Gambaran keseluruhan

Strategi ini adalah strategi perdagangan kuantitatif yang berasaskan sinergi antara indikator yang agak kuat ((RSI) dan pengayun dinamik ((AO)). Strategi ini mengiktiraf peluang perdagangan yang berpotensi dengan menangkap isyarat gabungan RSI yang menembusi 50 dan AO yang berada di kawasan negatif. Strategi ini menggunakan mekanisme peratusan stop loss untuk menguruskan risiko dan secara lalai menggunakan 10% dana akaun untuk berdagang.

Prinsip Strategi

Logik utama strategi ini adalah berdasarkan kerjasama antara dua indikator teknikal:

- Penunjuk RSI: Menggunakan penunjuk RSI 14 kitaran untuk memantau pergerakan harga, yang dianggap sebagai tenaga pergerakan ke atas apabila RSI menembusi 50 di tengah-tengah.

- Penunjuk AO: Mengira pergerakan harga dengan membandingkan purata bergerak 5 kitaran dengan kitaran 34, yang menunjukkan pasaran berada di kawasan oversold apabila AO adalah negatif.

- Keperluan untuk masuk: Apabila RSI melepasi 50 dan AO negatif, anda boleh mengambil lebih banyak kedudukan, yang bermaksud menangkap isyarat pembalikan harga di kawasan oversold.

- Syarat Keluar: Menggunakan 2% Stop Stop dan 1% Stop Loss untuk memastikan setiap dagangan mempunyai nisbah risiko dan keuntungan yang wajar.

Kelebihan Strategik

- Kebolehpercayaan isyarat yang tinggi: dengan pengesahan ganda RSI dan AO, kebolehpercayaan isyarat perdagangan meningkat.

- Kawalan risiko yang sempurna: Peratusan yang ditetapkan untuk menghentikan dan menghentikan kerugian, mengawal risiko setiap perdagangan secara berkesan.

- Sains pengurusan wang: menggunakan peratusan tetap dana akaun untuk berdagang, mengelakkan kelebihan leverage.

- Logik yang jelas dan mudah: peraturan strategi intuitif dan mudah difahami dan dilaksanakan.

- Kesan visual yang baik: pelbagai jenis isyarat ditandakan dengan jelas di carta untuk memudahkan peniaga mengenali dan mengesahkan.

Risiko Strategik

- Risiko penembusan palsu: RSI menembusi 50 mungkin berlaku penembusan palsu, perlu disahkan dengan penunjuk teknikal lain.

- Stop loss terlalu kecil: Stop loss 1% mungkin terlalu kecil dan mudah disentuh oleh turun naik pasaran.

- Sekatan perdagangan satu arah: Strategi hanya melakukan lebih banyak dan tidak kosong, mungkin terlepas peluang untuk pasaran kosong.

- Kesan slippage: Mungkin menghadapi risiko slippage yang lebih besar apabila pasaran berubah-ubah.

- Sensitiviti parameter: Kesan strategi dipengaruhi oleh RSI dan parameter AO.

Arah pengoptimuman strategi

- Penapisan isyarat: Mencadangkan untuk menambah mekanisme pengesahan jumlah pesanan untuk meningkatkan kebolehpercayaan isyarat.

- Hentian dinamik: Hentian tetap boleh ditukar menjadi Hentian Pemantauan untuk melindungi keuntungan yang lebih baik.

- Optimasi parameter: disyorkan untuk mengoptimumkan pengulangan sejarah untuk kitaran RSI dan parameter AO.

- Penapisan pasaran: penambahan penilaian trend pasaran, hanya membuka perdagangan apabila trend besar meningkat.

- Pengurusan kedudukan: boleh disesuaikan mengikut dinamika kekuatan isyarat.

ringkaskan

Ini adalah strategi pengesanan trend yang menggabungkan RSI dan indikator AO untuk melakukan perdagangan berganda dengan menangkap isyarat pembalikan di kawasan oversold. Strategi ini direka dengan wajar, risiko terkawal, tetapi masih ada ruang untuk pengoptimuman.

