1

fokus pada

1664

Pengikut

Gambaran keseluruhan

Ini adalah strategi perdagangan pintar berdasarkan struktur penembusan (BOS) dan pengesahan jumlah transaksi. Strategi ini menggunakan mekanisme pengesahan berbilang syarat, termasuk permintaan pengesahan berturut-turut dan tetapan stop loss dinamik, untuk meningkatkan kebolehpercayaan perdagangan dan kawalan risiko.

Prinsip Strategi

Logik teras strategi merangkumi elemen utama berikut:

- Mengenali titik tinggi dan rendah struktural dengan mengira harga tertinggi dan terendah dalam tempoh yang ditetapkan

- Menggunakan purata bergerak untuk mengira kadar transaksi untuk menentukan sama ada jumlah transaksi semasa meningkat dengan ketara

- Bilangan pengesahan berganda yang terkumpul apabila harga melepasi tahap tertinggi sebelum ini dan jumlah transaksi meningkat

- Bilangan pengesahan kosong yang terkumpul apabila harga jatuh dari paras rendah awal dan jumlah transaksi meningkat

- Isyarat perdagangan hanya akan dicetuskan apabila jumlah pengesahan yang ditetapkan telah dicapai

- Harga Stop Loss Berasaskan Peratusan Selepas Pembinaan Gudang

Kelebihan Strategik

- Sistem pengesahan berbilang syarat meningkatkan kebolehpercayaan isyarat perdagangan

- Gabungan penunjuk masa lalu untuk mengelakkan kesalahan penghakiman yang disebabkan oleh pelanggaran palsu

- Menggunakan mekanisme pengesahan berterusan, mengurangkan frekuensi operasi, meningkatkan kadar kemenangan

- Menggunakan tetapan stop-loss yang dinamik untuk menyesuaikan kedudukan keluar secara automatik mengikut harga masuk

- Logik strategi yang jelas, parameter yang boleh disesuaikan, adaptasi yang baik

Risiko Strategik

- Pasaran yang bergolak mungkin sering mengalami penembusan palsu yang menyebabkan kerugian berterusan

- Stop loss mungkin tidak tepat pada masanya dalam keadaan yang tidak menentu.

- Mekanisme pengesahan boleh menyebabkan kelewatan kemasukan dan kehilangan harga terbaik

- Pengukuran kuantiti transaksi tetap, tidak dapat menyesuaikan diri dengan keadaan pasaran yang berubah Penyelesaian:

- Pengenalan penunjuk kadar turun naik pasaran, parameter penyesuaian dinamik

- Menambah penapis trend untuk mengurangkan isyarat palsu pasaran yang bergolak

- Mengoptimumkan logik henti rugi, meningkatkan fleksibiliti henti rugi

- Reka bentuk penyesuaian untuk pengiraan nilai terhad

Arah pengoptimuman strategi

- Menambah indikator trend seperti sistem purata bergerak yang hanya berdagang ke arah trend

- Memperkenalkan ATR untuk menyesuaikan jarak hentian secara dinamik dan meningkatkan fleksibiliti kawalan angin

- Mekanisme penilaian penurunan kuantiti yang direka untuk menyesuaikan kadar turun naik

- Menambah penapis masa untuk mengelakkan masa yang berisiko tinggi

- Mengoptimumkan mekanisme pengesahan untuk meningkatkan kecekapan semasa kemasukan sambil memastikan kebolehpercayaan

ringkaskan

Ini adalah sistem strategi yang menggabungkan teori klasik analisis teknikal dan kaedah perdagangan kuantitatif moden. Strategi mempunyai kestabilan dan kebolehpercayaan yang baik melalui pengesahan pelbagai syarat dan kawalan risiko yang ketat.

