Gambaran keseluruhan

Strategi penembusan dinamik yang beradaptasi secara dinamik adalah strategi perdagangan kuantitatif lanjutan yang menggunakan indikator dinamik yang beradaptasi dan pengenalan bentuk grafik. Strategi ini menyesuaikan diri dengan turun naik pasaran dengan menyesuaikan dinamik secara dinamik, dan menggabungkan pelbagai penapisan untuk mengenal pasti peluang penembusan trend dengan kebarangkalian tinggi.

Prinsip Strategi

Pengaturan kitaran dinamik:

- Strategi menggunakan penunjuk momentum yang menyesuaikan diri, menyesuaikan kitaran pengiraan mengikut dinamik turun naik pasaran.

- Dalam tempoh turun naik yang tinggi, kitaran dipersingkat untuk bertindak balas dengan cepat terhadap perubahan pasaran; dalam tempoh turun naik yang rendah, kitaran diperpanjang untuk mengelakkan perdagangan berlebihan.

- Julat kitaran ditetapkan antara 10 dan 40 untuk menilai keadaan turun naik melalui penunjuk ATR.

Pengiraan dan kelancaran:

- Menggunakan kitaran dinamik untuk mengira indeks dinamik.

- Anda boleh memilih sama ada untuk menghaluskan EMA pada tenaga, dan secara lalai menggunakan EMA 7 kitaran.

Mencari arah trend:

- Arah trend ditentukan dengan mengira kemiringan momentum ((perbezaan nilai semasa dengan nilai sebelumnya).

- Slope positif menunjukkan trend menaik, slope negatif menunjukkan trend menurun.

Pengiktirafan corak:

- Menggunakan fungsi tersuai untuk mengenal pasti corak pengalihan dan pengalihan.

- Pertimbangkan hubungan harga pembukaan dan harga penutupan bagi satu tong yang sedia ada.

- Memperkenalkan penapis saiz entiti minimum untuk meningkatkan kebolehpercayaan bentuk.

Sinyal dagangan dihasilkan:

- Isyarat berbilang kepala: lihat bentuk penelan lembu + kemiringan momentum positif.

- Isyarat kosong: bentuk penyembelihan + cerun dinamik negatif.

Pengurusan urus niaga:

- Isyarat disahkan dan K baris seterusnya dibuka.

- Pelancaran automatik selepas kitaran pegangan tetap (default 3 K lines)

Kelebihan Strategik

Ketabahan:

- Dinamik menyesuaikan kitaran dinamik untuk menyesuaikan diri dengan keadaan pasaran yang berbeza.

- Tindak balas cepat pada masa turun naik tinggi, mengelakkan perdagangan berlebihan pada masa turun naik rendah.

Mekanisme pengesahan berganda:

- Gabungan antara penunjuk teknikal ((kinerja) dan bentuk harga ((penghancuran), meningkatkan kebolehpercayaan isyarat.

- Menggunakan penapis kecenderungan dan saiz entiti untuk mengurangkan isyarat palsu.

Waktu masuk yang tepat:

- Menggunakan bentuk penelan untuk menangkap potensi perubahan trend.

- Di samping itu, ia juga boleh digunakan untuk menjana wang tunai.

Pengurusan risiko yang betul:

- Siklus pegangan tetap, mengelakkan terlalu banyak pegangan menyebabkan penarikan balik.

- Penapisan saiz entiti untuk mengurangkan kesalahan penghakiman yang disebabkan oleh perubahan kecil.

Fleksibiliti dan penyesuaian:

- Pelbagai parameter yang boleh disesuaikan untuk memudahkan pengoptimuman untuk pasaran dan jangka masa yang berbeza.

- Fungsi EMA yang boleh dipilih untuk menyeimbangkan sensitiviti dan kestabilan.

Risiko Strategik

Beranda “ Berita Semasa ” Berita Semasa:

- Dalam pasaran Forex, ia mungkin akan menimbulkan isyarat pecah palsu yang kerap berlaku.

- Kaedah pelemahan: Tambahkan penunjuk pengesahan trend tambahan, seperti penyambungan purata bergerak.

