E9 Shark 32 Corak Strategi Terobosan Harga Kuantitatif

Gambaran keseluruhan

Strategi ini adalah sistem perdagangan kuantitatif berdasarkan pengenalan bentuk harga, yang berpusat pada pengenalan dan memanfaatkan bentuk K-line khusus seperti “Shark 32”. Strategi ini menganalisis perubahan kesinambungan pada titik tinggi dan rendah, menetapkan tahap harga kritikal setelah penegasan bentuk, dan melakukan perdagangan apabila tahap ini pecah. Strategi ini menggabungkan beberapa elemen analisis teknikal seperti pengenalan bentuk, pengesanan trend dan harga yang pecah, untuk mewujudkan sistem perdagangan yang lengkap.

Prinsip Strategi

Pusat strategi adalah untuk mengenal pasti bentuk “32 penyu”, yang memerlukan syarat berikut: dua garis K terdahulu terus menurun, sementara garis tinggi terus meningkat. Apabila bentuk itu disahkan, strategi akan mengunci garis K yang bermula dengan bentuk tinggi dan rendah sebagai paras harga kritikal. Sistem membuka kedudukan apabila harga menembusi tahap kritikal ini: apabila harga saham menembusi tinggi yang terkunci, lakukan lebih banyak, apabila ia menembusi rendah yang terkunci.

Kelebihan Strategik

- Pengiktirafan bentuk yang tepat: bentuk dikenali melalui definisi matematik yang ketat, mengelakkan penghakiman subjektif

- Pengurusan risiko yang sempurna: termasuk tetapan sasaran yang jelas untuk menghentikan kerugian dan keuntungan

- Maklum balas visual yang jelas: menggunakan garis dan latar belakang dengan warna yang berbeza untuk menandakan bentuk dan isyarat perdagangan

- Menapis isyarat berulang: hanya satu transaksi dibenarkan untuk setiap bentuk, untuk mengelakkan overtrading

- Tetapan sasaran yang munasabah: Tetapan sasaran keuntungan berdasarkan kadar pergerakan bentuk, dengan nisbah risiko-keuntungan yang baik

Risiko Strategik

- Risiko pasaran goyah: Isyarat penembusan palsu yang kerap berlaku dalam pasaran goyah.

- Risiko tergelincir: kemungkinan tergelincir yang lebih besar dalam keadaan pantas

- Tergantung kepada satu bentuk: Terlalu bergantung kepada satu bentuk mungkin kehilangan peluang perdagangan lain

- Sensitiviti parameter: tetapan parameter untuk sasaran stop-loss dan profit mempunyai kesan yang lebih besar terhadap prestasi strategi

Arah pengoptimuman strategi

- Penambahan pengesahan jumlah transaksi: perubahan jumlah transaksi boleh digabungkan untuk mengesahkan kesahihan terobosan

- Memperkenalkan penapis keadaan pasaran: menambah penunjuk kekuatan trend untuk menapis keadaan pasaran yang tidak menguntungkan

- Mengoptimumkan Stop Loss: Menggunakan Stop Loss Dinamik boleh dipertimbangkan untuk meningkatkan daya serap strategi

- Menambah penapis masa: penapis masa perdagangan ditambah untuk mengelakkan turun naik pada masa tertentu

- Meningkatkan pengurusan dana: menambah modul pengurusan kedudukan untuk mengoptimumkan kecekapan penggunaan dana

ringkaskan

Strategi penembusan harga kuantitatif bentuk E9 Trout 32 adalah sistem perdagangan yang lengkap dan logik. Ia membina strategi perdagangan yang boleh dilaksanakan secara kuantitatif melalui definisi bentuk yang ketat dan peraturan perdagangan yang jelas. Sistem pengurusan risiko strategi telah disempurnakan, maklum balas visual jelas, mudah difahami dan dilaksanakan oleh pedagang.