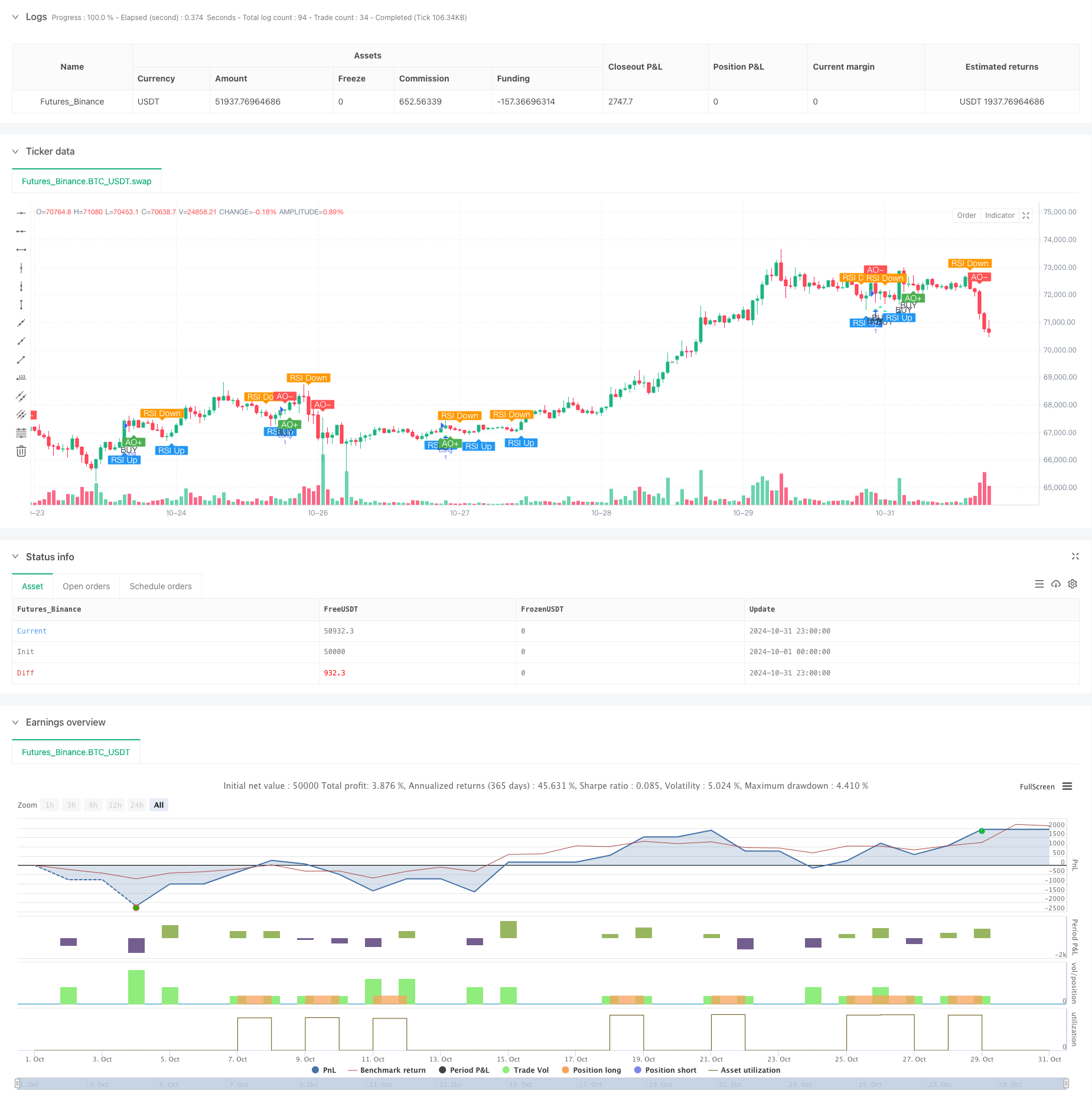

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="🐂 BUY Only - RSI Crossing 50 + AO Negative", shorttitle="🐂 AO<0 RSI+50 Strategy", overlay=true)