Masalah ketinggalan zaman:

- Penggunaan EMA yang lancar boleh menyebabkan isyarat terlewat dan terlepas titik masuk yang terbaik.

- Pengurangan: menyesuaikan kitaran EMA atau pertimbangkan untuk menggunakan kaedah yang lebih sensitif.

Kelemahan mekanisme keluar tetap:

- Keluar dari kitaran tetap boleh menamatkan aliran keuntungan lebih awal atau melanjutkan kerugian.

- Kaedah pengurangan: memperkenalkan hentian hentian dinamik, seperti hentian pengesanan atau keluar berdasarkan kadar turun naik.

Terlalu bergantung pada satu kerangka masa:

- Strategi mungkin mengabaikan trend keseluruhan dalam jangka masa yang lebih besar.

- Kaedah pelemahan: memperkenalkan analisis pelbagai kerangka masa untuk memastikan arah perdagangan selaras dengan trend yang lebih besar.

Sensitiviti parameter:

- Terlalu banyak parameter yang boleh disesuaikan boleh menyebabkan data sejarah yang terlalu sesuai.

- Pengurangan: menggunakan pengoptimuman langkah demi langkah dan ujian merentas sampel untuk mengesahkan kestabilan parameter.

Arah pengoptimuman strategi

Integrasi pelbagai kerangka masa:

- Memperkenalkan penghakiman trend pada jangka masa yang lebih besar, hanya berdagang ke arah trend utama.

- Sebab: meningkatkan kadar kejayaan keseluruhan transaksi dan mengelakkan operasi berlawanan trend.

Kerosakan penghentian dinamik:

- Mempunyai hentian dinamik berdasarkan ATR atau perubahan enjin.

- Menggunakan Tracking Stop Stop untuk memaksimumkan keuntungan trend.

- Sebab: Untuk menyesuaikan diri dengan turun naik pasaran, melindungi keuntungan, dan mengurangkan penarikan balik.

Analisis profil jumlah:

- Mengintegrasikan profil volum, mengenal pasti titik rintangan sokongan utama.

- Sebab: Meningkatkan ketepatan kedudukan masuk untuk mengelakkan penembusan kedudukan yang tidak sah.

Pembelajaran Mesin yang dioptimumkan:

- Parameter penyesuaian dinamik menggunakan algoritma pembelajaran mesin.

- Sebab: Kesesuaian berterusan dalam melaksanakan strategi untuk meningkatkan kestabilan jangka panjang.

Penunjuk emosi bersepadu

- Memperkenalkan penunjuk sentimen pasaran, seperti VIX atau pilihan implied volatility.

- Penyebabnya: Mengubah strategi semasa emosi melampau dan mengelakkan perdagangan berlebihan.

Analisis relevansi:

- Pertimbangkan pergerakan serentak aset yang berkaitan.

- Sebab: Meningkatkan kebolehpercayaan isyarat dan mengenal pasti trend pasaran yang lebih kuat.

ringkaskan

Strategi penembusan momentum yang beradaptasi secara dinamik adalah sistem perdagangan lanjutan yang menggabungkan analisis teknikal dan kaedah kuantitatif. Dengan menyesuaikan kitaran momentum secara dinamik, mengenal pasti corak penelan, dan menggabungkan pelbagai syarat penapisan, strategi ini dapat menangkap peluang penembusan tren yang berkemungkinan tinggi secara beradaptasi dalam pelbagai persekitaran pasaran. Walaupun terdapat beberapa risiko yang wujud, seperti penembusan palsu dan kepekaan parameter, strategi ini berpotensi untuk meningkatkan kestabilan dan keuntungan lebih lanjut melalui arah pengoptimuman yang dicadangkan, seperti analisis bingkai masa, pengurusan risiko dinamik, dan aplikasi pembelajaran mesin.

