1

fokus pada

1664

Pengikut

Gambaran keseluruhan

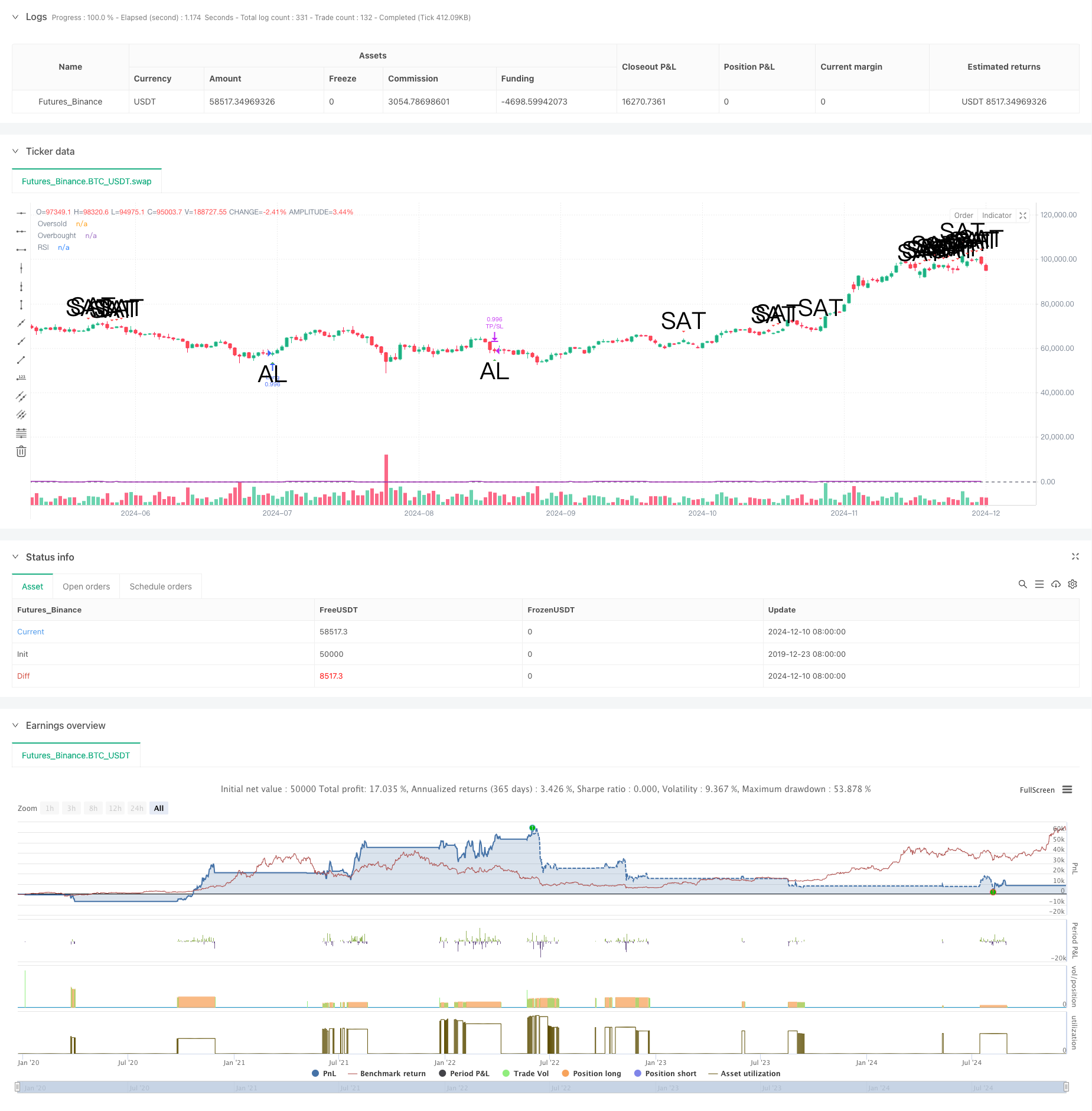

Strategi ini adalah sistem perdagangan trend-tracking yang menggabungkan MACD (Moving Average Convergence Scatter) dan RSI (Relatively Strong Indicator). Strategi ini berjalan pada kitaran masa 5 minit, menghasilkan isyarat perdagangan dengan menganalisis persimpangan MACD dengan garis isyarat dan tahap RSI overbought dan oversold.