// -----------------------------

// --- User Inputs ---

// -----------------------------

// RSI Settings

rsiPeriod = input.int(title="RSI Period", defval=14, minval=1)

// AO Settings

aoShortPeriod = input.int(title="AO Short Period", defval=5, minval=1)

aoLongPeriod = input.int(title="AO Long Period", defval=34, minval=1)

// Strategy Settings

takeProfitPerc = input.float(title="Take Profit (%)", defval=2.0, minval=0.0, step=0.1)

stopLossPerc = input.float(title="Stop Loss (%)", defval=1.0, minval=0.0, step=0.1)

// -----------------------------

// --- Awesome Oscillator (AO) Calculation ---

// -----------------------------

// Calculate the Awesome Oscillator

ao = ta.sma(hl2, aoShortPeriod) - ta.sma(hl2, aoLongPeriod)

// Detect AO Crossing Zero

aoCrossOverZero = ta.crossover(ao, 0)

aoCrossUnderZero = ta.crossunder(ao, 0)

// -----------------------------

// --- Relative Strength Index (RSI) Calculation ---

// -----------------------------

// Calculate RSI

rsiValue = ta.rsi(close, rsiPeriod)

// Detect RSI Crossing 50

rsiCrossOver50 = ta.crossover(rsiValue, 50)

rsiCrossUnder50 = ta.crossunder(rsiValue, 50)

// -----------------------------

// --- Plotting Arrows and Labels ---

// -----------------------------

// Plot AO Cross Over Arrow (AO+)

plotshape(series=aoCrossOverZero,

location=location.belowbar,

color=color.green,

style=shape.labelup,

title="AO Crosses Above Zero",

text="AO+",

textcolor=color.white,

size=size.small)

// Plot AO Cross Under Arrow (AO-)

plotshape(series=aoCrossUnderZero,

location=location.abovebar,

color=color.red,

style=shape.labeldown,

title="AO Crosses Below Zero",

text="AO-",

textcolor=color.white,

size=size.small)

// Plot RSI Cross Over Arrow (RSI Up)

plotshape(series=rsiCrossOver50,

location=location.belowbar,

color=color.blue,

style=shape.labelup,

title="RSI Crosses Above 50",

text="RSI Up",

textcolor=color.white,

size=size.small)

// Plot RSI Cross Under Arrow (RSI Down)

plotshape(series=rsiCrossUnder50,

location=location.abovebar,

color=color.orange,

style=shape.labeldown,

title="RSI Crosses Below 50",

text="RSI Down",

textcolor=color.white,

size=size.small)

// -----------------------------

// --- Buy Signal Condition ---

// -----------------------------

// Define Buy Signal: AO is negative and previous bar's RSI > 50

buySignal = (ao < 0) and (rsiValue[1] > 50)

// Plot Buy Signal

plotshape(series=buySignal,

location=location.belowbar,

color=color.lime,

style=shape.triangleup,

title="Buy Signal",

text="BUY",

textcolor=color.black,

size=size.small)

// -----------------------------

// --- Strategy Execution ---

// -----------------------------

// Entry Condition

if buySignal

strategy.entry("Long", strategy.long)

// Exit Conditions

// Calculate Stop Loss and Take Profit Prices

if strategy.position_size > 0

// Entry price

entryPrice = strategy.position_avg_price

// Stop Loss and Take Profit Levels

stopLevel = entryPrice * (1 - stopLossPerc / 100)

takeProfitLevel = entryPrice * (1 + takeProfitPerc / 100)

// Submit Stop Loss and Take Profit Orders

strategy.exit("Exit Long", from_entry="Long", stop=stopLevel, limit=takeProfitLevel)