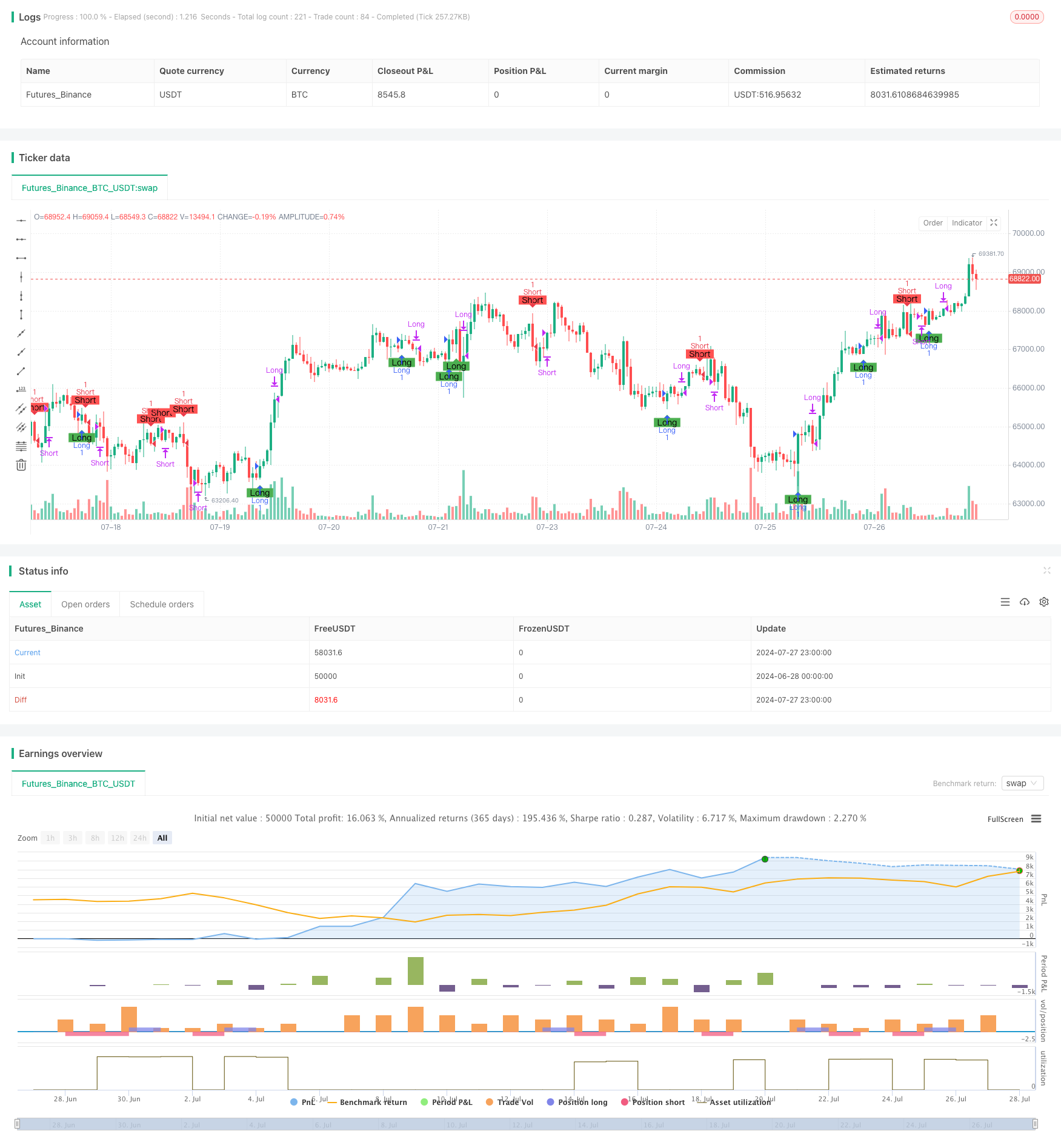

/*backtest

start: 2024-06-28 00:00:00

end: 2024-07-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ironperol

//@version=5

strategy("Adaptive Momentum Strategy", overlay=true, margin_long=100, margin_short=100)

// Input parameters for customization

src = input.source(close, title="Source")

min_length = input.int(10, minval=1, title="Minimum Length")

max_length = input.int(40, minval=1, title="Maximum Length")

ema_smoothing = input.bool(true, title="EMA Smoothing")

ema_length = input.int(7, title="EMA Length")

percent = input.float(2, title="Percent of Change", minval=0, maxval=100) / 100.0

