Gambaran keseluruhan

Strategi ini adalah strategi pengesanan trend berdasarkan purata bergerak indeks (EMA) dan penunjuk momentum. Ia dilakukan dengan menggabungkan isyarat pemecahan dinamik dan penapis trend EMA untuk berdagang apabila trend pasaran jelas. Strategi ini merangkumi modul pengurusan risiko yang lengkap, penapis masa perdagangan yang fleksibel, dan fungsi analisis statistik terperinci untuk meningkatkan kestabilan dan kebolehpercayaan strategi.

Prinsip Strategi

Logik teras strategi adalah berdasarkan elemen utama berikut:

- Pengiktirafan isyarat kuasa: Dengan mengira nilai kuasa dalam tempoh masa yang disesuaikan oleh pengguna, ia menghasilkan isyarat melakukan lebih banyak apabila kuasa menembusi ambang aras atas, dan menghasilkan isyarat kosong apabila ia menembusi ambang aras bawah.

- Penapisan trend EMA: menggunakan 200 kitaran EMA sebagai asas penilaian trend, harga di atas EMA dibenarkan melakukan lebih banyak, harga di bawah EMA dibenarkan melakukan lebih sedikit.

- Penapisan masa: anda boleh menetapkan masa dagangan tertentu dan menyokong penyesuaian zon waktu GMT, menjadikan strategi lebih sesuai dengan masa perdagangan di pasaran yang berbeza.

- Kawalan risiko: Sokongan untuk seting stop loss dan stop loss berdasarkan ATR atau peratusan tetap, dan had jumlah maksimum dagangan sehari.

Kelebihan Strategik

- Keupayaan untuk mengesan trend yang kuat: dengan EMA dan pengesahan dua hala, ia dapat menangkap trend utama dengan berkesan.

- Pengurusan risiko yang baik: menawarkan pelbagai pilihan penutupan, baik dengan penutupan ATR dinamik atau dengan penutupan peratusan tetap.

- Analisis statistik menyeluruh: Menjejaki pelbagai petunjuk prestasi dalam masa nyata, termasuk kadar kemenangan dalam penerbangan, nisbah risiko dan ganjaran.

- Fleksibiliti parameter: parameter utama boleh disesuaikan dengan ciri-ciri pasaran yang berbeza.

Risiko Strategik

Risiko pasaran goyah: Dalam pasaran yang goyah, mungkin terdapat banyak isyarat pecah palsu. Penyelesaian yang dicadangkan: Tambah penapis penunjuk gegaran atau tingkatkan paras penembusan.

Risiko Tergelincir: Tergelincir yang lebih besar mungkin berlaku dalam tempoh turun naik yang kuat. Penyelesaian yang disyorkan: Setting a reasonable stop loss range and avoiding trading during high volatility.

Risiko perdagangan berlebihan: isyarat yang terlalu kerap boleh menyebabkan perdagangan berlebihan. Penyelesaian yang dicadangkan: Tetapkan had maksimum transaksi harian yang munasabah.

Arah pengoptimuman strategi

- Pengoptimuman parameter dinamik: boleh menyesuaikan penurunan dinamik dan kitaran EMA secara automatik mengikut turun naik pasaran.

- Analisis kitaran masa berbilang: Tambah beberapa kitaran masa untuk mengesahkan trend, meningkatkan kebolehpercayaan isyarat.

- Pengenalan keadaan pasaran: Tambah modul analisis kadar turun naik, menggunakan parameter yang berbeza dalam keadaan pasaran yang berbeza.

- Peningkatan kekuatan isyarat: isyarat penembusan diberi peringkat kekuatan, skala pegangan disesuaikan mengikut dinamik kekuatan isyarat.

ringkaskan

Ini adalah strategi pengesanan trend yang direka dengan baik untuk menangkap peluang pasaran dengan cara menggabungkan pemecahan momentum dan trend EMA. Sistem pengurusan risiko strategi ini lengkap, analisis statistik yang kuat, kepraktisan yang baik dan kebolehskalian. Dengan pengoptimuman dan penyempurnaan yang berterusan, strategi ini dijangka dapat mengekalkan prestasi yang stabil dalam pelbagai keadaan pasaran.

