Gambaran keseluruhan

Ini adalah strategi perdagangan yang menggabungkan indikator MACD berganda dan analisis tingkah laku harga. Strategi ini menentukan trend pasaran dengan mengamati perubahan warna carta lurus MACD berganda pada kitaran 15 minit, sambil mencari bentuk ketegangan yang kuat pada kitaran 5 minit, dan mengesahkan isyarat penembusan pada kitaran 1 minit. Strategi ini menggunakan mekanisme stop loss dan penjejakan ketegangan dinamik berasaskan ATR untuk memaksimumkan ruang keuntungan sambil menguruskan risiko dengan berkesan.

Prinsip Strategi

Strategi menggunakan dua set penunjuk MACD dengan parameter yang berbeza ((34/144/9 dan 100/200/50) untuk mengesahkan trend pasaran. Apabila kedua-dua carta lurus MACD menunjukkan trend warna yang sama, sistem akan mencari bentuk gelung kuat pada carta 5 minit, yang dicirikan oleh entiti yang lebih besar daripada 1.5 kali garis bayangan. Setelah mencari gelung kuat, sistem akan memantau pada carta 1 minit untuk melihat apakah terdapat penembusan.

Kelebihan Strategik

- Analisis pelbagai kitaran: menggabungkan tiga kitaran masa 15 minit, 5 minit dan 1 minit untuk meningkatkan kebolehpercayaan isyarat

- Pengesahan Trend: Menggunakan Double MACD Cross Verification untuk mengurangkan isyarat palsu

- Analisis tingkah laku harga: mengenal pasti tahap harga kritikal melalui corak kejatuhan kuat

- Pengurusan Risiko Dinamis: Mekanisme Stop Loss dan Tracking Stop yang Berasaskan ATR

- Penapisan isyarat: Syarat kemasukan yang ketat mengurangkan kesilapan

- Tingkat automasi yang tinggi: Automasi keseluruhan transaksi, mengurangkan campur tangan manusia

Risiko Strategik

- Risiko trend reversal: kemungkinan terobosan palsu dalam pasaran yang bergolak

- Risiko slippage: Perdagangan frekuensi tinggi dalam kitaran 1 minit mungkin menghadapi kesan slippage

- Risiko Overtrading: Isyarat yang kerap boleh menyebabkan overtrading

- Kepercayaan kepada keadaan pasaran: Mungkin kurang baik dalam keadaan pasaran yang bergolak Langkah-langkah mitigasi:

- Tambah penapis trend

- Tetapkan had turun naik minimum

- Tambah had transaksi

- Memperkenalkan mekanisme pengenalan persekitaran pasaran

Arah pengoptimuman strategi

- Optimumkan parameter MACD: Parameter MACD boleh disesuaikan mengikut ciri-ciri pasaran yang berbeza

- Pengoptimuman Hentikan Kerosakan: Pertimbangkan untuk menambah Hentikan Bergerak Berasaskan Kadar Fluktuasi

- Penapisan masa dagangan: Tambah sekatan tetingkap masa dagangan

- Pengurusan lokasi: mewujudkan mekanisme pembinaan dan pengeluaran

- Penapisan keadaan pasaran: penambahan penunjuk kekuatan trend

- Kawalan penarikan balik: memperkenalkan mekanisme kawalan risiko berdasarkan kurva hak dan kepentingan

ringkaskan

Ini adalah sistem strategi yang menggunakan analisis teknikal dan pengurusan risiko secara komprehensif. Ia memastikan kualiti perdagangan melalui analisis pelbagai kitaran dan penapisan isyarat yang ketat, sambil menggunakan risiko pengurusan yang berkesan dengan menghentikan kerugian dinamik dan mengesan mekanisme hentian.