// Separate body size filters for current and previous candles

min_body_size_current = input.float(0.5, title="Minimum Body Size for Current Candle (as a fraction of previous body size)", minval=0)

min_body_size_previous = input.float(0.5, title="Minimum Body Size for Previous Candle (as a fraction of average body size of last 5 candles)", minval=0)

close_bars = input.int(3, title="Number of Bars to Hold Position", minval=1) // User-defined input for holding period

//######################## Calculations ##########################

// Initialize dynamic length variable

startingLen = (min_length + max_length) / 2.0

var float dynamicLen = na

if na(dynamicLen)

dynamicLen := startingLen

high_Volatility = ta.atr(7) > ta.atr(14)

if high_Volatility

dynamicLen := math.max(min_length, dynamicLen * (1 - percent))

else

dynamicLen := math.min(max_length, dynamicLen * (1 + percent))

momentum = ta.mom(src, int(dynamicLen))

value = ema_smoothing ? ta.ema(momentum, ema_length) : momentum

// Calculate slope as the difference between current and previous value

slope = value - value[1]

// Calculate body sizes

currentBodySize = math.abs(close - open)

previousBodySize = math.abs(close[1] - open[1])

// Calculate average body size of the last 5 candles

avgBodySizeLast5 = math.avg(math.abs(close[1] - open[1]), math.abs(close[2] - open[2]), math.abs(close[3] - open[3]), math.abs(close[4] - open[4]), math.abs(close[5] - open[5]))

//######################## Long Signal Condition ##########################

// Function to determine if the candle is a bullish engulfing

isBullishEngulfing() =>

currentOpen = open

currentClose = close

previousOpen = open[1]

previousClose = close[1]

isBullish = currentClose >= currentOpen

wasBearish = previousClose <= previousOpen

engulfing = currentOpen <= previousClose and currentClose >= previousOpen

bodySizeCheckCurrent = currentBodySize >= min_body_size_current * previousBodySize

bodySizeCheckPrevious = previousBodySize >= min_body_size_previous * avgBodySizeLast5

isBullish and wasBearish and engulfing and bodySizeCheckCurrent and bodySizeCheckPrevious

// Long signal condition

longCondition = isBullishEngulfing() and slope > 0

// Plotting long signals on chart

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="Long", title="Long Condition")

// Alerts for long condition

if (longCondition)

alert("Long condition met", alert.freq_once_per_bar_close)

//######################## Short Signal Condition ##########################

// Function to determine if the candle is a bearish engulfing

isBearishEngulfing() =>

currentOpen = open

currentClose = close

previousOpen = open[1]

previousClose = close[1]

isBearish = currentClose <= currentOpen

wasBullish = previousClose >= previousOpen

engulfing = currentOpen >= previousClose and currentClose <= previousOpen

bodySizeCheckCurrent = currentBodySize >= min_body_size_current * previousBodySize

bodySizeCheckPrevious = previousBodySize >= min_body_size_previous * avgBodySizeLast5

isBearish and wasBullish and engulfing and bodySizeCheckCurrent and bodySizeCheckPrevious

// Short signal condition

shortCondition = isBearishEngulfing() and slope < 0

// Plotting short signals on chart

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Short", title="Short Condition")

// Alerts for short condition

if (shortCondition)

alert("Short condition met", alert.freq_once_per_bar_close)

//######################## Trading Logic ##########################

// Track the bar number when the position was opened

var int longEntryBar = na

var int shortEntryBar = na

// Enter long trade on the next candle after a long signal

if (longCondition and na(longEntryBar))

strategy.entry("Long", strategy.long)

longEntryBar := bar_index + 1

// Enter short trade on the next candle after a short signal

if (shortCondition and na(shortEntryBar))

strategy.entry("Short", strategy.short)

shortEntryBar := bar_index + 1

// Close long trades `close_bars` candles after entry

if (not na(longEntryBar) and bar_index - longEntryBar >= close_bars)

strategy.close("Long")

longEntryBar := na

// Close short trades `close_bars` candles after entry

if (not na(shortEntryBar) and bar_index - shortEntryBar >= close_bars)

strategy.close("Short")

shortEntryBar := na