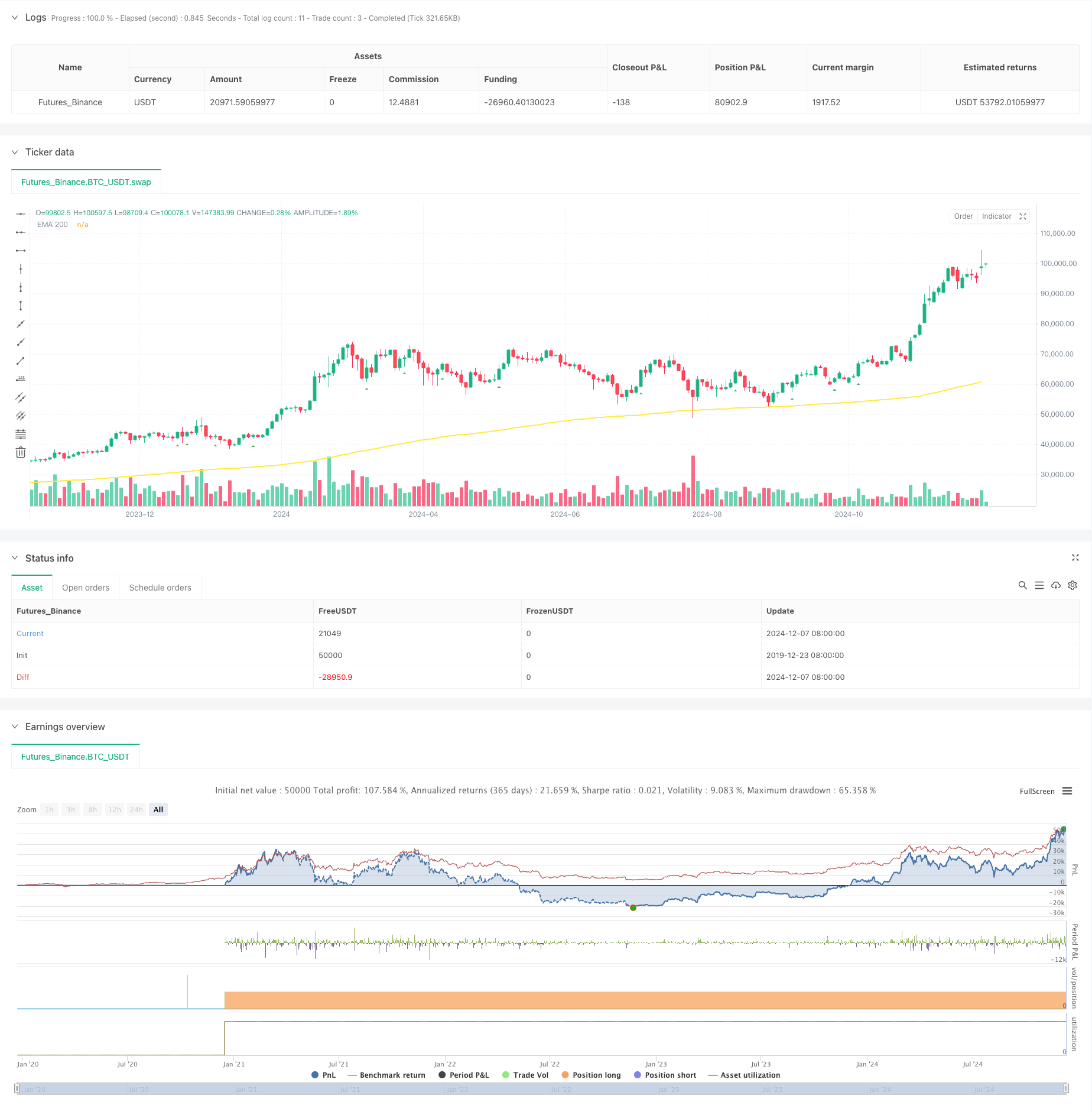

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("[Mustang Algo] EMA Momentum Strategy",

shorttitle="[Mustang Algo] Mom Strategy",

overlay=true,

initial_capital=10000,

default_qty_type=strategy.fixed,

default_qty_value=1,

pyramiding=0,

calc_on_every_tick=false,

max_bars_back=5000)

