1

fokus pada

1664

Pengikut

Gambaran keseluruhan

Strategi ini adalah sistem pengesanan trend yang menggabungkan purata bergerak ganda dan penunjuk MACD. Ia menggunakan purata bergerak 50 dan 200 untuk menentukan arah trend, sambil menggunakan penunjuk MACD untuk menangkap masa masuk tertentu.

Prinsip Strategi

Logik utama strategi ini adalah berdasarkan kepada beberapa elemen utama:

- Penghakiman trend: Menggunakan hubungan kedudukan 50 dan 200 garis rata-rata untuk menilai trend keseluruhan, apabila garis rata-rata cepat berada di atas garis rata-rata perlahan, ia dianggap sebagai tren naik, sebaliknya sebagai tren menurun.

- Isyarat masuk: Selepas mengesahkan arah trend, gunakan penyambung penunjuk MACD untuk mencetuskan isyarat masuk tertentu. Dalam trend menaik, MACD masuk lebih banyak ketika melintasi garis isyarat; dalam trend menurun, MACD masuk kosong ketika melintasi garis isyarat.

- Penapisan dagangan: Memperkenalkan pelbagai mekanisme penapisan seperti selang dagangan minimum, kekuatan trend dan nilai terhad MACD untuk mengelakkan perdagangan berlebihan dalam keadaan pasaran yang bergolak.

- Kawalan risiko: Menggunakan hentian kerugian dengan nombor titik tetap dan mekanisme penangguhan yang boleh disesuaikan, digabungkan dengan garis purata bergerak dan isyarat pembalikan MACD sebagai syarat keluar dari padang yang dinamik.

Kelebihan Strategik

- Pengesanan trend digabungkan dengan momentum: Dengan menggabungkan garis purata bergerak dan penunjuk MACD, anda dapat memahami trend besar dan menentukan masa masuk dengan tepat.

- Pengurusan risiko yang baik: Terdapat pelbagai mekanisme penangguhan, termasuk penangguhan tetap dan penangguhan dinamik yang dicetuskan oleh petunjuk teknikal.

- Tetapan parameter yang fleksibel: parameter utama seperti jumlah titik hentian hentian, kitaran purata dan lain-lain boleh disesuaikan dengan keadaan pasaran.

- Mekanisme penapisan pintar: mengurangkan isyarat palsu dan meningkatkan kualiti urus niaga melalui pelbagai syarat penapisan.

- Statistik prestasi yang lengkap: Fungsi statistik perdagangan terperinci yang terbina dalam, termasuk pengiraan masa nyata untuk petunjuk utama seperti kadar kemenangan, purata keuntungan dan kerugian.

Risiko Strategik

- Risiko pasaran goyah: Isyarat palsu yang sering mungkin berlaku dalam pasaran goyah mendatar disarankan untuk menambah indikator pengesahan trend.

- Risiko slippage: Perdagangan kitaran kecil mudah terjejas oleh slippage dan disyorkan untuk mengendurkan tetapan stop loss.

- Sensitiviti parameter: prestasi strategi lebih sensitif kepada tetapan parameter, yang memerlukan pengoptimuman parameter yang mencukupi.

- Kepercayaan kepada keadaan pasaran: Strategi ini berfungsi dengan baik dalam pasaran yang sedang bercenderungan, tetapi kesannya mungkin tidak stabil dalam keadaan pasaran lain.

Arah pengoptimuman strategi

- Pengoptimuman Hentian Dinamis: Anda boleh menyesuaikan amplitudo hentian secara dinamik mengikut petunjuk ATR, untuk menjadikannya lebih sesuai dengan turun naik pasaran.

- Optimasi masa masuk: Indikator tambahan seperti RSI boleh ditambah untuk mengesahkan masa masuk dan meningkatkan ketepatan perdagangan.

- Pengurusan kedudukan yang dioptimumkan: memperkenalkan sistem pengurusan kedudukan dinamik berdasarkan kadar turun naik untuk mengawal risiko dengan lebih baik.

- Pengenalan persekitaran pasaran: menambah modul pengenalan persekitaran pasaran, menggunakan kombinasi parameter yang berbeza dalam keadaan pasaran yang berbeza.

ringkaskan

Ini adalah sistem perdagangan trend yang dirancang dengan logik dan logik. Dengan menggabungkan petunjuk teknikal klasik dan kaedah pengurusan risiko moden, strategi ini memberi tumpuan kepada trend dan juga mengawal risiko. Walaupun terdapat beberapa tempat yang perlu dioptimumkan, secara keseluruhan adalah strategi perdagangan yang bernilai praktikal.