Prinsip Strategi

Strategi ini berdasarkan kepada logik teras berikut:

- Penunjuk MACD menggunakan parameter 12-26-9 untuk menangkap trend harga

- Indeks RSI 14 kitaran untuk mengenal pasti keadaan overbought dan oversold

- Apabila MACD melintasi garis isyarat dan RSI adalah di bawah 45, ia akan mencetuskan isyarat ganda

- Apabila MACD melintasi talian isyarat secara offline dan RSI lebih tinggi daripada 55, mencetuskan isyarat kedudukan rata

- Tetapkan 1.2% Stop Loss untuk mengawal risiko dan 2.4% Stop Stop untuk mengunci keuntungan

- Menggunakan 10 kitaran EMA sebagai penapis trend untuk meningkatkan kualiti isyarat

Kelebihan Strategik

- Kelebihan Kumpulan Indeks: Gabungan ciri-ciri trend MACD dan ciri-ciri pergerakan RSI, dapat menangkap titik-titik perubahan pasaran dengan lebih tepat

- Pengendalian risiko yang sempurna: menggunakan stop loss stop stop dengan peratusan tetap, mengawal risiko perdagangan tunggal dengan ketat

- Mekanisme pengesahan isyarat: syarat MACD dan RSI perlu dipenuhi untuk membuka kedudukan, mengurangkan isyarat palsu

- Kebolehsuaian: boleh disesuaikan dengan parameter untuk menyesuaikan diri dengan keadaan pasaran yang berbeza

- Logik pelaksanaan yang jelas: Peraturan transaksi jelas dan mudah untuk diotomatiskan

Risiko Strategik

- Risiko pasaran goyah: Perdagangan yang kerap boleh menyebabkan kerugian di pasaran goyah.

- Risiko slippage: sering berdagang dalam kitaran 5 minit, mungkin menghadapi slippage yang lebih besar

- Risiko penembusan palsu: isyarat silang MACD mungkin berlaku

- Sensitiviti parameter: tetapan parameter penunjuk mempunyai kesan yang lebih besar terhadap prestasi strategi

- Kepercayaan kepada keadaan pasaran: Strategi lebih baik di pasaran yang jelas trend

Arah pengoptimuman strategi

- Menambah penapis kuantiti pertukaran: Faktor kuantiti pertukaran dipertimbangkan semasa menghasilkan isyarat, meningkatkan kebolehpercayaan isyarat

- Tetapan hentian dinamik: menyesuaikan kadar hentian mengikut turun naik pasaran

- Memperkenalkan penapis kekuatan trend: menambah penunjuk kekuatan trend seperti ADX, mengoptimumkan masa perdagangan

- Pengurusan kedudukan yang lebih baik: kawalan kedudukan dinamik berdasarkan kadar turun naik

- Penyesuaian parameter pengoptimuman: Membangunkan mekanisme pengoptimuman dinamik parameter, meningkatkan kebolehsesuaian strategi

ringkaskan

Strategi ini menggabungkan kelebihan MACD dan RSI untuk membina sistem perdagangan yang menggabungkan ciri trend dan dinamika. Kaedah kawalan risiko yang baik dan logik perdagangan yang jelas menjadikannya praktikal. Dengan arah pengoptimuman yang disyorkan, strategi ini masih mempunyai ruang untuk meningkatkan lagi.

Kod sumber strategi

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-11 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

strategy("MACD + RSI Basit Strateji", overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// İndikatör parametreleri

fastLength = input(12, "MACD Fast Length")

slowLength = input(26, "MACD Slow Length")

signalLength = input(9, "MACD Signal Length")

rsiLength = input(14, "RSI Period")

rsiOversold = input(45, "RSI Oversold Level")

rsiOverbought = input(55, "RSI Overbought Level")

// Stop Loss ve Take Profit ekledim

stopLoss = input(1.2, "Stop Loss (%)")

takeProfit = input(2.4, "Take Profit (%)")

// MACD hesaplama

[macdLine, signalLine, histLine] = ta.macd(close, fastLength, slowLength, signalLength)

// RSI hesaplama

rsiValue = ta.rsi(close, rsiLength)

// EMA trend filtresi

emaValue = ta.ema(close, 10)

// Alım sinyali koşulları - sadece MACD ve RSI kullanalım

longCondition = macdLine > signalLine and rsiValue < rsiOversold

// Satım sinyali koşulları

shortCondition = macdLine < signalLine and rsiValue > rsiOverbought

// Pozisyon yönetimi - Stop Loss ve Take Profit ekledim

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL", "Long",

profit = close * takeProfit / 100,

loss = close * stopLoss / 100)

if (shortCondition)

strategy.close("Long")

// Grafik göstergeleri

plotshape(longCondition, title="Alım",

style=shape.triangleup,

location=location.belowbar,

color=color.green,

size=size.large,

text="AL")

plotshape(shortCondition, title="Satım",

style=shape.triangledown,

location=location.abovebar,

color=color.red,

size=size.large,

text="SAT")

// İndikatörleri göster

plot(rsiValue, "RSI", color=color.purple)

hline(rsiOversold, "Oversold", color=color.gray)

hline(rsiOverbought, "Overbought", color=color.gray)