Strategi penjejakan aliran dinamik berbilang penunjuk berdasarkan EMA dan SMA

EMA SMA ATR PP supertrend

Tarikh penciptaan:

2024-12-27 14:12:50

Akhirnya diubah suai:

2024-12-27 14:12:50

Salin:

5

Bilangan klik:

505

1

fokus pada

1664

Pengikut

Gambaran Keseluruhan Strategi

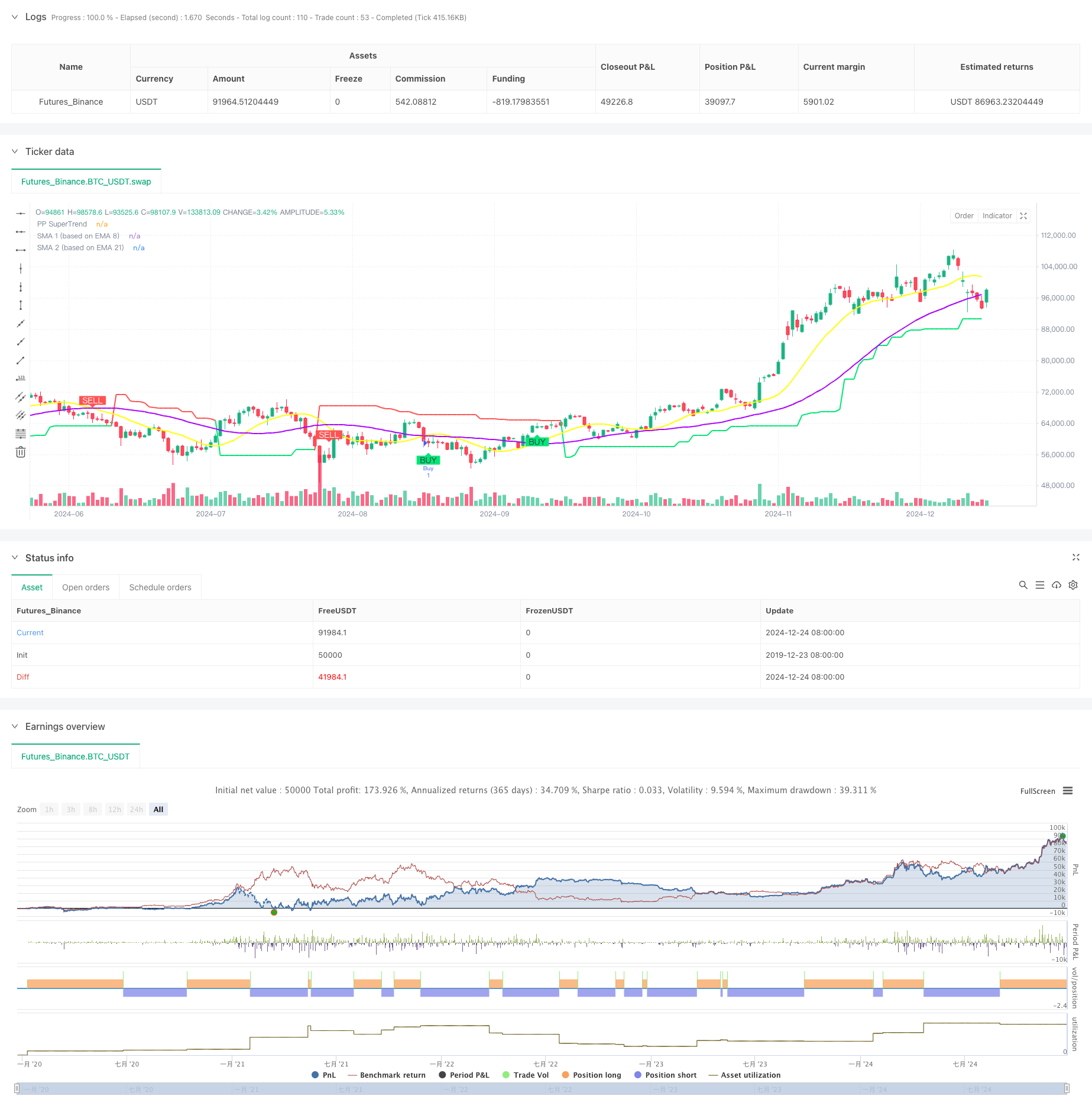

Strategi ini adalah sistem pengesanan trend dinamik yang menggabungkan pelbagai petunjuk teknikal. Ia mengenal pasti trend pasaran dan peluang perdagangan dengan mengintegrasikan titik pivot, petunjuk SuperTrend, dan isyarat silang rata-rata bergerak.