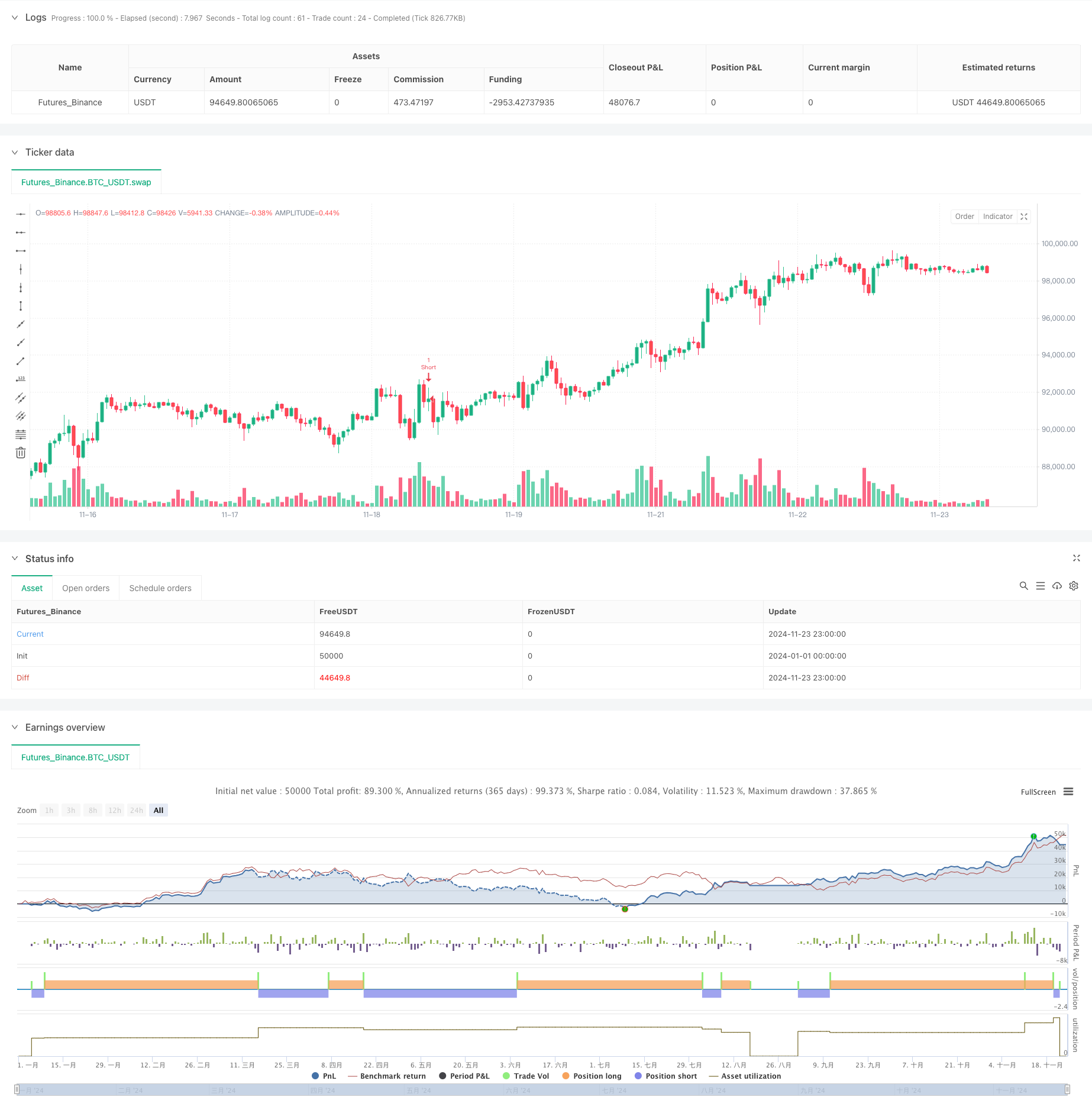

/*backtest

start: 2024-01-01 00:00:00

end: 2024-11-24 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=5

strategy("Price Action + Double MACD Strategy with ATR Trailing", overlay=true)

// Inputs for MACD

fastLength1 = input.int(34, title="First MACD Fast Length")

slowLength1 = input.int(144, title="First MACD Slow Length")

signalLength1 = input.int(9, title="First MACD Signal Length")

fastLength2 = input.int(100, title="Second MACD Fast Length")

slowLength2 = input.int(200, title="Second MACD Slow Length")

signalLength2 = input.int(50, title="Second MACD Signal Length")