// Momentum Parameters

len = input.int(10, minval=1, title="Length")

src = input(close, title="Source")

momTimeframe = input.timeframe("", title="Momentum Timeframe")

timeframe_gaps = input.bool(true, title="Autoriser les gaps de timeframe")

momFilterLong = input.float(5, title="Filtre Momentum Long", minval=0)

momFilterShort = input.float(-5, title="Filtre Momentum Short", maxval=0)

// EMA Filter

useEmaFilter = input.bool(true, title="Utiliser Filtre EMA")

emaLength = input.int(200, title="EMA Length", minval=1)

// Position Size

contractSize = input.float(1.0, title="Taille de position", minval=0.01, step=0.01)

// Time filter settings

use_time_filter = input.bool(false, title="Utiliser le Filtre de Temps")

start_hour = input.int(9, title="Heure de Début", minval=0, maxval=23)

start_minute = input.int(30, title="Minute de Début", minval=0, maxval=59)

end_hour = input.int(16, title="Heure de Fin", minval=0, maxval=23)

end_minute = input.int(30, title="Minute de Fin", minval=0, maxval=59)

gmt_offset = input.int(0, title="Décalage GMT", minval=-12, maxval=14)

// Risk Management

useAtrSl = input.bool(false, title="Utiliser ATR pour SL/TP")

atrPeriod = input.int(14, title="Période ATR", minval=1)

atrMultiplier = input.float(1.5, title="Multiplicateur ATR pour SL", minval=0.1, step=0.1)

stopLossPerc = input.float(1.0, title="Stop Loss (%)", minval=0.01, step=0.01)

tpRatio = input.float(2.0, title="Take Profit Ratio", minval=0.1, step=0.1)

// Daily trade limit

maxDailyTrades = input.int(2, title="Limite de trades par jour", minval=1)

// Variables for tracking daily trades

var int dailyTradeCount = 0

// Reset daily trade count

if dayofweek != dayofweek[1]

dailyTradeCount := 0

// Time filter function

is_within_session() =>

current_time = time(timeframe.period, "0000-0000:1234567", gmt_offset)

start_time = timestamp(year, month, dayofmonth, start_hour, start_minute, 0)

end_time = timestamp(year, month, dayofmonth, end_hour, end_minute, 0)

in_session = current_time >= start_time and current_time <= end_time

not use_time_filter or in_session

// EMA Calculation

ema200 = ta.ema(close, emaLength)

// Momentum Calculation

gapFillMode = timeframe_gaps ? barmerge.gaps_on : barmerge.gaps_off

mom = request.security(syminfo.tickerid, momTimeframe, src - src[len], gapFillMode)

// ATR Calculation

atr = ta.atr(atrPeriod)

// Signal Detection with Filters

crossoverUp = ta.crossover(mom, momFilterLong)

crossoverDown = ta.crossunder(mom, momFilterShort)

emaUpTrend = close > ema200

emaDownTrend = close < ema200

// Trading Conditions

longCondition = crossoverUp and (not useEmaFilter or emaUpTrend) and is_within_session() and dailyTradeCount < maxDailyTrades and barstate.isconfirmed

shortCondition = crossoverDown and (not useEmaFilter or emaDownTrend) and is_within_session() and dailyTradeCount < maxDailyTrades and barstate.isconfirmed