Kod sumber strategi

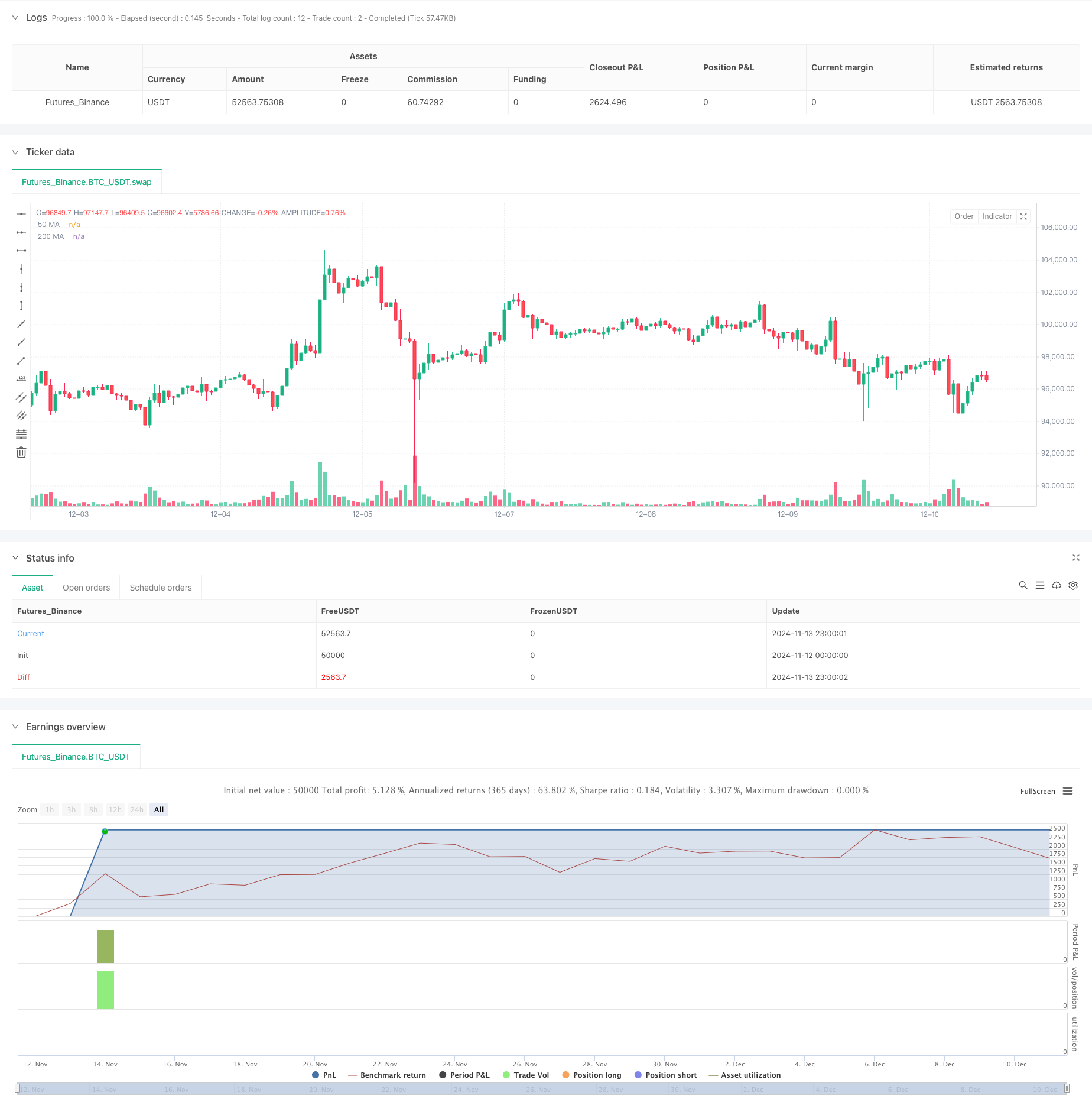

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © WolfofAlgo

//@version=5

strategy("Trend Following Scalping Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Input Parameters

stopLossPips = input.float(5.0, "Stop Loss in Pips", minval=1.0)

takeProfitPips = input.float(10.0, "Take Profit in Pips", minval=1.0)

useFixedTakeProfit = input.bool(true, "Use Fixed Take Profit")

// Moving Average Parameters

fastMA = input.int(50, "Fast MA Period")

slowMA = input.int(200, "Slow MA Period")

// MACD Parameters

macdFastLength = input.int(12, "MACD Fast Length")

macdSlowLength = input.int(26, "MACD Slow Length")

macdSignalLength = input.int(9, "MACD Signal Length")

