MA", color=color.blue, linewidth=2)

plot(longMA, title="Long MA", color=color.red, linewidth=2)

// Generate Buy/Sell signals

longCondition = ta.crossover(shortMA, longMA)

shortCondition = ta.crossunder(shortMA, longMA)

// Plot Buy/Sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Risk management: calculate position size

risk_amount = capital * (risk_per_trade / 100)

position_size = risk_amount / close

// Execute Buy/Sell orders with position size

if (longCondition)

strategy.entry("Buy", strategy.long, qty=1, comment="Buy")

if (shortCondition)

strategy.close("Buy", comment="Sell")

// Display the initial capital and risk per trade on the chart

var label initialLabel = na

if (na(initialLabel))

initialLabel := label.new(x=bar_index, y=high, text="Initial Capital: " + str.tostring(capital) + "\nRisk Per Trade: " + str.tostring(risk_per_trade) + "%", style=label.style_label_down, color=color.white, textcolor=color.black)

else

label.set_xy(initialLabel, x=bar_index, y=high)