Prinsip Strategi

Strategi ini beroperasi berdasarkan mekanisme teras berikut:

- Analisis menggunakan data harga pada tempoh masa yang tetap untuk mengelakkan gangguan yang disebabkan oleh tempoh masa yang berbeza

- Pengiraan SMA melalui EMA 8 kitaran dan kitaran 21 untuk membentuk asas trend

- Indikator SuperTrend yang dikombinasikan dengan ATR dan titik sokongan untuk menentukan arah trend

- Sinyal silang SMA yang muncul dalam tempoh 3 kitaran di titik pangkal dianggap sebagai isyarat yang sah

- Menghitung dan mengesan tahap sokongan / rintangan secara dinamik untuk memberi rujukan kepada keputusan perdagangan

Kelebihan Strategik

- Memperbaiki kebolehpercayaan isyarat melalui cross-validasi pelbagai indikator

- Analisis kitaran masa tetap, mengurangkan gangguan isyarat palsu

- Mekanisme pengesahan titik-titik untuk memastikan transaksi berlaku pada tahap harga kritikal

- Pengesanan dinamik menyokong titik rintangan untuk membantu menentukan kedudukan halangan henti

- Penggunaan penunjuk SuperTrend memberikan pengesahan tambahan mengenai arah trend

- Tetapan parameter yang fleksibel, boleh disesuaikan dengan keadaan pasaran yang berbeza

Risiko Strategik

- Penunjuk berbilang boleh menyebabkan ketinggalan isyarat

- Mungkin terlalu banyak isyarat palsu di pasaran Forex

- Analisis kitaran masa tetap mungkin terlepas isyarat penting untuk kitaran lain

- Mekanisme pengesahan titik-titik boleh menyebabkan kehilangan peluang perdagangan yang penting

- Optimasi parameter yang berlebihan boleh menyebabkan overfitting

Arah pengoptimuman strategi

- Memperkenalkan mekanisme penapisan turun naik untuk mengurangkan kekerapan dagangan semasa turun naik rendah

- Meningkatkan penegasan kekuatan trend seperti ADX atau MACD

- Membangunkan sistem parameter yang menyesuaikan diri, menyesuaikan parameter secara dinamik mengikut keadaan pasaran

- Tambah analisis volum dagangan untuk meningkatkan kebolehpercayaan isyarat

- Mempunyai mekanisme hentian dinamik yang menyesuaikan kedudukan hentian mengikut turun naik pasaran

ringkaskan

Strategi ini membina sistem perdagangan yang mengesan trend yang agak lengkap dengan menggabungkan pelbagai petunjuk teknikal. Kelebihan utamanya adalah meningkatkan kebolehpercayaan isyarat melalui analisis kitaran masa tetap dan pengesahan bit penyokong. Walaupun terdapat risiko ketinggalan tertentu, ia dapat dikawal dengan berkesan melalui pengoptimuman parameter dan langkah-langkah pengurusan risiko.

Kod sumber strategi

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Buy Sell Pivot Point", overlay=true)

// Input Parameters

prd = input.int(defval=2, title="Periodo Pivot Point", minval=1, maxval=50)

Factor = input.float(defval=3, title="Fator ATR", minval=1, step=0.1)

Pd = input.int(defval=10, title="Periodo ATR", minval=1)

showpivot = input.bool(defval=false, title="Mostrar Pivot Points")

showlabel = input.bool(defval=true, title="Mostrar Buy/Sell Labels")

showcl = input.bool(defval=false, title="Mostrar PP Center Line")

showsr = input.bool(defval=false, title="Mostrar Support/Resistance")

sma1_length = input.int(defval=8, title="SMA 1")

sma2_length = input.int(defval=21, title="SMA 2")

timeframe_fix = input.timeframe("D", title="Timeframe Fixo")

// Request data from the fixed timeframe

fix_close = request.security(syminfo.tickerid, timeframe_fix, close)

fix_high = request.security(syminfo.tickerid, timeframe_fix, high)

fix_low = request.security(syminfo.tickerid, timeframe_fix, low)

fix_ph = request.security(syminfo.tickerid, timeframe_fix, ta.pivothigh(prd, prd))

fix_pl = request.security(syminfo.tickerid, timeframe_fix, ta.pivotlow(prd, prd))

fix_atr = request.security(syminfo.tickerid, timeframe_fix, ta.atr(Pd))