// Input for ATR Trailing

atrMultiplier = input.float(1.5, title="ATR Multiplier for Trailing")

// Inputs for Stop Loss

atrStopMultiplier = input.float(1.0, title="ATR Multiplier for Stop Loss")

// MACD Calculations

[macdLine1, signalLine1, macdHist1] = ta.macd(close, fastLength1, slowLength1, signalLength1)

[macdLine2, signalLine2, macdHist2] = ta.macd(close, fastLength2, slowLength2, signalLength2)

// Get 15M MACD histogram colors

macdHist1Color = request.security(syminfo.tickerid, "15", (macdHist1 >= 0 ? (macdHist1[1] < macdHist1 ? #26A69A : #B2DFDB) : (macdHist1[1] < macdHist1 ? #FFCDD2 : #FF5252)))

macdHist2Color = request.security(syminfo.tickerid, "15", (macdHist2 >= 0 ? (macdHist2[1] < macdHist2 ? #26A69A : #B2DFDB) : (macdHist2[1] < macdHist2 ? #FFCDD2 : #FF5252)))

// Check MACD color conditions

isMacdUptrend = macdHist1Color == #26A69A and macdHist2Color == #26A69A

isMacdDowntrend = macdHist1Color == #FF5252 and macdHist2Color == #FF5252

// Function to detect strong 5M candles

isStrongCandle(open, close, high, low) =>

body = math.abs(close - open)

tail = math.abs(high - low) - body

body > tail * 1.5 // Ensure body is larger than the tail

// Variables to track state

var float fiveMinuteHigh = na

var float fiveMinuteLow = na

var bool tradeExecuted = false

var bool breakoutDetected = false

var float entryPrice = na

var float stopLossPrice = na

var float longTakeProfit = na

var float shortTakeProfit = na

// Check for new 15M candle and reset flags

if ta.change(time("15"))

tradeExecuted := false // Reset trade execution flag

breakoutDetected := false // Reset breakout detection

if isStrongCandle(open[1], close[1], high[1], low[1])

fiveMinuteHigh := high[1]

fiveMinuteLow := low[1]

else

fiveMinuteHigh := na

fiveMinuteLow := na

// Get 1-minute close prices

close1m = request.security(syminfo.tickerid, "5", close)

// Ensure valid breakout direction and avoid double breakouts

if not na(fiveMinuteHigh) and not breakoutDetected

for i = 1 to 3

if close1m[i] > fiveMinuteHigh and not tradeExecuted // 1M breakout check with close

breakoutDetected := true

if isMacdUptrend

// Open Long trade

entryPrice := close

stopLossPrice := close - (atrStopMultiplier * ta.atr(14)) // ATR-based stop loss

longTakeProfit := close + (atrMultiplier * ta.atr(14)) // Initialize take profit

strategy.entry("Long", strategy.long)

tradeExecuted := true

break // Exit the loop after detecting a breakout

else if close1m[i] < fiveMinuteLow and not tradeExecuted // 1M breakout check with close

breakoutDetected := true

if isMacdDowntrend

// Open Short trade

entryPrice := close

stopLossPrice := close + (atrStopMultiplier * ta.atr(14)) // ATR-based stop loss

shortTakeProfit := close - (atrMultiplier * ta.atr(14)) // Initialize take profit

strategy.entry("Short", strategy.short)

tradeExecuted := true

break // Exit the loop after detecting a breakout

// Update trailing take-profit dynamically

if tradeExecuted and strategy.position_size > 0 // Long trade

longTakeProfit := math.max(longTakeProfit, close + (atrMultiplier * ta.atr(14)))

strategy.exit("Long TP/SL", "Long", stop=stopLossPrice, limit=longTakeProfit)

else if tradeExecuted and strategy.position_size < 0 // Short trade

shortTakeProfit := math.min(shortTakeProfit, close - (atrMultiplier * ta.atr(14)))

strategy.exit("Short TP/SL", "Short", stop=stopLossPrice, limit=shortTakeProfit)

// Reset trade state when position is closed

if strategy.position_size == 0

tradeExecuted := false

entryPrice := na

longTakeProfit := na

shortTakeProfit := na