Kod sumber strategi

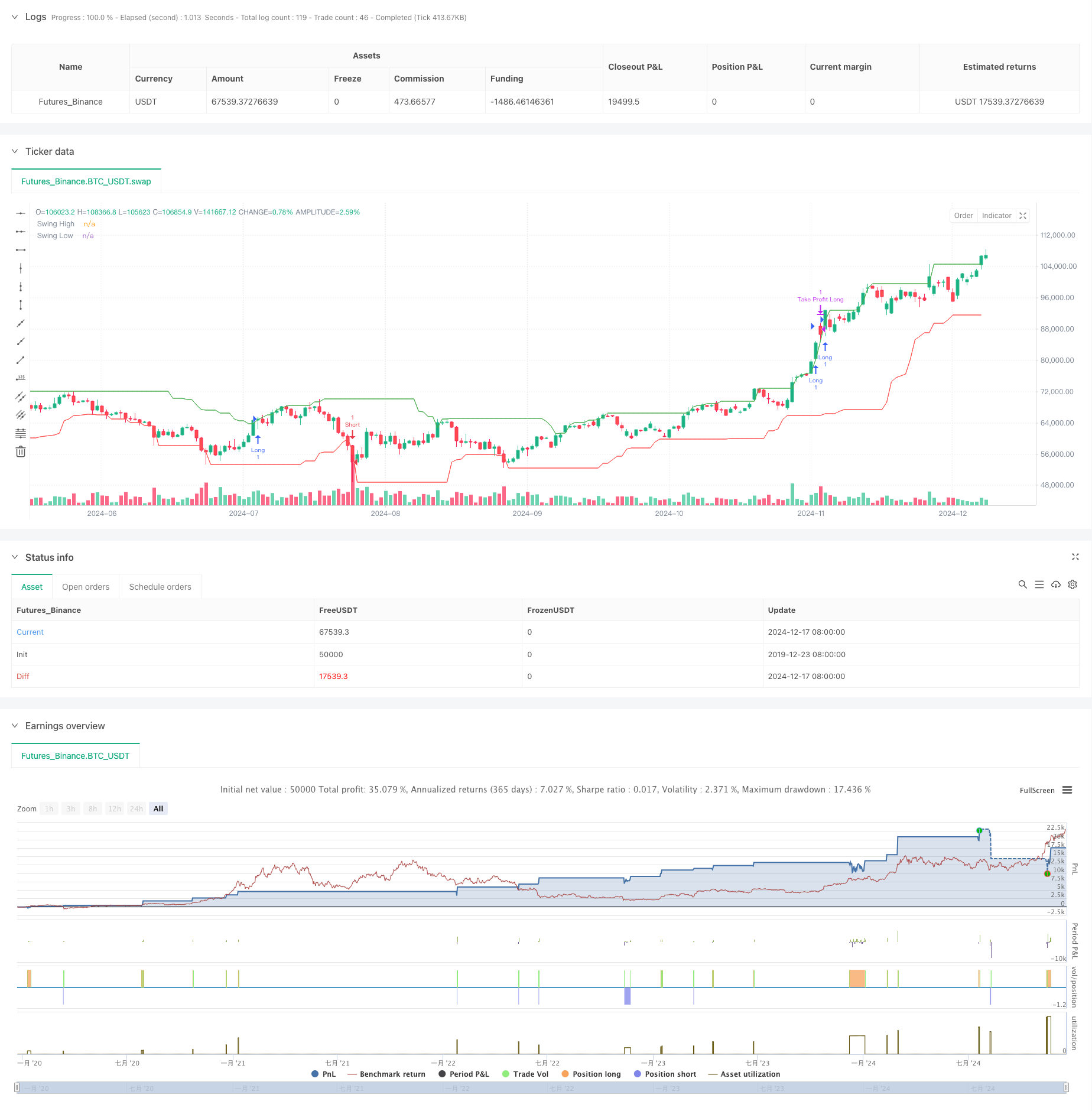

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BOS and Volume Strategy with Confirmation", overlay=true)

// Parameters

swingLength = input.int(20, title="Swing Length", minval=1)

volumeMultiplier = input.float(1.1, title="Volume Multiplier", step=0.1)

volumeSMA_length = input.int(10, title="Volume SMA Length", minval=1)

takeProfitPercentage = input.float(0.02, title="Take Profit Percentage", step=0.01)

stopLossPercentage = input.float(0.15, title="Stop Loss Percentage", step=0.01) // New parameter for stop loss

atrLength = input.int(14, title="ATR Length")

confirmationBars = input.int(2, title="Confirmation Bars", minval=1)

// Calculate Swing Highs and Lows

swingHigh = ta.highest(high, swingLength)[1]

swingLow = ta.lowest(low, swingLength)[1]

// Calculate Volume Moving Average

volumeSMA = ta.sma(volume, volumeSMA_length)

highVolume = volume > (volumeSMA * volumeMultiplier)

// Break of Structure Detection with Confirmation

var int bullishCount = 0

var int bearishCount = 0

if (close > swingHigh and highVolume)

bullishCount := bullishCount + 1

bearishCount := 0

else if (close < swingLow and highVolume)

bearishCount := bearishCount + 1

bullishCount := 0

else

bullishCount := 0

bearishCount := 0

bullishBOSConfirmed = (bullishCount >= confirmationBars)

bearishBOSConfirmed = (bearishCount >= confirmationBars)

// Entry and Exit Conditions

var float entryPrice = na // Declare entryPrice as a variable

if (bullishBOSConfirmed and strategy.position_size <= 0)

entryPrice := close // Use ':=' for assignment

strategy.entry("Long", strategy.long)

if (strategy.position_size > 0)

// Calculate stop loss price

stopLossPrice = entryPrice * (1 - stopLossPercentage)

strategy.exit("Take Profit Long", from_entry="Long", limit=entryPrice * (1 + takeProfitPercentage), stop=stopLossPrice)

if (bearishBOSConfirmed and strategy.position_size >= 0)

entryPrice := close // Use ':=' for assignment

strategy.entry("Short", strategy.short)

if (strategy.position_size < 0)

// Calculate stop loss price

stopLossPrice = entryPrice * (1 + stopLossPercentage)

strategy.exit("Take Profit Short", from_entry="Short", limit=entryPrice * (1 - takeProfitPercentage), stop=stopLossPrice)

// Plot Swing Highs and Lows for Visualization

plot(swingHigh, title="Swing High", color=color.green, linewidth=1)

plot(swingLow, title="Swing Low", color=color.red, linewidth=1)