// Trade Filter Parameters (Adjusted to be less strict)

minBarsBetweenTrades = input.int(5, "Minimum Bars Between Trades", minval=1)

trendStrengthPeriod = input.int(10, "Trend Strength Period")

minTrendStrength = input.float(0.4, "Minimum Trend Strength", minval=0.1, maxval=1.0)

macdThreshold = input.float(0.00005, "MACD Threshold", minval=0.0)

// Variables for trade management

var int barsLastTrade = 0

barsLastTrade := nz(barsLastTrade[1]) + 1

// Calculate Moving Averages

ma50 = ta.sma(close, fastMA)

ma200 = ta.sma(close, slowMA)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

// Calculate trend strength (simplified)

trendDirection = ta.ema(close, trendStrengthPeriod) > ta.ema(close, trendStrengthPeriod * 2)

isUptrend = close > ma50 and ma50 > ma200

isDowntrend = close < ma50 and ma50 < ma200

// Calculate pip value

pointsPerPip = syminfo.mintick * 10

// Entry Conditions with Less Strict Filters

macdCrossUp = ta.crossover(macdLine, signalLine) and math.abs(macdLine - signalLine) > macdThreshold

macdCrossDown = ta.crossunder(macdLine, signalLine) and math.abs(macdLine - signalLine) > macdThreshold

// Long and Short Conditions

longCondition = close > ma50 and macdCrossUp and barsLastTrade >= minBarsBetweenTrades and isUptrend

shortCondition = close < ma50 and macdCrossDown and barsLastTrade >= minBarsBetweenTrades and isDowntrend

// Exit Conditions (made more lenient)

exitLongCondition = macdCrossDown or close < ma50

exitShortCondition = macdCrossUp or close > ma50

// Reset bars counter on new trade

if (longCondition or shortCondition)

barsLastTrade := 0

// Calculate stop loss and take profit levels

longStopPrice = strategy.position_avg_price - (stopLossPips * pointsPerPip)

longTakeProfitPrice = strategy.position_avg_price + (takeProfitPips * pointsPerPip)

shortStopPrice = strategy.position_avg_price + (stopLossPips * pointsPerPip)

shortTakeProfitPrice = strategy.position_avg_price - (takeProfitPips * pointsPerPip)

// Plot Moving Averages

plot(ma50, "50 MA", color=color.blue)

plot(ma200, "200 MA", color=color.red)

// Plot Entry Signals

plotshape(longCondition, "Long Signal", shape.triangleup, location.belowbar, color.green, size=size.small)

plotshape(shortCondition, "Short Signal", shape.triangledown, location.abovebar, color.red, size=size.small)

// Strategy Entry Rules

if (longCondition and strategy.position_size == 0)

strategy.entry("Long", strategy.long)

if (shortCondition and strategy.position_size == 0)

strategy.entry("Short", strategy.short)

// Strategy Exit Rules

if (strategy.position_size > 0 and exitLongCondition)

strategy.close("Long")

if (strategy.position_size < 0 and exitShortCondition)

strategy.close("Short")

// Stop Loss and Take Profit Management

if (strategy.position_size > 0)

strategy.exit("Long TP/SL", "Long", stop=longStopPrice, limit=useFixedTakeProfit ? longTakeProfitPrice : na)

if (strategy.position_size < 0)

strategy.exit("Short TP/SL", "Short", stop=shortStopPrice, limit=useFixedTakeProfit ? shortTakeProfitPrice : na)

// Performance Metrics

var float totalTrades = 0

var float winningTrades = 0

var float totalProfitPips = 0

var float totalLossPips = 0

if (strategy.closedtrades > 0)

totalTrades := strategy.closedtrades

winningTrades := strategy.wintrades

totalProfitPips := strategy.grossprofit / pointsPerPip

totalLossPips := math.abs(strategy.grossloss) / pointsPerPip

// Display Stats

var label statsLabel = na

label.delete(statsLabel[1])

// Create performance stats text

var string stats = ""

if (strategy.closedtrades > 0)

winRate = (winningTrades / math.max(totalTrades, 1)) * 100

avgWin = totalProfitPips / math.max(winningTrades, 1)

avgLoss = totalLossPips / math.max(totalTrades - winningTrades, 1)

plRatio = avgWin / math.max(avgLoss, 1)

stats := "Win Rate: " + str.tostring(winRate, "#.##") + "%\n" +

"Avg Win: " + str.tostring(avgWin, "#.##") + " pips\n" +

"Avg Loss: " + str.tostring(avgLoss, "#.##") + " pips\n" +

"P/L Ratio: " + str.tostring(plRatio, "#.##") + "\n" +

"Total Trades: " + str.tostring(totalTrades, "#")

statsLabel := label.new(x=bar_index, y=high, text=stats, style=label.style_label_down, color=color.new(color.blue, 80))