Gambaran keseluruhan

Strategi ini adalah sistem perdagangan berdasarkan analisis pelbagai kerangka masa yang menggabungkan Bollinger Bands, Hull Moving Averages dan weighted Moving Averages untuk menghasilkan isyarat perdagangan. Strategi ini beroperasi pada kerangka masa 1 jam, sambil mengintegrasikan data pasaran dalam tiga tempoh masa 5 minit, 1 jam dan 3 jam, untuk mengesahkan peluang perdagangan melalui kombinasi pelbagai petunjuk teknikal.

Prinsip Strategi

Logik teras strategi ini adalah berdasarkan pengesahan silang pelbagai petunjuk teknikal. Ia memantau hubungan harga dengan pelbagai jenis garis rata pada masa yang sama dalam pelbagai tempoh masa, termasuk purata bergerak bertimbangan dalam kitaran 5 minit (VWMA), purata bergerak bertimbangan dalam kitaran 1 jam, dan purata bergerak Hull dalam kitaran 3 jam (HMA). Apabila harga berada di atas semua petunjuk tempoh masa, sistem akan menghasilkan banyak isyarat apabila harga meletup; sebaliknya, apabila harga berada di bawah semua petunjuk, sistem akan menghasilkan isyarat kosong apabila harga meletup.

Kelebihan Strategik

- Analisis kitaran masa berganda mengurangkan risiko penembusan palsu dan meningkatkan kebolehpercayaan isyarat perdagangan

- Tetapan Stop Loss yang dinamik dapat menyesuaikan diri dengan keadaan pasaran yang berbeza

- Pengurusan kedudukan berdasarkan hak dan kepentingan akaun memastikan penggunaan dana yang munasabah

- Pilihan pelbagai mekanisme penyingkiran meningkatkan fleksibiliti strategi

- Antara muka grafik yang memberikan isyarat perdagangan yang jelas untuk analisis dan penghakiman

- Mengintegrasikan pelbagai penunjuk teknikal yang matang untuk meningkatkan ketepatan keputusan perdagangan

Risiko Strategik

- Penggunaan pelbagai petunjuk boleh menyebabkan isyarat perdagangan terlewat

- Isyarat pelarian palsu yang kerap mungkin berlaku dalam pasaran yang tidak menentu

- Nisbah Stop Loss Tetap mungkin tidak sesuai untuk semua keadaan pasaran

- Pemprosesan data dalam tempoh masa yang berbilang boleh meningkatkan kerumitan operasi strategi

- Risiko tergelincir yang mungkin lebih besar dalam pasaran yang sangat tidak menentu

Arah pengoptimuman strategi

- Memperkenalkan penunjuk turun naik untuk melaraskan tahap ambil untung dan henti kerugian secara dinamik

- Tambah ciri pengenalan keadaan pasaran, menggunakan tetapan parameter yang berbeza dalam keadaan pasaran yang berbeza

- Mekanisme penapisan isyarat yang dioptimumkan untuk mengurangkan kerosakan akibat penembusan palsu

- Menambah kebolehpercayaan isyarat penembusan dengan analisis jumlah transaksi

- Membangunkan mekanisme pengoptimuman parameter yang bersesuaian untuk meningkatkan kestabilan strategi

ringkaskan

Strategi ini membina sistem perdagangan yang agak lengkap dengan menggabungkan analisis kitaran masa dan pelbagai petunjuk teknikal. Kelebihan strategi adalah kebolehpercayaan isyarat dan keberkesanan pengurusan risiko, tetapi ada juga masalah seperti kelewatan isyarat dan pengoptimuman parameter. Dengan pengoptimuman dan penambahbaikan yang berterusan, strategi ini dijangka mengekalkan prestasi yang stabil dalam pelbagai keadaan pasaran.