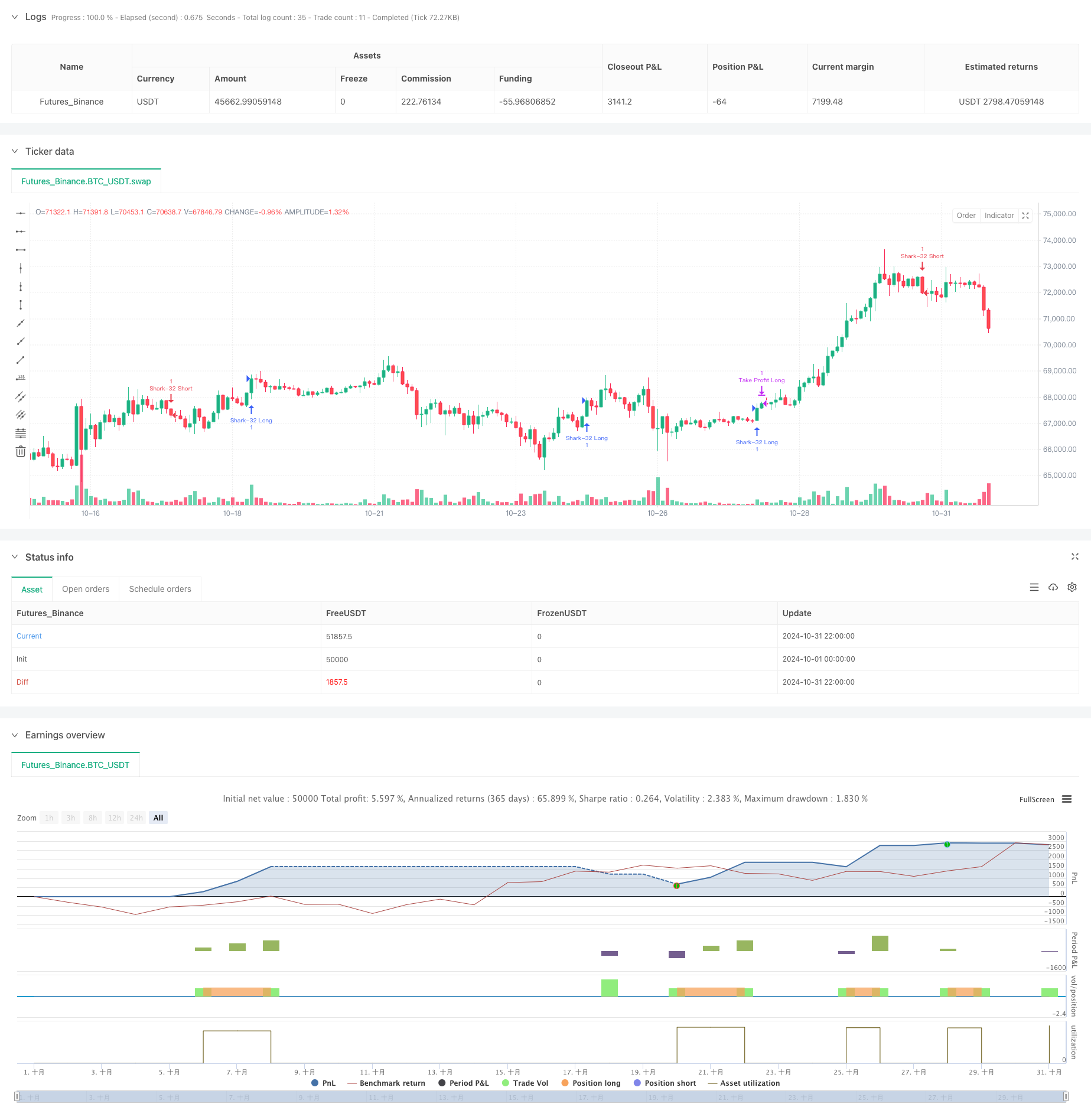

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//╔═════════════════════════════════════════════════════════════════════════════════════════════════════════════╗

//║ ║

//║ ░▒▓████████▓▒░▒▓███████▓▒░ ░▒▓██████▓▒░░▒▓███████▓▒░░▒▓████████▓▒░▒▓███████▓▒░ ░▒▓████████▓▒░▒▓██████▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓███████▓▒░░▒▓████████▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓██████▓▒░ ░▒▓███████▓▒░. ░▒▓██████▓▒░ ░▒▓███████▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓███████▓▒░░▒▓████████▓▒░▒▓█▓▒░░▒▓█▓▒. ░▒▓████████▓▒░▒▓██████▓▒░ ║

//║ ║

//╚═════════════════════════════════════════════════════════════════════════════════════════════════════════════╝

//@version=5

strategy("E9 Shark-32 Pattern Strategy with Target Lines", shorttitle="E9 Shark-32 Strategy", overlay=true)

// Inputs for background color settings

bgcolorEnabled = input(true, title="Enable Background Color")

bgcolorColor = input.color(color.new(color.blue, 90), title="Background Color")

// Inputs for bar color settings

barcolorEnabled = input(true, title="Enable Bar Color")

barcolorColor = input.color(color.rgb(240, 241, 154), title="Bar Color")

// Inputs for target lines settings

targetLinesEnabled = input(true, title="Enable Target Lines")

targetLineColor = input.color(color.white, title="Target Line Color")

targetLineThickness = input.int(1, title="Target Line Thickness", minval=1, maxval=5)

// Define Shark-32 Pattern

shark32 = low[2] < low[1] and low[1] < low and high[2] > high[1] and high[1] > high