// Convert Pivot High/Low to valid boolean for conditions

ph_cond = not na(fix_ph)

pl_cond = not na(fix_pl)

// Draw Pivot Points

plotshape(ph_cond and showpivot, title="Pivot High", text="H", style=shape.labeldown, color=color.red, textcolor=color.red, location=location.abovebar, offset=-prd)

plotshape(pl_cond and showpivot, title="Pivot Low", text="L", style=shape.labelup, color=color.lime, textcolor=color.lime, location=location.belowbar, offset=-prd)

// Calculate the Center line using pivot points

var float center = na

lastpp = ph_cond ? fix_ph : pl_cond ? fix_pl : na

if not na(lastpp)

center := na(center) ? lastpp : (center * 2 + lastpp) / 3

// Upper/Lower bands calculation

Up = center - (Factor * fix_atr)

Dn = center + (Factor * fix_atr)

// Get the trend

var float TUp = na

var float TDown = na

var int Trend = 0

TUp := na(TUp[1]) ? Up : fix_close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := na(TDown[1]) ? Dn : fix_close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

Trend := fix_close > TDown[1] ? 1 : fix_close < TUp[1] ? -1 : nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// Plot the trend

linecolor = Trend == 1 ? color.lime : Trend == -1 ? color.red : na

plot(Trailingsl, color=linecolor, linewidth=2, title="PP SuperTrend")

// Plot Center Line

plot(showcl ? center : na, color=showcl ? (center < fix_close ? color.blue : color.red) : na, title="Center Line")

// Calculate Base EMAs

ema_8 = ta.ema(fix_close, 8)

ema_21 = ta.ema(fix_close, 21)

// Calculate SMAs based on EMAs

sma1 = ta.sma(ema_8, sma1_length)

sma2 = ta.sma(ema_21, sma2_length)

// Plot SMAs

plot(sma1, color=#ffff00, linewidth=2, title="SMA 1 (based on EMA 8)")

plot(sma2, color=#aa00ff, linewidth=2, title="SMA 2 (based on EMA 21)")

// Initialize variables to track pivot points

var float last_pivot_time = na

// Update the pivot time when a new pivot is detected

if (ph_cond)

last_pivot_time := bar_index

if (pl_cond)

last_pivot_time := bar_index

// Calculate the crossover/crossunder signals

buy_signal = ta.crossover(sma1, sma2) // SMA 8 crossing SMA 21 upwards

sell_signal = ta.crossunder(sma1, sma2) // SMA 8 crossing SMA 21 downwards

// Ensure signal is only valid if it happens within 3 candles of a pivot point

valid_buy_signal = buy_signal and (bar_index - last_pivot_time <= 3)

valid_sell_signal = sell_signal and (bar_index - last_pivot_time <= 3)

// Plot Buy/Sell Signals

plotshape(valid_buy_signal and showlabel, title="Buy Signal", text="BUY", style=shape.labelup, color=color.lime, textcolor=color.black, location=location.belowbar)

plotshape(valid_sell_signal and showlabel, title="Sell Signal", text="SELL", style=shape.labeldown, color=color.red, textcolor=color.white, location=location.abovebar)

// Get S/R levels using Pivot Points

var float resistance = na

var float support = na

support := pl_cond ? fix_pl : support[1]

resistance := ph_cond ? fix_ph : resistance[1]

// Plot S/R levels

plot(showsr and not na(support) ? support : na, color=showsr ? color.lime : na, style=plot.style_circles, offset=-prd)

plot(showsr and not na(resistance) ? resistance : na, color=showsr ? color.red : na, style=plot.style_circles, offset=-prd)

// Execute trades based on valid signals

if valid_buy_signal

strategy.entry("Buy", strategy.long)

if valid_sell_signal

strategy.entry("Sell", strategy.short)

// Alerts

alertcondition(valid_buy_signal, title="Buy Signal", message="Buy Signal Detected")

alertcondition(valid_sell_signal, title="Sell Signal", message="Sell Signal Detected")

alertcondition(Trend != Trend[1], title="Trend Changed", message="Trend Changed")