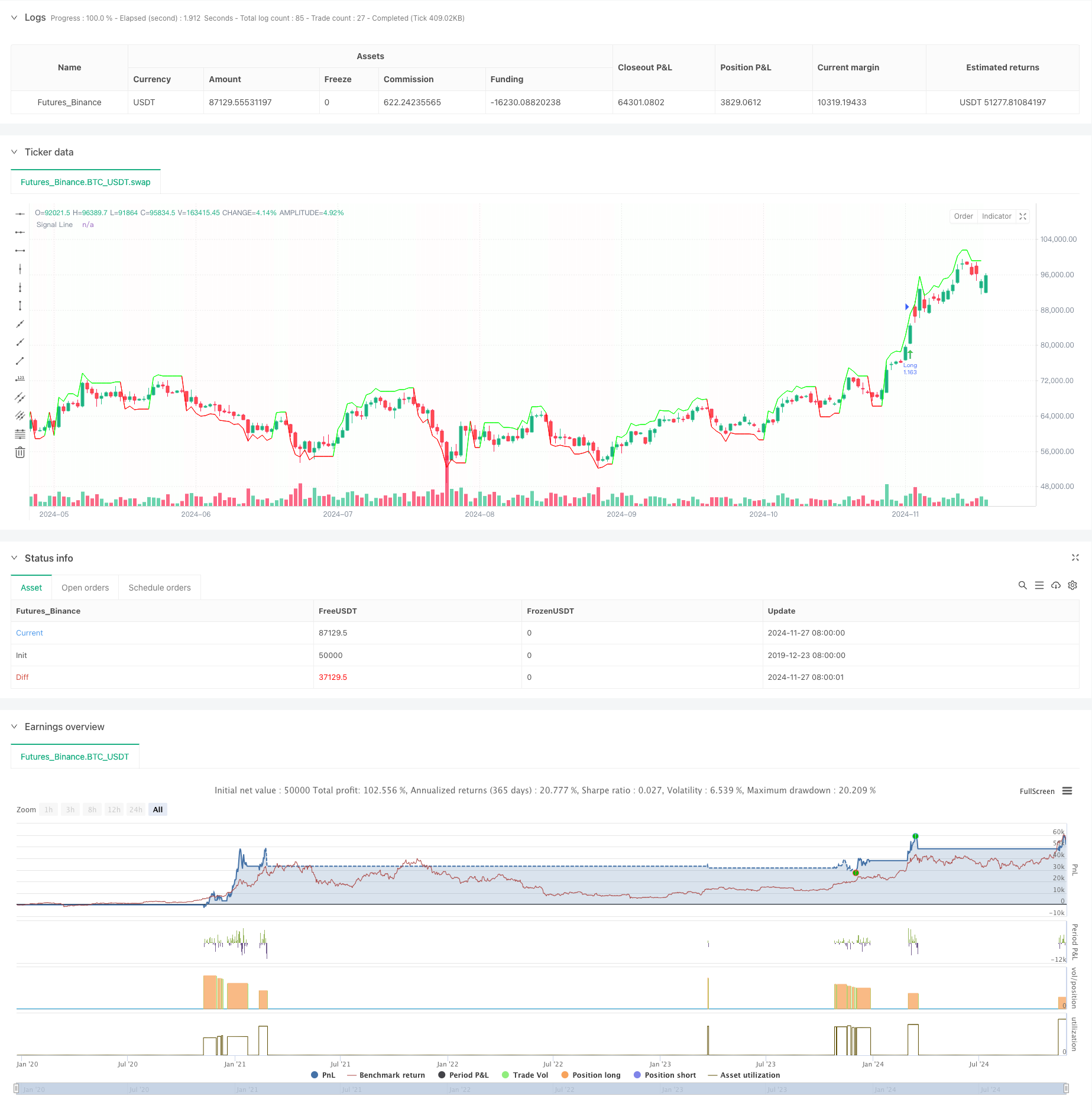

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("1H- 280, 2.7", overlay=true)

// Fetch the indicator values from different timeframes

vwma5 = request.security(syminfo.tickerid, "5", ta.wma(close, 233), lookahead = barmerge.lookahead_off)

vwma_hourly = request.security(syminfo.tickerid, "60", ta.wma(close, 89), lookahead = barmerge.lookahead_off)

hullma155_3h = request.security(syminfo.tickerid, "180", ta.hma(close, 155), lookahead = barmerge.lookahead_off)