// Calcul des niveaux de Stop Loss et Take Profit

float stopLoss = useAtrSl ? (atr * atrMultiplier) : (close * stopLossPerc / 100)

float takeProfit = stopLoss * tpRatio

// Modification des variables pour éviter les erreurs de repainting

var float entryPrice = na

var float currentStopLoss = na

var float currentTakeProfit = na

// Exécution des ordres avec gestion des positions

if strategy.position_size == 0

if longCondition

entryPrice := close

currentStopLoss := entryPrice - stopLoss

currentTakeProfit := entryPrice + takeProfit

strategy.entry("Long", strategy.long, qty=contractSize)

strategy.exit("Exit Long", "Long", stop=currentStopLoss, limit=currentTakeProfit)

dailyTradeCount += 1

if shortCondition

entryPrice := close

currentStopLoss := entryPrice + stopLoss

currentTakeProfit := entryPrice - takeProfit

strategy.entry("Short", strategy.short, qty=contractSize)

strategy.exit("Exit Short", "Short", stop=currentStopLoss, limit=currentTakeProfit)

dailyTradeCount += 1

// Plot EMA

plot(ema200, color=color.yellow, linewidth=2, title="EMA 200")

// Plot Signals

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// // Performance Statistics

// var int longWins = 0

// var int longLosses = 0

// var int shortWins = 0

// var int shortLosses = 0

// if strategy.closedtrades > 0

// trade = strategy.closedtrades - 1

// isLong = strategy.closedtrades.entry_price(trade) < strategy.closedtrades.exit_price(trade)

// isWin = strategy.closedtrades.profit(trade) > 0

// if isLong and isWin

// longWins += 1

// else if isLong and not isWin

// longLosses += 1

// else if not isLong and isWin

// shortWins += 1

// else if not isLong and not isWin

// shortLosses += 1

// longTrades = longWins + longLosses

// shortTrades = shortWins + shortLosses

// longWinRate = longTrades > 0 ? (longWins / longTrades) * 100 : 0

// shortWinRate = shortTrades > 0 ? (shortWins / shortTrades) * 100 : 0

// overallWinRate = strategy.closedtrades > 0 ? (strategy.wintrades / strategy.closedtrades) * 100 : 0

// avgRR = strategy.grossloss != 0 ? math.abs(strategy.grossprofit / strategy.grossloss) : 0

// // Display Statistics

// var table statsTable = table.new(position.top_right, 4, 7, border_width=1)

// if barstate.islastconfirmedhistory

// table.cell(statsTable, 0, 0, "Type", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 0, "Win", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 0, "Lose", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 0, "Daily Trades", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 1, "Long", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 1, str.tostring(longWins), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 1, str.tostring(longLosses), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 1, str.tostring(dailyTradeCount) + "/" + str.tostring(maxDailyTrades), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 2, "Short", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 2, str.tostring(shortWins), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 2, str.tostring(shortLosses), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 3, "Win Rate", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 3, "Long: " + str.tostring(longWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 3, "Short: " + str.tostring(shortWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 4, "Overall", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 4, "Win Rate: " + str.tostring(overallWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 4, "Total: " + str.tostring(strategy.closedtrades) + " | RR: " + str.tostring(avgRR, "#.##"), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 5, "Trading Hours", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 5, "Start: " + str.format("{0,time,HH:mm}", start_hour * 60 * 60 * 1000 + start_minute * 60 * 1000), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 5, "End: " + str.format("{0,time,HH:mm}", end_hour * 60 * 60 * 1000 + end_minute * 60 * 1000), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 5, "GMT: " + (gmt_offset >= 0 ? "+" : "") + str.tostring(gmt_offset), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 6, "SL/TP Method", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 6, useAtrSl ? "ATR-based" : "Percentage-based", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 6, useAtrSl ? "ATR: " + str.tostring(atrPeriod) : "SL%: " + str.tostring(stopLossPerc), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 6, "TP Ratio: " + str.tostring(tpRatio), bgcolor=color.new(color.blue, 90))