// Initialize color variables for bars

var color barColorCurrent = na

var color barColor1 = na

var color barColor2 = na

// Update color variables based on Shark-32 pattern

barColorCurrent := barcolorEnabled and (shark32 or shark32[1] or shark32[2]) ? barcolorColor : na

barColor1 := barcolorEnabled and (shark32[1] or shark32[2]) ? barcolorColor : na

barColor2 := barcolorEnabled and shark32[2] ? barcolorColor : na

// Apply the bar colors to the chart

barcolor(barColorCurrent, offset=-2, title="Shark-32 Confirmed Current")

barcolor(barColor1, offset=-3, title="Shark-32 Confirmed Previous Bar 1")

barcolor(barColor2, offset=-4, title="Shark-32 Confirmed Previous Bar 2")

// Variables for locking the high and low of confirmed Shark-32

var float patternHigh = na

var float patternLow = na

var float upperTarget = na

var float lowerTarget = na

// Once Shark-32 pattern is confirmed, lock the patternHigh, patternLow, and target lines

if shark32

patternHigh := high[2] // The high of the first bar in Shark-32 pattern

patternLow := low[2] // The low of the first bar in Shark-32 pattern

// Calculate the upper and lower white target lines

upperTarget := patternHigh + (patternHigh - patternLow) // Dotted white line above

lowerTarget := patternLow - (patternHigh - patternLow) // Dotted white line below

// Initialize variables for the lines

var line greenLine = na

var line redLine = na

var line upperTargetLine = na

var line lowerTargetLine = na

// Draw the lines based on the locked patternHigh, patternLow, and target lines

// if shark32

// future_bar_index_lines = bar_index + 10

// // Draw lines based on locked patternHigh and patternLow

// greenLine := line.new(x1=bar_index[2], y1=patternHigh, x2=future_bar_index_lines, y2=patternHigh, color=color.green, width=2, extend=extend.none)

// redLine := line.new(x1=bar_index[2], y1=patternLow, x2=future_bar_index_lines, y2=patternLow, color=color.red, width=2, extend=extend.none)

// // Draw dotted white lines if targetLinesEnabled is true

// if targetLinesEnabled

// upperTargetLine := line.new(x1=bar_index[2], y1=upperTarget, x2=future_bar_index_lines, y2=upperTarget, color=targetLineColor, width=targetLineThickness, style=line.style_dotted, extend=extend.none)

// lowerTargetLine := line.new(x1=bar_index[2], y1=lowerTarget, x2=future_bar_index_lines, y2=lowerTarget, color=targetLineColor, width=targetLineThickness, style=line.style_dotted, extend=extend.none)

// // Create a box to fill the background between the red and green lines

// if bgcolorEnabled

// box.new(left=bar_index[2], top=patternHigh, right=future_bar_index_lines, bottom=patternLow, bgcolor=bgcolorColor)

// -------------------------------------------------------------------------

// Strategy Entry and Exit Parameters

// -------------------------------------------------------------------------

// Input parameters for stop loss

longStopLoss = input.float(1.0, title="Long Stop Loss (%)", minval=0.1) // Percentage-based stop loss for long

shortStopLoss = input.float(1.0, title="Short Stop Loss (%)", minval=0.1) // Percentage-based stop loss for short

// Variable to track if a trade has been taken

var bool tradeTaken = false

// Reset the flag when a new Shark-32 pattern is confirmed

if shark32

tradeTaken := false

// Entry conditions only trigger after the Shark-32 is confirmed

longCondition = ta.crossover(close, patternHigh) and not tradeTaken // Long entry when close crosses above locked patternHigh

shortCondition = ta.crossunder(close, patternLow) and not tradeTaken // Short entry when close crosses below locked patternLow

// Trigger long and short trades based on the crossover conditions

if (longCondition)

label.new(bar_index, high, "Long Trigger", style=label.style_label_down, color=color.green, textcolor=color.white, size=size.small)

strategy.entry("Shark-32 Long", strategy.long)

tradeTaken := true // Set the flag to true after a trade is taken

if (shortCondition)

label.new(bar_index, low, "Short Trigger", style=label.style_label_up, color=color.red, textcolor=color.white, size=size.small)

strategy.entry("Shark-32 Short", strategy.short)

tradeTaken := true // Set the flag to true after a trade is taken

// Exit long trade based on the upper target line (upper white dotted line) as take profit

if strategy.position_size > 0

strategy.exit("Take Profit Long", "Shark-32 Long", limit=upperTarget, stop=close * (1 - longStopLoss / 100))

// Exit short trade based on the lower target line (lower white dotted line) as take profit

if strategy.position_size < 0

strategy.exit("Take Profit Short", "Shark-32 Short", limit=lowerTarget, stop=close * (1 + shortStopLoss / 100))