// Calculate the deviation value

deviation = close * 0.032

// Initialize the signal variables

var float signalLine = na

var color lineColor = na

// Long Entry Conditions

longCondition_5min = close > vwma5

longCondition_hourly = close > vwma_hourly

longCondition_3h = close > hullma155_3h

// Short Entry Conditions

shortCondition_5min = close < vwma5

shortCondition_hourly = close < vwma_hourly

shortCondition_3h = close < hullma155_3h

// Long Entry

if longCondition_5min and longCondition_hourly and longCondition_3h

signalLine := close + deviation

lineColor := color.rgb(0, 255, 0, 1)

// Short Entry

if shortCondition_5min and shortCondition_hourly and shortCondition_3h

signalLine := close - deviation

lineColor := color.rgb(255, 0, 0, 1)

// Plotting the connecting line

plot(signalLine, title="Signal Line", color=lineColor, linewidth=1, style=plot.style_line)

// Colorize the signal line

bgcolor(signalLine > close ? color.rgb(0, 255, 0, 99) : color.rgb(255, 0, 0, 99), transp=90)

// Strategy settings

useTPSL = input(true, "Use TP/SL for closing long positions?")

useDownbreakOutbreak = input(false, "Use Downbreak and Outbreak for closing positions?")

useM7FClosing = input(false, "Use M7F Signal for closing positions?")

length1 = input.int(280, minval=1)

src = input(close, title="Source")

mult = input.float(2.7, minval=0.001, maxval=50, title="StdDev")

basis = ta.vwma(src, length1)

dev = mult * ta.stdev(src, length1)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

length2 = input.int(55, minval=1)

src2 = input(close, title="Source")

hullma = ta.wma(2 * ta.wma(src2, length2 / 2) - ta.wma(src2, length2), math.floor(math.sqrt(length2)))

hullmacrosslower = ta.crossover(hullma, lower)

hullmacrossupper = ta.crossunder(hullma, upper)

breakout = ta.crossover(ohlc4, upper)

breakdown = ta.crossunder(ohlc4, upper)

outbreak = ta.crossover(ohlc4, lower)

downbreak = ta.crossunder(ohlc4, lower)

// Calculate position size and leverage

margin_pct = 1

leverage = 1

position_size = strategy.equity * margin_pct

qty = position_size / close / leverage

// Define take profit and stop loss levels

take_profit = 0.14

stop_loss = 0.06

// Opening a long position

if breakout

strategy.entry("Long", strategy.long, qty, limit=close*(1+take_profit), stop=close*(1-stop_loss))

// Opening a short position

if downbreak

strategy.entry("Short", strategy.short, qty, limit=close*(1-take_profit), stop=close*(1+stop_loss))

// Closing positions based on chosen method

if useTPSL

// Using TP/SL for closing long positions

if strategy.position_size > 0 and breakdown

strategy.close("Long", comment="Breakdown")

else if useDownbreakOutbreak

// Using Downbreak and Outbreak for closing positions

if strategy.position_size > 0 and (breakdown or downbreak)

strategy.close("Long", comment="Breakdown")

if strategy.position_size < 0 and (outbreak or downbreak)

strategy.close("Short", comment="Outbreak")

else if useM7FClosing

// Using M7F Signal for closing positions

if strategy.position_size > 0 and (signalLine < close)

strategy.close("Long", comment="M7F Signal")

if strategy.position_size < 0 and (signalLine > close)

strategy.close("Short", comment="M7F Signal")

// Plotting entry signals

plotshape(hullmacrosslower, title="High Bear Volatility", style=shape.arrowup, text="^^^^^", color=color.rgb(75, 202, 79), location=location.belowbar)

plotshape(hullmacrossupper, title="High Bull Volatility", style=shape.arrowdown, text="-----", color=color.rgb(215, 72, 72), location=location.abovebar)

plotshape(breakout ? 1 : na, title="Breakout", style=shape.arrowup, text="", color=color.rgb(75, 202, 79), location=location.belowbar, size=size.tiny)

plotshape(breakdown ? 1 : na, title="Breakdown", style=shape.arrowdown, text="", color=color.rgb(201, 71, 71), location=location.abovebar, size=size.tiny)

plotshape(outbreak ? 1 : na, title="Outbreak", style=shape.arrowup, text="", color=color.rgb(0, 110, 255), location=location.belowbar, size=size.tiny)

plotshape(downbreak ? 1 : na, title="Downbreak", style=shape.arrowdown, text="", color=color.rgb(255, 111, 0), location=location.abovebar, size=size.tiny)